QUOTE(ryan18 @ Jul 4 2021, 04:31 PM)

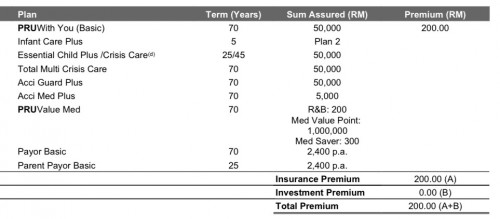

Just trying to get second opinion as 1 contact who is an insurance agent(non Prudential) said it’s a bad idea to include CI(TMCC), accident and medical card in the same plan.so he suggested to get stand-alone CI instead

Sustainability will be affected and premiums need to be increased substantially in the future

Which in in contrast to what my agent said sustainability will be up to 71 by increasing my current premium from 150 to 250

To answer your question, you need to look at your current's policy sustainability. If your current policy sustainability is up to age 80, then if you add TMCC to the existing policy the TMCC cost of insurance is also calculated to sustain up to age 80 (since TMCC is a rider that will follow the policy sustainability term).

Do you think you'd still be working to generate an income at age 75 or would you have retired?

If not, then just start with a new TMCC policy limiting the sustainability age to 60 or 70 (albeit with a lower premium) to act as income protection during our productive years.

» Click to show Spoiler - click again to hide... «

The purpose of TMCC/CI is to act as a replacement of income, should a CI occurs which stops us from generating an income. Eg, if a person earns RM3K/mth and not able to work for 5 years, that accumulates to RM180K of loss of income.

IMO, the more important question that you need to ask is how much you'd need the CI and for how long you need to maintain this cover. RM500K? RM1M?

Jun 10 2021, 12:21 AM

Jun 10 2021, 12:21 AM

Quote

Quote

0.0842sec

0.0842sec

0.87

0.87

7 queries

7 queries

GZIP Disabled

GZIP Disabled