QUOTE(cybermaster98 @ Jan 29 2015, 03:49 PM)

1) Im in the 26% tax bracket so what would my minimum investment amount in PRS be to enjoy the maximum tax rebate of RM780?

2) What is the best PRS scheme to invest in in terms of returns? Im currently invested in KGF and Eastsprings Small Cap which arent doing too well.

Can someone help me on this, I interested to ask my mom to invest in PRS due to the tax rebate, but based on my mom salary n after calculate, how much refund you can get from 3k investment not according to your tax bracket..here the calculation for discussion

before PRS

-------------

Salary 90k

-rebat without PRS = 20k ( Kwsp,insuran, child, zakat )

taxable income = 70k

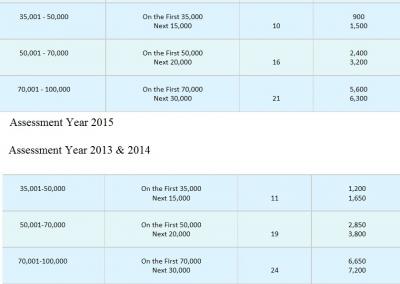

according to LHDN tax bracket for 2015 onwards -

http://www.hasil.gov.my/goindex.php?kump=5...it=5000&sequ=11first 70k = RM5600

Tax need to pay = Rm5600

After invest in PRS

----------------------

Salary 90k

-rebat with PRS = 23k (Kwsp,insuran, child,zakat + add 3k for PRS)

taxable income = 67000

tax calculation ( 50k - 70k tax bracket)

First 50000 = RM2,850

next 17000 = RM 2720

Tax need to pay = RM5,570

Difference( before - after ) RM5600 - Rm5570 = Rm30 !!

only RM30 difference?? so seem like it not worth it for my mom to invest in PRS right..better go for the normal mutual fund then.

My tax calculation correct or not :-P

Mar 29 2015, 10:18 AM

Mar 29 2015, 10:18 AM

Quote

Quote

0.0180sec

0.0180sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled