Outline ·

[ Standard ] ·

Linear+

Private Retirement Fund, What the hell is that??

|

T231H

|

Jan 29 2015, 01:21 PM Jan 29 2015, 01:21 PM

|

|

QUOTE(CluelessNick @ Jan 29 2015, 01:15 PM) Hi, i would like to purchase public bank prs scheme. If there is anyone selling it, can pm me? could you be more specific as to where you to contact you and how much you want to invest? ex, you could be in Sabah and the agents could be in Perlis.....wasting both your time and his time to PM and reply. isn't it?  |

|

|

|

|

|

T231H

|

Jan 29 2015, 04:39 PM Jan 29 2015, 04:39 PM

|

|

QUOTE(cybermaster98 @ Jan 29 2015, 03:56 PM) So as long as i commit 3K per year i will get back RM780 rite? just a note: Tax Relief of RM 3000 Deferred Annuity and Private Retirement Scheme (PRS) - with effect from year assessment 2012 until year assessment 2021http://www.hasil.gov.my/goindex.php?kump=5...3&unit=1&sequ=1 |

|

|

|

|

|

T231H

|

Jan 31 2015, 06:49 PM Jan 31 2015, 06:49 PM

|

|

QUOTE(MNet @ Jan 31 2015, 06:34 PM) Let say I already bought CIMB PRS fund pay rm10 PPA account opening, then I apply for Manulife PRS fund, so do i need to pay any fee?  I think the RM 10 account opening fees is one-off....if I am correct, then when you apply for another fund, then there will be no fees for PPA unless those charged by the FH. unless for the 2nd year....if you top up 2 funds...then 2 x RM 8 annual fees applies. because I read PPA Annual fees --This fee is not payable by you for the year your account is first opened and the year(s) where no contribution has been made. |

|

|

|

|

|

T231H

|

Jan 31 2015, 06:53 PM Jan 31 2015, 06:53 PM

|

|

QUOTE(MNet @ Jan 31 2015, 06:51 PM) Does it mean that if I have 5 fund from different company every yr i need pay RM8 x 5= RM40 ? Annual fees = RM 8 to be charged yearly per provider (not payable for the year the account was opened and on the year where there is no contribution) from the wordings....YES, sound like it. UNLESS there is no contribution for that year. I not yet have this experience or asked the FH/PPA yet. This post has been edited by T231H: Jan 31 2015, 07:04 PM |

|

|

|

|

|

T231H

|

Feb 26 2015, 08:01 PM Feb 26 2015, 08:01 PM

|

|

QUOTE(David83 @ Feb 26 2015, 07:10 PM) Class A: SC up to 3% Class C: SC up to 0.5% wow the mgmt fees also NOT same. SLOWLY< slowly, makan you BALIK?  Attached thumbnail(s) Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

Feb 26 2015, 08:06 PM Feb 26 2015, 08:06 PM

|

|

QUOTE(David83 @ Feb 26 2015, 08:04 PM) That's a max MF that PRS can charge. A good fund will be lower than that guidance.  lower SC but HIGHER mgmt. fees?  |

|

|

|

|

|

T231H

|

Mar 20 2015, 11:15 AM Mar 20 2015, 11:15 AM

|

|

QUOTE(low yat 82 @ Mar 20 2015, 11:02 AM) there r a few. jus dat wit foreign exposure, there is onli affin hwang prs moderate / growth..   i dun get the actual meaning of yr post. do you mean "onli affin hwang prs moderate / growth" are not holding into one or more funds of the respective PRS provider? |

|

|

|

|

|

T231H

|

Mar 27 2015, 12:13 PM Mar 27 2015, 12:13 PM

|

|

PRS funds performance data...from PPA http://www.ppa.my/getting-started/funds-re...nd-performance/just an added note: Investment involves risk. The price of securities may go down as well as up, and under certain circumstances an investor may sustain a total or substantial loss of investment. Past performance is not necessarily indicative of the future or likely performance of the fund. Investors should read the relevant fund's prospectus for details before making any investment decision. An Investor should make an appraisal of the risks involved in investing in these products and should consult their own independent and professional advisors, to ensure that any decision made is suitable with regards to their circumstances and financial position.  This post has been edited by T231H: Mar 27 2015, 12:20 PM This post has been edited by T231H: Mar 27 2015, 12:20 PM |

|

|

|

|

|

T231H

|

Mar 27 2015, 12:20 PM Mar 27 2015, 12:20 PM

|

|

QUOTE(David83 @ Mar 27 2015, 10:50 AM) ..... Since PRS fund is meant for long term, you won't want to be bothered by short term volatility.  |

|

|

|

|

|

T231H

|

Mar 27 2015, 06:51 PM Mar 27 2015, 06:51 PM

|

|

QUOTE(low yat 82 @ Mar 27 2015, 05:03 PM) ....... if u see d bulk of d PRS invesment been done, n using d normal PRS Funds Selection Option http://www.ppa.my/prs/about-prs/prs-providers-funds-option/ we can gauge most investor is at wat age. something to ponder..  any idea where to see?  |

|

|

|

|

|

T231H

|

Mar 27 2015, 09:04 PM Mar 27 2015, 09:04 PM

|

|

QUOTE(RisK.yO @ Mar 27 2015, 09:00 PM) Anyone has got the RM500 incentive? I invested more than RM1000 in Kenanga oneprs last year but still haven't see the incentive yet  last year when?....Dec?  Page#34 post#664 did ask and some forummers had responded. This post has been edited by T231H: Mar 27 2015, 09:13 PM |

|

|

|

|

|

T231H

|

Mar 29 2015, 10:42 AM Mar 29 2015, 10:42 AM

|

|

QUOTE(migai @ Mar 29 2015, 10:18 AM) Is it good if I advise my wife to take PRS for tax relief purpose? Currently she worked / agent for a company and dont have constant income. I ask her to declare her income to strengthen her income prove as she dont have any epf. Is it helping? If want to contribute to EPF can do the self contribution http://www.kwsp.gov.my/portal/en/web/kwsp/...lf-contributionwith EPF can have tax break too PRS is added tax break. just do bear in mind that what ever goes into those...have T&C when one needs to withdraws.  |

|

|

|

|

|

T231H

|

Mar 29 2015, 11:15 AM Mar 29 2015, 11:15 AM

|

|

QUOTE(migai @ Mar 29 2015, 11:12 AM) Thanks. Very helpful. Another question, if my wife done contribution to epf, another contribution to prs would increase amount of tax relief? see note 21 & 23... note 11 can consider too http://www.hasil.gov.my/goindex.php?kump=5...3&unit=1&sequ=1 |

|

|

|

|

|

T231H

|

Mar 29 2015, 07:05 PM Mar 29 2015, 07:05 PM

|

|

QUOTE(hazremi @ Mar 29 2015, 07:01 PM) what is the best PRS scheme? what about prudential prs?   List of PRS Providers approved as at 25 April 2013 http://www.sc.com.my/list-of-prs-providers/Best? how to define? Best Return? Best resilience? Best Suits you? etc.... PRS funds performance data...from PPA http://www.ppa.my/getting-started/funds-re...nd-performance/just an added note: Investment involves risk. The price of securities may go down as well as up, and under certain circumstances an investor may sustain a total or substantial loss of investment. Past performance is not necessarily indicative of the future or likely performance of the fund. Investors should read the relevant fund's prospectus for details before making any investment decision. An Investor should make an appraisal of the risks involved in investing in these products and should consult their own independent and professional advisors, to ensure that any decision made is suitable with regards to their circumstances and financial position.  This post has been edited by T231H: Mar 29 2015, 07:25 PM This post has been edited by T231H: Mar 29 2015, 07:25 PM |

|

|

|

|

|

T231H

|

Apr 2 2015, 02:33 PM Apr 2 2015, 02:33 PM

|

|

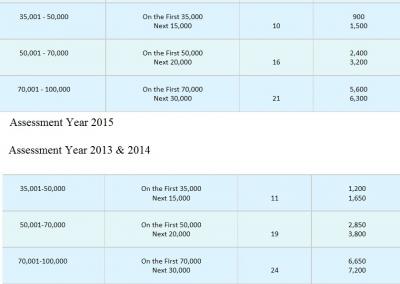

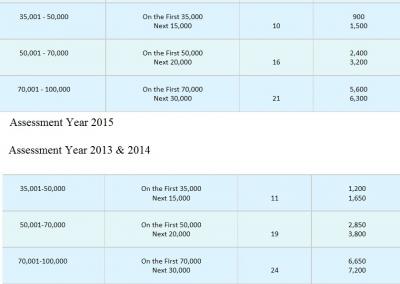

tax rate table....redo the maths? This post has been edited by T231H: Apr 2 2015, 02:34 PM Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

Apr 4 2015, 09:45 AM Apr 4 2015, 09:45 AM

|

|

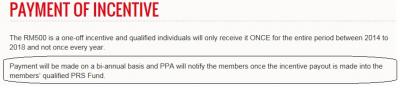

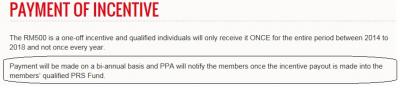

QUOTE(RisK.yO @ Apr 4 2015, 02:55 AM) I invested RM3k in September 2014   If they got it in OCT, then I think you will get it in Apr... This post has been edited by T231H: Apr 4 2015, 09:50 AM Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

Apr 8 2015, 09:54 AM Apr 8 2015, 09:54 AM

|

|

QUOTE(Kaka23 @ Apr 8 2015, 09:42 AM) no CIMB PRS that feed into Ponzi 2.0?   |

|

|

|

|

|

T231H

|

Apr 8 2015, 11:06 AM Apr 8 2015, 11:06 AM

|

|

QUOTE(~Curious~ @ Apr 8 2015, 10:57 AM) i was wondering izzzit more profitable to buy into prs with RM1k+RM500 youth incentive,or just buy RM1k worth of unit trusts out there. if im not wrong PRS funds can only withdraw upon reaching 55 y/o rite? I m not too concerned about tax relief as of yet too. Wad do you guys think? so if you are not concern about the tax relief or the withdrawal limitation.... I think, why not.....50% extra... as for the performance of the fund compared to others...who knows how it or THEY will go. why you asked? you think not? |

|

|

|

|

|

T231H

|

Apr 8 2015, 03:30 PM Apr 8 2015, 03:30 PM

|

|

QUOTE(yong417 @ Apr 8 2015, 03:26 PM) Ponzi 2.0??  i m looking to invest in CIMB fund nxt year wo.... Ponzi 2.0 = CIMB-PRINCIPAL ASIA PACIFIC DYNAMIC INCOME FUND http://www.fundsupermart.com.my/main/fundi...umber=MYCIMB007CIMB-PRINCIPAL PRS PLUS ASIA PACIFIC EX JAPAN EQUITY - CLASS C http://www.fundsupermart.com.my/main/fundi...umber=MYCPPRS5Chttp://www.fundsupermart.com.my/main/admin...etMYCPPRS5C.pdfThis post has been edited by T231H: Apr 8 2015, 03:33 PM |

|

|

|

|

|

T231H

|

Apr 8 2015, 05:43 PM Apr 8 2015, 05:43 PM

|

|

QUOTE(Kaka23 @ Apr 8 2015, 05:41 PM) nola.. Ponzi 2.0 using cash investment if go thur PRS...0 SC but got withdrawal restriction |

|

|

|

|

Jan 29 2015, 01:21 PM

Jan 29 2015, 01:21 PM

Quote

Quote

0.0257sec

0.0257sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled