QUOTE(MUM @ Apr 8 2020, 01:12 PM)

just an added note to take note in the link...

"Note: One of the prevailing terms and conditions for pre-retirement withdrawal from sub-account B is still applicable, whereby such withdrawals may only be made from a PRS fund one year after enrolment."

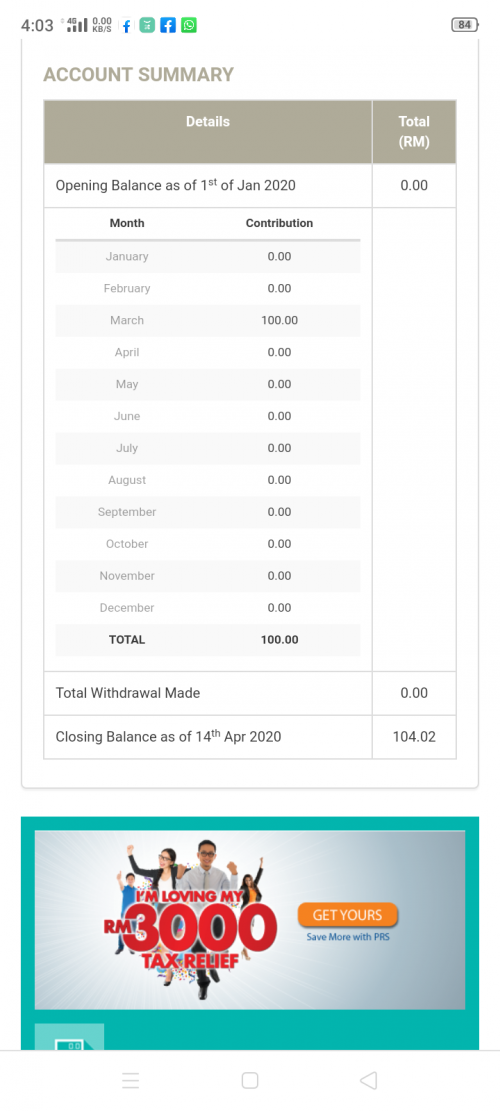

so does it clearly mentioned that, in order to get the tax relief of RM3000 for this year's contribution, does one need to put in only RM3000 or (RM3000 + what ever that had been withdrawn under this special perks)?

while waiting for further news/info from the authority ..."Note: One of the prevailing terms and conditions for pre-retirement withdrawal from sub-account B is still applicable, whereby such withdrawals may only be made from a PRS fund one year after enrolment."

so does it clearly mentioned that, in order to get the tax relief of RM3000 for this year's contribution, does one need to put in only RM3000 or (RM3000 + what ever that had been withdrawn under this special perks)?

I bet/think is, one need to put in RM3000 + what ever that had been withdrawn under this special perks, to qualify for the max tax relief of RM3k claim in next year April tax submission.

my reason is being,

that is current non tax penalty withdrawal of RM1500 is to help those in need of money to tie over the cash flow problem due to the impact of Covid19,

since if one can have "surplus money" to put into PRS, then it just shown that one did not have cash flow problem anymore,....thus they need to put back that withdrawn money back too

Apr 8 2020, 01:48 PM

Apr 8 2020, 01:48 PM

Quote

Quote

0.0231sec

0.0231sec

0.38

0.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled