Outline ·

[ Standard ] ·

Linear+

Private Retirement Fund, What the hell is that??

|

iamkid

|

Jul 23 2017, 12:45 PM Jul 23 2017, 12:45 PM

|

|

QUOTE(Ramjade @ Jun 30 2017, 06:12 PM) Buy any PRS fund with RM3k. Done. That's all. Yes. Need to dump another RM3k next year. For PRS, don't think about the tax relief. Think also the about the best bang for buck fund. If I were you, I will start away from public mutual. Reason: 1) lousy fund (which mean overtime you will get more money if you choose other fund - cimb/kenanga) 2) 3% service charge. Buy PRS from FSM MY. Zero percent service charge. Thank you for the info. May i ask, is it we cant sell the PRS until 55 years old? (so every year dump 3k like dat?) |

|

|

|

|

|

iamkid

|

Mar 16 2018, 05:07 PM Mar 16 2018, 05:07 PM

|

|

QUOTE(Kilohertz @ Mar 9 2018, 12:48 PM) When will the incentive be usually credited? I just opened my account early this month.. i also open in march. found no answer, only this. keep waiting  When will I receive the RM1,000? How will the incentive be transferred to me? The RM1,000 will be automatically credited into the sub-account A of your qualified PRS Fund. PPA will notify you once the Incentive pay-out has been made into your qualified PRS Fund in the form of units. |

|

|

|

|

|

iamkid

|

Apr 25 2018, 10:52 AM Apr 25 2018, 10:52 AM

|

|

QUOTE(netroais @ Apr 23 2018, 05:09 PM) Hi, want to ask around other sifu. I open PRS account at FSM since April 2015 and select "CIMB Islamic PRS Plus Asia Pacific Ex Japan Equity - Class C". so for every month put in RM250 to get the 3k tax relief. My question why since 2015, I don't get any dividend credited to my account? at FSM historical view, I only can see buy in statement, No dividend for my PRS. Compare to my eastspring investment, I can see the dividend credited to my account. Anyone can answers this question? How to know the fund performance? It is so bad that no dividend for PRS fund I selected? cimb prs memang no dividend one... so if the price drop, then thats it. i always tell my friends that the prs not necessary profit at the end as the price might go down |

|

|

|

|

|

iamkid

|

Apr 8 2020, 05:13 PM Apr 8 2020, 05:13 PM

|

|

Cant find any option to withdraw/sell PRS in Fundsupermart FSM

|

|

|

|

|

|

iamkid

|

Apr 8 2020, 05:28 PM Apr 8 2020, 05:28 PM

|

|

QUOTE(GrumpyNooby @ Apr 8 2020, 05:16 PM) Manual process 15.7 Can I sell my PRS funds? Yes, you can sell your units in Account B after 1 year of your subscription. You will need to submit a copy of fund house redemption form to process the withdrawal. Please be noted that a tax penalty of 8% will occur to you by to Inland Revenue Board of Malaysia unless your age is 55 and above. The PPA pre-retirement redemption fee of MYR 25.00 is waived by PPA until further notice. For account A, you can only redeem your PRS investments upon retirement age of 55. Redemption for a deceased member or permanent departure of a member from Malaysia are required to furnish documents which required by PPA. You may click here to view the details. https://www.fundsupermart.com.my/fsmone/fun...ment-Scheme-PRSThanks for the link! I thought can sell directly there. |

|

|

|

|

|

iamkid

|

Dec 26 2020, 02:14 PM Dec 26 2020, 02:14 PM

|

|

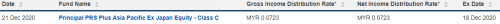

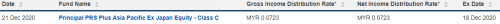

QUOTE(GrumpyNooby @ Dec 21 2020, 06:20 PM) The first time Principal PRS Plus Asia Pacific Ex Japan Equity - Class C declares distribution:  may i know where can we view this? |

|

|

|

|

|

iamkid

|

Apr 11 2021, 03:05 PM Apr 11 2021, 03:05 PM

|

|

QUOTE(honsiong @ Apr 11 2021, 10:23 AM) Hurtful man, I didnt go all in RM 0.90 thinking it will drop lower. Shot to RM 1.30 + dividends, crazy. same here.  |

|

|

|

|

Jul 23 2017, 12:45 PM

Jul 23 2017, 12:45 PM

Quote

Quote

0.2175sec

0.2175sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled