QUOTE(tehoice @ Apr 8 2020, 12:23 PM)

i did a brief calculation of how much my account has made (pure profit for 2019), since don't have the actual official numbers on my profit.

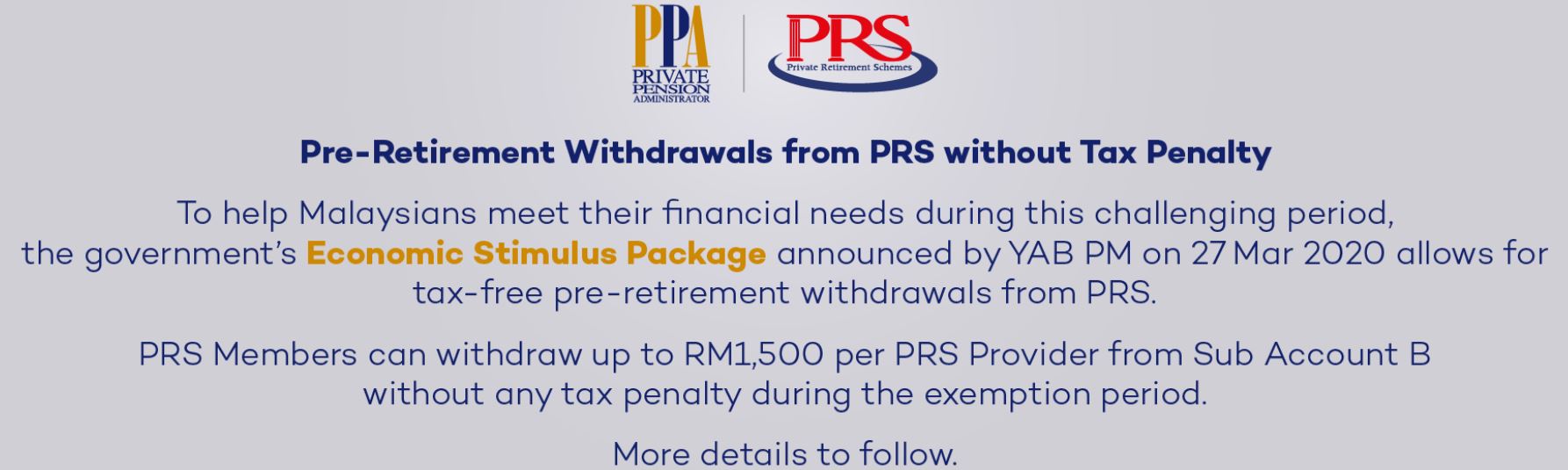

The recent market tumbles wiped out all of my profits made for 2019. despite that, when you withdraw, you are merely withdrawing your past years' profit and you still let your capital run in it. at least for my case lah. Yes, now is really a buy high and sell low situation, but my own argument is, look back at the main reason for me to invest into PRS and that is the tax relief of 3k each year.

Now that you're able to withdraw at least some money back at no penalty, why not take this chance and cash it out a little.

so the cash out from account B is merely withdrawing some of the profits that you have made in your past years.

Minus the investment concept, letting the monies remain in your account, be it, EPF or PRS, is because you want to let the magic of compounding to work for your future retirement pot. i assume your EPF will certainly has much bigger pot of money and the compounding effect can definitely works better than your money does in the PRS right? (let's just assume, say 5% p.a. for each).

So let's say you have 2 providers and both also more than RM1500 in your account, won't you withdraw RM3k from PRS instead of EPF?

this is not a sure thing yet - LHDN has yet said anything

"so the cash out from account B is merely withdrawing some of the profits that you have made in your past years. "my POV doesnt jive with such logic,

i simplify to "buy high, sell low"

"Minus the investment concept, letting the monies remain in your account, be it, EPF or PRS, is because you want to let the magic of compounding to work for your future retirement pot. i assume your EPF will certainly has much bigger pot of money and the compounding effect can definitely works better than your money does in the PRS right? (let's just assume, say 5% p.a. for each). "my POV doesnt jive with such logic too.

what has EPF's bigger pot has anything to do with PRS smaller pot, in context of removing/selling down EPF or PRS?

ie. assuming both same returns as U said, so why would amount in EPF matter to amount in PRS?

logic = ?

5%pa is 5%pa loss on amount taken/sold out, whether or not i took out from EPF or sold PRS $1.5K

In addition - for sure EPF out doesnt impact my tax relief, thus my views on taking/not taking out PRS. It'll be my last card - after robbing:

1. EPF A/C2 via LESTARI & monthly mortgage withdrawal

2. flexi-mortgage prepayments

3. SSPNs

no ultimate right/wrong ya - it depends on one's situation and one's access to tools/knowledge. Best we can do is to make sure the logic & maths is sound.

This post has been edited by wongmunkeong: Apr 8 2020, 12:50 PM

Apr 6 2020, 12:50 AM

Apr 6 2020, 12:50 AM

Quote

Quote

0.0241sec

0.0241sec

0.25

0.25

6 queries

6 queries

GZIP Disabled

GZIP Disabled