QUOTE(LostAndFound @ Mar 9 2022, 01:18 PM)

So rewards vs interest using kipplepay and the likes. Will be missing dividen payment for the month.SSPN, Skim Simpanan Pendidikan Nasional

SSPN, Skim Simpanan Pendidikan Nasional

|

|

Mar 9 2022, 01:36 PM Mar 9 2022, 01:36 PM

Return to original view | Post

#41

|

Senior Member

2,618 posts Joined: Apr 2012 |

|

|

|

|

|

|

Mar 9 2022, 03:37 PM Mar 9 2022, 03:37 PM

Return to original view | Post

#42

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(LostAndFound @ Mar 9 2022, 03:25 PM) As I understand from discussing with PTPTN agent, you won't miss dividend payments. Dividend payments are calculated based on the recorded date in system, not on when system display is updated. I asked this before because the molpay method often takes like 2+ weeks. Pls dont believe oral answer from agent. Recorded date in system display matters if not how to dispute, and like all deposit taking instituition, system display is the only proof you have. Like i have previously said maybe in some other thread , its just their personal opinion. Try to deposit earlier next time.I did a deposit from Maybank2u before and the system display date is not to my liking, so henceforth i only use fpx. This post has been edited by magika: Mar 9 2022, 03:42 PM |

|

|

Mar 9 2022, 06:51 PM Mar 9 2022, 06:51 PM

Return to original view | Post

#43

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(LostAndFound @ Mar 9 2022, 05:04 PM) If you actually read what I said, it is the recorded date (which is what is shown in the left most column) which counts for dividend calculation. NOT when the system display is updated (which is when you actually can see the transaction online). You are arguing something totally different. I must be confused when you mentioned 2 types of dates. Apologies if i strike a nerve. As far as i can see in my statement there is only one type so i may be confused, as long as the date there correlates with when you deposited then thats all that matters.Anyway your answer is basically "don't believe the person who actually works there, instead you should believe me" because I didn't like what I saw previously on one occasion (which actually is a totally different situation from what the original question was). You win lor. |

|

|

Mar 11 2022, 07:13 PM Mar 11 2022, 07:13 PM

Return to original view | Post

#44

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(rocketm @ Mar 11 2022, 07:06 PM) Is there any limit on the amount per withdrawal request? There is no limit for even online withdrawal. Done it last month for large amount, and next day around 10pm is already in bank account.If I withdraw on between 6-30 of each month & deposit back before 5th on the following month, will I still entitle for the dividend for each month when SSPN announce dividend in the following year? Deposit before 5th will get dividend starting from 5th. rocketm liked this post

|

|

|

Mar 22 2022, 05:59 PM Mar 22 2022, 05:59 PM

Return to original view | Post

#45

|

Senior Member

2,618 posts Joined: Apr 2012 |

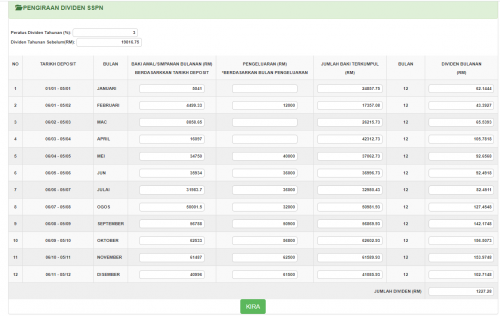

QUOTE(ohyes_02 @ Mar 22 2022, 04:52 PM) Hi, based on my deposited and withdraw for year 2021 for SSPN prime, i suppose to get 1.2k interest if based on their calculator, but at the end my interest only RM150. is it something wrong? Why dont you count it manually ? Jpg a bit blur so cant really see. SSPN dividend calculation is based on minimum sum of the month and only deposit in before 6th of every month is entitled. Fair or not each of us has to make our decision. If it still does not tally then your best option is to visit PTPTN office or fai an e- aduan. This post has been edited by magika: Mar 22 2022, 06:19 PM |

|

|

Mar 22 2022, 08:40 PM Mar 22 2022, 08:40 PM

Return to original view | Post

#46

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(ohyes_02 @ Mar 22 2022, 08:30 PM) ya, i deposit in before 5th of every month and withdraw it after 8th of every month. i think i need go one round ptptn office for more clarification Trying to beat the system....? What are you really trying to say ? I now know what you are doing. Anyway only way is to contact sspn. This post has been edited by magika: Mar 22 2022, 09:01 PM |

|

|

|

|

|

Mar 24 2022, 03:41 PM Mar 24 2022, 03:41 PM

Return to original view | Post

#47

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(kochin @ Mar 24 2022, 03:14 PM) not sure whether this is official or not (it seems there are tonnes of sspn website). Husband and wife can even open same child account and each can claim 8k separately. Can also open account for all your children as beneficiary and only those below 29yrs can claim tax relief. It will be computed automatically in your tax form so no need to keyin.but if i were to follow this interpretation: 1. it's not 18 but until 29 instead. am not sure whether only age is governing factor or must have proof that the child is still a student? 2. solely judging from the information, it would suggest that i can open another account for my second child once my first reaches the condition i.e. 29 years old. anybody else can confirm my assumptions please? Other than that you can also open single name account to be used for Saving purposes. vinzhaw liked this post

|

|

|

Mar 24 2022, 04:00 PM Mar 24 2022, 04:00 PM

Return to original view | Post

#48

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(kochin @ Mar 24 2022, 03:53 PM) we are currently operating on me contributing to 1st child and wife to 2nd child. No difference. Only need deposit RM20 to open account. Btw dont close any account as their system does not closed it fully.means i need to switch to 2nd child once the 1st hits 29 right? should i open the account now or later? any difference? many thanks for your reply. You can switch now and both husband and wife can claim for same child. Eventhough we open together with children names, the account and money still belong to us. Also i recomend encouraging your children no matter their age to open single name account so that in later years they may benefit from the Ganjaran if it is still running. This post has been edited by magika: Mar 24 2022, 04:08 PM |

|

|

Mar 24 2022, 04:11 PM Mar 24 2022, 04:11 PM

Return to original view | Post

#49

|

Senior Member

2,618 posts Joined: Apr 2012 |

|

|

|

Mar 27 2022, 09:05 PM Mar 27 2022, 09:05 PM

Return to original view | Post

#50

|

Senior Member

2,618 posts Joined: Apr 2012 |

I did 4 deposit thru fpx today. Just as normal , i check back the associated account to ensure its recorded. Seems all the deposits are in instantly for Year 2022.

However i then click to Year 2021, and the sum deposited today are also reflected in that particular year and also all the way back many years. Something is seriously wrong with their servers. Just print out the latest statement for safety sake. |

|

|

Apr 21 2022, 04:08 PM Apr 21 2022, 04:08 PM

Return to original view | Post

#51

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(lovelyuser @ Apr 21 2022, 12:15 PM) If you are having 60k and below of cash to play with, then EPF will be your best choice. Can point to source of info...' withdrawal once every 30 days " ?Bear in mind EPF voluntary contribution linited to RM 60k per annum, withdrawal only once every 30 days after your previous withdrawal |

|

|

Apr 22 2022, 03:32 PM Apr 22 2022, 03:32 PM

Return to original view | Post

#52

|

Senior Member

2,618 posts Joined: Apr 2012 |

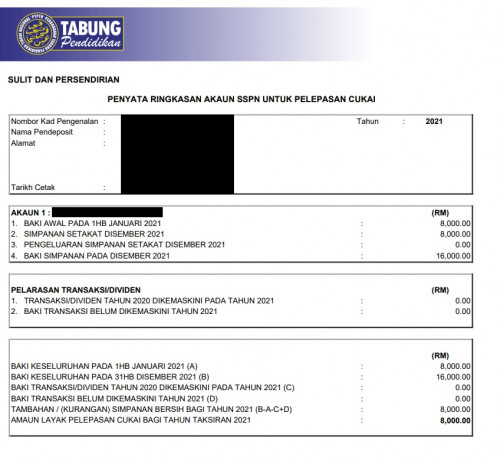

QUOTE(Watta?? @ Apr 22 2022, 02:35 PM) Hi Guys, Two possibilities.Just wanted to ask.. How come i don't see any dividends for my SSPN ya? I've deposited since 2020 and not withdrawn a single cent since then  1. Deposit RM8000.00 after 5 December 2020 so it became January 2021 deposit. 2. Account suspended Show screenshot of 2020 statement then everything become clear. |

|

|

May 24 2022, 04:34 PM May 24 2022, 04:34 PM

Return to original view | Post

#53

|

Senior Member

2,618 posts Joined: Apr 2012 |

|

|

|

|

|

|

Jul 29 2022, 04:43 PM Jul 29 2022, 04:43 PM

Return to original view | Post

#54

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(AnAngel65 @ Jul 14 2022, 03:03 PM) Why want to terminate your account ? It will not actually be closed but just floating. Leave RM20 inside as next time you might utilised it for the ganjaran benefits. |

|

|

Aug 1 2022, 02:59 PM Aug 1 2022, 02:59 PM

Return to original view | Post

#55

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(AnAngel65 @ Aug 1 2022, 10:57 AM) I dont have kids so the account is for self usage only, so if reaching age 29 i cant get any more divident or i cant cash out anymore then might as well cash it all out. Dividend is not limited to age 29 and below. As for ganjaran benefits, its important to look at the future instead of short term only.RM20 left inside is better than closing it and as i mentioned its not totally closed so next time may have a big problem reopening it.My account opened on 2021 so theres no ganjaran benefit. All my children opened their own individual account also and to encourage them to save, we distribute some of our funds to them as early inheritance. This post has been edited by magika: Aug 1 2022, 03:04 PM |

|

|

Aug 2 2022, 08:22 AM Aug 2 2022, 08:22 AM

Return to original view | Post

#56

|

Senior Member

2,618 posts Joined: Apr 2012 |

With FD rates breaching 3.0% pa, there will be an exodus of funds from sspn once ganjaran rewards are paid.

|

|

|

Aug 2 2022, 02:06 PM Aug 2 2022, 02:06 PM

Return to original view | Post

#57

|

Senior Member

2,618 posts Joined: Apr 2012 |

|

|

|

Dec 17 2022, 08:52 PM Dec 17 2022, 08:52 PM

Return to original view | Post

#58

|

Senior Member

2,618 posts Joined: Apr 2012 |

|

|

|

Dec 18 2022, 07:35 AM Dec 18 2022, 07:35 AM

Return to original view | Post

#59

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(cybpsych @ Dec 17 2022, 09:58 PM) I use it in year 2015 and recomend a few friends to use credit card for deposit and they are quite happy with it. Not sure but a year later it was stopped. guy3288 liked this post

|

|

|

Dec 28 2022, 01:03 PM Dec 28 2022, 01:03 PM

Return to original view | Post

#60

|

Senior Member

2,618 posts Joined: Apr 2012 |

QUOTE(sijun @ Dec 28 2022, 12:42 PM) Hi. im currently considering saving in sspn for my newborn baby. 1. YesIm totally new to sspn and would like to clarify a few thing to see if i understand it correctly 1. sspn prime is the one i should got for as sspn plus looks like insurance to me. 2. tax rebate is 8k/y, and must be fresh funds. if i withdraw x amount, it must be deducted from any fresh deposit i added for the same yr for the rebate. what if i only withdraw and do no deposit? or deposit the following yr? 3. does it matter if i open an acc under my name or my newborn baby's name? or acc holder must be an adult, or is there joint acc? does it affect the tax rebate? 4. does the dividend affect the tax rebate? IE if i have 8k + 100 divd, and i withdraw the divd, does that need to be deducted from the funds for that yr. 2. Withdrawal for the year will affect only the year of withdrawal 3. It need to be in your name with the baby name as beneficary for tax rebate 4. Yes any withdrawal will affect it |

| Change to: |  0.2210sec 0.2210sec

0.41 0.41

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 07:22 AM |