QUOTE(victorian @ Feb 23 2024, 08:43 AM)

That's the way it is, that's why

people are depositing at the end of the month and withdrawing at the beginning of the month.

If you are talking about the processing time, then there's nothing much you can do.

But if you are talking about SSPN taking only the lowest balance of the month, EPF and ASNB is doing the same too

You are wrong there, only people who dont know how dividend is calculated would deposit end of month

those who know deposit SSPNi early in the month before 6th.

QUOTE(victorian @ Feb 23 2024, 08:43 AM)

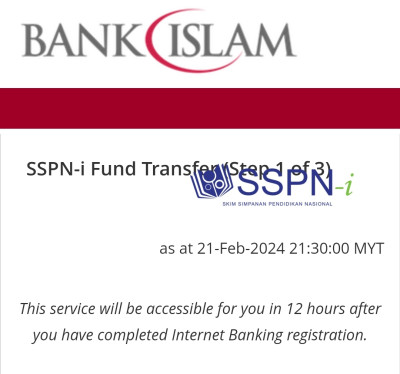

If you are talking about the processing time, then there's nothing much you can do.

But if you are talking about SSPN taking only the lowest balance of the month, EPF and ASNB is doing the same too

Again wrong. if you know the cut off processing time for same day interest you CAN make your deposit BEFORE that.

Eg. KDI Save deposit is 11AM. you dont want to lose that interest , deposit lah before that cut off time or date!

be more financial savvy bro, unless your deposits are all too small amount then 'no difference'

And dont confuse yourself on the different cut off dates for deposits to earn interest

for SSPN, EPF, ASNB , semua tak sama!

tanya lah the veterans in here.

Feb 21 2024, 02:49 PM

Feb 21 2024, 02:49 PM

Quote

Quote

0.0271sec

0.0271sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled