If you compare other physical gold in the world in USA, UK, Europe. I think Public Gold spread is OK.

Considering it is a local company has to do it's own marketing, distribution, minting etc.

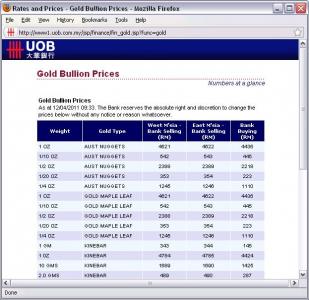

It 5% for 100 gram, UOB is 4% spread.

Try not to go beyond 100 gram as people can drill hole and put some other metal inside the bar especially for big one.

You only need to find few fake gold bar in a vendor, then the vendor is finished. So far, nobody found any.

It 's not easy to beat the density machine.

Further more all gold sourced will 1st have to be fully melted first before the bar is made.

Fake gold will be detected during the melting process.

If you want to make a tipu business in gold, with your picture flying around here and there and family staying in Malaysia. It's not long b4 someone find out where you and your family stay. With many Malaysian buyer some are police, army , custom etc. Frankly speaking I will not dare to do it lah. Next day you come out, die already also nobody know or care.

can U imagine how angry will they be when they previously brought at USD1000/oz and now it's turn out to be fake and the price now is USD5000/oz.

The only thing they can play is the spread, agent structure etc.

QUOTE(FrancescoTop8 @ Apr 15 2011, 10:45 PM)

DEFINITELY.

U can change ur paper gold to physical gold

BUT with terms and conditions.

Public gold just have their business in Malaysia, correct me if im wrong.

Thus, their market are exclusively in Malaysia only.

Risky because their market is small and gold are quite complicated business.

Tricky because, public gold employ a MLM-like scheme. U buy and u automatically become a dealer, and u have to find another buyer to get reward or something. Their premium charge also quite high.

Have u heard any established bank (Maybank,Public Bank,UOB or KFH) go crazy to promote their gold products ?

NO,they dont because they know gold have a high volatility.

There`s a lot to know before u invest in gold.

That`s why i keep telling u, buy gold from BANK & dont buy from unestablished company or whatever it names because gold is not an easy business.

Added on April 16, 2011, 3:10 pmQUOTE(FrancescoTop8 @ Apr 15 2011, 09:50 PM)

Dude, i dont recommend Public gold because i find it quite tricky and risky.

Do some research before start gold investment. Dont easily believe what other/broker say.

For me, just buy gold in bank. KFH and Maybank have physical gold. It is safer and less headache.

_______________

Nope, u can have ur gold in physical if u buy paper gold, BUT u have to follow some procedures.

And i find that the terms and conditions of paper gold quite tricky and time-consuming.

For public Bank,

the option for physical delivery is available.

The prices for delivery is also stated , you can call them up to find out. Within 30 mins get an answer.

Whether it is always available or not, now or in the the future. It remain a question.

No buy back after physical delivery.

For MayBank,

the option for physical delivery is available.

The prices for delivery is also not stated in their website, you can call them up to find out. There phone system difficult to reach as too many customer.

Whether it is always available or not, now or in the the future. It remain a question.

No buy back after physical delivery.

For KFH,

You can take delivery, and sell back to them after taking delivery.

So susah! you may as well buy UOB physical at the 1st place or Maybank kijang emas

If that option is not available then only buy Public Gold.

Added on April 16, 2011, 3:11 pmQUOTE(xcarfieldx @ Apr 15 2011, 06:54 PM)

Finally finish reading 9 pages.

May I know, how to check the spread of UOB from the picture attached in page 8? Spread is actually means the difference between buying and selling price?

I wish to invest in these. But I not sure which to go for, go for physical or paper? Gold or silver? Can anyone advise? Which bank should I buy from since UOB spread has increase? Or public gold is the best? Hehe.. I hope I ask the right question.

Go for physical. With price going up like mad these few months, it ;s signal the lack of physical gold.

This post has been edited by GoldChan: Apr 16 2011, 03:11 PM

Feb 28 2011, 12:45 PM, updated 15y ago

Feb 28 2011, 12:45 PM, updated 15y ago

Quote

Quote

0.1972sec

0.1972sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled