Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

BboyDora

|

Oct 3 2024, 10:22 AM Oct 3 2024, 10:22 AM

|

|

QUOTE(TOS @ Sep 26 2024, 12:06 AM) Poor people are always discriminated by bankers  Citibank to close last branch in Singapore in October amid shift to wealth hubs (no paywall) https://www.straitstimes.com/business/banki...-to-wealth-hubs even in Malaysia too. i got rejected to open bank account after they see my income statement   |

|

|

|

|

|

Songchien

|

Oct 4 2024, 11:53 AM Oct 4 2024, 11:53 AM

|

|

Hi guys, just created OCBC SG account. It was fine to receive and send money during the 1st day I set it up. After about 2 weeks, it seems like I cannot even receive money in this account. Anyone faced similar issue before?

|

|

|

|

|

|

!@#$%^

|

Oct 4 2024, 11:54 AM Oct 4 2024, 11:54 AM

|

|

QUOTE(Songchien @ Oct 4 2024, 11:53 AM) Hi guys, just created OCBC SG account. It was fine to receive and send money during the 1st day I set it up. After about 2 weeks, it seems like I cannot even receive money in this account. Anyone faced similar issue before? maybe can try shoot a secure mail and ask. never happened to me, yet. |

|

|

|

|

|

Songchien

|

Oct 4 2024, 12:00 PM Oct 4 2024, 12:00 PM

|

|

QUOTE(!@#$%^ @ Oct 4 2024, 11:54 AM) maybe can try shoot a secure mail and ask. never happened to me, yet. ya. I sent 1 yesterday but may have to wait up to 5 days.  I better let my HR know to deposit salary into another SG account before my pay date. |

|

|

|

|

|

adam1190

|

Oct 18 2024, 11:47 AM Oct 18 2024, 11:47 AM

|

|

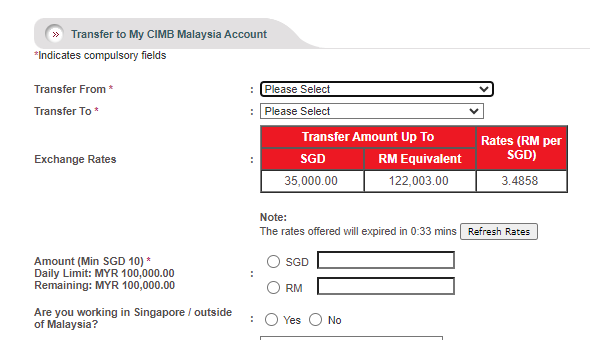

QUOTE(Ramjade @ Apr 26 2024, 01:16 PM) Cannot use that way anymore Cimb not earning money. Only way is cimb Malaysia or as intended local sg bank account under your name. That’s sad for the first transfer verification purpose as the exchange rate to transfer from cimb Malaysia to own cimb Singapore account is ridiculously high at 3.33+ as compared to the real exchange rate at 3.27+ .. |

|

|

|

|

|

!@#$%^

|

Oct 18 2024, 11:48 AM Oct 18 2024, 11:48 AM

|

|

QUOTE(adam1190 @ Oct 18 2024, 11:47 AM) That’s sad for the first transfer verification purpose as the exchange rate to transfer from cimb Malaysia to own cimb Singapore account is ridiculously high at 3.33+ as compared to the real exchange rate at 3.27+ .. that's normal for most, if not all banks. |

|

|

|

|

|

Medufsaid

|

Oct 18 2024, 11:53 AM Oct 18 2024, 11:53 AM

|

|

QUOTE(adam1190 @ Oct 18 2024, 11:47 AM) That’s sad for the first transfer verification purpose as the exchange rate to transfer from cimb Malaysia to own cimb Singapore account is ridiculously high at 3.33+ as compared to the real exchange rate at 3.27+ .. go for these alternatives - ocbc SG. ask the regulars here who use OCBC for referral codes

- MBB sg

once you created with either of them, u can then create a CIMB sg acct by doing a free local bank transfer. before OCBC/MBB sg -> you need CIMB sg more than they need you after OCBC/MBB sg -> you now have the high ground. it's only CIMB sg's loss if they didn't open acct for you |

|

|

|

|

|

adam1190

|

Oct 18 2024, 12:40 PM Oct 18 2024, 12:40 PM

|

|

QUOTE(Medufsaid @ Oct 18 2024, 11:53 AM) go for these alternatives

- ocbc SG. ask the regulars here who use OCBC for referral codes

- MBB sg

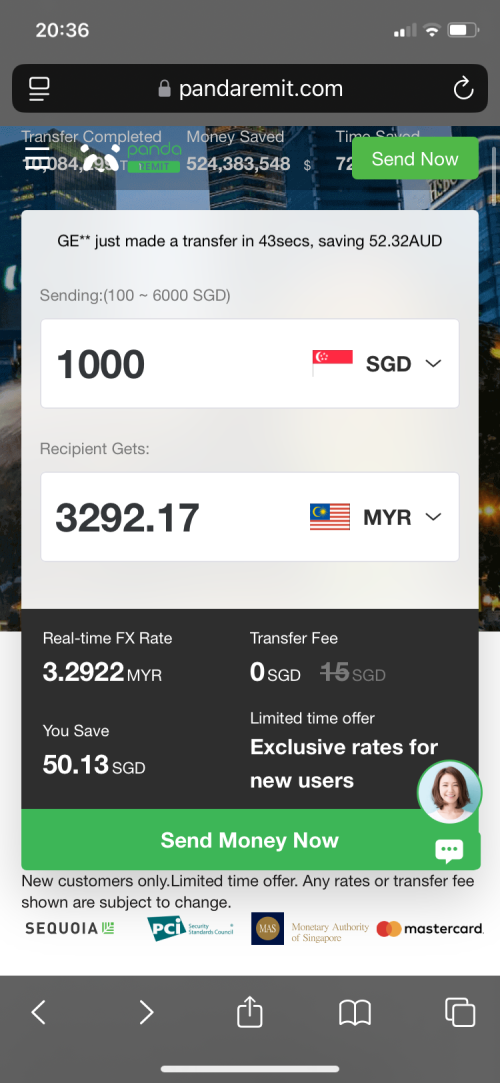

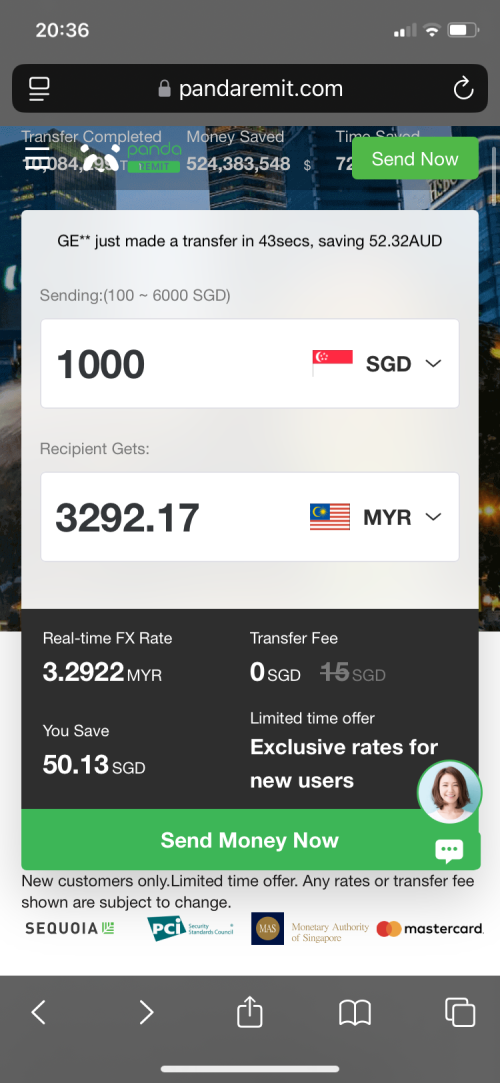

once you created with either of them, u can then create a CIMB sg acct by doing a free local bank transfer. before OCBC/MBB sg -> you need CIMB sg more than they need you after OCBC/MBB sg -> you now have the high ground. it's only CIMB sg's loss if they didn't open acct for you I never expect the spread to be such a big difference from the mid point exchange rate cimb my to cimb sg .. The cheapest way from cimb to cimb Singapore is via DuitNow / transfer only right This post has been edited by adam1190: Oct 18 2024, 12:41 PM Attached thumbnail(s)

|

|

|

|

|

|

Medufsaid

|

Oct 18 2024, 01:39 PM Oct 18 2024, 01:39 PM

|

|

QUOTE(adam1190 @ Oct 18 2024, 12:40 PM) The cheapest way from cimb to cimb Singapore is via DuitNow (CIMB is inaccurate here. DuitNow for MYR-to-MYR only) / transfer only right before CIMB sg acct is validated, yes this is the only way after CIMB sg acct is validated, u can use moneymatch or sunwaymoney to send from CIMB MY to CIMB sg instead This post has been edited by Medufsaid: Oct 18 2024, 02:34 PM |

|

|

|

|

|

Ramjade

|

Oct 19 2024, 01:11 AM Oct 19 2024, 01:11 AM

|

|

QUOTE(adam1190 @ Oct 18 2024, 11:47 AM) That’s sad for the first transfer verification purpose as the exchange rate to transfer from cimb Malaysia to own cimb Singapore account is ridiculously high at 3.33+ as compared to the real exchange rate at 3.27+ .. Think of it as fees for opening sg bank account. Still cheap. Vs parking 20k in SGD with banks in Singapore. |

|

|

|

|

|

katshi

|

Oct 20 2024, 10:20 AM Oct 20 2024, 10:20 AM

|

New Member

|

Hi everyone, i am looking to open an account in sg, preferrably with debit card, as I foresee frequent visit to sg. Also potentially future investment. I am currently working and staying in malaysia, without sg resident address. May I ask what are the options?

1. CIMB Fastsaver (no debit)

2. Maybank iSavvy Account

3. OCBC digital? (can?)

I am currently using wise to hold some sgd, while can use debit card for payment, i believe to withdraw money in sg got charges. May I know if these options valid or any other option? All these 3 banks I have account in Malaysia as well.

|

|

|

|

|

|

Medufsaid

|

Oct 20 2024, 11:16 AM Oct 20 2024, 11:16 AM

|

|

QUOTE(katshi @ Oct 20 2024, 10:20 AM) Hi everyone, i am looking to open an account in sg, preferrably with debit card MBB sg with debit go for ar-rihla. Minimum balance only S$200 https://www.maybank2u.com.sg/en/personal/cr...casa/index.pageCIMB no debit This post has been edited by Medufsaid: Jul 18 2025, 04:31 PM |

|

|

|

|

|

adam1190

|

Oct 20 2024, 08:46 PM Oct 20 2024, 08:46 PM

|

|

Anyone use panda remit before, the rate seems good?  |

|

|

|

|

|

Medufsaid

|

Oct 20 2024, 09:33 PM Oct 20 2024, 09:33 PM

|

|

adam1190 we're looking for MYR->SGD remittance of which pandaremit doesn't have.

as for SGD->MYR, nothing can beat CIMB sg -> CIMB my during office hours

|

|

|

|

|

|

Medufsaid

|

Oct 24 2024, 11:48 PM Oct 24 2024, 11:48 PM

|

|

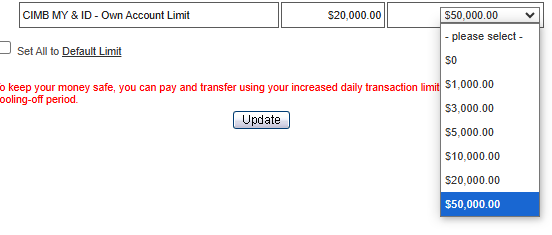

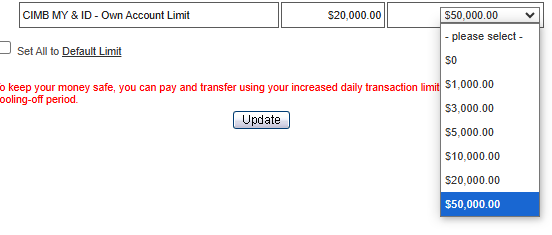

QUOTE(Medufsaid @ Jan 4 2024, 05:39 PM) CIMB SG has updated their daily limit. Max no longer RM100k  This post has been edited by Medufsaid: Oct 24 2024, 11:48 PM This post has been edited by Medufsaid: Oct 24 2024, 11:48 PM |

|

|

|

|

|

kockroach2

|

Nov 4 2024, 10:29 PM Nov 4 2024, 10:29 PM

|

Getting Started

|

QUOTE(moonsatelite @ May 13 2024, 11:53 AM) just a small update/ info furnishing, to those who opened an OCBC SG account via OCBC Digital account opening (MyKad and Malaysian passport), you ARE considered as a non-resident. you will need to maintain SGD $20,000 after the first year of account opening or else you will be charged a fall below fee every month. i opened a Monthly Savings Account alongside that account and i visited a branch to close the Statement Savings account and the Global USD account will be closed too. i furnished my work document and passport, i am considered a resident in Singapore and no point for me to keep the Statement Savings account + Global USD account hence why i closed the account. i was informed that you have to close the account in person Is the Statement Savings account link with the Global USD account, I.e. Closing the Savings account will automatically close the Global USD account? |

|

|

|

|

|

Gabriel03

|

Nov 18 2024, 09:21 PM Nov 18 2024, 09:21 PM

|

|

Dear sifu,

In order to get the best SGD-MYR exchange rate, I went to open CIMB at MY & SG.

I have opened CIMB FastSaver online.

MY side, despite claiming that it can be done competely online, they asked me to go to branch to complete the online registration.

The issue now is that I applied online to open Basic Savings without Annual Fee but the branch staff changed the account to EcoSave-i without my consent. After finding it out, I asked why change as it comes with annual fee.

She claimed that Basic Savings Account cannot be linked to CIMB SG. Is this true? Any sifu here who has a Basic Savings Account and linked it to CIMB SG?

|

|

|

|

|

|

Ramjade

|

Nov 18 2024, 09:53 PM Nov 18 2024, 09:53 PM

|

|

QUOTE(Gabriel03 @ Nov 18 2024, 09:21 PM) Dear sifu, In order to get the best SGD-MYR exchange rate, I went to open CIMB at MY & SG. I have opened CIMB FastSaver online. MY side, despite claiming that it can be done competely online, they asked me to go to branch to complete the online registration. The issue now is that I applied online to open Basic Savings without Annual Fee but the branch staff changed the account to EcoSave-i without my consent. After finding it out, I asked why change as it comes with annual fee. She claimed that Basic Savings Account cannot be linked to CIMB SG. Is this true? Any sifu here who has a Basic Savings Account and linked it to CIMB SG? I have. The bank officer lied to you. My account have always been cimb free basic savings account. You should have open cimb Malaysia first. Then only open CIMB sg. Then only link. Don't tell the bank officer anything about CIMB sg. Just tell them you want to open cimb free basic savings account. After 6 months just close the ecosave -i account. This post has been edited by Ramjade: Nov 18 2024, 10:03 PM |

|

|

|

|

|

Gabriel03

|

Nov 18 2024, 10:13 PM Nov 18 2024, 10:13 PM

|

|

QUOTE(Ramjade @ Nov 18 2024, 09:53 PM) I have. The bank officer lied to you. My account have always been cimb free basic savings account. You should have open cimb Malaysia first. Then only open CIMB sg. Then only link. Don't tell the bank officer anything about CIMB sg. Just tell them you want to open cimb free basic savings account. After 6 months just close the ecosave -i account. i have already submited an inquiry to CIMB. If the answer is not promising, I'll submit a complaint to Bank Negara. |

|

|

|

|

|

Medufsaid

|

Nov 18 2024, 11:12 PM Nov 18 2024, 11:12 PM

|

|

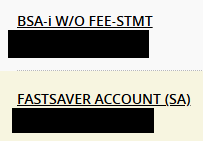

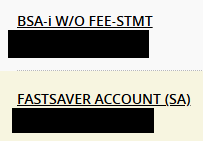

Gabriel03 i have BSA-i. walk-in to open basic acct without telling them my plans. previously i dare not open CIMB MY acct bcos of horror stories about debit card fraud  btw, since i'm here. just to state that i can no longer wholeheartedly recommend moneymatch. do compare with sunwaymoney as they have the upperhand lately when it comes to converting your ringgit QUOTE Just an update: RM20000 to SGD Wise: 6,179 MoneyMatch: 6201 (+ RM5 fee) SunwayMoney: 6208 (+ RM8 fee) So today is SunwayMoney the best. Immediately transferred some more. Thanks everyone!

|

|

|

|

|

Oct 3 2024, 10:22 AM

Oct 3 2024, 10:22 AM

Quote

Quote

0.0235sec

0.0235sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled