QUOTE(a9z1 @ Nov 25 2021, 01:08 PM)

Back to normal now. I made an online transfer from dbs to my scb account no problem.Opening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Nov 25 2021, 01:54 PM Nov 25 2021, 01:54 PM

Show posts by this member only | IPv6 | Post

#3841

|

Senior Member

2,544 posts Joined: Jan 2003 |

QUOTE(a9z1 @ Nov 25 2021, 01:08 PM) Back to normal now. I made an online transfer from dbs to my scb account no problem. TOS liked this post

|

|

|

|

|

|

Nov 26 2021, 10:29 AM Nov 26 2021, 10:29 AM

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Nov 26 2021, 10:51 AM Nov 26 2021, 10:51 AM

Show posts by this member only | IPv6 | Post

#3843

|

All Stars

24,432 posts Joined: Feb 2011 |

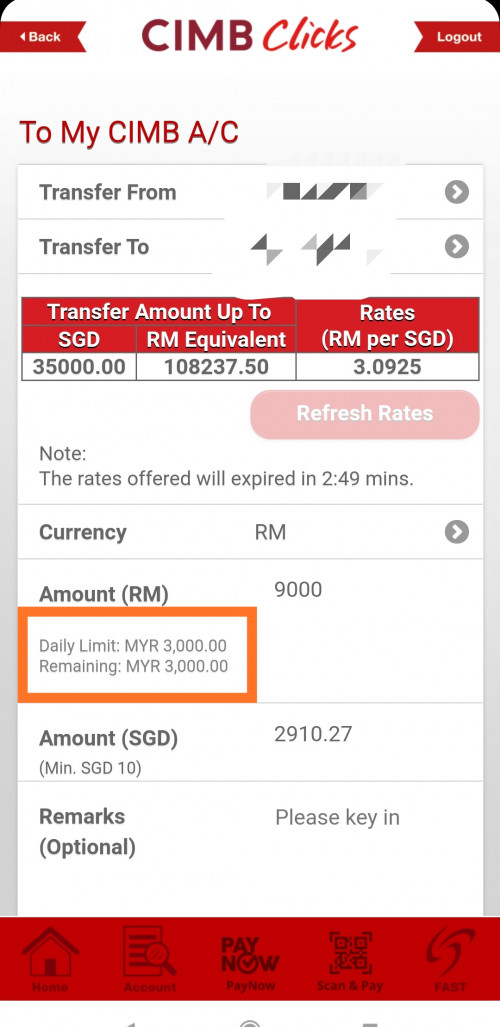

QUOTE(mushigen @ Nov 26 2021, 10:29 AM) Guys, I noticed there's this RM3k daily transfer limit in CIMB (Sgd>RM) when it wasn't there the last time I checked. Is this a default that can be changed? I'm not able to change it via App and I can't check using desktop browser due to password issue. You can increase your limit. |

|

|

Nov 26 2021, 11:18 AM Nov 26 2021, 11:18 AM

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Dec 1 2021, 03:54 AM Dec 1 2021, 03:54 AM

Show posts by this member only | IPv6 | Post

#3845

|

Junior Member

43 posts Joined: Mar 2007 |

QUOTE(Ramjade @ Nov 2 2021, 02:35 AM) I already wrote there need to visit their HQ. They dont have HQ in Malaysia. Does this still work for now? When did you use this method to open account successfully?1 You need to fly or take a train or bus into Singapore. 2. Bring at least SGD10k (to make your journey worth it) 3. Go to marina bay financial center via smrt 4. Go to DBS HQ ask for DBS Vickers account with DBS bank account. 5. You need to open Vickers or else you won't get the bank account at all. It's their requirement. You don't need to fund it or use it. Take whatever account they give you. Don't bargain. 6. Deposit in the SGD10k. 7. After 6 months and 1 day, open DBS MY account via online. 8.Transfer money into DBS MY account from previous DBS/posb account. 9. Close your current DBS/POSB account online. 2 years ago I went to their branch and they said need SGD300k investment to open DBS account. Several banks also told me similar requirement. |

|

|

Dec 1 2021, 10:13 AM Dec 1 2021, 10:13 AM

Show posts by this member only | IPv6 | Post

#3846

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(tankteam @ Dec 1 2021, 03:54 AM) Does this still work for now? When did you use this method to open account successfully? Almost 5 years ago. That's their standard reply. I went to another sg bank on the same day and got same reply as you. But it was not DBS. But if you never try, you never know. I went there with no hope of opening and just to try my luck and who knows it works.2 years ago I went to their branch and they said need SGD300k investment to open DBS account. Several banks also told me similar requirement. |

|

|

|

|

|

Dec 2 2021, 08:55 AM Dec 2 2021, 08:55 AM

Show posts by this member only | IPv6 | Post

#3847

|

Probation

19 posts Joined: May 2020 |

Hi, dear all, i m newbie in investment line, I'd like to know why most of u recommend CIMB singapore account rather than Maybank Singapore account?

Maybank Singapore account come with debit ATM card, is it? More convenient if v can withdraw money from singapore ATM, is it? Just want to find out more info (pro and cons) of CIMB and Maybank singapore account. Thanks |

|

|

Dec 2 2021, 09:06 AM Dec 2 2021, 09:06 AM

|

Senior Member

6,269 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(k_f_kho @ Dec 2 2021, 08:55 AM) Hi, dear all, i m newbie in investment line, I'd like to know why most of u recommend CIMB singapore account rather than Maybank Singapore account? Maybank must leave 500 SGD (IIRC) inside to avoid being charged monthly fee in SGD. CIMB don't need.Maybank Singapore account come with debit ATM card, is it? More convenient if v can withdraw money from singapore ATM, is it? Just want to find out more info (pro and cons) of CIMB and Maybank singapore account. Thanks If you travel often enough to SG to want to withdraw money from singapore ATM, then you should have access to other banks and not only limited to maybank and cimb (which are discussed here because you can open their accounts without being physically present). k_f_kho liked this post

|

|

|

Dec 2 2021, 09:53 AM Dec 2 2021, 09:53 AM

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(k_f_kho @ Dec 2 2021, 08:55 AM) Hi, dear all, i m newbie in investment line, I'd like to know why most of u recommend CIMB singapore account rather than Maybank Singapore account? Maybank sg-> my lousy rates.Maybank Singapore account come with debit ATM card, is it? More convenient if v can withdraw money from singapore ATM, is it? Just want to find out more info (pro and cons) of CIMB and Maybank singapore account. Thanks Maybank have to lock up min sgd500. If your value drop, you pay penalty sgd2.00/month. You don't need sg ATM or their card. Just apply for bigpay and spend in Singapore. This post has been edited by Ramjade: Dec 2 2021, 09:53 AM k_f_kho liked this post

|

|

|

Dec 8 2021, 01:00 AM Dec 8 2021, 01:00 AM

|

Junior Member

18 posts Joined: Sep 2011 |

Hi guys, I've just set up CIMB SG Fastsaver account. I was looking to make a transfer from the Fastsaver account to another bank account in SG, but it looks like all I could do was to transfer funds between my own CIMB accs. How do I go about doing this? Thanks

|

|

|

Dec 8 2021, 01:23 AM Dec 8 2021, 01:23 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Arashi @ Dec 8 2021, 01:00 AM) Hi guys, I've just set up CIMB SG Fastsaver account. I was looking to make a transfer from the Fastsaver account to another bank account in SG, but it looks like all I could do was to transfer funds between my own CIMB accs. How do I go about doing this? Thanks You can use FAST to transfer funds from CIMB SG to say, Maybank SG. (It's under "To other banks" list) Hansel liked this post

|

|

|

Dec 8 2021, 07:21 PM Dec 8 2021, 07:21 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hansel @ Dec 8 2021, 04:29 PM) I am prospering in SG,... and am indebted to SG. Replying from this thread since I have a question on DBS SG. Forget abt that Ramjade fella,... I advised him to start with SG first, he did,.. and today, he is backstabbing SG instruments,... He forgot where he started from. He forgot he learnt to use Interactive Brokers from his SG experience. He forgot he is still stubbornly holding-on to his DBS Acct even after I told him to close them. Not sure about your story with him, why did you recommend to close DBS SG account? I think having a facility to receive USD in SG is not a bad idea for emergency purposes right? Or did I miss out anything? Hansel liked this post

|

|

|

Dec 8 2021, 07:29 PM Dec 8 2021, 07:29 PM

Show posts by this member only | IPv6 | Post

#3853

|

All Stars

14,966 posts Joined: Mar 2015 |

QUOTE(TOS @ Dec 8 2021, 07:21 PM) Replying from this thread since I have a question on DBS SG. while waiting for his response,...Not sure about your story with him, why did you recommend to close DBS SG account? I think having a facility to receive USD in SG is not a bad idea for emergency purposes right? Or did I miss out anything? if i am not mistaken,...previously someone mentioned that or something like this...,..they have this fall below fees (if monthly balance less than xxx, than $$ will be deducted....) thus i guess, that maybe part of the reason TOS liked this post

|

|

|

|

|

|

Dec 8 2021, 07:42 PM Dec 8 2021, 07:42 PM

Show posts by this member only | IPv6 | Post

#3854

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(TOS @ Dec 8 2021, 07:21 PM) Replying from this thread since I have a question on DBS SG. He is being sarcastic. Period. Cause I say bad but true stuff about sg banks and their market so in Chinese he "bo-song" (not happy) for those who don't understand Chinese.Not sure about your story with him, why did you recommend to close DBS SG account? I think having a facility to receive USD in SG is not a bad idea for emergency purposes right? Or did I miss out anything? Don't worry. You missed nothing..Let's see if what I said is true about him "bo-song". Anyway some stuff I said which stuck a nerve with him to bring you up to date - no fingerprint authorisation withdrawal. Very weird for financial center to not have fingerprint authorisation but depend on signature. Even Malaysia have fingerprint for withdrawal. Come in la - unable to move USD freely like HK banks. I know HK banks can move money digitally like FAST transfer but no such options exist in sg exist except via cheque/echeque/local TT between local bank account. I even specifically ask customer service is there anyway to move USD using service like FAST, they told me no. - expensive local sg bank based brokerage for overseas stocks - lousy market. This you know already. Keep in mind this is from a regular joe and not from a priority/private banking point if view. I think that is all. That's why don't know why he' is sensitive when I just state truth. Maybe like people said the truth hurts. I welcome him to debate the above points especially about the banks (first and 2nd point) Why should I close an account that does not have any fees and have a very good multicurrency account (not wise level, but still better than Malaysian bank account). I don't invest in sg market anymore does not mean I need to close their account. This post has been edited by Ramjade: Dec 8 2021, 08:09 PM TOS liked this post

|

|

|

Dec 8 2021, 07:52 PM Dec 8 2021, 07:52 PM

Show posts by this member only | IPv6 | Post

#3855

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(thecurious @ Dec 8 2021, 07:46 PM) CIMB sg close his account I think. thecurious liked this post

|

|

|

Dec 8 2021, 07:55 PM Dec 8 2021, 07:55 PM

|

All Stars

15,192 posts Joined: Oct 2004 |

|

|

|

Dec 8 2021, 08:20 PM Dec 8 2021, 08:20 PM

|

All Stars

15,192 posts Joined: Oct 2004 |

QUOTE(Ramjade @ Dec 8 2021, 08:01 PM) This is true. Only one branch Not really. My friend received money from her freelancer programming job and the bank warned her can't use personal account to receive business job.Actually they close account only if you did something wrong or cannot provide documentation of where money come from harlo this is not business. Just one transaction rec'd and they queried it after two months and the purpose of incoming one func. |

|

|

Dec 8 2021, 08:25 PM Dec 8 2021, 08:25 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

QUOTE(TOS @ Dec 8 2021, 07:21 PM) Replying from this thread since I have a question on DBS SG. He's right ! I was being sarcastic abt him....Not sure about your story with him, why did you recommend to close DBS SG account? I think having a facility to receive USD in SG is not a bad idea for emergency purposes right? Or did I miss out anything? Since he spoke so badly abt SG and the investments there, why kept his account opened, right ? Then he'll twist and turn again to justify his holding-on to his acct,... and subsequently,... talk bad abt SG again,.... TOS liked this post

|

|

|

Dec 8 2021, 08:26 PM Dec 8 2021, 08:26 PM

|

Senior Member

1,620 posts Joined: Mar 2020 |

|

|

|

Dec 8 2021, 08:26 PM Dec 8 2021, 08:26 PM

Show posts by this member only | IPv6 | Post

#3860

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(jack2 @ Dec 8 2021, 08:20 PM) Not really. My friend received money from her freelancer programming job and the bank warned her can't use personal account to receive business job. If cannot use money to receive salary then rather pointless.harlo this is not business. Just one transaction rec'd and they queried it after two months and the purpose of incoming one func. |

| Change to: |  0.4630sec 0.4630sec

1.74 1.74

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 01:08 PM |