QUOTE(Ramjade @ Feb 15 2021, 08:26 PM)

I opened my account for

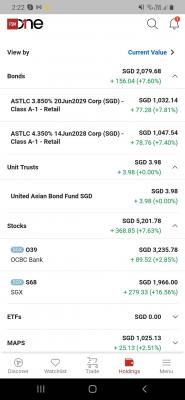

1. Invest into sg reits. They offer 3-8%p.a dividend yield.

2. Use it to invest into US market since overseas broker accept SGD deposit and not RM.

And in case you are wondering, my SGD is minimum giving me 6%p.a

QUOTE(!@#$%^ @ Feb 15 2021, 09:34 PM)

mine was idle. but recently trying out stashaway, endowus and syfe.

QUOTE(donhay @ Feb 17 2021, 12:34 PM)

My $$ in my SG bank account is 20% , the other 80% are in SGX ( reits, banks) and UT from the bank.

QUOTE(mavistan89 @ Feb 20 2021, 01:01 AM)

For me, not FD purpose, just to keep my $$ in sg in case myr depreciate more. Hedging purpose

QUOTE(cklimm @ Feb 20 2021, 02:19 PM)

The Stashaway MY and SG, both invest the in same market right?

SG bank is a bridgehead, leading to an array of opportunities.

Thank you all for the replies. For a complete beginner, what reading material wold you suggest to get started on using funds in SG account (for non-SG residents)?

Googling brings up plenty of resources but in terms of money I'm very risk adverse so being very cautious in what should be taken as truth vs bad advice.

Right now I'm reading fundsupermart.com, but unsure if it's just to promote their own portfolio or really trying to help

This post has been edited by corad: Feb 21 2021, 12:37 PM

Feb 14 2021, 08:59 PM

Feb 14 2021, 08:59 PM

Quote

Quote

0.0314sec

0.0314sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled