QUOTE(myroy @ Apr 30 2024, 10:37 AM)

im 30y old in kuli IT career

i saw this tread and i seems "How the hell you guys can save a lot"

i came from b40 family from east cost, and something i need to gave some money to my parent & siblings not much just a few hundreds

Hope this can get align back on my mission to follow you guys step

i would love to get advice on thisLoan House = RM460k - RM2100/month remaining RM420,000

Study loan = RM88,+++ remaining RM45,+++

Transport = RM45,+++ remaining RM24,+++

AssestPhysical Gold = RM20,+++

Cash investment = RM25,+++

My current goal is to get RM100k worth of cash investment, pay up my transport -> study loan -> then house

QUOTE(myroy @ Apr 30 2024, 03:17 PM)

House - Possible to stay with your parents and rent out this house?

Not possible - because i come from east coast, i am first generation coming here. Need to stand on my own, parent in east coast.

Transport - Sure this one i think once done with the payment i will not add more liabilities

Income - ongoing... i skill my self up and trying to be the best in my own field. For 2nd income i'm not sure yet, because my 1st job already taking too much time in my daily live. But let see in the future if i can free up some my time and find 2nd income

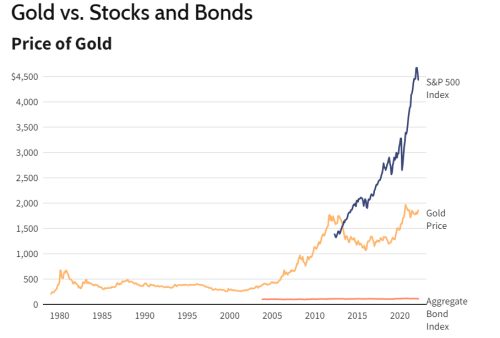

you can refer to what Warren Buffett say about gold. That might change your perspective towards gold, who knows?

forget everything about now.

ask yourself how much per month you need to live comfortably. And then set target to earn that amount through passive income. How much amount you need to save up in order it can generate the passive income.

you are in IT. Then you are in the field where your work can be done remotely and potentially earning foreign currency while living in M'sia.

Apr 29 2024, 11:36 AM

Apr 29 2024, 11:36 AM

Quote

Quote

0.0216sec

0.0216sec

1.44

1.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled