This thread suddenly derailed into stocks vs. properties

(tho still an interesting read)

Let me try to bring it back on track and also leave a footprint here while at it since I haven't posted this in forums before (usually just updates on my blog)

Came from a hardcore B40 family and frankly speaking,

I got friggin' lucky and never would've thought that these were possible if you asked me about this 10-15 years ago. I only have my mom to thank - her insistence to send me to uni despite our financials (and I wasn't even grateful or helping her out back then) and she can now harvest her fruits (me)

Age: 32, Female

Occupation: IT kuli

Marital Status: Single with One Dependent (Parent) / No Kids

[attachmentid=11495479]

~RM891K Net Worth, valued as of

March 2024 rounded up to the nearest thousands. Could be more frugal, but happy with the current balance in life vs. savings

Asset(s):Condo @ RM0 -

I value it at RM0 since it's generating expenses rather than cash flow. It's a concept I took from Rich Dad Poor Dad  . Controversial, yes, but I'm more comfortable this way. (Market Value probably RM400k-ish nett transaction fees)Vehicle @ RM0

. Controversial, yes, but I'm more comfortable this way. (Market Value probably RM400k-ish nett transaction fees)Vehicle @ RM0 -

it's just a piece of metal junk that gets me from point A to point B, 15 years and running!Cash @ RM200K - includes all kind of random cash - be it in my Flexi Loan, FD / StashAway Simple / Overseas Cash / etc. Recently hoarded more than I'd personally like, but no choice since I need to spend these in short/mid term.

EPF (Passive) @ RM447K - passively managed EPF a.k.a our sweet sweet Conventional Portfolio with yearly dividends

EPF (Active) @ RM117K - actively managed EPF a.k.a i-Invest or withdraw-to-invest and try to outsmart EPF. And yes, I fared worse than EPF. Might as well kept it untouched.

My "Freedom" Portfolio @ RM440K

My "Freedom" Portfolio @ RM440K - ETFs, Stocks, FDs, and all random craps

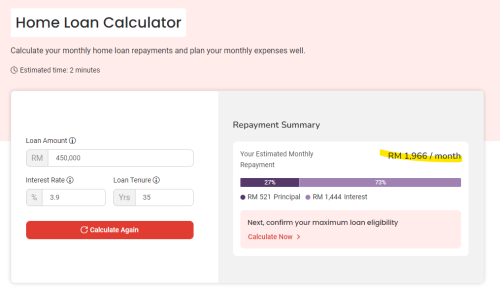

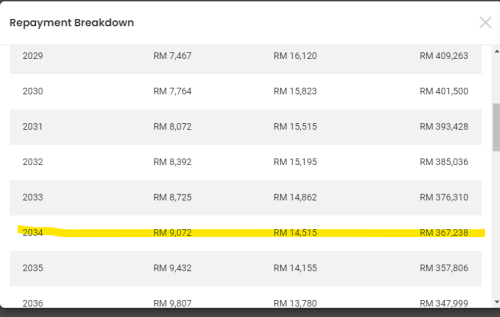

Liability:Mortgage Loan @ RM310K - been accelerating my payments since Dec 2023 before I make my next big move in my lifetime.

Very good and transparent trackable portfolio. nice to meet you. I have a 7 years trackable portfolio at 17.6% CAGR

Sep 26 2021, 01:40 PM

Sep 26 2021, 01:40 PM

Quote

Quote

0.0200sec

0.0200sec

1.01

1.01

7 queries

7 queries

GZIP Disabled

GZIP Disabled