QUOTE(MakNok @ Nov 7 2019, 01:51 PM)

I also thought as well until I check and realise that my Alliance Loan can never cleared within 10 year.

Outstanding Loan rm16.9k

Pay.rm150 monthly...

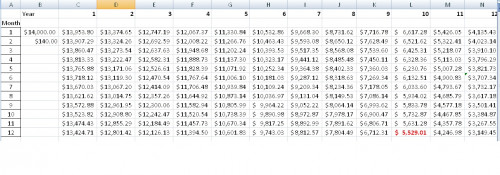

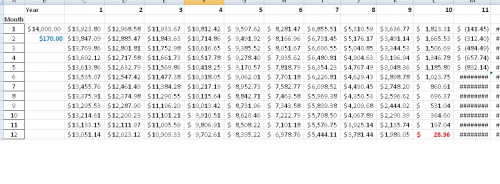

My excel calculation show that it is impossible to settle within 10year.

I can only guess at that time...I told the AKPK Officer that I can only afford max rm2.1k.

And she play around this figure trying to settle all debts.

At that time...there is no online akpk website to check updates..

So i just let it be until i realise that AKPK now can check online....

I think I started more or less like you....about 9 year back..

My last payment suppose to be March 2020 (10 year)

And I still have 2 debts which cannot be cleared.

I have check using excel...

It is correct.

Others Bank cleared as schedule.

My HSBC have no problem at all..

I do pay HSBC a visit and chat with them..

HSBC statement also correct, in my case.

I also need to see AKPK again..

I was told I can walk in and see them anytime after I ask them to check my Alliance debts...

How your meet up with Akpk officer?

As far as I know...akpk will ask you to refer to akpk dept for that bank for outstanding..

AkPK is just mediator....

If you don't mind.....

Do you know your initially outstanding balance ?

If rm23k and pay only rm260....definitely cannot settle within 10 year

omg...try check a few things.

1. the opening balance 9-10 years ago when u submit to akpk. it wld be same or just slightly off.

2. interest. there could be differences between what akpk proposed and what bank has. it should be same.

based on akpk and bnm told me, if opening balance incorrect.. okay la, but this is 1 case. just need to drill back all statements back then.

if opening balance SAME but then interest difference or tenure difference, then this is another case.

Based on akpk proposed amount, tenure, interest etc...., the bank has to either:

1. acknowledge back to akpk that is it okay for bank OR keep quite means okay/no rejection.

2. if bank disagree on the proposed interest, amount, tenure by akpk, the bank has to inform/notify/reject this proposal. Then akpk will have to reconnect to you to review again the dmp plan.

if the bank don't inform akpk, how akpk will act as dmp counselor to help you clear your debt.

My case is where bank does not agree with proposed interest and the tenure, as the amount proposed does not able to clear all in 10 year tenure.

The process is there, may not be perfect back 9-10 years ago, but that is pretty standard process. What we all agreed in the agreement is x-year x amount to clear all. it is an agreement.

Bank may not act according to the process back then, but again it is a process where all has to follow. Else it is a compliance issue.

Let's look at another SAMPLE:

Ah Lien has committed a crime, and sentenced in court by the judge, prison for 10-years !

So Ah Lien served 9 years 364 days and she is so happy that she has 1 more day to go and will be released....BUT, on the day of release, the prison tells her that she has to serve another 2+ years.....WHATTTT...

same right?? If the bank or anyone laugh, then...how.... should Ah Lien continue to be prisoned for x years???

--------------------------------- Sorry... forgot about your questions

How your meet up with Akpk officer? KL> I walked in after so many calls with akpk customer service and the bank.

As far as I know...akpk will ask you to refer to akpk dept for that bank for outstanding..

AkPK is just mediator....

KL> yes, akpk is like a "middleman", but DMP, this is not DMP professionally, my view. We can check with bank, if it is just few hundreds, i think still bearable, it above 5k (like my case), how...

If you don't mind.....

Do you know your initially outstanding balance ?

If rm23k and pay only rm260....definitely cannot settle within 10 year

KL> My one is 14k, pay 140. akpk proposed 0%.. it will be matched as even i pay full 10-year, it is 16,800. Now my problem is interest. 0% <> 8.5%. SCREWED.

This post has been edited by Kiefer: Nov 7 2019, 03:43 PM

Nov 6 2019, 05:04 PM

Nov 6 2019, 05:04 PM

Quote

Quote

0.0180sec

0.0180sec

0.40

0.40

6 queries

6 queries

GZIP Disabled

GZIP Disabled