Is the Kastam still imposing an import tax on computer parts?

![]() Malaysia Import Duties

Malaysia Import Duties

| Bump Topic Add Reply RSS Feed New Topic New Poll |

![]() Malaysia Import Duties

Malaysia Import Duties

|

|

Apr 26 2020, 10:51 PM Apr 26 2020, 10:51 PM

Show posts by this member only | IPv6 | Post

#1781

|

Junior Member

148 posts Joined: Sep 2019 |

Is the Kastam still imposing an import tax on computer parts?

|

|

|

|

|

|

May 8 2020, 04:33 PM May 8 2020, 04:33 PM

|

Junior Member

65 posts Joined: Feb 2019 |

|

|

|

May 9 2020, 12:48 PM May 9 2020, 12:48 PM

|

Junior Member

65 posts Joined: Feb 2019 |

|

|

|

May 11 2020, 10:21 PM May 11 2020, 10:21 PM

Show posts by this member only | IPv6 | Post

#1784

|

Probation

1 posts Joined: May 2020 |

Hi there

1. What duty will I have to pay if I buy a road bike crank online from the USA ? 2. What will customs charge for a crank based power meter ? Thanks |

|

|

May 17 2020, 06:37 PM May 17 2020, 06:37 PM

Show posts by this member only | IPv6 | Post

#1785

|

Senior Member

1,180 posts Joined: Oct 2010 |

Hi all, didn’t know there’s such thread

My first time buying toys from eBay,  So how much tax will I kena, and my parcel is 11lbs too First time just click and hantam only 😬 And also in future, besides splitting into small packages, how can I be sure that I’ll only be paying item+shipping price ? Or is anything listed on eBay with Import Charges stated means, that I need to item+shipping + import charges and I no need to pay additional tax when it lands in MY? Many many thanks This post has been edited by persona93: May 17 2020, 06:45 PM |

|

|

May 19 2020, 08:08 PM May 19 2020, 08:08 PM

Show posts by this member only | IPv6 | Post

#1786

|

Junior Member

377 posts Joined: Jun 2016 |

Dear kherel77

How much duty for importation of bicycle wheelset? Thanks bro. This post has been edited by Fenix98: May 19 2020, 08:09 PM |

|

|

May 20 2020, 04:31 AM May 20 2020, 04:31 AM

|

Junior Member

23 posts Joined: Dec 2006 |

FYI anyone thinking of ordering Collectors models, statuettes, (polystone / polyresin items). (Duty code: 3926) its a 30% tax cash ( they don't except cards).

This post has been edited by Priss: May 20 2020, 04:35 AM |

|

|

May 20 2020, 04:41 AM May 20 2020, 04:41 AM

|

Junior Member

23 posts Joined: Dec 2006 |

QUOTE(persona93 @ May 17 2020, 06:37 PM) Hi all, didn’t know there’s such thread Dude Ebay is the last place to buy toys but yes if ebay made you pay for import charges then item will be direct shipped to you My first time buying toys from eBay,  So how much tax will I kena, and my parcel is 11lbs too First time just click and hantam only 😬 And also in future, besides splitting into small packages, how can I be sure that I’ll only be paying item+shipping price ? Or is anything listed on eBay with Import Charges stated means, that I need to item+shipping + import charges and I no need to pay additional tax when it lands in MY? Many many thanks btw I was looking for statue , the same statue with tax I shopped around Malaysian store = RM1690 ebay = Rm36642.86 (cheapest I could find) Australian online store = RM2590.34 This post has been edited by Priss: May 20 2020, 04:43 AM |

|

|

May 20 2020, 09:23 AM May 20 2020, 09:23 AM

Show posts by this member only | IPv6 | Post

#1789

|

Senior Member

1,180 posts Joined: Oct 2010 |

QUOTE(Priss @ May 20 2020, 04:41 AM) Dude Ebay is the last place to buy toys but yes if ebay made you pay for import charges then item will be direct shipped to you if conversion price + shipping , still okbtw I was looking for statue , the same statue with tax I shopped around Malaysian store = RM1690 ebay = Rm36642.86 (cheapest I could find) Australian online store = RM2590.34 but if got 25% customs tax then gg dy so can i say next time whenever i see got import charges on any listing, means i no need worry about customs tax dy? |

|

|

May 20 2020, 11:46 AM May 20 2020, 11:46 AM

|

Junior Member

23 posts Joined: Dec 2006 |

QUOTE(persona93 @ May 20 2020, 09:23 AM) if conversion price + shipping , still ok yeah if they charge you upfront already customs will not interfere . Amazon also precharge customs tax when shipping to Malaysia and sometimes at the end of the year they refund me the extra tax they charged me.but if got 25% customs tax then gg dy so can i say next time whenever i see got import charges on any listing, means i no need worry about customs tax dy? |

|

|

|

|

|

May 20 2020, 11:58 AM May 20 2020, 11:58 AM

|

Senior Member

1,180 posts Joined: Oct 2010 |

QUOTE(Priss @ May 20 2020, 11:46 AM) yeah if they charge you upfront already customs will not interfere . Amazon also precharge customs tax when shipping to Malaysia and sometimes at the end of the year they refund me the extra tax they charged me. thanks for your reply mateappreciate it and yeah Amazon also, thanks for the idea |

|

|

May 20 2020, 09:09 PM May 20 2020, 09:09 PM

Show posts by this member only | IPv6 | Post

#1792

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

|

|

|

May 20 2020, 09:44 PM May 20 2020, 09:44 PM

|

Junior Member

377 posts Joined: Jun 2016 |

|

|

|

May 22 2020, 09:08 AM May 22 2020, 09:08 AM

|

Probation

6 posts Joined: Mar 2020 |

Hi guys.

Saya baru saja selesai bercakap dengan UPS. Katanya, barang saya dikenakan cukai RM200+. Tapi, barang yang saya beli ni Monitor PC jatuh dibawah bahagian 8528.51 (HS CODE). Tapi, kenapa tetiba dikenakan cukai? padahal tak ada langsung cukai Import untuk Monitor PC kecuali 5% SST? Dorang kata, Kastam akan call saya dalam masa terdekat bagi penerangan. Sekarang ni nak tanya, kalau dorang still insist barang yang saya beli tu jatuh dibawah bahagian tertentu, nak buat apa eh? ke, saya silap? |

|

|

Jun 2 2020, 02:04 PM Jun 2 2020, 02:04 PM

|

Junior Member

97 posts Joined: Jan 2010 |

Hello, I just found out my trading card kena tahan by kastam. Total fee is 60k yen including shipping. After doing some research, my code is 950440 according to website if I am not mistaken. How much tax do I need to pay?

|

|

|

Jun 15 2020, 04:58 PM Jun 15 2020, 04:58 PM

|

Junior Member

158 posts Joined: Nov 2009 |

I have a slight confusion regarding the freight rates. Is the rate not as per the shipping fee I paid? I paid around RM70 for DHL shipping from Japan but my freight charge was stated RM321.91, causing the total value to exceed RM500 and I have to pay duty. I checked with DHL and they informed me this is according to IATA rates. I however have never faced any IATA rates problem with EMS or regular airmail before.

Appreciate it if anyone can explain this situation to me. |

|

|

Jun 24 2020, 05:08 PM Jun 24 2020, 05:08 PM

|

Junior Member

25 posts Joined: Dec 2011 From: Penang Island |

Hi kherel77,

I understand that Computer Graphics Card don't have import duty but i have to pay 6% GST. My question is the GST calaculation based on CIF value or Invoice value? If based on CIF, how i calculate CIF value? (Item from China paid RM1550 total) Thank you in advance. Steven Law. This post has been edited by stevenlaw188: Jun 24 2020, 05:09 PM |

|

|

Jun 27 2020, 12:52 AM Jun 27 2020, 12:52 AM

|

Senior Member

608 posts Joined: Aug 2008 |

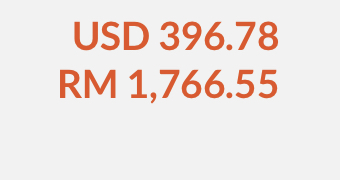

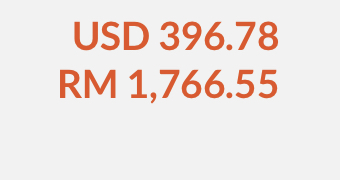

QUOTE(Mr.RW @ May 9 2020, 12:48 PM) Go to Pos Malaysia International Hub KLIA (near the old LCCT).You show them the tracking number, they find out your parcel and handle to you, you than open the parcel infront of the custom officers, take out the invoice and show them, They will calculation the amount of duties need to be paid base on the total value stated in the invoice. Me also order from Taiwan, I paid Import Duties there and take home my parcel after paid.

Part of the invoice showing total value of the imported goods.

This post has been edited by tanhks: Jun 27 2020, 06:51 PM |

|

|

Jun 29 2020, 07:04 PM Jun 29 2020, 07:04 PM

|

Junior Member

110 posts Joined: Aug 2019 |

Hi,

I have some question regarding to custom clearance, I hope anyone can help me out by sharing your personal experience. I just wonder: 1. Does Malaysia Custom permit and won't confiscate Anime blu-ray disc (Age Rating: 16+) that ship from US? Items I would like to Buy: - https://www.rightstufanime.com/Monogatari-S...Box-Set-Blu-ray so I just wonder if Malaysia Custom will allow them to be ship to Malaysia? will really Appreciate if you can share with me your experience, thanks! |

|

|

Jul 14 2020, 06:00 PM Jul 14 2020, 06:00 PM

Show posts by this member only | IPv6 | Post

#1800

|

Junior Member

274 posts Joined: Oct 2008 |

If I want to buy lower arms for cars and have it sent to Malaysia, how much is the import tax?

|

| Change to: |  0.0251sec 0.0251sec

0.80 0.80

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 02:06 PM |