QUOTE(kherel77 @ Dec 17 2019, 11:09 AM)

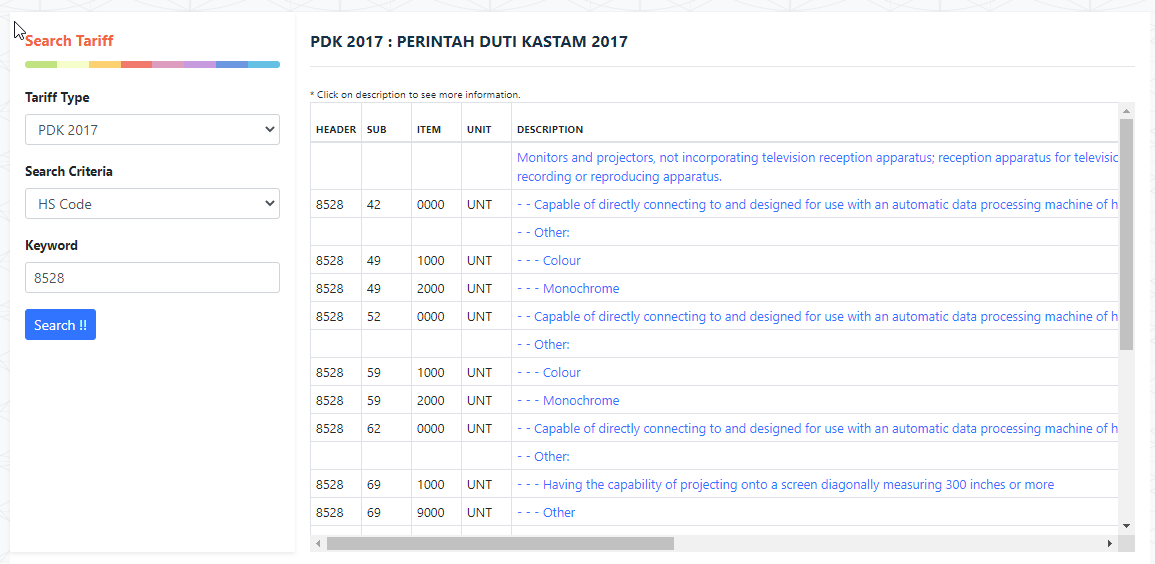

If not mistaken is 8528.52.0000 which have 5% SST.

I have this book for my job requirement.

» Click to show Spoiler - click again to hide... «

Hi Kherel, is it just 5% SST for a VR headset or are there other duties such as import duty or IATA TACT rates as well ?

This is my first time so please pardon my ignorance.

Thanks!

Jan 6 2021, 11:10 AM

Jan 6 2021, 11:10 AM

Quote

Quote

0.0421sec

0.0421sec

1.77

1.77

6 queries

6 queries

GZIP Disabled

GZIP Disabled