Hi guys,

I need some advice.

Last week I bought some mill max sockets,

https://my.mouser.com/ProductDetail/Mill-Ma...i1rs8w5iF41k%3DThe total value is RM255, and freigh was RM74. And I used FedEx.

Upon reaching Malaysia, I was informed that I need to pay RM211 for tax. And the reason behind it is because my freight charges is now RM523 as declared by FedEx (or Customs, I don't know who).

The invoice shows freight RM523.

2 months ago, I bought the exact same product, and I used UPS.

The freight was RM88.

However, that time, I wasn't taxed and the reason was because the freight in the custom invoice was RM88, so my CIF was less than RM500.

I have approached the PK today, and they told me any item from the US, even if it's RM1, will be charged freight RM523.

I just need to know whether I am being conned.

Update:

After much resistance.

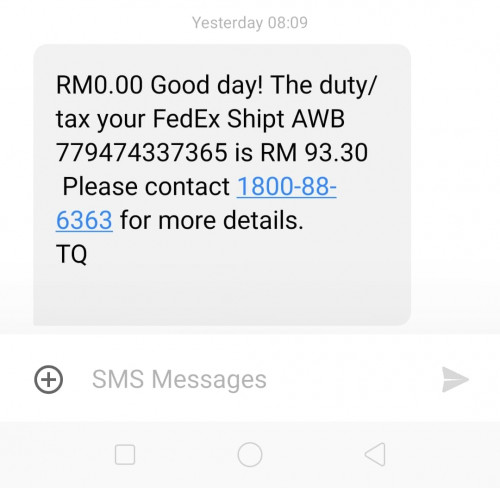

FedEx has agreed to lower my tax from RM211 to RM83.

I have agreed but will never use FedEx again.

This post has been edited by remeron: Jan 31 2020, 11:50 AM ![]() Malaysia Import Duties

Malaysia Import Duties

Dec 12 2019, 02:28 PM

Dec 12 2019, 02:28 PM

Quote

Quote

0.0312sec

0.0312sec

0.27

0.27

6 queries

6 queries

GZIP Disabled

GZIP Disabled