QUOTE(neooren @ Feb 18 2019, 09:30 AM)

hi, the <RM500 rules no tax or import duties applicable to all item or certain item only?

Ordered some used car spare part (ABS/VSA modulator/pump) from japan total include delivery USD113 (RM462).

Anyone know it falls under which category/code?

received my item last week..paid 5% import duty + 10% SST + RM5 Handling Fee.Ordered some used car spare part (ABS/VSA modulator/pump) from japan total include delivery USD113 (RM462).

Anyone know it falls under which category/code?

email from fedex:

The Customs Duty/Tax is calculated based on total CIF value.

CIF value consists of Cost of Goods + Insurance + Freight.

Exchange rate : 1 USD = MYR 4.1329

Cost of Goods (FOB)

= USD 67.00 x MYR 4.1329

= MYR 276.90

Insurance (1%)

= MYR 276.90 x 1%

= MYR 2.77

Freight *

= MYR 326.30

= MYR 326.30

Total CIF Value (Taxable Value)

= MYR 605.97

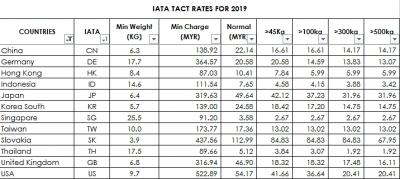

* The Freight rate is derived from IATA table by Customs.

The rate differs according to the Country of Origin and Total Shipment’s Weight.

This Freight rate is not the shipping charges that you have paid to the Shipper or the shipping charges that the Shipper has paid to FedEx.

This post has been edited by neooren: Feb 27 2019, 12:00 PM

Feb 27 2019, 11:55 AM

Feb 27 2019, 11:55 AM

Quote

Quote

0.0255sec

0.0255sec

0.30

0.30

6 queries

6 queries

GZIP Disabled

GZIP Disabled