hihi....anyone know is there any import permit required for LEATHER (i mean leather that have not made into goods)

as for tax , is it still follows CIF < rm 500 = no tax?

![]() Malaysia Import Duties

Malaysia Import Duties

| Bump Topic Add Reply RSS Feed New Topic New Poll |

![]() Malaysia Import Duties

Malaysia Import Duties

|

|

Apr 15 2019, 10:51 PM Apr 15 2019, 10:51 PM

Show posts by this member only | IPv6 | Post

#1641

|

Junior Member

40 posts Joined: Feb 2011 |

hihi....anyone know is there any import permit required for LEATHER (i mean leather that have not made into goods)

as for tax , is it still follows CIF < rm 500 = no tax? |

|

|

|

|

|

Apr 21 2019, 07:20 PM Apr 21 2019, 07:20 PM

|

|

Moderator

10,308 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(kherel77 @ Mar 25 2019, 09:17 PM) If my item is a mouse send from Hong Kong, which is the tariff type? |

|

|

Apr 21 2019, 08:03 PM Apr 21 2019, 08:03 PM

Show posts by this member only | IPv6 | Post

#1643

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

|

|

|

Apr 23 2019, 10:27 PM Apr 23 2019, 10:27 PM

|

Senior Member

675 posts Joined: Nov 2011 |

is diecast action figure under 9503.00.400?

|

|

|

Apr 24 2019, 10:25 AM Apr 24 2019, 10:25 AM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

|

|

|

Apr 24 2019, 10:26 AM Apr 24 2019, 10:26 AM

|

Senior Member

675 posts Joined: Nov 2011 |

|

|

|

May 9 2019, 12:24 PM May 9 2019, 12:24 PM

|

Senior Member

1,457 posts Joined: Jul 2009 |

I wanna buy reolink ip camera cost around rm350 ship from HK (by sea).. will i need to pay tax? And also do i need to get sirim approval??

|

|

|

May 12 2019, 07:00 AM May 12 2019, 07:00 AM

|

Junior Member

25 posts Joined: Aug 2010 |

Hi anyone figure out the hs code for smartwatch?

|

|

|

May 16 2019, 06:24 AM May 16 2019, 06:24 AM

Show posts by this member only | IPv6 | Post

#1649

|

Junior Member

442 posts Joined: Jan 2003 |

Hi

May I know how to chk the import duties,, Been browse thru many pages,, found a link but with many type of tariff type.. quite confusing,, any guide on that I need to buy a roller blade from Sg, how to calculate the import tax and sst? |

|

|

May 16 2019, 09:01 AM May 16 2019, 09:01 AM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(gn01117135 @ May 16 2019, 06:24 AM) Hi Tariff Code #9506.70.0000 which have 0% import duties + 10% SSTMay I know how to chk the import duties,, Been browse thru many pages,, found a link but with many type of tariff type.. quite confusing,, any guide on that I need to buy a roller blade from Sg, how to calculate the import tax and sst? |

|

|

|

|

|

May 27 2019, 07:08 PM May 27 2019, 07:08 PM

|

Senior Member

1,537 posts Joined: Jan 2003 From: Lumpy Koala |

Hey guys was thinking of buying a performance cam shaft for my car from Germany.

Been going through http://mysstext.customs.gov.my/tariff/ and searching through item description for a HS code, but the closest HS code I can find is 848310000 from AJCEP. I am konfius. Can someone help me out? |

|

|

May 27 2019, 08:47 PM May 27 2019, 08:47 PM

Show posts by this member only | IPv6 | Post

#1652

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(alvin_goh @ May 27 2019, 07:08 PM) Hey guys was thinking of buying a performance cam shaft for my car from Germany. We use PDK 2017 classification under normal declaration. For normal car camshaft usually under 8483.10.2500 / 2600 / 2700 which have 5% import duties + 10% SST.Been going through http://mysstext.customs.gov.my/tariff/ and searching through item description for a HS code, but the closest HS code I can find is 848310000 from AJCEP. I am konfius. Can someone help me out? |

|

|

May 28 2019, 08:52 AM May 28 2019, 08:52 AM

|

Senior Member

1,537 posts Joined: Jan 2003 From: Lumpy Koala |

|

|

|

Jun 13 2019, 12:13 AM Jun 13 2019, 12:13 AM

|

Junior Member

346 posts Joined: Apr 2017 |

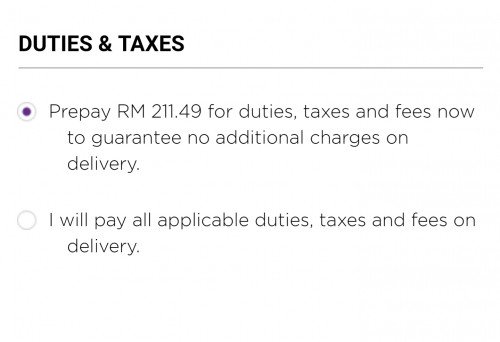

when i paid those prepay duty/tax upon checkout, will my item might get charged extra tax/duty by custom?

|

|

|

Jun 13 2019, 02:11 PM Jun 13 2019, 02:11 PM

|

All Stars

13,473 posts Joined: Jan 2012 |

QUOTE(IdiuU @ Jun 13 2019, 12:13 AM) when i paid those prepay duty/tax upon checkout, will my item might get charged extra tax/duty by custom? Who are you buying from and what did they charge you? Oversea sellers will most definitely not be collecting import taxes/duties on behalf of Malaysia custom. What they charge you is based on the sales taxes or export duties if required by their local government. You will be dealing with Malaysia custom by yourself or through the forwarding/courier if you are being subjected to import duties or whatever taxes the custom deem necessary according to the law. |

|

|

Jun 13 2019, 04:32 PM Jun 13 2019, 04:32 PM

|

Junior Member

346 posts Joined: Apr 2017 |

QUOTE(andrekua2 @ Jun 13 2019, 02:11 PM) Who are you buying from and what did they charge you? some websites hv this option...Oversea sellers will most definitely not be collecting import taxes/duties on behalf of Malaysia custom. What they charge you is based on the sales taxes or export duties if required by their local government. You will be dealing with Malaysia custom by yourself or through the forwarding/courier if you are being subjected to import duties or whatever taxes the custom deem necessary according to the law.  |

|

|

Jun 19 2019, 10:18 PM Jun 19 2019, 10:18 PM

Show posts by this member only | IPv6 | Post

#1657

|

Probation

1 posts Joined: Jun 2019 |

Hi, does anyone know how much tax will be charged if I buy an eink pc monitor 13.3" from China? The price is 1099usd

Thanks! |

|

|

Jun 20 2019, 01:22 AM Jun 20 2019, 01:22 AM

|

Junior Member

74 posts Joined: Sep 2007 |

Hello, can anyone tell me if diamond rings are still tax exempted this year? I was planning to buy it from a jeweler from US. Appreciate your advices. Thank you!

|

|

|

Jun 21 2019, 01:39 AM Jun 21 2019, 01:39 AM

|

Newbie

7 posts Joined: May 2007 From: Selangor |

First off, excellent thread! Thank you to all that have shared their knowledge here!

Can anyone share some more of their experience regarding import duties and other taxes? I am still not exactly sure what will be applicable and how the final amount will be calculated for my case. I've got an incoming purchase for keyboards and keyboard parts 8471.60.3000 totaling US$681. Just from checking the mysstext link (much thanks to @kherel77) I can see that this will incur 5% SST. The supplier, which will send the items from Melbourne, Australia is charging US$46.53 for shipping costs via DHL Express. I am not sure how to find out what the IATA Freight Rates currently are. Does this mean Malaysian Customs only will levy the 5% of SST on top of my shipment value + freight cost ($727.53)? This post has been edited by timb4: Jun 21 2019, 01:41 AM |

|

|

Jun 22 2019, 04:24 PM Jun 22 2019, 04:24 PM

|

Newbie

1 posts Joined: Aug 2008 |

If Use aramex ship to singapore, the receiver need to pay any duty & tax payment?

If the product is HS 4015190011 total amount RM200. How the calculation? |

| Change to: |  0.0299sec 0.0299sec

0.27 0.27

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 01:41 PM |