QUOTE(zambria @ Dec 27 2018, 07:03 PM)

dear sifu's , need ur help here...

i ordered 3 items from amazon usa to be shipped to malaysia. The item is shipped via Aramex

item 1 - Brother brand small label printer with Bluetooth

item 2- a small toothbrush holder made of plastic

item 3 - a 6 pcs set of kitchen utensils - no knife , only pasta spoon,soup spoon..etc..

The cost of all these items is RM 300 and shipping cost it RM 90. So total is less than RM 400.

I received email from Aramex saying i would need sirim permit. WHich i knew before buying the label printer. Because it has bluetooth. communication device. So i know i cannot escape that, so thru online, emailed sirim, send product details and paid the sirim RM100 for the bluetooth label printer.

Now i receive email from Aramex, asking me to pay the duty Rm 80 + Rm30 Aramex Processing free. What happen to the rule of

item below RM500 no need pay any tax or sst? Is aramex squeezing me? From the document i received, there is hs code declared for my item..but the categories under the item is more like for manufactures. I bought the item for personal use and not under any company.

Please advise. Would i be able to talk to customs and collect the item myself?

thank you.

First, did you know how exactly this rule apply for inbound shipment?

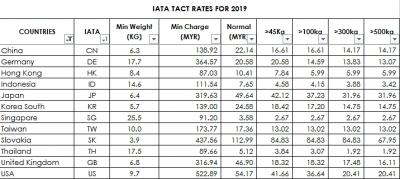

"Customs Duties Exemption Order 1988 Item#172: Any goods below RM500 CIF value using air courier services thru KLIA, Subang, Bayan Lepas, Senai, KK & Kuching airport will be duties/taxes exempted except cigarettes, liquors & tobaccos."CIF Value = Invoice value + 1% insurance + IATA Freight Rate

Minimum 2018 IATA Freight Rate from USA to MY is RM535.54. So total up your shipment's CIF Value is more than RM500.00

Second, personal or company use will be applied under same Customs Act. No different.

Yes, you can try talk to Customs for their clemency & waived your duty/tax. Aramex won't do that on your behalf.

Nov 21 2018, 02:47 PM

Nov 21 2018, 02:47 PM

Quote

Quote

0.0424sec

0.0424sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled