QUOTE(BobSponge @ Dec 6 2019, 02:02 PM)

Thanks kherel. I got the same result but I would like to ask how did you get the 10% SST figure?

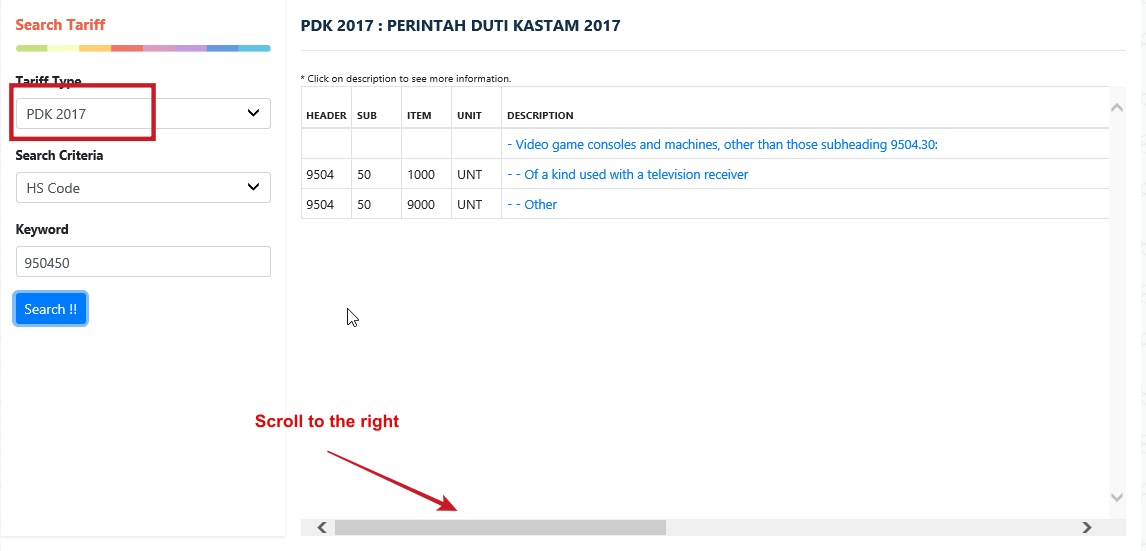

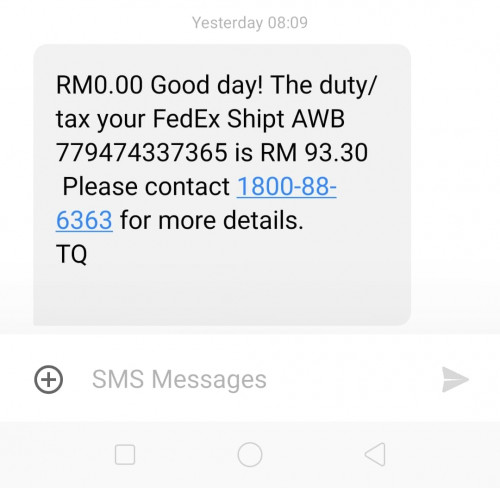

If you see the result below under PDK 2017, The column for "IMPORT RATE" and "SST" is blank on the customs page. I assume blank would mean 0% for both import duty and SST?

If you see the result below under PDK 2017, The column for "IMPORT RATE" and "SST" is blank on the customs page. I assume blank would mean 0% for both import duty and SST?

Scroll to the right for duty/tax percentage.

QUOTE(BobSponge @ Dec 6 2019, 02:02 PM)

I have a second question if you don't mind. Do you know what's the HS code for console games? (e.g. PS4/PC/XBOX games). Basically console games on disc.

8523.80.9900: Import duty 0%, SST 5%

Dec 6 2019, 03:27 PM

Dec 6 2019, 03:27 PM

Quote

Quote

0.0202sec

0.0202sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled