QUOTE(timb4 @ Jun 21 2019, 01:39 AM)

First off, excellent thread! Thank you to all that have shared their knowledge here!

Can anyone share some more of their experience regarding import duties and other taxes?

I am still not exactly sure what will be applicable and how the final amount will be calculated for my case.

I've got an incoming purchase for keyboards and keyboard parts 8471.60.3000 totaling US$681.

Just from checking the mysstext link (much thanks to @kherel77) I can see that this will incur 5% SST.

The supplier, which will send the items from Melbourne, Australia is charging US$46.53 for shipping costs via DHL Express.

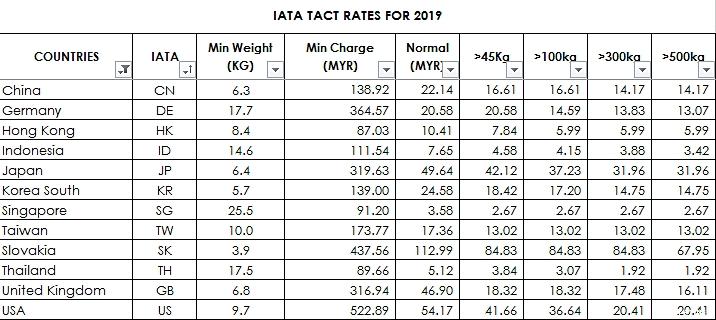

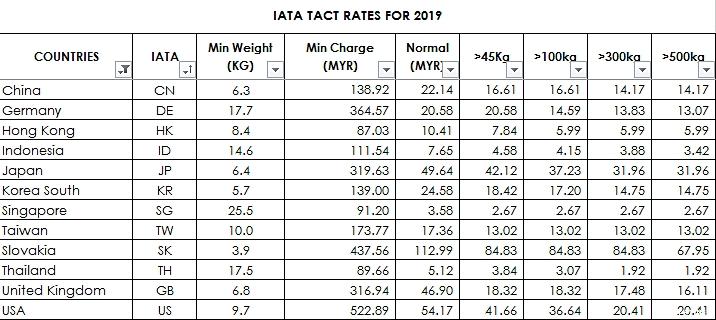

I am not sure how to find out what the IATA Freight Rates currently are.

Does this mean Malaysian Customs only will levy the 5% of SST on top of my shipment value + freight cost ($727.53)?

5% from shipment value (invoice value + 1% insurance + IATA freight cost - see below). $727.53 is between you & the seller.

QUOTE(tinghost85 @ Jun 22 2019, 04:24 PM)

If Use aramex ship to singapore, the receiver need to pay any duty & tax payment?

If the product is HS 4015190011 total amount RM200.

How the calculation?

Depend on the Incoterm used.

SG use VAT (similar to our previous GST) with higher %. If not mistaken 7%.

This post has been edited by kherel77: Jun 22 2019, 10:54 PM

Mar 18 2019, 04:22 PM

Mar 18 2019, 04:22 PM

Quote

Quote

0.0206sec

0.0206sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled