QUOTE(hz428 @ Aug 13 2020, 09:57 AM)

QUOTE(kherel77 @ Oct 13 2015, 08:57 AM)

| Bump Topic Add Reply RSS Feed New Topic New Poll |

![]() Malaysia Import Duties

Malaysia Import Duties

|

|

Aug 13 2020, 07:15 PM Aug 13 2020, 07:15 PM

Return to original view | IPv6 | Post

#181

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(hz428 @ Aug 13 2020, 09:57 AM) QUOTE(kherel77 @ Oct 13 2015, 08:57 AM) |

|

|

|

|

|

Jan 6 2021, 07:14 PM Jan 6 2021, 07:14 PM

Return to original view | Post

#182

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

|

|

|

Jan 7 2021, 10:02 PM Jan 7 2021, 10:02 PM

Return to original view | IPv6 | Post

#183

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

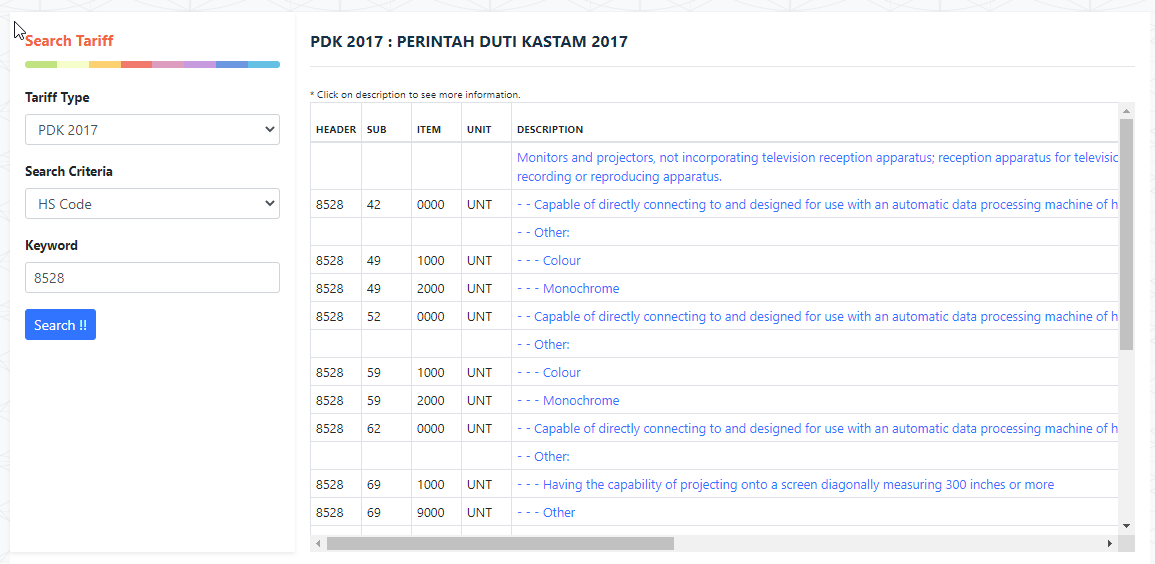

QUOTE(MidnightNappyRun @ Jan 7 2021, 02:59 PM) Hi Kherel http://mysstext.customs.gov.my/tariff/Sorry may I please ask you for a reference or photo?! I couldn't refer the code anywhere because I'll be shipping through Aramex and they're usually bad at this.  Slide to the right to see duties/taxes value. |

|

|

Jul 22 2021, 10:28 AM Jul 22 2021, 10:28 AM

Return to original view | Post

#184

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(regan96 @ Jul 19 2021, 06:27 PM) Hi everyone, my company in singapore is planning to send laptops to malaysia for company usage. The amount of laptop to be sent here is 16 units of laptops each costing about RM3000. The DHL company told us that the custom charges may go up to 90% of the total value of the item. Is this true? If so is there a place where I can learn about this more? Please find another reliable courier provider as they talk bullshit.Laptop only have 5% SST. Tariff Code 8471.30.2000 |

| Change to: |  0.0426sec 0.0426sec

0.72 0.72

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 05:38 PM |