QUOTE(Kaka23 @ Jan 30 2012, 10:29 PM)

Dear Mr Wong,

Thanks for trying to answer my "weird" question. Haha.. appreciate your effort to help out. Maybe I am no finance people and even dont know what is CAGR. Although I have google it put for many times on this term, but just cant really inject the meaning into my head.

What I am confuse is, can I actually calculate my return/profit (say I buy lump sum and sell after 10yrs) using compounded return when I buy into any unit trust? (say example OSK UOB Kid save, in fundsupermart saying the bid to bid annualize return for 10yrs is 11.6%)

If using compounded return (based on Kid save fund), my RM10K will become approx RM32K when I sell off.. is that right?

Mr Wong's my dad

, i'm just wongmunkeong and i'm in IT, thus not Finance ppl too

.

Ok, back to "work".

The concept of CAGR is in simple effect, your returns on your capital + returns on returns, which i think U've nailed down. It's just the bleeding maths thinggy right? i'm no maths genius (Credit3 only for SPM

) but logic is my game, thus, in Excel, for lump sum:

1. IF U know the %pa compounded (CAGR) and years compoundedU calculate forwards for $10K and grow it by 11.6%pa compounded, it'll be $29,966.90879,

eg. $10,000 * (1 +11.6%)^10yrs

Note: The karat symbol, "^", is math's "BY POWER OF" (pls correct my math's English if i'm mistaken)

Thus, yes, you're right IF past history is repeated perfectly for your purchase and sell timingI'm just assUme-ing that U are estimating your future returns?

If so, please be aware that U should always look at "bad ending", "good ending" & so-so ending scenarios for your time horizon, to get a holistic probable view (IMHO lar).

eg

for 10 years' bad ending = 1999 Jan to 2008 Dec

for 10 years' good ending = 1998 Dec to 2007 Jan

for 10 years' so-so ending = 2001 Jan to 2011 Dec

2. IF U know the total value at end of 10yrs and want to find out the %pa compounded (CAGR)CAGR %pa = (Current Value / Cost)^(1/years) -1

Where:

Current Value = units * NAV (ie. redemption value / sell back value)

Cost = total cost for that transaction or purchase

Using your example, Kid Save Fund:

Current Value = $29,966.90879

Cost = $10,000

Years = 10

Thus, CAGR = ($29,966.90879/$10,000) ^(1/10) -1

=2.996691 ^0.1 -1

=1.116 -1

= 11.6% pa compounded (CAGR)

Cool or

?

For multiple entries/buys (like DCA or VCA) in a fund, calculating your overall CAGR is even more

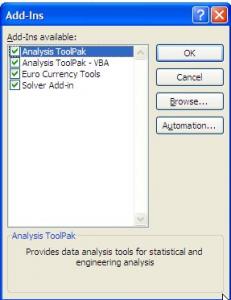

(unless U use Excel's XIRR function to have a close approximate) but calculating each entry's CAGR is the same as the above (2).

Hope the above helps more than confuse

This post has been edited by wongmunkeong: Jan 30 2012, 11:28 PM

This post has been edited by wongmunkeong: Jan 30 2012, 11:28 PM

Jan 27 2012, 09:47 AM

Jan 27 2012, 09:47 AM

Quote

Quote

0.0653sec

0.0653sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled