QUOTE(MGM @ Jan 19 2012, 02:17 PM)

Bro Wong, when did u start investing methodically, and what is your CAGR since then? I am sure you are one of the few who keep track of your investment at all time.

Bought one of the book highly recommended by u, "Secrets of the millionaire ..." but have not read yet. Could not find the book on Twinvest.

Hey ya MGM. Me - methodologically?

Since.. hm.. 2004/2005, decided to put real $ to test & track a few methodologies (entries & exits) coupled with filteration & AA (asset allocation). I'm an idiot - no real $ on the line, i get lazy tracking

Of course i did some back testing with historical prices / NAV too for 10 years and 5 years stretch but nothing beats real $ on the line to see if i will follow-through/how easy to execute.

Tried out TwinVest, AIM-HI, Trend as per the book "The TRENDadvisor Guide to Breakthrough Profits" and a few not too smart totally TA-based entries & exits (hey, i'm as dumb/smart as the next fellow

).

All in all, found that value opportunities + TwinVest + Trend works well in combination with my personal filtering methods.

Once done, in 2009 - i "rebooted" nearly all my investments and started "clean" with 50% of ammunition in Programmatic (no fear/greed) via TwinVest + 50% in Opportunistic (Value opportunities + Trend) executions to hit my AA.

Note - before 2004/2005 - was only using value opportunity entries for stocks (no REITs then) & DCA / lump sum for mutual funds.

----

Hm.. my CAGR in totality? Unsure wor.

er.. i dont count total other than Net Worth which thus far, ranges from 18.91%pa to 43.83%pa (woohoo end 2008 / early 2009 to mid 2010

) based on a moving 12mths average differences.

Detailed CAGR got lar based on per transaction in stocks & REITs OR group of mutual funds via a methodology

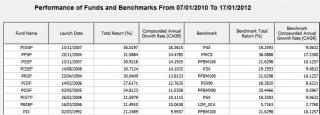

Please note that the data below are based on 18/01/2012 NAV and limited to mutual funds only (since mutual funds' thread mar):

Please note that the data below are based on 18/01/2012 NAV and limited to mutual funds only (since mutual funds' thread mar):Prudential SmallCaps via buy lump sum (3 times) and hold stupidly since 2005: 9.56%pa

PFEPRF via Trend opportunity since 2009: 20.84%pa

PFEPRF via TwinVest since 2009: 3.80%pa

PIX via TwinVest since 2009: 9.06%pa

PSSF via TwinVest since 2009: 8.56%pa

PFES via DCA since Jan 2008: -7.91%

PBOND as just a storage for unused $ until deployed since rebooting 2009: 8.19%pa

PSBF as a storage for unused $ via EPF until deployed since rebooting 2009: 6.10%pa

Things i think of interest:a. Wah! Bond funds' consistent returns are nothing to sneeze at. Dang the sales agents that keep pushing just Equity Funds

b. PFEPRF bought via Trend Entry - i made >66% net profit in less than 1 year. Took my cost +10%pa expected profits off the table, left the abnormal profits to run till now.

c. Prudential SmallCaps - buy & hold still works (assuming semi-good to good fund/fund mgt lar). This thing climbed to 26%pa+ before 2008!

d. PFES - whoa.. this thing can really swing. Good times can be > or = 25%pa (i take profits when > or = 25%pa and had several transactions hitting that earlier

), bad times.. tadaa

pheww.. my apologies for the long winded post. i hope the above helps gauge whether TwinVest, Trend + Buy & Hold is worthwhile or not

Added on January 19, 2012, 3:50 pmQUOTE(MGM @ Jan 19 2012, 02:17 PM)

Bro Wong, when did u start investing methodically, and what is your CAGR since then? I am sure you are one of the few who keep track of your investment at all time.

Bought one of the book highly recommended by u, "Secrets of the millionaire ..." but have not read yet. Could not find the book on Twinvest.

Added on January 19, 2012, 2:31 pmProblem with me is I never keep track if my KLSE stocks are making gains. Only border with total wealth (which is wrong). Care to recommend any software for easy tracking. Currently 50% on ASNB, 10% cash, 5% KLSE, 5% private equity. If after GE no severe drop, will put cash-in-hand into low PE market like China, KLSE PE a bit high.

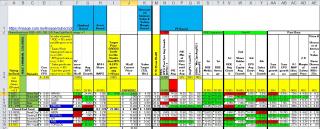

Heheh - i'm using simple old Excel (with several donkey years of customizing for easy triggering screen + tracking screens). No fancy software bro MGM. I can share a template for:

a. funds5 sheets

worksheet that reads PM's website & Pru website for NAV

worksheet that holds the values & % held by categories - type of funds (Equities or Bonds) and via (Cash or EPF)

worksheet that holds the summary for each fund and using website worksheet's date & NAV

worksheet for tracking held details and using summary's date & NAV

worksheet for tracking switched/redeemed details and using summary's date & NAV

b. Stocks / REITs3 sheets

worksheet that reads CSV exported from HLeB or Maybank - Equities

worksheet that reads CSV exported from HLeB or Maybank - REITs

worksheet for tracking held details, dividends & sold

This post has been edited by wongmunkeong: Jan 19 2012, 03:50 PM

Jan 12 2012, 02:13 PM

Jan 12 2012, 02:13 PM

Quote

Quote

0.0644sec

0.0644sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled