Outline ·

[ Standard ] ·

Linear+

ASB loan, worth to get it???

|

leo_kiatez

|

Jul 14 2021, 01:25 PM Jul 14 2021, 01:25 PM

|

|

QUOTE(matyrze @ Jun 13 2021, 12:37 PM) Yeah majority of people in the internet talk about terminating due to 'low' ASB dividend, glaringly obvious in FB for example. Again, only if they know the mathematics.. Anyway, to your question, its always best to park your cash somewhere able to generate return rate higher than your ASBF rate. I'd imagine it's not difficult to find it. This means you forgo saving from loan interest, to gain investment return at higher rate. If you pay off the loan early, that's an opportunity cost for you as well. Table did not include up until 40 years? Possible to stretch until 40 years? What are those to generate return rate higher than the ASBF rate? Please share,bro.. Sharing is caring! Thank you!! |

|

|

|

|

|

eastwest

|

Jul 15 2021, 01:23 PM Jul 15 2021, 01:23 PM

|

|

QUOTE(adamhzm90 @ Jul 12 2021, 05:48 PM) moratorium approved.. basically zero cost dividend for 6 month..hehe I'm just wondering if take 50% reduction option, is it a good move? |

|

|

|

|

|

TheReckless

|

Jul 16 2021, 01:45 PM Jul 16 2021, 01:45 PM

|

Getting Started

|

Hello, I never have any commitment before as I just start working for few months already after finish study. So I thought of doing ASB Financing as my first. Is it worth to start now? What I'm worried is that assuming lower dividend this year causes to have the same or less loan rate so technically I might receive loss instead. What ae your thoughts about this? Or should I just invest ASB normally instead of financing it. Or is there any better shariah financing alternative other than ASB? Thank you sifu

|

|

|

|

|

|

Azury36

|

Jul 16 2021, 01:50 PM Jul 16 2021, 01:50 PM

|

Getting Started

|

QUOTE(TheReckless @ Jul 16 2021, 01:45 PM) Hello, I never have any commitment before as I just start working for few months already after finish study. So I thought of doing ASB Financing as my first. Is it worth to start now? What I'm worried is that assuming lower dividend this year causes to have the same or less loan rate so technically I might receive loss instead. What ae your thoughts about this? Or should I just invest ASB normally instead of financing it. Or is there any better shariah financing alternative other than ASB? Thank you sifu All the answer is within yourself 1) Is the job secure? 2) If secure ASBF>ASB alone 3) ASBF is not something you need to commit until death 4) You can stop anytime you want advisable range 3 - 5 years 5) Don't take ASBF Insurance |

|

|

|

|

|

eastwest

|

Jul 19 2021, 11:27 AM Jul 19 2021, 11:27 AM

|

|

Guys, I'm wondering how much I've really paid for asbf. The combination of changing opr and the moratorium taken last year.. What's the correct way for me to calculate? Principal and interest payed all this years..

|

|

|

|

|

|

SUSpfizer

|

Jul 19 2021, 11:09 PM Jul 19 2021, 11:09 PM

|

Getting Started

|

QUOTE(adamhzm90 @ Jul 12 2021, 05:48 PM) moratorium approved.. basically zero cost dividend for 6 month..hehe Bad move. You will accumulate interest. |

|

|

|

|

|

adamhzm90

|

Jul 20 2021, 01:08 AM Jul 20 2021, 01:08 AM

|

|

QUOTE(pfizer @ Jul 19 2021, 11:09 PM) Bad move. You will accumulate interest. Nope. Everyone have their own strategy for asbf. If housing/personal loan then yes, bad move |

|

|

|

|

|

iamloco

|

Sep 30 2021, 08:49 PM Sep 30 2021, 08:49 PM

|

|

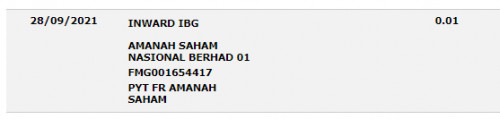

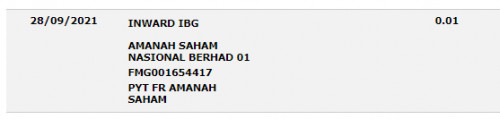

Received RM0.01 transferred to my SA from ASNB. Anyone had similar experience?

|

|

|

|

|

|

Joshua_0718

|

Sep 30 2021, 09:24 PM Sep 30 2021, 09:24 PM

|

|

Any idea for loan financing for asb/asb2, is there such thing like full flexi like home loan?

|

|

|

|

|

|

MUM

|

Sep 30 2021, 10:24 PM Sep 30 2021, 10:24 PM

|

|

QUOTE(Joshua_0718 @ Sep 30 2021, 09:24 PM) Any idea for loan financing for asb/asb2, is there such thing like full flexi like home loan? something like this? ASB FLEXI LOAN Purpose ASB Flexi is a term loan to purchase ASB units with the choice to repay the loan (through Flexi Cash scheme). This product is only offered at ........... https://www.maybank2u.com.my/iwov-resources...-fl_tnc_eng.pdf |

|

|

|

|

|

junclj

|

Oct 1 2021, 10:41 AM Oct 1 2021, 10:41 AM

|

|

QUOTE(iamloco @ Sep 30 2021, 08:49 PM) Received RM0.01 transferred to my SA from ASNB. Anyone had similar experience? Same here, I have no idea what is that. Probably is used for verifying our bank account status for T+6, start counting from 28/9/2021. Wait for next week and check back my myASNB portal whether the bank account status is still under pending.  |

|

|

|

|

|

NF2M

|

Oct 4 2021, 02:28 PM Oct 4 2021, 02:28 PM

|

Getting Started

|

Hi all. I'm asking on behalf of a friend.

What is the shortest tenure of takaful coverage for Maybank ASB loan?

|

|

|

|

|

|

tr3xsdcc

|

Oct 5 2021, 10:56 AM Oct 5 2021, 10:56 AM

|

Getting Started

|

QUOTE(NF2M @ Oct 4 2021, 02:28 PM) Hi all. I'm asking on behalf of a friend. What is the shortest tenure of takaful coverage for Maybank ASB loan? 5years I guess. Asb2? |

|

|

|

|

|

NF2M

|

Oct 5 2021, 12:20 PM Oct 5 2021, 12:20 PM

|

Getting Started

|

QUOTE(tr3xsdcc @ Oct 5 2021, 10:56 AM) He's interested in ASB1 as ASB2 would be a suicide for him since the dividend is always lower than ASB1. Btw, wonder how big is the difference in takaful premium for a smoker and nonsmoker. Hope someone here could shed some light on this. Thank you in advance. This post has been edited by NF2M: Oct 5 2021, 12:21 PM |

|

|

|

|

|

Alert_RaZO

|

Oct 5 2021, 06:21 PM Oct 5 2021, 06:21 PM

|

|

Hi... Which bank offer lower rate and longer tenure?

Ambank is 3.45%

|

|

|

|

|

|

perky

|

Oct 6 2021, 09:02 AM Oct 6 2021, 09:02 AM

|

|

QUOTE(Alert_RaZO @ Oct 5 2021, 06:21 PM) Hi... Which bank offer lower rate and longer tenure? Ambank is 3.45% Hi, this rate is for asb 1 loan? I have been quoted 3.4% for asbf2 from maybank with takaful. This post has been edited by perky: Oct 6 2021, 09:18 AM |

|

|

|

|

|

SUSXnet

|

Oct 6 2021, 12:27 PM Oct 6 2021, 12:27 PM

|

|

CIMB is slow with this ASBF2

|

|

|

|

|

|

facktura

|

Oct 6 2021, 08:54 PM Oct 6 2021, 08:54 PM

|

|

QUOTE(Xnet @ Oct 6 2021, 12:27 PM) CIMB is slow with this ASBF2 So ASB2F is already available again eh? |

|

|

|

|

|

tr3xsdcc

|

Oct 7 2021, 11:09 AM Oct 7 2021, 11:09 AM

|

Getting Started

|

Asb2f still available?

|

|

|

|

|

|

Joshua_0718

|

Oct 7 2021, 02:04 PM Oct 7 2021, 02:04 PM

|

|

QUOTE(tr3xsdcc @ Oct 7 2021, 11:09 AM) Yes, Maybank @ 3.4% |

|

|

|

|

Jul 14 2021, 01:25 PM

Jul 14 2021, 01:25 PM

Quote

Quote

0.0377sec

0.0377sec

0.15

0.15

6 queries

6 queries

GZIP Disabled

GZIP Disabled