QUOTE(AtMostFear @ Nov 11 2011, 05:21 PM)

Alamak haiiii..still dont get it ka? I know I'll be paying more than what I will get in the end, but I'm not paying them with money from my own pocket. I'm paying the bank with the dividends that I get.

so technically the amount of money spent out of MY pocket, is only RM8k.

not sure if trolling or too smart..

let me do simple calculation for u.

Assume the BLR fixed at 6.60% throughout the tenure.

The dividend is 7% throughout the tenure (this is the worst scenario.

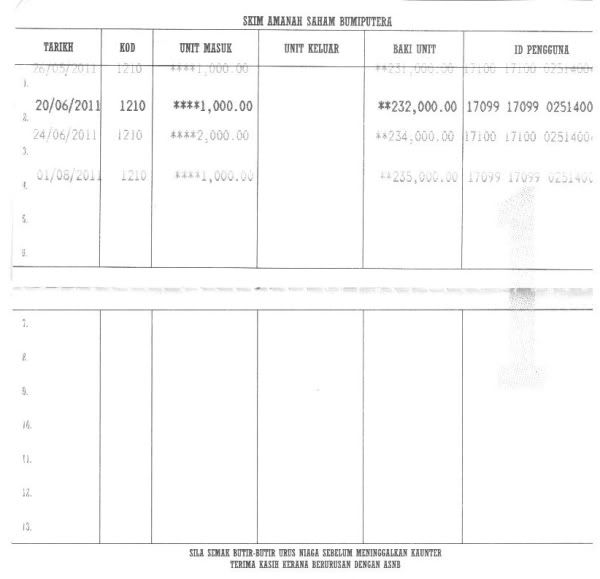

Based on the table provided by CIMB bank for ASB loan.

Assume i take rm100k loan and loan it for 20 years.

monthly instalment rm657

total payment made after 20 yrs

=(657 x 12mth x 20yrs)

=157,680

thats mean total interest paid after 20 yrs is 57,680

Although the loan is based on reducing balance method,

let me assume it is using compound interest method,

use compound interest formula,

We find the rate of interest using compound interest formula,

P(1+r)^n = Principal +interest

100,000 (1+r)^20=157,680

use ur calculator,

r= 2.3031%

in case of worst scenario,

ur ASB dividend at least generate 7% without include bonus.

u borrow at 2.3031% but u get a return of 7% at least per annum.

Ask urself, is it worth?

the figures tell it all.

This is just a simple arbitrage. I will not say it is a free money, because u gain higher return by facing higher risk. but the risk is near to zero. if the BLR increase to 7%, using weighted average for 20 yrs, u still in financially better position, becaouse the 2 interest gap is quite big. if PNB collapse, i think malaysia will face bankruptcy too. Then the ringgit u deposited inside the bank also will worth nothing at the end. better u buy gold if u dont have confident with the prospect of malaysia.

Nov 11 2011, 04:50 PM

Nov 11 2011, 04:50 PM

Quote

Quote

0.0844sec

0.0844sec

0.21

0.21

6 queries

6 queries

GZIP Disabled

GZIP Disabled