for me asb loan is for those who think about long term, after retirement where that day we don't have enough capability to do work, but at least we still have money to keep survive + for our children..

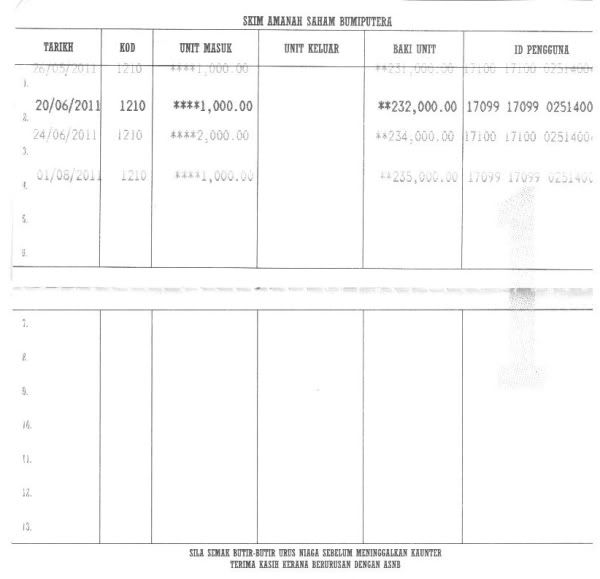

frankly, im still young.. i take rm200k asb loan for 25 years tenure. my target is 1m after 25 YEARS. if i'm not survive that long, it also for my family's benefit. it's ok.

my method, i'm not touching my dividend at all. don't worry, if some say suddenly got emergency where u need to use money immediately, it's your choice. u can cash out that dividend anytime after 1 year. it's ok

based on example situation ... lets say dividend is 7% every month (worst case scenario) .. itu belum campur bonus lagi

i pay rm1132 per month / rm13584 per year.

so total i pay rm339600.

but then... after 25 years, i manage to get rm 1,014,473.

so, conclusion is .... i just pay rm339,600, but i get rm1,014,473 back.

instead if i'm not taking advantage of asb loan ... i just got that rm339,600 from my own saving only.

so, ape yang rugi nyer amek asb loan? idop sengsara 25 tahun? kalau betol la rasa macam sengsara, amek method laen. tahun ke-2 byr guna untung dividen aje, tak payah nak sentuh dah duit gaji tu. 1 sen pon tak luak dari gaji. cuma untung sikit la, sikit takpe... at least still ada. dari tak ada langsung?

Nov 11 2011, 05:52 PM

Nov 11 2011, 05:52 PM Quote

Quote

0.0289sec

0.0289sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled