speechless about MGM..

just unpredictable.. I will just watch market today..

Investing in US stocks, Does anyone know how?

Investing in US stocks, Does anyone know how?

|

|

Nov 25 2009, 11:58 PM Nov 25 2009, 11:58 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

speechless about MGM..

just unpredictable.. I will just watch market today.. |

|

|

|

|

|

Nov 26 2009, 12:04 AM Nov 26 2009, 12:04 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Nov 26 2009, 12:25 AM Nov 26 2009, 12:25 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

read here before somewhere, that buying etf is better than buying individual stock

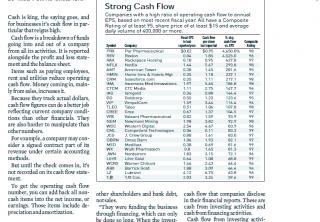

jjc is etf for copper & its individual stock with powderful movement : fcx, tck, clf & rtp looking at prices & chart, wat do u all think? seems here, most like co that hoard their cash, isn't it better they reinvest in r&d or do acquisition? than paying out high dividend imo, once stock pass the stage of growth & become highly moat, then they'll like to give out div prior to that, they sometimes can roket, in teori ozak, u still doing paper trade? since here, lots of u love company that sit on cash & do nothing with it can u pick 1 stock to paper trade from below shorter list, as the last 100 stock i gave was massive for me i choose lz, u wanna gamble & pick 1?

means gambling portfolio is now swing trade riding jjc, clf & lz in watchlist, awaiting pullback for gold stocks : gld, ego, svm, iag & kgn in watchlist, izit a roket? watching the chart formation before deciding : swm, ctrp, heat & caas |

|

|

Nov 26 2009, 06:26 AM Nov 26 2009, 06:26 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

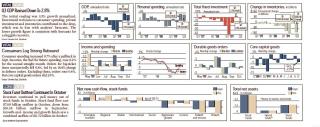

Closing update (6:23am)

Dow 10464.40 +30.69 +0.29% Nasdaq 2176.05 +6.87 +0.32% S&P 500 1110.63 +4.98 +0.45% Not bad.. not bad at all. Bulls managed to maintain that two steps forward before the holidays. I'll be taking a break a break as well since my US customers not calling until next week. I may pop in for half trading day on Friday evening. Can't stay away from the smell of money! This post has been edited by danmooncake: Nov 26 2009, 06:31 AM |

|

|

Nov 26 2009, 12:48 PM Nov 26 2009, 12:48 PM

|

All Stars

17,018 posts Joined: Jan 2005 |

QUOTE(sulifeisgreat @ Nov 26 2009, 12:25 AM) ozak, u still doing paper trade? since here, lots of u love company that sit on cash & do nothing with it Paper trade? You mean trade without real money? Never try before. I direct go in and invest.can u pick 1 stock to paper trade from below shorter list, as the last 100 stock i gave was massive for me i choose lz, u wanna gamble & pick 1? Will try it from your shorter list. |

|

|

Nov 26 2009, 12:55 PM Nov 26 2009, 12:55 PM

|

All Stars

17,018 posts Joined: Jan 2005 |

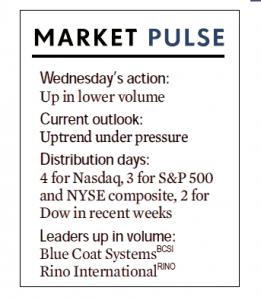

QUOTE Financial Stocks Have Been Laying Low Commentary: The financial stocks have been laying low for several months after being in the spotlight during one of the steepest declines on record. After stabilizing in early 2009 amid a sea of government intervention and programs, the financial sector began a rally that lasted well into the summer of 2009. The group has since been trading sideways lazily, as interest in the group has died down. Beginning in the summer, the tech group and then commodities took the spotlight as money rotated into their sectors. (For a quick refresher on this subject, see Sector Rotation: The Essentials.) In looking more closely at the financials though, it appears that some are at critical areas, and they could come to the forefront again soon. The chart for the Financial Select Sector SPDR ETF (NYSE:XLF) summarizes what many of the bank stocks and financials look like. XLF has been in a consolidation since August, as it works off its prior rally. It has been trading in a very tight range recently, and the 20- and 50-day moving averages have practically turned sideways. The very narrow range over the past few weeks should be watched as a break to either direction would probably lead to a continuation move past the larger overall pattern. [attachmentid=1324325] Bank of America Corporation (NYSE:BAC) looks very similar to the XLF chart with one exception: While XLF respected the lower bounds of its trading range, BAC actually broke under the range in late October. However, there was no follow-through, and BAC was able to climb back into the base. This often ends up turning into a bear trap, but BAC would have to first clear the narrow trading range highlighted in red before the bears get nervous. A move below the narrow range could lead to a full-fledged breakdown and a test of the 200-day moving average. [attachmentid=1324330] JPMorgan Chase and Co. (NYSE:JPM) is another financial stock that may be in a critical area. JPM has been gradually rolling over, and has begun to set lower highs. However, it is important to note that JPM hasn't broken support either, and remains entrenched in its current base. While the pattern is beginning to resemble a head-and-shoulders topping pattern, the pattern will not be valid until JPM closes beneath the neckline (highlighted in blue). The whole area between $40.50 and $42 is the level that needs to hold for JPM on a pullback. [attachmentid=1324334] Capital One Financial (NYSE:COF) is also sporting an interesting chart. COF is showing mild weakness, although it is still in its base. It attempted a breakout in late October, but the rally had no follow-through whatsoever. Since that time, it has begun building a base instead and is currently hugging the 50-day moving average. A move below the 50-day moving average would show weakness, and could threaten to lead a much deeper correction. [attachmentid=1324340] Bottom Line While the financials have been out of the spotlight for a few months, it might be time for the light to shine back on them. While they are showing some near-term weakness, the fact that the markets continue to be in an intermediate uptrend must be respected. Volatility has died down in the financials, and the next move in the group could be a large move to either direction. As such, they should be watched as a possible catalyst for the next move in the general markets. This post has been edited by ozak: Nov 26 2009, 12:56 PM |

|

|

|

|

|

Nov 26 2009, 02:37 PM Nov 26 2009, 02:37 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

XLF/UYG not moving much lately. Still remains in the zone.

Sold my LVS. Now only holding: C (for kurap) and ETFC (speculation of take over) |

|

|

Nov 26 2009, 08:28 PM Nov 26 2009, 08:28 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(ozak @ Nov 26 2009, 12:48 PM) Paper trade? You mean trade without real money? Never try before. I direct go in and invest. hmm... but do u dd (due diligence) before direct invest Will try it from your shorter list. can u assist to put up some dd, on whether to buy / ignore / short stock called 'heat' jus wanna check, how u derive the info, for the pleasure reading of the thread stalkers since u were able to get weekly info for us to analyse this past few weeks if can't extract info on heat, then nvm... gambling that it may roket in 6 months & here dd for caas

guess the investor never read the memo from the fed that usd is cheap but the consumer sure knows how to read the fed & wonder is the consumer = investor mindset

i learn how to censor from bolehland, thus some articles reflect the skil that the gomen imparted as usual, below for livermore, speculator & gamble lovers onli, categories other than tat, dun click it & spoil ur day » Click to show Spoiler - click again to hide... «

|

|

|

Nov 26 2009, 08:46 PM Nov 26 2009, 08:46 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(ozak @ Nov 26 2009, 12:55 PM) interesting read, it does seem to ring a bell on the scenario for financial stocks its the holiday season, i suspek the big momo r on holiday, since their bonus its humongous & left behind their kelefe to do trading as usual, below for livermore, speculator & gamble lovers onli, categories other than tat, dun click it & spoil ur day » Click to show Spoiler - click again to hide... «

|

|

|

Nov 27 2009, 12:33 AM Nov 27 2009, 12:33 AM

|

All Stars

17,018 posts Joined: Jan 2005 |

QUOTE(sulifeisgreat @ Nov 26 2009, 08:28 PM) hmm... but do u dd (due diligence) before direct invest I didn't do any dd. Just check the previous high and low price, history and some comment. And follow the crowd. can u assist to put up some dd, on whether to buy / ignore / short stock called 'heat' jus wanna check, how u derive the info, for the pleasure reading of the thread stalkers since u were able to get weekly info for us to analyse this past few weeks if can't extract info on heat, then nvm... gambling that it may roket in 6 months & here dd for caas Those report are arrive at my mailbox every week without fail. Since forumer here interesting, I just post it up. |

|

|

Nov 27 2009, 12:33 AM Nov 27 2009, 12:33 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

watch again tonight.

not because share not good. Just that too tired, just back from late dinner. enjoy yourselves. |

|

|

Nov 27 2009, 01:29 AM Nov 27 2009, 01:29 AM

|

Senior Member

768 posts Joined: Jan 2005 |

Tonight market close for Thanksgiving.

|

|

|

Nov 27 2009, 06:37 AM Nov 27 2009, 06:37 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

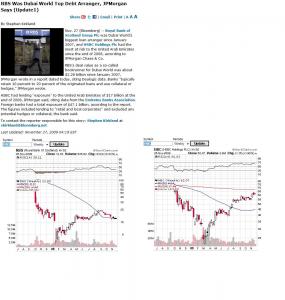

QUOTE(ozak @ Nov 27 2009, 12:33 AM) I didn't do any dd. Just check the previous high and low price, history and some comment. And follow the crowd. finally the longkang day seems to have arrive (u guys / gals ac, ready to short & put options?)Those report are arrive at my mailbox every week without fail. Since forumer here interesting, I just post it up. can bear jump out of window teori work in a cheap usd environment? we r about to find out in this roller coaster guess usa market will move about 2.5% downwards - hav to close my swing trade & no need watch roket position liao darn, wat to short? i not so sure what safe haven is define as? should i buy etf bonds, commodities or fxy? another round of cheaper maxis to be accumulated soon http://www.businessinsider.com/potential-d...-buying-2009-11 i did not short gold, though it was extremely tempting, but is anyone shorting gold? article for them to read The following is Jim Sinclair's take on this: Overnight news out of Dubai has sent global equity markets reeling and generated a safe haven flow into the US Dollar as carry trades are unwound and a flight away from risk occurs. Dubai has asked for a 6 month moratorium on its debt obligations, which for all practical purposes is a type of default. Needless to say, this came with little to no warning and has sent the markets into quite a tizzy. Gold shot higher on the news and touched a record $1,195 before some light long liquidation connected with carry trade unwinding got underway. Look for it to be well bid on any setbacks in price as this sort of news is extremely disturbing. After all, we are talking about the financial hub of the Middle East. Imagine the repercussions that would occur should London have announced this sort of news and you can understand why stock markets were pummeled overnight. Stocks have been floating higher and higher for the reasons described yesterday (increased profits due to expense cutting plus easy money and lots of liquidity) but this is the kind of news that could cut off all such rallies right at the knees. The reason – it creates fear and uncertainty, two of the prime ingredients in a selling binge. If Dubai could go under, then who or what might be next becomes the nagging question hanging over the markets like the proverbial sword of Damocles. We are in a period in which we could experience price swings across the markets of the magnitude which will parallel those that we witnessed as the Japanese Yen Carry trade was unwound last year. Huge leveraged bets employing the Dollar as the borrowed currency have set up a situation in which billions of Dollars in one way bets are once again on the table. These idiots never learn as their greed will be the ruin of them all but unfortunately, it is always the innocent and those who play by the rules who get caught in the crossfire generated by the pond scum hedge fund community. Be careful out there and be thankful that you own gold. Things are coming unraveled at an alarming speed. Just imagine the kind of losses that are now on the books of those banks who hold Dubai sovereign debt. Then again, that should not be a problem. The Central Banks can just print them some more money to replace those losses. Heaven help us all…. i dunno about the arab brothers helping each other news? if there was any, i have not come across yet here are some article on the tentacle wide reach of dubai conglomerate & to quote another forum "Looking over the Dubai holdings and sub-companies they own, it becomes very clear that if Dubai goes down, the world economy is toasted. Following just one company through all the variations brings them to our shores and that sucking sound...just might be your insurances. Figures don’t it." http://www.menafn.com/qn_news_story_s.asp?StoryId=1093189875 That is a chunk.....from WSJ: * NOVEMBER 26, 2009, 10:46 A.M. ET By CHIP CUMMINS DUBAI -- This debt-laden city-state said Wednesday it would restructure its largest corporate entity, Dubai World, a conglomerate spanning real estate and ports, and announced a six-month standstill on the group's debt. The surprise move quickly sapped investor confidence in Dubai 's ability to pay down its large debt load, sharply increasing the price of insuring against a default. It also represents the most significant fallout so far in the city-state's yearlong economic crisis, triggered by a collapse in its once-booming real-estate sector late last year. In response to the news, both Moody's Investors Service and Standard & Poor's heavily downgraded the debt of various Dubai government-related entities with interests in property, utilities, commercial operations and commodities trading. In Moody's case, the downgrade meant that the affected agencies lost their investment grade status. The government of Dubai said it appointed Deloitte LLP to spearhead the restructuring effort, naming an executive at the consultancy as the group's "chief restructuring officer." The move appeared to sideline, at least for the time being, the company's current management team, which had launched an internal corporate restructuring earlier this year. http://www.bloomberg.com/apps/news?pid=206...LeSDaGA1o&pos=2 http://www.bloomberg.com/apps/news?pid=206...id=aRsjlClzl500 http://www.reuters.com/article/newsOne/idU...0091126?sp=true http://www.breitbart.com/article.php?id=CN...&show_article=1 who knows? maybe a Mr Hope will save the bull |

|

|

|

|

|

Nov 27 2009, 11:50 AM Nov 27 2009, 11:50 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(epalbee3 @ Nov 27 2009, 12:33 AM) watch again tonight. ENJOY! tonite is half day trading with red sea on ur screen unless u short, then its green sea not because share not good. Just that too tired, just back from late dinner. enjoy yourselves. put option premium would be price crazily, if brave can do it, or else short, otherwise, refer old postings on bear etf but seeing how lyn forumers act, they rather stand there & get whack - no offense unless they have zero position, then can do nothing & after carnage over, to buy back anyway, to hav some idea wat to short (the mainstream media will giv some idea to panic the sheep) can u decipher below link clue : remember dubai world is a giant octopus, hav lots of stakes worldwide, how to unwind & pare down? izit buy more stocks? any accountant here that does restructuring, to advise us & thread lurkers? http://www.bloomberg.com/apps/news?pid=206...q7ulh0gio&pos=3 http://www.bloomberg.com/apps/news?pid=206...T3NxqmUOo&pos=2 for me, to buy those 4 bear etf & fxy, seems copper not consider safe haven soon will know what Sifu Market thinks of dubai thingy, coz it kinda ignore China banking liquidity concern the other day at least now i know the answer why gold keep on gap up, with no correction in sight - those f-ing insiders got news of dubai thingy sigh... should hav jus been a speculator & ride with them (for me, wil reconsider FA analisis on the overvalue thingy & gravity defying crab there goes my tuition fees again following tips - haha...

i did wonder how come not much momo buying from louyah analyst report even with cheap usd the smart momo r really smart until dubai stop giving us surprises & start acting maturely ie. giving investors updated news on what their next course of action or arab brothers help (but u gotta go to google & read up on arab investors mentality) Mr Market hates indecision & indecisiveness imo, the momo wil use this reason to sent us on a trip to longkang, later dunno when, they can buy back cheap - ENJOY! |

|

|

Nov 27 2009, 12:09 PM Nov 27 2009, 12:09 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Would like to see some pull backs. after short break..

make me more money! The futures are super RED! This is massive Black Friday alright. I'm going to short the heck out of FAS! This post has been edited by danmooncake: Nov 27 2009, 02:32 PM |

|

|

Nov 27 2009, 02:36 PM Nov 27 2009, 02:36 PM

|

Senior Member

1,120 posts Joined: Jul 2006 |

QUOTE(danmooncake @ Nov 27 2009, 12:09 PM) Would like to see some pull backs. after short break.. Its falling down all the way ..make me more money! The futures are super RED! This is massive Black Friday alright. I'm going to short the heck out of FAS! Dubai sent whole world down with them...haha short short short. (still holding Gold short positions since Tuesday) |

|

|

Nov 27 2009, 04:02 PM Nov 27 2009, 04:02 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

if u r a forever fan / ur FA says it is fine to hold, while a bullet train speeding towards u

its fine, its ur bank ac & everyone is at diff stage of learning with diff level of experience, no problemo all i can say is, in 3 months time, u go to bookstore there will be many books with the title along the lines of "Dubai crisis, why we did not take action & see the warning signs" so u go buy the book or jus flip thru it & wonder why too really up to each individual, when its the time to take action or not to who knows? maybe in 3 months time is a bull market? China is quite a responsible country & the world believes it can handle itself appropriately, so no sharp sell off the other day dun u jus love the below attachment

for dubai, is it cheaper for arab brothers to buy dubai world, when its bankrupt later or to take up its debt now, i no idea on restructuring, anyone pass their accounts exam recently to assist us & thread lurkers below is an excerpt from an article on dubai, pls see the last paragraph for those who wonder why it is super dubai! (& it is not signs of 'to buy') In early October, for example, S&P warned that it was nearly out of cash. But yesterday the once high-flying Emirate confirmed that it's reached zero-hour. Government-owned Dubai World is a conglomerate with interests in real estate, ports and the leisure industry. The firm carries around $60 billion in liabilities. Despite the issues being out there, financial markets, including Brazil and London (when it's open) are pulling back, the pound is tanking and -- uh-oh -- the greenback is rallying! That could be bad news when stocks open on Black Friday. Dubai itself isn't necessarily huge, but that's not exactly the point. What people are most likely freaked out about -- as Rick Bookstaber might point out -- is that people who own Dubai World debt may be forced to sell something else in unison to raise cash, triggering a bigger reaction. http://www.bloomberg.com/apps/news?pid=new...id=aoWQpISpzxkY http://www.bloomberg.com/apps/news?pid=206...nWP7gBVM&pos=10 http://www.bloomberg.com/apps/news?pid=206...T4zUDb0Y8&pos=2 look at the links, cool, all bad news to force/ psycho sheep panic & sell if sheep dun panic sell, momo will offer a price and time period, that the sheep will rather cash out, than prolong the agony as always, there r die hard fans who will never take up the offer, good luck being hit by the speeding bullet train

entering above positions & to short bulls etf, look at the f-ing volume on signs of bears patience, but i also can't decipher & read it all myself thanx to the forumers feedback, updates & its quite right, when forumers say, 'watch your right and left flak. I'll watch your six.. ready to jump off track if there's on coming train.' & 'If that is the case, forumers should be united for a win-win , irrespective of TA/FA.' & its good, tat the klse players starting to have an international outlook too... haha, i can take a rest now btw, wonder where r those forex players who advertise their services? how come no updates from them & give us warning i find futures very risky, but i virgin in futures, anyway now i can finally short ewm - M'sia Boleh

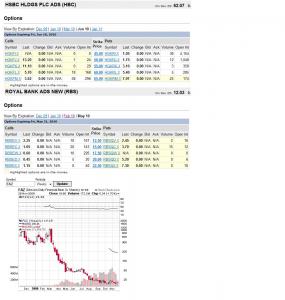

such a frenly jpmorgan tips, target longkang rbs $5.54 & hbc $45.54

This post has been edited by sulifeisgreat: Nov 27 2009, 06:22 PM |

|

|

Nov 27 2009, 06:36 PM Nov 27 2009, 06:36 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

Good luck.. Seems like the world has awaken.

|

|

|

Nov 27 2009, 07:26 PM Nov 27 2009, 07:26 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(epalbee3 @ Nov 27 2009, 06:36 PM) i think the klse players need the luck bear dance is 5 step back & 2 step forward, they wun let u take the short monies so easily all the articles coming out, says bank hardest hit, hsbc & std chtd dun wan to comment izit a trap for those short financial stock/etf? http://www.bloomberg.com/apps/news?pid=206...nyTmC..20&pos=1 http://finance.yahoo.com/news/Dubai-debt-c...2&asset=&ccode=

|

|

|

Nov 27 2009, 10:31 PM Nov 27 2009, 10:31 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Good for opportunities for both shorts and longs today.

Shorts take some profits. Long open new positions during dip. I don't expect more volume since this is half day trading. Let see if this bear can cause some damage. Both MGM and C have some exposures to Dubai.. will probably get fried today. Bought another batch: 200 TCK 33.00 100 DSX 15.70 This post has been edited by danmooncake: Nov 27 2009, 10:45 PM |

|

Topic ClosedOptions

|

| Change to: |  0.0243sec 0.0243sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 03:05 AM |