QUOTE(junsheng @ Dec 22 2025, 12:59 AM)

do you even know what i'm talking about?

there's no ev that come with active load management

the ev don't know how much load your house is currently dynamically using

regardless of how many A, if you're near the max limit, it's going to overload the circuit

to solve this issue is to use ev charger that come with active load management

it monitors household demand and automatically throttles charging allowed to the ev

so the total stays within the main breaker limit, single phase is 63 - 65A, 3 phase 100A with 33.33A individually

i still haven't talk about earthing requirements, pen faults, the use of proper rccd type & rated for ev charging yet

Some el cheapo installers are doing stupid shits like.

1. Use type AC Rccb ( instead of type A)

2. Upgrade tnb fuse to 100A to prevent fuse burn(only ok if wiring can support it. Most houses are not able to suport this

3. Direct tap from meter bypassing the main MCB and leaving protection to the tnb fuse only. Couple with method 2 and its a perfect recipe for disaster.

Other risks

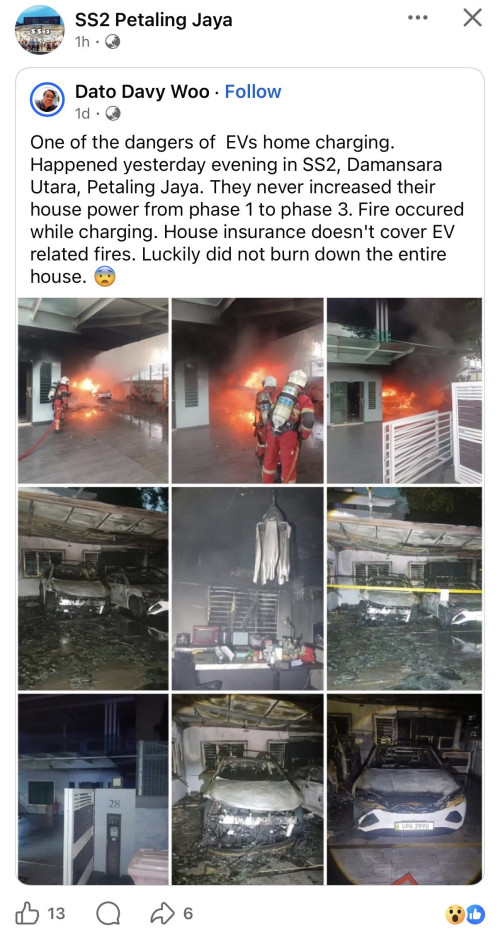

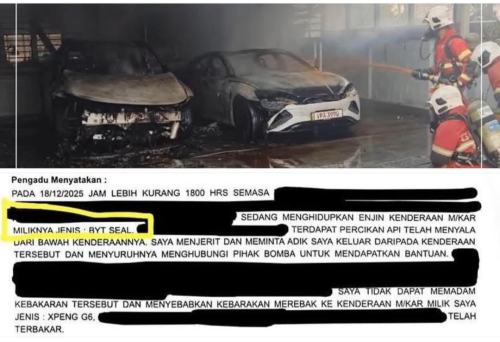

1.some old houses have degraded incoming tnb cables. Even at 25mm2 with load balanced charger, there was a fire event.

2. Loose connection on tnb neutral block, incoming junction box with elevated temperature.

Expect more incoming tnb issues and insurance refusing coverage. Most people have no clue about all this

Today, 08:42 AM

Today, 08:42 AM

Quote

Quote

0.0167sec

0.0167sec

0.62

0.62

5 queries

5 queries

GZIP Disabled

GZIP Disabled