This post has been edited by RT8081: Yesterday, 05:22 PM

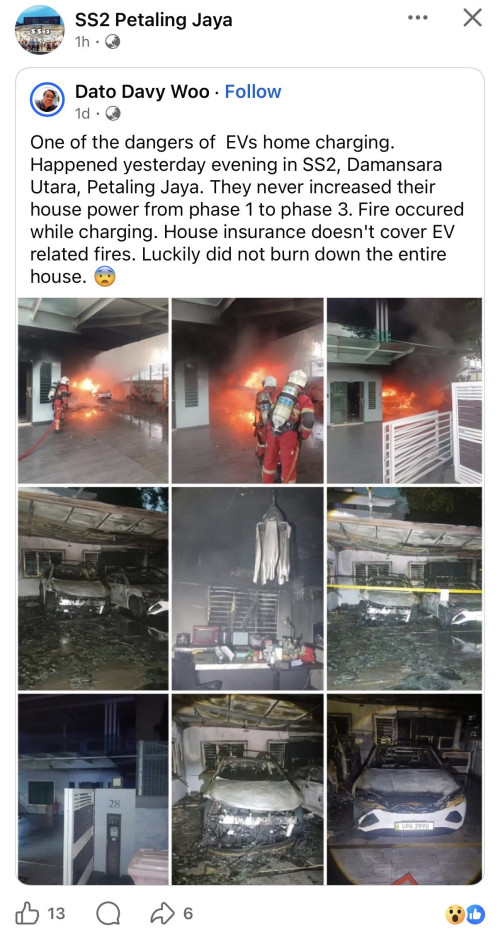

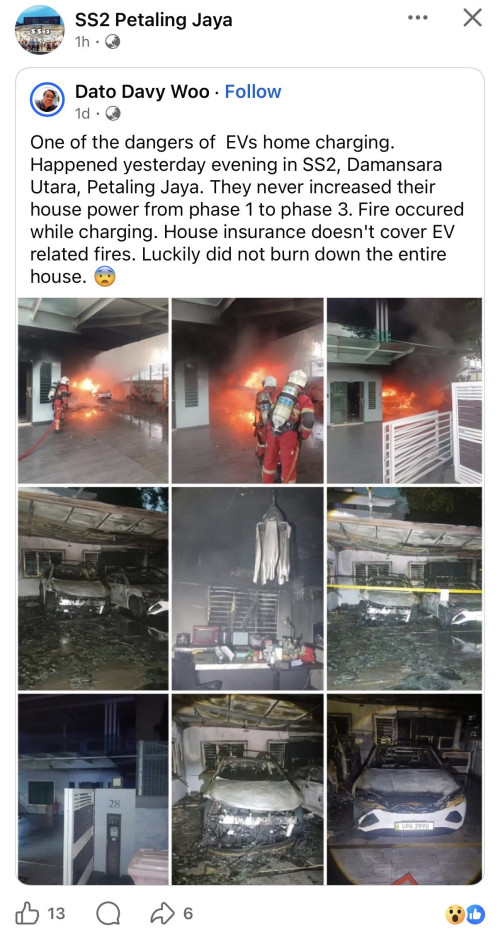

So if house burned due to EV, insurance won’t, Cover ?

|

|

Yesterday, 05:19 PM, updated 12h ago Yesterday, 05:19 PM, updated 12h ago

Return to original view | Post

#1

|

Junior Member

356 posts Joined: May 2022 |

https://www.facebook.com/share/p/1GuMiKH7kQ/?mibextid=wwXIfr

This post has been edited by RT8081: Yesterday, 05:22 PM |

|

|

|

|

|

Yesterday, 05:27 PM Yesterday, 05:27 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

356 posts Joined: May 2022 |

|

|

|

Yesterday, 08:15 PM Yesterday, 08:15 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

356 posts Joined: May 2022 |

|

|

|

Yesterday, 08:16 PM Yesterday, 08:16 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

356 posts Joined: May 2022 |

QUOTE(TOMEI-R @ Dec 21 2025, 05:28 PM) No 1 requirement before you buy and EV is that you have 3 phase wiring at your home. Proper installation of a wall charger is a must. Many house owners don't even have home insurance. QUOTE(GOPI56 @ Dec 21 2025, 07:54 PM) Yup, by default most of the home insurance does not cover it. You need to check with your insurance provider. Thanks! Looks like need to evaluate first before buying EVThen got some terms and conditions set by the insurance provider like; 1. The installation of EV charger follow guidelines set by suruhanjaya tenaga (ST) 2. The installation of EV charger is done by those certified and licensed professionals or contractors. (Keep their invoices, receipts, etc) |

|

|

Yesterday, 08:23 PM Yesterday, 08:23 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

356 posts Joined: May 2022 |

QUOTE(hihihehe @ Dec 21 2025, 08:22 PM) Yes and noQUOTE In general, fire damage caused by an accidental fire from a cigarette is typically covered by a Malaysian home insurance policy, provided you have been honest with your insurer about the smoking habits of household members. However, coverage can be voided if the damage is a result of gross negligence or an intentional act. QUOTE Key Considerations Honesty is Crucial: When you apply for home insurance, you are generally asked whether you or any member of your household smokes. If you declare that you are a smoker, your premium might be slightly higher due to the increased risk, but a legitimate claim will be honored. If you lie or fail to disclose this information, the insurer can refuse to pay out the claim on the grounds of misrepresentation, as they underwrote the policy based on incorrect risk information. Negligence vs. Accident: An accidental fire (e.g., a lit cigarette falling and igniting a couch unintentionally) is usually covered. Gross negligence (e.g., routinely smoking in bed and falling asleep, or leaving a lit cigarette unattended knowing the high risk of fire) may lead to a rejected claim. Insurers investigate the circumstances surrounding a fire to determine the cause. Policy Wording: Standard home insurance policies in Malaysia cover fire as a basic, named peril. Always check the specific wording of your policy document, including the exclusions section, to understand exactly what is and is not covered under "fire" and "accidental damage". Contents Insurance: A basic fire insurance policy covers the building structure itself. For damage to your furniture, personal effects, and household goods, you need a separate householder or contents insurance policy, which also typically includes fire damage as a standard cover. This post has been edited by RT8081: Yesterday, 08:24 PM |

|

|

Yesterday, 09:26 PM Yesterday, 09:26 PM

Return to original view | Post

#6

|

Junior Member

356 posts Joined: May 2022 |

QUOTE(ozak @ Dec 21 2025, 08:55 PM) Wrong infor. Interesting, thanksIf the charger require 3 phase, it need to be install with 3 phase wiring. Single phase cannot use. If the charger have an option of 3P or single phase, it will cap the current draw for single phase. Aka, slow charge for single phase. Even if the charger want draw more power, it still need to go through the house MCB, RCD and the TNB fuse. Either device will trip or blown the fuse. |

|

|

Today, 09:30 AM Today, 09:30 AM

Return to original view | Post

#7

|

Junior Member

356 posts Joined: May 2022 |

|

| Change to: |  0.0143sec 0.0143sec

0.51 0.51

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 10:22 PM |