Are M’sians so lazy and scare of competition with seniors?

Why Msian so against new 65 yr old retirement age?

Why Msian so against new 65 yr old retirement age?

|

|

Jun 4 2025, 01:42 PM, updated 7 months ago Jun 4 2025, 01:42 PM, updated 7 months ago

Show posts by this member only | IPv6 | Post

#1

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

Other countries OK je Are M’sians so lazy and scare of competition with seniors? lordgamer3 liked this post

|

|

|

|

|

|

Jun 4 2025, 01:44 PM Jun 4 2025, 01:44 PM

Show posts by this member only | IPv6 | Post

#2

|

Junior Member

494 posts Joined: Apr 2009 From: The Fifth Dimension |

We are not known to be competitive in work, in case u taktau... This post has been edited by vassilius: Jun 4 2025, 01:44 PM brutalsoul, Juggerballz, and 18 others liked this post

|

|

|

Jun 4 2025, 01:45 PM Jun 4 2025, 01:45 PM

Show posts by this member only | Post

#3

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

higher official retirement age is less relevant to private staff as they can still retire early if they wanted to.

It's civil servants that are more affected, if they don't work until the set retirement age, they may get lower entitlement to their govt pension scheme. |

|

|

Jun 4 2025, 01:47 PM Jun 4 2025, 01:47 PM

Show posts by this member only | Post

#4

|

Junior Member

310 posts Joined: Aug 2008 From: Jerusalem |

Lagi ask soalan susah

Muslim majority country Muslim wanna enough time to repent and spend time with loved ones before they die you can't transfer money and career in afterlife only deeds, sins and memories |

|

|

Jun 4 2025, 01:47 PM Jun 4 2025, 01:47 PM

Show posts by this member only | Post

#5

|

Junior Member

121 posts Joined: Apr 2011 |

https://www.theguardian.com/world/2025/apr/...ension-age-rise

QUOTE Disgruntled French workers encouraged to arrive late in protest over pension age rise Ini baru satu. Not only Malaysia. |

|

|

Jun 4 2025, 01:52 PM Jun 4 2025, 01:52 PM

Show posts by this member only | IPv6 | Post

#6

|

Junior Member

70 posts Joined: Jun 2018 |

They against that increase full withdrawal age in EPF and welfare benefits...owai

Edit : Additional info This post has been edited by PathofLife: Jun 4 2025, 01:53 PM |

|

|

|

|

|

Jun 4 2025, 01:53 PM Jun 4 2025, 01:53 PM

Show posts by this member only | Post

#7

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

well you are denying youngster their employment post and their career growth because the oldfag still holding down the decision maker post. also productivity out of windows because this oldfag dont have energy to work for long and need to go for their routine treatment (e.g dialysis, physiotherapy, wound cleaning) due to their chronic illness.

|

|

|

Jun 4 2025, 01:53 PM Jun 4 2025, 01:53 PM

Show posts by this member only | Post

#8

|

Newbie

5 posts Joined: Jun 2018 |

don't want work till mampus at work place like boomers

|

|

|

Jun 4 2025, 01:54 PM Jun 4 2025, 01:54 PM

Show posts by this member only | Post

#9

|

Senior Member

2,541 posts Joined: Dec 2007 |

65 baru dpt duit kwsp 100k... tak syok la...

|

|

|

Jun 4 2025, 01:55 PM Jun 4 2025, 01:55 PM

Show posts by this member only | IPv6 | Post

#10

|

Senior Member

2,547 posts Joined: Oct 2007 |

its a matter of not willing to let pension money withheld by government for longer. eddystorm, Maverick_Neutron, and 5 others liked this post

|

|

|

Jun 4 2025, 01:56 PM Jun 4 2025, 01:56 PM

|

Junior Member

848 posts Joined: Oct 2004 |

Good to increase, now got purple tong u pundeks think your epf cukup to eat ah even die oso no money

|

|

|

Jun 4 2025, 01:57 PM Jun 4 2025, 01:57 PM

|

Junior Member

848 posts Joined: Oct 2004 |

|

|

|

Jun 4 2025, 01:57 PM Jun 4 2025, 01:57 PM

Show posts by this member only | IPv6 | Post

#13

|

Junior Member

157 posts Joined: Oct 2008 |

QUOTE(knwong @ Jun 4 2025, 01:42 PM) I am not against. But at least 60-65 years old should be allowed max of 25 hours of working per week.They got to give chance to next generation and enjoy the life la.. At age 60 nearly half step into coffin d |

|

|

|

|

|

Jun 4 2025, 01:59 PM Jun 4 2025, 01:59 PM

|

Senior Member

3,678 posts Joined: Apr 2019 |

|

|

|

Jun 4 2025, 01:59 PM Jun 4 2025, 01:59 PM

Show posts by this member only | IPv6 | Post

#15

|

Junior Member

560 posts Joined: Mar 2008 |

Retirement tak senang

|

|

|

Jun 4 2025, 02:00 PM Jun 4 2025, 02:00 PM

|

Junior Member

225 posts Joined: May 2007 From: KL |

From the previous thread, it seems like lot of ktards under the impression that you are forced to work until retirement, cannot decide to retire before 65.

|

|

|

Jun 4 2025, 02:00 PM Jun 4 2025, 02:00 PM

Show posts by this member only | IPv6 | Post

#17

|

Junior Member

221 posts Joined: Jan 2019 From: Earth |

Maybe 60-65 only work 2 days per week with 1/3 salary IF they choose to stay?

|

|

|

Jun 4 2025, 02:00 PM Jun 4 2025, 02:00 PM

Show posts by this member only | IPv6 | Post

#18

|

Senior Member

774 posts Joined: Nov 2010 |

QUOTE(iGamer @ Jun 4 2025, 01:45 PM) higher official retirement age is less relevant to private staff as they can still retire early if they wanted to. it will be relevant if they update the epf withdrawal age with the new retirement age dikIt's civil servants that are more affected, if they don't work until the set retirement age, they may get lower entitlement to their govt pension scheme. |

|

|

Jun 4 2025, 02:00 PM Jun 4 2025, 02:00 PM

Show posts by this member only | IPv6 | Post

#19

|

Senior Member

2,013 posts Joined: Jan 2003 From: abyss |

i kinda more concern if this age affect the epf withdrawal or just purely working age, as a SG fren once said, gov keep pushing the age to withdraw retirement fund, even u have millions in epf, dunno u got the life to use it or not. usingtea and lurkingaround liked this post

|

|

|

Jun 4 2025, 02:01 PM Jun 4 2025, 02:01 PM

Show posts by this member only | IPv6 | Post

#20

|

All Stars

10,477 posts Joined: Jan 2003 From: Sarawak |

Malaysians are just lazy. many people want early retirement at age 40-50.

|

|

|

Jun 4 2025, 02:04 PM Jun 4 2025, 02:04 PM

Show posts by this member only | IPv6 | Post

#21

|

Senior Member

2,547 posts Joined: Oct 2007 |

QUOTE(ben_ang @ Jun 4 2025, 02:00 PM) i kinda more concern if this age affect the epf withdrawal or just purely working age, this is the core reason. singapore is a very good model of how longer retirement age will look like.as a SG fren once said, gov keep pushing the age to withdraw retirement fund, even u have millions in epf, dunno u got the life to use it or not. |

|

|

Jun 4 2025, 02:05 PM Jun 4 2025, 02:05 PM

|

Senior Member

4,498 posts Joined: Jun 2011 |

|

|

|

Jun 4 2025, 02:06 PM Jun 4 2025, 02:06 PM

Show posts by this member only | IPv6 | Post

#23

|

Junior Member

844 posts Joined: Sep 2011 |

QUOTE(iGamer @ Jun 4 2025, 01:45 PM) higher official retirement age is less relevant to private staff as they can still retire early if they wanted to. Govt pension is sedap. Work 40yrs guaranteed increment and promotions, retire and and live another 25-30 yrs get half celery and can pass on to spouse and children after passing. Damn sedap.It's civil servants that are more affected, if they don't work until the set retirement age, they may get lower entitlement to their govt pension scheme. |

|

|

Jun 4 2025, 02:09 PM Jun 4 2025, 02:09 PM

|

Senior Member

1,327 posts Joined: Jun 2019 |

1. gov paying less pension.

2. gov can tax more coz you work longer. win-win for gov. |

|

|

Jun 4 2025, 02:10 PM Jun 4 2025, 02:10 PM

|

Junior Member

250 posts Joined: Aug 2024 |

QUOTE(zerorating @ Jun 4 2025, 01:53 PM) well you are denying youngster their employment post and their career growth because the oldfag still holding down the decision maker post. also productivity out of windows because this oldfag dont have energy to work for long and need to go for their routine treatment (e.g dialysis, physiotherapy, wound cleaning) due to their chronic illness. old fags sampai masa, sudah kaya, plox die far far |

|

|

Jun 4 2025, 02:10 PM Jun 4 2025, 02:10 PM

|

Senior Member

1,782 posts Joined: Jul 2022 |

|

|

|

Jun 4 2025, 02:13 PM Jun 4 2025, 02:13 PM

|

Junior Member

376 posts Joined: Jul 2005 From: K.Hills |

QUOTE(ben_ang @ Jun 4 2025, 02:00 PM) i kinda more concern if this age affect the epf withdrawal or just purely working age, I personally have “millions” in epf for sometime already, and have been using it as a high yield easily accessible account.as a SG fren once said, gov keep pushing the age to withdraw retirement fund, even u have millions in epf, dunno u got the life to use it or not. It’s a non-issue to me at all as i can withdraw freely anyway even before the retirement age. It’s also a non issue to all my similar acquaintances - those with already millions in EPF knows it’s a damn good investment portfolio to diversify into, while those who can’t even break out from the EPF threshold instead will be the ones to bash epf, be the loudest and says how they’re a “master” investor and making more money elsewhere, while can’t even meet the mere epf limit for withdrawals lol Instead you should be worried for those that almost reach million but never gets there as the goalpost will be constantly moved. |

|

|

Jun 4 2025, 02:19 PM Jun 4 2025, 02:19 PM

|

Junior Member

54 posts Joined: Feb 2022 |

3 things:

1. Thought will get free money when retired, thats why as early as possible 2. Thought KWSP regardless amount is enough for rest of life no matter 10 years,20years or 30 years. Bad in math. 3. Asalkan syukur. |

|

|

Jun 4 2025, 02:20 PM Jun 4 2025, 02:20 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

|

|

|

Jun 4 2025, 02:23 PM Jun 4 2025, 02:23 PM

Show posts by this member only | IPv6 | Post

#30

|

Junior Member

569 posts Joined: Jul 2007 |

If no kids to take care and house already paid. Why still need to work? Ayam 47 already planning for retirement. Don't ask me to work till 65. Unless only need to work 3 days a week and no deadline. St0rmFury liked this post

|

|

|

Jun 4 2025, 02:24 PM Jun 4 2025, 02:24 PM

Show posts by this member only | IPv6 | Post

#31

|

Senior Member

1,682 posts Joined: Oct 2004 From: let there be rain |

pretty much ask pensioners to fly kite. gov will help spend ur pension. lol.

|

|

|

Jun 4 2025, 02:26 PM Jun 4 2025, 02:26 PM

Show posts by this member only | IPv6 | Post

#32

|

Senior Member

1,521 posts Joined: May 2008 |

Not Malaysian in general, but rather workers of public sector with pencen.

Private sector? You can retire anytime you wish as long as you think you already have enough in your EPF. |

|

|

Jun 4 2025, 02:30 PM Jun 4 2025, 02:30 PM

|

Senior Member

6,639 posts Joined: Jan 2003 From: "New Castle" |

If can retire earlier with lots of cash, better. Can enjoy other aspects of life rather than going to work. Retire age 60, maybe lots of cash, but no energy or no longer healthy to enjoy remaining years.

|

|

|

Jun 4 2025, 02:49 PM Jun 4 2025, 02:49 PM

|

Newbie

8 posts Joined: Jun 2015 |

They withdraw epf money for vios and iPhone, so no money left.😅 work till 65 also not enough.

|

|

|

Jun 4 2025, 02:51 PM Jun 4 2025, 02:51 PM

Show posts by this member only | IPv6 | Post

#35

|

Newbie

19 posts Joined: Oct 2014 |

QUOTE(St0rmFury @ Jun 4 2025, 02:00 PM) From the previous thread, it seems like lot of ktards under the impression that you are forced to work until retirement, cannot decide to retire before 65. It’s more like you can’t withdraw epf before 65. Gomen can set whatever retirement age they want as long as they don’t hoard our money. |

|

|

Jun 4 2025, 02:55 PM Jun 4 2025, 02:55 PM

Show posts by this member only | IPv6 | Post

#36

|

Junior Member

361 posts Joined: Jun 2007 |

The only one who want to raise retirement age is politician, so they can continue to songlap...

|

|

|

Jun 4 2025, 02:57 PM Jun 4 2025, 02:57 PM

|

Senior Member

1,769 posts Joined: Jan 2003 From: Malaysia |

I already wanted to retire at 45 . Why so dumb work for your entire life , most of the people wont live past 65 nowadays . life != work

|

|

|

Jun 4 2025, 02:58 PM Jun 4 2025, 02:58 PM

Show posts by this member only | IPv6 | Post

#38

|

Junior Member

808 posts Joined: Aug 2011 |

Angmoh work cuz no kopitiam to lepak everything close after 6pm

|

|

|

Jun 4 2025, 03:00 PM Jun 4 2025, 03:00 PM

|

Junior Member

87 posts Joined: Oct 2017 |

QUOTE(poooky @ Jun 4 2025, 02:06 PM) Govt pension is sedap. Work 40yrs guaranteed increment and promotions, retire and and live another 25-30 yrs get half celery and can pass on to spouse and children after passing. Damn sedap. That’s how the poor remain poor, with such shortsighted mindset and lazy attitude in expecting “guaranteed” increment. With no risk, naturally you’ll get extremely low returns too.Let’s use your example of 40yrs drawing working salary, but instead said worker is in private sector, contributing to EPF: Starting with rm0 in epf, and assuming ZERO increase to EPF contributions for the full 40 years, at the end of year 40, said private sector worker will have RM2,458,902.05 as a lump sum available to him with 5%~ epf rate. Let me repeat that again, a person who contributes just 1500 for 40 years, with NO increase towards that mere 1500 monthly (inclusive of the employer contribution, means your payslip deduction is lesser than 1500), will have around 2.5mil as his retirement “gift”. With 2.5million in capital, it freely generates rm125,000 annually in interest @5% returns, which equates to a little bit more than 10k income per month for that said private sector retiree. On top of that 10k per month income, don’t forget he still holds onto 2.5million as his investment capital, a money that will guarantee generational wealth even after you die. Moral of the story is, dont be stupid, govt pencen is not the point of working for the government, it’s the “supplemental”, “extra-mile”, “close-1-eye”, “contract&procument” fees that you earn through your 40years is the main selling point, not some bodo pencen, which only draws 50%? 60% out of whatever low ammount of gov workers base salary scale lah |

|

|

Jun 4 2025, 03:00 PM Jun 4 2025, 03:00 PM

|

Senior Member

2,116 posts Joined: Apr 2013 |

|

|

|

Jun 4 2025, 03:02 PM Jun 4 2025, 03:02 PM

|

Junior Member

617 posts Joined: Jul 2006 |

I'm ok with senile old ppl working. But how menurunkan kuasa is coin in 1st place.

Not not taking the responsibility, unclear order, go meeting and seminar and go back office just handle PowerPoint presentation and ask all staff do it . Oh! I should using bold, UPPERCASE and humongous Font. Like their belly. |

|

|

Jun 4 2025, 03:02 PM Jun 4 2025, 03:02 PM

|

Senior Member

3,582 posts Joined: Oct 2007 From: everywhere in sabah |

QUOTE(knwong @ Jun 4 2025, 01:42 PM) because legally retirement age is just a number....there are no rules or laws that say u have to retire at the age of 55realistically raising retirement age means raising the age where you can touch your EPF |

|

|

Jun 4 2025, 03:07 PM Jun 4 2025, 03:07 PM

Show posts by this member only | IPv6 | Post

#43

|

Junior Member

95 posts Joined: Nov 2016 |

Need retire early, coz gov boleh bagi tongkat in few different ways.

Rakyat sokong, keep voting politikus yang bagi tongkat, and fxck the future gen. |

|

|

Jun 4 2025, 03:09 PM Jun 4 2025, 03:09 PM

Show posts by this member only | IPv6 | Post

#44

|

Senior Member

9,050 posts Joined: Jan 2003 |

After 65, retired for what? Most may drop dead the very next day.

All becoming company slaves. Now, young people fighting back by not getting married and have kids. |

|

|

Jun 4 2025, 03:23 PM Jun 4 2025, 03:23 PM

|

Junior Member

661 posts Joined: Jan 2005 From: Legio Titanicus |

Up the retirement age to 65 but allow full EPF withdrawal by 60. Kan senang.

|

|

|

Jun 4 2025, 03:27 PM Jun 4 2025, 03:27 PM

|

Senior Member

1,565 posts Joined: Jan 2009 |

QUOTE(St0rmFury @ Jun 4 2025, 02:00 PM) From the previous thread, it seems like lot of ktards under the impression that you are forced to work until retirement, cannot decide to retire before 65. A lot of countries in the list quoted by TS eg Netherlands you get full pension only upon working till the required age eg 67.Private sector also pension by govt. 🤔 This post has been edited by dogbert_chew: Jun 4 2025, 03:28 PM |

|

|

Jun 4 2025, 03:29 PM Jun 4 2025, 03:29 PM

Show posts by this member only | IPv6 | Post

#47

|

Junior Member

569 posts Joined: Jul 2007 |

sad case is after retire, you don't know what to do. Ho hobby, friends are all from work. Just site home wait for the day to come.

|

|

|

Jun 4 2025, 03:29 PM Jun 4 2025, 03:29 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(dogbert_chew @ Jun 4 2025, 03:27 PM) A lot of countries in the list quoted by TS eg Netherlands you get full pension only upon working till the required age eg 67. Yeah. I have one colleague in Turkey decided to retire at 40 yo to get that pension. A very pitiful amountPrivate sector also pension by govt. 🤔 Then she slowly go find new job Their retirement age law is subject to the day they start working This post has been edited by knwong: Jun 4 2025, 03:32 PM |

|

|

Jun 4 2025, 03:42 PM Jun 4 2025, 03:42 PM

Show posts by this member only | IPv6 | Post

#49

|

Junior Member

685 posts Joined: Jun 2014 From: Earth |

the problem is some old people are somewhat senile and cant make logical decisions anymore

this will create trouble in the workplace This post has been edited by bigmac999: Jun 4 2025, 03:43 PM |

|

|

Jun 4 2025, 03:42 PM Jun 4 2025, 03:42 PM

|

Junior Member

651 posts Joined: Mar 2009 |

cause work is for cow

|

|

|

Jun 4 2025, 03:58 PM Jun 4 2025, 03:58 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(buraqdunia @ Jun 4 2025, 03:02 PM) I'm ok with senile old ppl working. But how menurunkan kuasa is coin in 1st place. Not not taking the responsibility, unclear order, go meeting and seminar and go back office just handle PowerPoint presentation and ask all staff do it . Oh! I should using bold, UPPERCASE and humongous Font. Like their belly. QUOTE(bigmac999 @ Jun 4 2025, 03:42 PM) the problem is some old people are somewhat senile and cant make logical decisions anymore The Older-Worker Productivity Drain Is (Mostly) a Myth: Studythis will create trouble in the workplace https://www.thinkadvisor.com/2023/11/27/the...y-a-myth-study/ QUOTE Conclusions In short, the authors conclude, older workers appear to be as productive as younger workers, but they may cost more to employ. |

|

|

Jun 4 2025, 03:58 PM Jun 4 2025, 03:58 PM

Show posts by this member only | IPv6 | Post

#52

|

Junior Member

844 posts Joined: Sep 2011 |

QUOTE(TheOnly @ Jun 4 2025, 03:00 PM) That’s how the poor remain poor, with such shortsighted mindset and lazy attitude in expecting “guaranteed” increment. With no risk, naturally you’ll get extremely low returns too. You make good points, but all my confident in the system has been broken last few years. We all know it as much as we wan to believe the opposite.Let’s use your example of 40yrs drawing working salary, but instead said worker is in private sector, contributing to EPF: Starting with rm0 in epf, and assuming ZERO increase to EPF contributions for the full 40 years, at the end of year 40, said private sector worker will have RM2,458,902.05 as a lump sum available to him with 5%~ epf rate. Let me repeat that again, a person who contributes just 1500 for 40 years, with NO increase towards that mere 1500 monthly (inclusive of the employer contribution, means your payslip deduction is lesser than 1500), will have around 2.5mil as his retirement “gift”. With 2.5million in capital, it freely generates rm125,000 annually in interest @5% returns, which equates to a little bit more than 10k income per month for that said private sector retiree. On top of that 10k per month income, don’t forget he still holds onto 2.5million as his investment capital, a money that will guarantee generational wealth even after you die. Moral of the story is, dont be stupid, govt pencen is not the point of working for the government, it’s the “supplemental”, “extra-mile”, “close-1-eye”, “contract&procument” fees that you earn through your 40years is the main selling point, not some bodo pencen, which only draws 50%? 60% out of whatever low ammount of gov workers base salary scale lah Also there is no guarantee that ppl can remain employed in private all the way to 60. Most will be laid off many2 years before that so no more contribution. Any work they can fine maybe pay minimum wage at most unless they take out capital to do own business. Job for life is very lesser now. For gov pencen, plenty of lifetime servants who keep head down and retired at 60, monthly draw around 7k+ not bad what. These days can live another 25 yrs. Then pass to spouse and children some more + other benefits for serving nation. If it is kacang putih as u imply they wouldn't have pushing civil servants to epf system because too expensive |

|

|

Jun 4 2025, 04:24 PM Jun 4 2025, 04:24 PM

Show posts by this member only | IPv6 | Post

#53

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |

QUOTE(knwong @ Jun 4 2025, 01:42 PM) .Fyi, 34 countries provide social pension to the elderly/retirees that is funded by tax money. In USA, their Social Security Fund for retirees is being used or borrowed by the US government for its annual budget. In Malaysia, the government also borrows from the EPF for its annual budget, besides providing social pension to retired civil servants. Similarly for other countries borrowing from the pension funds for their annual budgets. So, there is motivation for the governments in the world to extend the retirement age to about 65-75 yo = pension fund or social pension withdrawal age also extended, so that the govts could borrow more from the pension funds or spend less tax money for social pensions. ....... https://en.wikipedia.org/wiki/Pension https://en.wikipedia.org/wiki/Social_pension https://en.wikipedia.org/wiki/Social_Securi...(United_States) . |

|

|

Jun 4 2025, 04:28 PM Jun 4 2025, 04:28 PM

Show posts by this member only | IPv6 | Post

#54

|

Junior Member

117 posts Joined: Jun 2014 |

|

|

|

Jun 4 2025, 04:29 PM Jun 4 2025, 04:29 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(poooky @ Jun 4 2025, 03:58 PM) You make good points, but all my confident in the system has been broken last few years. We all know it as much as we wan to believe the opposite. What gov role can get 7k+ monthly pencen? Most I know are way below thatAlso there is no guarantee that ppl can remain employed in private all the way to 60. Most will be laid off many2 years before that so no more contribution. Any work they can fine maybe pay minimum wage at most unless they take out capital to do own business. Job for life is very lesser now. For gov pencen, plenty of lifetime servants who keep head down and retired at 60, monthly draw around 7k+ not bad what. These days can live another 25 yrs. Then pass to spouse and children some more + other benefits for serving nation. If it is kacang putih as u imply they wouldn't have pushing civil servants to epf system because too expensive 7k+ pencen is drawing like >20k month previously... poooky liked this post

|

|

|

Jun 4 2025, 04:34 PM Jun 4 2025, 04:34 PM

|

Junior Member

87 posts Joined: Oct 2017 |

QUOTE(poooky @ Jun 4 2025, 03:58 PM) You make good points, but all my confident in the system has been broken last few years. We all know it as much as we wan to believe the opposite. Well yes, you can’t argue that government job security is one of the greatest peace of mind someone could have. Any other MNC job will just layoff staffs in the guise of “re-org” ie. Legally firing you.Also there is no guarantee that ppl can remain employed in private all the way to 60. Most will be laid off many2 years before that so no more contribution. Any work they can fine maybe pay minimum wage at most unless they take out capital to do own business. Job for life is very lesser now. For gov pencen, plenty of lifetime servants who keep head down and retired at 60, monthly draw around 7k+ not bad what. These days can live another 25 yrs. Then pass to spouse and children some more + other benefits for serving nation. If it is kacang putih as u imply they wouldn't have pushing civil servants to epf system because too expensive However i strongly believe the govt move to push civil servants for epf is because epf business nature: investments is a great hedge againts inflation and has a proven track record of consistent profit, and the more capital epf has to work with, the more net profit they will get. Some split of their investors (ie.epf contributers), while the rest is plain profit for the epf organization. It takes money to make serious money. Ie. If someone is holding onto 250k capital, it would take them 25~years to reach their first 1mil (assuming 5%~ rate again), while it takes the same person, just another 13years, to make their 2nd million, and it just snowballs greatly from there onwards. My point is, the EPF organization undeniably is generating profit for the country, and the more ringgits they have, the more return in absolute ringgit value (not %s), that they will have. And how to load up the the EPF organization with even more capital? Forced contributions for all goverment servants. It is to benefit the EPF organization & govermental body first, and not the “rakyat”. I know from insiders info that there are multiple years that EPF’s profit rate was in the 12%~, while the investors are only getting 5% out of it. Heck even s&p500 is averaging 10% but with risks lah, so most ppl still ok or uneducated to let EPF fly with it. There’s so many nuances you could argue from both side that it’s impractical to talk about in a forum format. Ie. Super stress free whole life, retirement no need think, special healthcare/room benefit for retiree, etc, but like i said earlier, if completely low risk, don’t expect great returns. poooky liked this post

|

|

|

Jun 4 2025, 04:37 PM Jun 4 2025, 04:37 PM

|

Junior Member

473 posts Joined: Sep 2019 |

Yeah I'm against 65 retirement age because I don't want to have any retirement age. I want to work continuously.

|

|

|

Jun 4 2025, 04:39 PM Jun 4 2025, 04:39 PM

|

Senior Member

1,019 posts Joined: Sep 2018 |

All, remember u can retire anytime u want. U can retire before 60.

For those who think about getting rid of older staff so that they can rise up to higher positions, no it wont happen. If u r confident of ur own capability, enjoy ur work, u wont think like that |

|

|

Jun 4 2025, 04:40 PM Jun 4 2025, 04:40 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(lurkingaround @ Jun 4 2025, 04:24 PM) . How much Msia gomen borrow from EPF? Got pay back?Fyi, 34 countries provide social pension to the elderly/retirees that is funded by tax money. In USA, their Social Security Fund for retirees is being used or borrowed by the US government for its annual budget. In Malaysia, the government also borrows from the EPF for its annual budget, besides providing social pension to retired civil servants. Similarly for other countries borrowing from the pension funds for their annual budgets. So, there is motivation for the governments in the world to extend the retirement age to about 65-75 yo = pension fund or social pension withdrawal age also extended, so that the govts could borrow more from the pension funds or spend less tax money for social pensions. ....... https://en.wikipedia.org/wiki/Pension https://en.wikipedia.org/wiki/Social_pension https://en.wikipedia.org/wiki/Social_Securi...(United_States) . |

|

|

Jun 4 2025, 04:43 PM Jun 4 2025, 04:43 PM

|

Junior Member

87 posts Joined: Oct 2017 |

QUOTE(knwong @ Jun 4 2025, 04:29 PM) What gov role can get 7k+ monthly pencen? Most I know are way below that Yea, i personally know one retiree whos some sort of state representative for whatever the heck, is drawing close to 5k only for pencen.7k+ pencen is drawing like >20k month previously... And he’s not your average govermental servant ya.. he has drivers, and a shitload of very “official” looking benefits such as authorized to officiate shits, have state owned cars and the shebangs. He just told me that most of his prior $ comes from additional allowances thats not part of pencen calculations, and his base salary is ciput, says i can just google his salary scale for his grade and I’ll understand. But of course i couldn’t be bothered and he got no point in lying to me anyway |

|

|

Jun 4 2025, 04:43 PM Jun 4 2025, 04:43 PM

|

Junior Member

570 posts Joined: Jan 2003 From: /k/ isle |

even if you retire, you will be charge on the interest earn. So soon they will have this law

|

|

|

Jun 4 2025, 04:44 PM Jun 4 2025, 04:44 PM

|

Junior Member

173 posts Joined: Jun 2012 |

QUOTE(iGamer @ Jun 4 2025, 01:45 PM) higher official retirement age is less relevant to private staff as they can still retire early if they wanted to. with how lazy some of them are good laIt's civil servants that are more affected, if they don't work until the set retirement age, they may get lower entitlement to their govt pension scheme. |

|

|

Jun 4 2025, 04:57 PM Jun 4 2025, 04:57 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(TheOnly @ Jun 4 2025, 04:43 PM) Yea, i personally know one retiree whos some sort of state representative for whatever the heck, is drawing close to 5k only for pencen. Many in my family members are way lower than that...and they are very grateful. Just before retirement they get good golden handshake $$ alsoAnd he’s not your average govermental servant ya.. he has drivers, and a shitload of very “official” looking benefits such as authorized to officiate shits, have state owned cars and the shebangs. He just told me that most of his prior $ comes from additional allowances thats not part of pencen calculations, and his base salary is ciput, says i can just google his salary scale for his grade and I’ll understand. But of course i couldn’t be bothered and he got no point in lying to me anyway |

|

|

Jun 4 2025, 05:03 PM Jun 4 2025, 05:03 PM

Show posts by this member only | IPv6 | Post

#64

|

|

Elite

2,556 posts Joined: Jan 2003 |

|

|

|

Jun 4 2025, 05:04 PM Jun 4 2025, 05:04 PM

|

Senior Member

8,653 posts Joined: Sep 2005 From: lolyat |

QUOTE(knwong @ Jun 4 2025, 04:29 PM) What gov role can get 7k+ monthly pencen? Most I know are way below that As i know JUSA level confirm can get7k+ pencen is drawing like >20k month previously... Grade 48,52,54 also can hit provided they serve long enough serve 30 years and above can get 60% pension of last drawn basic salary This post has been edited by yhtan: Jun 4 2025, 05:05 PM |

|

|

Jun 4 2025, 05:08 PM Jun 4 2025, 05:08 PM

|

Senior Member

1,782 posts Joined: Jul 2022 |

|

|

|

Jun 4 2025, 05:09 PM Jun 4 2025, 05:09 PM

|

Senior Member

8,653 posts Joined: Sep 2005 From: lolyat |

QUOTE(TheOnly @ Jun 4 2025, 04:43 PM) Yea, i personally know one retiree whos some sort of state representative for whatever the heck, is drawing close to 5k only for pencen. i know allowances can goes up above 10k for JUSA level, last time i remember one of my mum's friend who is JUSA C level, petrol fleet card pun ada RM1,500 limit. And he’s not your average govermental servant ya.. he has drivers, and a shitload of very “official” looking benefits such as authorized to officiate shits, have state owned cars and the shebangs. He just told me that most of his prior $ comes from additional allowances thats not part of pencen calculations, and his base salary is ciput, says i can just google his salary scale for his grade and I’ll understand. But of course i couldn’t be bothered and he got no point in lying to me anyway Some more most of the allowances is tax exempted, making their tax payment even lower than the private sector. |

|

|

Jun 4 2025, 05:09 PM Jun 4 2025, 05:09 PM

|

Senior Member

1,774 posts Joined: Nov 2007 From: Planet Earth |

I don't even know if boss want me to pasang pc at that age lol

|

|

|

Jun 4 2025, 05:15 PM Jun 4 2025, 05:15 PM

Show posts by this member only | IPv6 | Post

#69

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |

QUOTE(St0rmFury @ Jun 4 2025, 02:00 PM) From the previous thread, it seems like lot of ktards under the impression that you are forced to work until retirement, cannot decide to retire before 65. .If the full EPF Withdrawal age is also increased to 65, the option to retire before 65 would be limited, eg opt to retire at 50.. . |

|

|

Jun 4 2025, 05:18 PM Jun 4 2025, 05:18 PM

|

Junior Member

246 posts Joined: Jun 2020 |

|

|

|

Jun 4 2025, 05:20 PM Jun 4 2025, 05:20 PM

|

Junior Member

246 posts Joined: Jun 2020 |

QUOTE(lurkingaround @ Jun 4 2025, 09:15 AM) . Level tinggi can retire early, level rendah saupei lah.If the full EPF Withdrawal age is also increased to 65, the option to retire before 65 would be limited, eg opt to retire at 50.. . Moi also sudah 49, wanna retire now also can but what for if your job is fun. But for the rest, can only blame sendiri why low level low achievement low benefit. Keh keh keh. |

|

|

Jun 4 2025, 05:25 PM Jun 4 2025, 05:25 PM

Show posts by this member only | IPv6 | Post

#72

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |

QUOTE(ben_ang @ Jun 4 2025, 02:00 PM) i kinda more concern if this age affect the epf withdrawal or just purely working age, .as a SG fren once said, gov keep pushing the age to withdraw retirement fund, even u have millions in epf, dunno u got the life to use it or not. Yes, AFAIK, Singapore's CPF no more Full EPF Withdrawal at retirement age, ie only monthly "subsistence" withdrawals until you die, like insurance annuity. You like.? Malaysia's EPF could end up like Singapore's CPF = more money for the government to borrow for its annual budget. . |

|

|

Jun 4 2025, 05:29 PM Jun 4 2025, 05:29 PM

Show posts by this member only | IPv6 | Post

#73

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(lurkingaround @ Jun 4 2025, 06:15 PM) . My prediction If the full EPF Withdrawal age is also increased to 65, the option to retire before 65 would be limited, eg opt to retire at 50.. . The retirement age will probably increase from 62 to 65 No more options to withdraw everything except a small amount Balance will be monthly withdrawal until 75 to 80 |

|

|

Jun 4 2025, 05:34 PM Jun 4 2025, 05:34 PM

Show posts by this member only | IPv6 | Post

#74

|

Junior Member

935 posts Joined: Jul 2005 |

Bcoz raising retirement age is an indirect reflection of the failure of gomens to curb costs of living and inflation...

Instead of solving the issue , you're made to work longer to ensure you have adequate savings or if you still dont have enuff savings by that retirement age - you will definitely be nearly your last days. So you're just a temporary problem for them until your depopz... |

|

|

Jun 4 2025, 05:37 PM Jun 4 2025, 05:37 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

QUOTE(30624770 @ Jun 4 2025, 05:29 PM) My prediction Before implementing officially, they will give a window first for the workforce and EPF contributors to 'adjust' themselves. We can do the necessary then during this time before full implementation.The retirement age will probably increase from 62 to 65 No more options to withdraw everything except a small amount Balance will be monthly withdrawal until 75 to 80 |

|

|

Jun 4 2025, 05:47 PM Jun 4 2025, 05:47 PM

Show posts by this member only | IPv6 | Post

#76

|

Junior Member

935 posts Joined: Jul 2005 |

QUOTE(Hansel @ Jun 4 2025, 05:37 PM) Before implementing officially, they will give a window first for the workforce and EPF contributors to 'adjust' themselves. We can do the necessary then during this time before full implementation. STRF is the new EPF soon... fixed 7% PA ( after -30% withholding tax ) NBDRE ... pump muh buttcoins ppl... |

|

|

Jun 4 2025, 05:54 PM Jun 4 2025, 05:54 PM

Show posts by this member only | IPv6 | Post

#77

|

Junior Member

269 posts Joined: Oct 2021 |

|

|

|

Jun 4 2025, 06:14 PM Jun 4 2025, 06:14 PM

Show posts by this member only | IPv6 | Post

#78

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

|

|

|

Jun 4 2025, 06:34 PM Jun 4 2025, 06:34 PM

Show posts by this member only | IPv6 | Post

#79

|

Junior Member

395 posts Joined: Dec 2017 |

99% of the population, i.e., employees, will have to struggle longer, while 1% of the population (employers) are relived from pressure to increase wages and can continue to enrich themselves at expense of others.

|

|

|

Jun 4 2025, 06:40 PM Jun 4 2025, 06:40 PM

Show posts by this member only | IPv6 | Post

#80

|

Newbie

14 posts Joined: Oct 2014 From: Bandar Damai dan Indah |

QUOTE(zerorating @ Jun 4 2025, 01:53 PM) well you are denying youngster their employment post and their career growth because the oldfag still holding down the decision maker post. also productivity out of windows because this oldfag dont have energy to work for long and need to go for their routine treatment (e.g dialysis, physiotherapy, wound cleaning) due to their chronic illness. Mahathir elok jeOh wai |

|

|

Jun 4 2025, 08:34 PM Jun 4 2025, 08:34 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(soul78 @ Jun 4 2025, 05:34 PM) Bcoz raising retirement age is an indirect reflection of the failure of gomens to curb costs of living and inflation... Literally all government in this world, SG included. All are failing gomenInstead of solving the issue , you're made to work longer to ensure you have adequate savings or if you still dont have enuff savings by that retirement age - you will definitely be nearly your last days. So you're just a temporary problem for them until your depopz... littlefire and ruffy_z liked this post

|

|

|

Jun 4 2025, 08:37 PM Jun 4 2025, 08:37 PM

Show posts by this member only | IPv6 | Post

#82

|

Senior Member

6,249 posts Joined: Jul 2006 |

QUOTE(knwong @ Jun 4 2025, 01:42 PM) » Click to show Spoiler - click again to hide... « more like seniors blocking earth from moving, making youngsters waste more time in smaller roles QUOTE(iGamer @ Jun 4 2025, 01:45 PM) higher official retirement age is less relevant to private staff as they can still retire early if they wanted to. on the other end of the scale the old boomers in higher positions don't want to retire earlyIt's civil servants that are more affected, if they don't work until the set retirement age, they may get lower entitlement to their govt pension scheme. so can suap more |

|

|

Jun 4 2025, 08:37 PM Jun 4 2025, 08:37 PM

Show posts by this member only | IPv6 | Post

#83

|

Newbie

21 posts Joined: May 2017 |

QUOTE(zerorating @ Jun 4 2025, 01:53 PM) well you are denying youngster their employment post and their career growth because the oldfag still holding down the decision maker post. also productivity out of windows because this oldfag dont have energy to work for long and need to go for their routine treatment (e.g dialysis, physiotherapy, wound cleaning) due to their chronic illness. So that the higher management position oldfag can continue to songlap. |

|

|

Jun 4 2025, 08:44 PM Jun 4 2025, 08:44 PM

Show posts by this member only | IPv6 | Post

#84

|

Newbie

17 posts Joined: Mar 2015 |

Only if malaysia can become a science and tech strong economy with modern agriculture the next best industry then it can rely less on oil and gas and provide more jobs for young people

|

|

|

Jun 4 2025, 08:50 PM Jun 4 2025, 08:50 PM

Show posts by this member only | IPv6 | Post

#85

|

Junior Member

463 posts Joined: Jan 2011 |

60 cukup la let old dogs retire

|

|

|

Jun 4 2025, 11:52 PM Jun 4 2025, 11:52 PM

Show posts by this member only | IPv6 | Post

#86

|

Junior Member

305 posts Joined: Jan 2003 |

because one of madani minister suggested this. if bawang or abahkau or mr print money suggested this conlanfirm many will agree.

|

|

|

Jun 5 2025, 04:30 AM Jun 5 2025, 04:30 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Jun 5 2025, 04:32 AM Jun 5 2025, 04:32 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

If boomers don't retire, how to get promotion to senior position?

|

|

|

Jun 5 2025, 05:35 AM Jun 5 2025, 05:35 AM

Show posts by this member only | IPv6 | Post

#89

|

Junior Member

86 posts Joined: Jan 2012 |

To solve what problem first?

If it’s about manpower, we already have bangla paki waiting to replace us If it’s about epf, fark off |

|

|

Jun 5 2025, 09:13 AM Jun 5 2025, 09:13 AM

|

Junior Member

308 posts Joined: Sep 2014 From: Kampung Pandan |

Kerja sampai mampus

|

|

|

Jun 5 2025, 09:16 AM Jun 5 2025, 09:16 AM

Show posts by this member only | IPv6 | Post

#91

|

Junior Member

321 posts Joined: May 2020 |

hedonism in someone culture and value over hard work till death.

|

|

|

Jun 5 2025, 09:17 AM Jun 5 2025, 09:17 AM

|

Senior Member

8,446 posts Joined: Nov 2005 |

QUOTE(tupai @ Jun 4 2025, 11:52 PM) because one of madani minister suggested this. if bawang or abahkau or mr print money suggested this conlanfirm many will agree. I actually think it will be otherwise. Many issues are considered serious threat and cruelty to the citizen until Madani become government, suddenly become bright idea. Eg AES/AWAS. |

|

|

Jun 5 2025, 09:21 AM Jun 5 2025, 09:21 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(zenix @ Jun 4 2025, 09:37 PM) [/spoiler] If youngsters are capable, they be able to overtake the boomersmore like seniors blocking earth from moving, making youngsters waste more time in smaller roles on the other end of the scale the old boomers in higher positions don't want to retire early so can suap more There are plenty of C suite people who are young today However, there are tons of youngsters who think they are better than boomers but in reality they are just dreaming |

|

|

Jun 5 2025, 09:26 AM Jun 5 2025, 09:26 AM

|

Senior Member

7,938 posts Joined: Mar 2014 |

Many people I talked to said that felt happy after retirement for few months and then don't know what to do with boredom

|

|

|

Jun 5 2025, 09:26 AM Jun 5 2025, 09:26 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(jasontoh @ Jun 5 2025, 10:17 AM) I actually think it will be otherwise. Many issues are considered serious threat and cruelty to the citizen until Madani become government, suddenly become bright idea. Eg AES/AWAS. Raising retirement age has been discussed since Najib time lahNajib was the one who raise it to 60 We need to revisit this issue today because it's genuinely a problem which we must tackle I don't know why there are people who against it If you want to retire early, no one is forcing you to retire at 65 This option is for those who still need to work as they can't afford to retire early As for EPF, if people rely only on EPF as their only source of fundings after retirement, it means that you really should retire at 65 As for not allowing people to withdraw everything, just look at Singapore and the reason why they are doing it lah |

|

|

Jun 5 2025, 09:33 AM Jun 5 2025, 09:33 AM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(Zot @ Jun 5 2025, 09:26 AM) Many people I talked to said that felt happy after retirement for few months and then don't know what to do with boredom A very good advise I received from a retiree friend who recently pass awayJust before you retire make sure take up hobby of interest so that you wake up with motivation to pursue it That's why he pick up photography, computer repair, racket sports... This post has been edited by knwong: Jun 5 2025, 09:33 AM |

|

|

Jun 5 2025, 09:36 AM Jun 5 2025, 09:36 AM

|

Junior Member

900 posts Joined: Oct 2009 |

extending the option to work a longer time is a good thing, isn't it?

While those who are capable and tired of working can just stop working earlier. |

|

|

Jun 5 2025, 09:40 AM Jun 5 2025, 09:40 AM

Show posts by this member only | IPv6 | Post

#98

|

Senior Member

3,666 posts Joined: Oct 2010 |

You work in a shitty work environment aka chinaman 996 work culture and ciput salary you think you want to work until 65?

Those that are willing to work until 65 are those that are getting good salary and good working environment like WFH or 4 days work week. Work until die also ok for these people...... This post has been edited by COOLPINK: Jun 5 2025, 09:43 AM |

|

|

Jun 5 2025, 09:50 AM Jun 5 2025, 09:50 AM

|

Senior Member

2,736 posts Joined: Jun 2009 From: Penang |

QUOTE(gundamsp01 @ Jun 5 2025, 10:36 AM) extending the option to work a longer time is a good thing, isn't it? Yes, all these while these are options. Not sure why so many hoo haa around here. If not mistaken age 55 already can take EPF. While those who are capable and tired of working can just stop working earlier. If given choice i will work until 65, earn more money, more epf, more interest rolling. As per some feedback, i have seen quite a few example when people not working. If not plan well, if will just hurt more than benefits and also accelerate a lot of sickness especially Alzheimer's disease and dementia due to less function of brand activities. For me i know i sure will suffer as i need something to work on to avoid boredom. gundamsp01 liked this post

|

|

|

Jun 5 2025, 10:15 AM Jun 5 2025, 10:15 AM

|

Senior Member

8,446 posts Joined: Nov 2005 |

QUOTE(30624770 @ Jun 5 2025, 09:26 AM) Raising retirement age has been discussed since Najib time lah 1st - the reply was to a comment saying many against it's due to coming from a MahalDaNi minister, but I would say that usually anything that coming out from the other side the MahalDahni minister leading the reformati will comment that it is a serious threat or cruelty towards the citizen. Najib was the one who raise it to 60 We need to revisit this issue today because it's genuinely a problem which we must tackle I don't know why there are people who against it If you want to retire early, no one is forcing you to retire at 65 This option is for those who still need to work as they can't afford to retire early As for EPF, if people rely only on EPF as their only source of fundings after retirement, it means that you really should retire at 65 As for not allowing people to withdraw everything, just look at Singapore and the reason why they are doing it lah 2nd - Many are against it because it will make the already bloated civil service more bloated. |

|

|

Jun 5 2025, 10:28 AM Jun 5 2025, 10:28 AM

Show posts by this member only | IPv6 | Post

#101

|

Junior Member

110 posts Joined: Jan 2009 |

just raise it to 62/63 first lah. less pushback that way.

|

|

|

Jun 5 2025, 10:31 AM Jun 5 2025, 10:31 AM

Show posts by this member only | IPv6 | Post

#102

|

Senior Member

1,732 posts Joined: Jul 2016 From: tomato land |

|

|

|

Jun 5 2025, 10:48 AM Jun 5 2025, 10:48 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(jasontoh @ Jun 5 2025, 11:15 AM) 1st - the reply was to a comment saying many against it's due to coming from a MahalDaNi minister, but I would say that usually anything that coming out from the other side the MahalDahni minister leading the reformati will comment that it is a serious threat or cruelty towards the citizen. When Najib increase the retirement age to 60, it was the same lah2nd - Many are against it because it will make the already bloated civil service more bloated. There are people who supports it and there are people who are against it As for bloated civil service, you should consider how we calculate our civil service We include police officers, military personnel and teachers but most countries do not include them The biggest issue today is more towards unbalance distribution of civil service Look at government hospitals for examples. Why are nurses and doctors bogged down with doing administrative jobs? Fact is today, the pros of extending the retirement age is higher than maintaining it at 60 Why are there so many people especially youngsters are against it? Singapore retirement age is 64 and do you really think our people savings are more than Singaporeans when they retire? |

|

|

Jun 5 2025, 11:05 AM Jun 5 2025, 11:05 AM

|

Junior Member

328 posts Joined: Jul 2008 |

We are going towards ageing society already, meaning population is growing older. Make sense to raise retirement age...

|

|

|

Jun 5 2025, 11:07 AM Jun 5 2025, 11:07 AM

|

Junior Member

328 posts Joined: Jul 2008 |

QUOTE(30624770 @ Jun 5 2025, 10:48 AM) When Najib increase the retirement age to 60, it was the same lah The impression that I get from reading netizens reaction is that they just butthurt seeing how much old people earn. Lol. They want the money but don't want to put in the shift... Susah sikit at opis, terus tenderThere are people who supports it and there are people who are against it As for bloated civil service, you should consider how we calculate our civil service We include police officers, military personnel and teachers but most countries do not include them The biggest issue today is more towards unbalance distribution of civil service Look at government hospitals for examples. Why are nurses and doctors bogged down with doing administrative jobs? Fact is today, the pros of extending the retirement age is higher than maintaining it at 60 Why are there so many people especially youngsters are against it? Singapore retirement age is 64 and do you really think our people savings are more than Singaporeans when they retire? This post has been edited by dagnarus: Jun 5 2025, 11:08 AM |

|

|

Jun 5 2025, 11:23 AM Jun 5 2025, 11:23 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(dagnarus @ Jun 5 2025, 12:07 PM) The impression that I get from reading netizens reaction is that they just butthurt seeing how much old people earn. Lol. They want the money but don't want to put in the shift... Susah sikit at opis, terus tender A lot of them think they can easily replace the boomers, and the boomers are just blocking their wayHowever, they forgot that there are plenty of youngsters reaching c suite level If they are not in those position today, it only means they are not there yet |

|

|

Jun 5 2025, 11:26 AM Jun 5 2025, 11:26 AM

|

Junior Member

305 posts Joined: Jan 2003 |

QUOTE(jasontoh @ Jun 5 2025, 09:17 AM) I actually think it will be otherwise. Many issues are considered serious threat and cruelty to the citizen until Madani become government, suddenly become bright idea. Eg AES/AWAS. actually if you remember why many people are against AES was due to the fact that AES was operated by 2 private companies on profit sharing basis. I don't know about you, but I conlanfirm hate the idea of law enforcement by any private companies. Lots of movies about this topic and none of them has good outcome.In real life also this has happened in several countries, US allows private companies to enforce traffic light camera and speed camera, UK allows for enforcement of municipal by-laws, among others. THis create controversies mainly about conflict of interest. The enforcement of laws, justice vs profit , lack of accountability etc. Now, back to AES, some people claimed that two companies awarded the AES project were linked to some ehem ehem. That's why when gomen at that time finally decided to cancel that contract due to some internal and external pressure. Thats the rumors i heard so take that with a grain of salt. WHats confirmed was that gomen acquired the AES from the 2 companies by the tunes of hundreds millions. Using money from lembaga tabung angkatan tentera. That by itself created another controversy. You can google all this easily. If too lazy ask AI to summarize for you. Heck, I've googled this and google AI give me the summary. The bolded part i dont need to google. Those who actually know to read and digest info during that particular time (2012) already know that AES was initially privately run. |

|

|

Jun 5 2025, 11:36 AM Jun 5 2025, 11:36 AM

|

Junior Member

333 posts Joined: Mar 2005 From: 夢の国 |

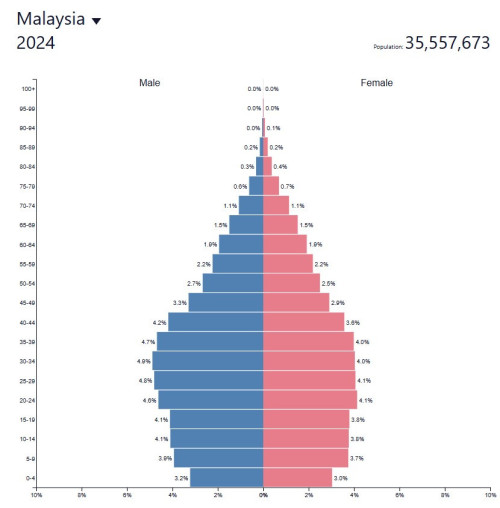

QUOTE(dagnarus @ Jun 5 2025, 11:05 AM) We are going towards ageing society already, meaning population is growing older. Make sense to raise retirement age... No we are not, our population is still young and brain drain of young talents are real. sos : https://www.populationpyramid.net/malaysia/2024/ older people have lower productivity and bloated salary is also a fact - must be addressed. Extending these people retirement age only does not help, dismiss them from their existing authorities and important positions to become teacher to nurture the young ones ? Yes please - question is nobody is going to do it that's why we have retarded teachers. if you are type C then yes then this race is going extinct in Malaysia in the future but truth is for Malaysian, we have a lot of Kelantan and Terengganu babies coming to KL work |

|

|

Jun 5 2025, 11:51 AM Jun 5 2025, 11:51 AM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(stinger @ Jun 5 2025, 12:36 PM) No we are not, our population is still young and brain drain of young talents are real. Malaysia is projected to become an aged country by 2030, with 15.3% of the population aged 60 and over. This is a result of increasing life expectancy and declining fertility rates. The percentage of those aged 60 and over is expected to increase from 7.9% in 2010 to 15.3% in 2030.sos : https://www.populationpyramid.net/malaysia/2024/ older people have lower productivity and bloated salary is also a fact - must be addressed. Extending these people retirement age only does not help, dismiss them from their existing authorities and important positions to become teacher to nurture the young ones ? Yes please - question is nobody is going to do it that's why we have retarded teachers. if you are type C then yes then this race is going extinct in Malaysia in the future but truth is for Malaysian, we have a lot of Kelantan and Terengganu babies coming to KL work |

|

|

Jun 5 2025, 11:59 AM Jun 5 2025, 11:59 AM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(30624770 @ Jun 5 2025, 10:56 AM) Raising retirement age has been discussed since Najib time lah Why need to raise to 65. Najib was the one who raise it to 60 We need to revisit this issue today because it's genuinely a problem which we must tackle I don't know why there are people who against it If you want to retire early, no one is forcing you to retire at 65 This option is for those who still need to work as they can't afford to retire early As for EPF, if people rely only on EPF as their only source of fundings after retirement, it means that you really should retire at 65 As for not allowing people to withdraw everything, just look at Singapore and the reason why they are doing it lah Because there is problem with wealth generation down the economy. Raising retirement age doesnt mean will solve "afford to retire" the pool of wealth fund in EPF is dwindling very fast and the feed to the system is low. even increases retirement age, doesnt mean it will contribute towards replacing funds that is departing. Catch 22 problem. |

|

|

Jun 5 2025, 12:02 PM Jun 5 2025, 12:02 PM

|

Junior Member

333 posts Joined: Mar 2005 From: 夢の国 |

QUOTE(30624770 @ Jun 5 2025, 11:51 AM) Malaysia is projected to become an aged country by 2030, with 15.3% of the population aged 60 and over. This is a result of increasing life expectancy and declining fertility rates. The percentage of those aged 60 and over is expected to increase from 7.9% in 2010 to 15.3% in 2030. yes the keyword is projected - yes they can do it in 2030 but not nowLook at chart on 2024 and tell me, which age is the majority now? is the onion not obvious enough?  |

|

|

Jun 5 2025, 12:04 PM Jun 5 2025, 12:04 PM

|

Junior Member

198 posts Joined: Jan 2019 From: Praia Espiñeirido/Kuala Lumpur |

my god people so goddam stupid

government are not your friend, they are all stupid people and they have stolen your tax money over the past 70-80 years increase the retirement age ? increase to 100 lo I telling you la, majority of people are a frog in a boil water, slow cooking to death A.I and Automation are coming to replace alot of people I tell you these clowns will in 10 years time, increase the retirement age to 70 |

|

|

Jun 5 2025, 12:07 PM Jun 5 2025, 12:07 PM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Syie9^_^ @ Jun 5 2025, 12:59 PM) Why need to raise to 65. Fact 1. Malaysian population is aging populationBecause there is problem with wealth generation down the economy. Raising retirement age doesnt mean will solve "afford to retire" the pool of wealth fund in EPF is dwindling very fast and the feed to the system is low. even increases retirement age, doesnt mean it will contribute towards replacing funds that is departing. Catch 22 problem. Fact 2. Most Malaysian people don't have enough when they retire at 60 Fact 3. Some Malaysians used up all their retirement funds in just a few years after retiring Fact 4. Most successful countries in the world set their retirement age above 60 Fact 5. EPF sustainability will be a problem in the future if we continue with current set up There are tons of reasons why raising retirement age is a no brainer lah |

|

|

Jun 5 2025, 12:07 PM Jun 5 2025, 12:07 PM

|

Junior Member

269 posts Joined: Oct 2021 |

QUOTE(Shanks747 @ Jun 5 2025, 01:04 PM) my god people so goddam stupid You do know that nobody can force you to not retire early, right?government are not your friend, they are all stupid people and they have stolen your tax money over the past 70-80 years increase the retirement age ? increase to 100 lo I telling you la, majority of people are a frog in a boil water, slow cooking to death A.I and Automation are coming to replace alot of people I tell you these clowns will in 10 years time, increase the retirement age to 70 |

|

|

Jun 5 2025, 12:16 PM Jun 5 2025, 12:16 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(30624770 @ Jun 5 2025, 01:37 PM) Fact 1. Malaysian population is aging population is not about no brainer.Fact 2. Most Malaysian people don't have enough when they retire at 60 Fact 3. Some Malaysians used up all their retirement funds in just a few years after retiring Fact 4. Most successful countries in the world set their retirement age above 60 Fact 5. EPF sustainability will be a problem in the future if we continue with current set up There are tons of reasons why raising retirement age is a no brainer lah It is about solving the problem. No matter you aged long, if there is no skillset necessary for economic productivity and adequately allows you to live within your means. it is catch 22. Your Facts is not denied, but the larger question is what is sustainable for individual minus EPF system. |

|

|

Jun 5 2025, 12:21 PM Jun 5 2025, 12:21 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(stinger @ Jun 5 2025, 11:36 AM) No we are not, our population is still young and brain drain of young talents are real. The Older-Worker Productivity Drain Is (Mostly) a Myth: Studysos : https://www.populationpyramid.net/malaysia/2024/ older people have lower productivity and bloated salary is also a fact - must be addressed. Extending these people retirement age only does not help, dismiss them from their existing authorities and important positions to become teacher to nurture the young ones ? Yes please - question is nobody is going to do it that's why we have retarded teachers. if you are type C then yes then this race is going extinct in Malaysia in the future but truth is for Malaysian, we have a lot of Kelantan and Terengganu babies coming to KL work https://www.thinkadvisor.com/2023/11/27/the...y-a-myth-study/ |

|

|

Jun 5 2025, 12:21 PM Jun 5 2025, 12:21 PM

|

Junior Member

303 posts Joined: Aug 2005 |

QUOTE(icemanfx @ Jun 5 2025, 04:32 AM) instead of retire, what happening in singapore for my related who is senior in SIA, once reaching retirement age, he just rotate his job to junior position, he just want pass time. Very chill now, follows junior culture, go yumcha once reach tea time. |

|

|

Jun 5 2025, 12:22 PM Jun 5 2025, 12:22 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(30624770 @ Jun 5 2025, 10:48 AM) When Najib increase the retirement age to 60, it was the same lah What should be the proper way of calculating number of civil servants?There are people who supports it and there are people who are against it As for bloated civil service, you should consider how we calculate our civil service We include police officers, military personnel and teachers but most countries do not include them The biggest issue today is more towards unbalance distribution of civil service Look at government hospitals for examples. Why are nurses and doctors bogged down with doing administrative jobs? Fact is today, the pros of extending the retirement age is higher than maintaining it at 60 Why are there so many people especially youngsters are against it? Singapore retirement age is 64 and do you really think our people savings are more than Singaporeans when they retire? |

|

|

Jun 5 2025, 12:30 PM Jun 5 2025, 12:30 PM

Show posts by this member only | IPv6 | Post

#119

|

Junior Member

275 posts Joined: Aug 2011 |

QUOTE(30624770 @ Jun 5 2025, 12:07 PM) Fact 1. Malaysian population is aging population Fact 2. Most Malaysian people don't have enough when they retire at 60 Fact 3. Some Malaysians used up all their retirement funds in just a few years after retiring Fact 4. Most successful countries in the world set their retirement age above 60 Fact 5. EPF sustainability will be a problem in the future if we continue with current set up There are tons of reasons why raising retirement age is a no brainer lah QUOTE(30624770 @ Jun 5 2025, 12:07 PM) No issue with raising retirement age, provided epf withdrawal remains at 55/60I want to have the freedom to choose whether to continue working or relaxing in my later years but i can't agree to my epf funds being locked away like singapore |

|

|

Jun 5 2025, 12:46 PM Jun 5 2025, 12:46 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(bigwolf @ Jun 5 2025, 12:30 PM) No issue with raising retirement age, provided epf withdrawal remains at 55/60 Why Singaporean continue to vote PAP despite having evil gov locking their CPF?I want to have the freedom to choose whether to continue working or relaxing in my later years but i can't agree to my epf funds being locked away like singapore |

|

|

Jun 5 2025, 12:46 PM Jun 5 2025, 12:46 PM

Show posts by this member only | IPv6 | Post

#121

|

Senior Member

2,275 posts Joined: Jun 2010 |

Whatever janji ayam can cash out age 50

|

|

|

Jun 5 2025, 12:48 PM Jun 5 2025, 12:48 PM

|

Junior Member

290 posts Joined: Jul 2008 |

Mana Japan retirement age ah? haha

|

|

|

Jun 5 2025, 12:50 PM Jun 5 2025, 12:50 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

|

|

|

Jun 5 2025, 12:52 PM Jun 5 2025, 12:52 PM

Show posts by this member only | IPv6 | Post

#124

|

Junior Member

275 posts Joined: Aug 2011 |

QUOTE(knwong @ Jun 5 2025, 12:46 PM) You go and ask the singkies la, ask me for wat, i not voting there wat End of the day i want to withdraw my epf at 55/60 but the freedom to also choose to work until 65 if i want to. If you want the govt to keep holding your epf without letting you withdraw until you die, thats your choice This post has been edited by bigwolf: Jun 5 2025, 12:54 PM |

|

|

Jun 5 2025, 12:53 PM Jun 5 2025, 12:53 PM

Show posts by this member only | IPv6 | Post

#125

|

Senior Member

1,767 posts Joined: Jan 2019 |

QUOTE(Skylinestar @ Jun 4 2025, 02:01 PM) If can I want retire before 30, owai motherland liked this post

|

|

|

Jun 5 2025, 01:04 PM Jun 5 2025, 01:04 PM

|

Senior Member

2,487 posts Joined: Jul 2008 |

QUOTE(poooky @ Jun 4 2025, 02:06 PM) Govt pension is sedap. Work 40yrs guaranteed increment and promotions, retire and and live another 25-30 yrs get half celery and can pass on to spouse and children after passing. Damn sedap. yep. my grandma is 92 and still collecting half pension from my grandfather. My father also collecting pension for 15 years now. Private sector, all will bising if they raise EPF withdrawal to retirement age, but I think even I will work past 55, if anything just to keep busy....or just do some other easier and flexible jobs like consulting. poooky liked this post

|

|

|

Jun 5 2025, 01:06 PM Jun 5 2025, 01:06 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(jaycee1 @ Jun 5 2025, 01:04 PM) yep. my grandma is 92 and still collecting half pension from my grandfather. My father also collecting pension for 15 years now. How much is your grandma getting? CuriousPrivate sector, all will bising if they raise EPF withdrawal to retirement age, but I think even I will work past 55, if anything just to keep busy....or just do some other easier and flexible jobs like consulting. |

|

|

Jun 5 2025, 01:10 PM Jun 5 2025, 01:10 PM

|

Junior Member

368 posts Joined: Jan 2006 |

I think if gomen want to increase retirement age to 65 just go ahead with it.

EPF withdrawal should be kept at 60. At least it give seniors who cannot afford to retire an opportunity to continue working. For those poor and lazy who still wish to retire early, go ahead. You can resign and stop working anytime and consider yourself retired. |

|

|

Jun 5 2025, 01:10 PM Jun 5 2025, 01:10 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(30624770 @ Jun 5 2025, 10:48 AM) When Najib increase the retirement age to 60, it was the same lah These are gomen servants by any definitions. The difference is some of these are hired at city, county, state level rather than at federal or central gomen level in different country.There are people who supports it and there are people who are against it As for bloated civil service, you should consider how we calculate our civil service We include police officers, military personnel and teachers but most countries do not include them The biggest issue today is more towards unbalance distribution of civil service Look at government hospitals for examples. Why are nurses and doctors bogged down with doing administrative jobs? Fact is today, the pros of extending the retirement age is higher than maintaining it at 60 Why are there so many people especially youngsters are against it? Singapore retirement age is 64 and do you really think our people savings are more than Singaporeans when they retire? |

|

|

Jun 5 2025, 01:12 PM Jun 5 2025, 01:12 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(jaycee1 @ Jun 5 2025, 01:04 PM) yep. my grandma is 92 and still collecting half pension from my grandfather. My father also collecting pension for 15 years now. The privilege of gomen servant.Private sector, all will bising if they raise EPF withdrawal to retirement age, but I think even I will work past 55, if anything just to keep busy....or just do some other easier and flexible jobs like consulting. |

|

|

Jun 5 2025, 01:15 PM Jun 5 2025, 01:15 PM

|

Senior Member

2,487 posts Joined: Jul 2008 |

|

|

|

Jun 5 2025, 01:18 PM Jun 5 2025, 01:18 PM

|

Senior Member

1,238 posts Joined: Sep 2006 From: K.L |

65 or whaever age is fine as long as the 55yo full withdrawal option is there. Just imagine ppl who wanna early retirement before 55 then suddenly cannot withdraw the fund n no job. Damn sked eh

|

|

|

Jun 5 2025, 01:19 PM Jun 5 2025, 01:19 PM

|

Senior Member

2,487 posts Joined: Jul 2008 |

|

|

|

Jun 5 2025, 01:24 PM Jun 5 2025, 01:24 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

|

|

|

Jun 5 2025, 01:25 PM Jun 5 2025, 01:25 PM

Show posts by this member only | IPv6 | Post

#135

|

Junior Member

275 posts Joined: Aug 2011 |

QUOTE(anzen600 @ Jun 5 2025, 01:18 PM) 65 or whaever age is fine as long as the 55yo full withdrawal option is there. Just imagine ppl who wanna early retirement before 55 then suddenly cannot withdraw the fund n no job. Damn sked eh This. Can put retirement age at 80 oso i dun care as long as my epf can withdraw at 55/60. Not as if retirement age at 65/70/80/100 means you cannot retire and forced to continue working lol |

|

|

Jun 5 2025, 02:50 PM Jun 5 2025, 02:50 PM

|

Senior Member

8,446 posts Joined: Nov 2005 |

QUOTE(tupai @ Jun 5 2025, 11:26 AM) actually if you remember why many people are against AES was due to the fact that AES was operated by 2 private companies on profit sharing basis. I don't know about you, but I conlanfirm hate the idea of law enforcement by any private companies. Lots of movies about this topic and none of them has good outcome. Yes, your AI search is basically what car plate salesman say why previously PH think it is cruel towards the rakyat and now ok already since they are the government. My point is not only AES/AWAS which is the current issue people complaining. Just merely pointing out something which was bad will become good once PH proposed and not otherwise.In real life also this has happened in several countries, US allows private companies to enforce traffic light camera and speed camera, UK allows for enforcement of municipal by-laws, among others. THis create controversies mainly about conflict of interest. The enforcement of laws, justice vs profit , lack of accountability etc. Now, back to AES, some people claimed that two companies awarded the AES project were linked to some ehem ehem. That's why when gomen at that time finally decided to cancel that contract due to some internal and external pressure. Thats the rumors i heard so take that with a grain of salt. WHats confirmed was that gomen acquired the AES from the 2 companies by the tunes of hundreds millions. Using money from lembaga tabung angkatan tentera. That by itself created another controversy. You can google all this easily. If too lazy ask AI to summarize for you. Heck, I've googled this and google AI give me the summary. The bolded part i dont need to google. Those who actually know to read and digest info during that particular time (2012) already know that AES was initially privately run. |

|

|

Jun 5 2025, 03:02 PM Jun 5 2025, 03:02 PM

Show posts by this member only | IPv6 | Post

#137

|

Junior Member

27 posts Joined: Nov 2011 |

in the 90s if when u were kids, retirement 50 years old

in your mind u set your mind retirement 50-55, now u just keep striving until u reach that age nowadays u see the retirement age being pushed to 60 years old, 65 years old, means cost of living higher, you cant enjoy reitrement fully. |

|

|

Jun 5 2025, 03:15 PM Jun 5 2025, 03:15 PM

Show posts by this member only | IPv6 | Post

#138

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |

QUOTE(knwong @ Jun 5 2025, 12:46 PM) Coz they got no other good choice or alternative party to vote for, eg the PAP has often won more than two-thirds majority in GE = could change the Constitution = change CPF rules. In Malaysia, not often got two-thirds majority.. |

|

|

Jun 5 2025, 03:29 PM Jun 5 2025, 03:29 PM

|

Junior Member

305 posts Joined: Jan 2003 |

QUOTE(jasontoh @ Jun 5 2025, 02:50 PM) Yes, your AI search is basically what car plate salesman say why previously PH think it is cruel towards the rakyat and now ok already since they are the government. My point is not only AES/AWAS which is the current issue people complaining. Just merely pointing out something which was bad will become good once PH proposed and not otherwise. kids nowadays really lack reading comprehension skills. Like to shift goal post as well. ownself bagi examples on AES lagi mau pusing other story. I dare say people who didnt knew about AES history are either still 2" at that time or the really clueless type don't know anything type of people. well, you do you. |

|

|

Jun 5 2025, 06:36 PM Jun 5 2025, 06:36 PM

|

Senior Member

3,563 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(lurkingaround @ Jun 5 2025, 03:15 PM) Coz they got no other good choice or alternative party to vote for, eg the PAP has often won more than two-thirds majority in GE = could change the Constitution = change CPF rules. In Malaysia, not often got two-thirds majority. They should at least reduce PAP majority - to send signal telling them citizen are still the king. |

|

|

Jun 5 2025, 10:14 PM Jun 5 2025, 10:14 PM

Show posts by this member only | IPv6 | Post

#141

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |