Outline ·

[ Standard ] ·

Linear+

News EPF Account 3 to go live on May 11

|

yhtan

|

Apr 25 2024, 03:14 PM Apr 25 2024, 03:14 PM

|

|

QUOTE(Boy96 @ Apr 25 2024, 02:52 PM) If u have 100000 in your account, then dividen 6%.. become 106000 106000 - 2.5% = 103,350 So effective 3.35% saja... It deduct 2.5% of the whole balance every year Zakat 2.5% is not based on 6k return? How come your principal kena zakat as well? |

|

|

|

|

|

ye0073

|

Apr 25 2024, 03:14 PM Apr 25 2024, 03:14 PM

|

|

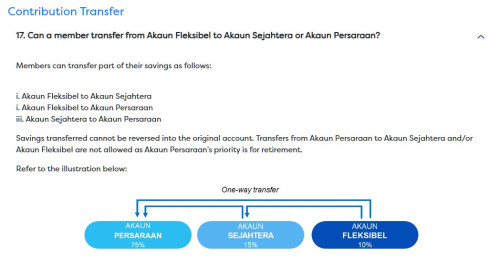

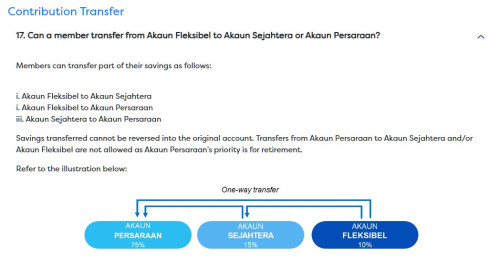

More info here at Q&A page. https://www.kwsp.gov.my/account-restructuringCan transfer back to account 1 or account 2 from account 3. QUOTE Members can submit a contribution transfer application at any EPF counter by completing the “Borang Pindahan Simpanan Ke Akaun Persaraan/ Akaun Sejahtera”.  |

|

|

|

|

|

jaycee1

|

Apr 25 2024, 03:19 PM Apr 25 2024, 03:19 PM

|

|

QUOTE(Sihambodoh @ Apr 25 2024, 01:40 PM) Gomen said no to withdrawals earlier but actually allowing more to be withdrawn. Past ones max 60k iinm. Now if you have 300k in your account 2,.you can withdraw 100k to spend on anything you like. Kekwa. Then 2025 can claim economic growth under mafani, funded by people's retirement money. I think if you have 300k or more in ACC2, you probably don't need the 100k in ACC3. You either already did pretty good for yourself to have additional savings and liquidity somewhere else or are already close to retirement. To me ACC3 is pretty much useless unless maybe a quick way to get funds lets say for a medical emergency. But we all know what people will spend ACC3 monies on. This post has been edited by jaycee1: Apr 25 2024, 03:20 PM |

|

|

|

|

|

Boy96

|

Apr 25 2024, 03:21 PM Apr 25 2024, 03:21 PM

|

|

QUOTE(yhtan @ Apr 25 2024, 03:14 PM) Zakat 2.5% is not based on 6k return? How come your principal kena zakat as well? Zakat has always been based on principal, not on the returns. But for epf theres an exemption where u only start paying zakat every year once you reach 55 age This post has been edited by Boy96: Apr 25 2024, 03:23 PM |

|

|

|

|

|

adamhzm90

|

Apr 25 2024, 03:23 PM Apr 25 2024, 03:23 PM

|

|

QUOTE(Boy96 @ Apr 25 2024, 02:52 PM) If u have 100000 in your account, then dividen 6%.. become 106000 106000 - 2.5% = 103,350 So effective 3.35% saja... It deduct 2.5% of the whole balance every year Not whole year la..once the money is yours eg 50 and 55 yo then can calculate based on the amount you get |

|

|

|

|

|

annoymous1234

|

Apr 25 2024, 03:23 PM Apr 25 2024, 03:23 PM

|

|

just in time can use acc 2 to buy macbook

|

|

|

|

|

|

Boy96

|

Apr 25 2024, 03:24 PM Apr 25 2024, 03:24 PM

|

|

QUOTE(adamhzm90 @ Apr 25 2024, 03:23 PM) Not whole year la..once the money is yours eg 50 and 55 yo then can calculate based on the amount you get Ya. Patut ramai once hit umur tu, withdraw all masuk tabung haji |

|

|

|

|

|

RegentCid

|

Apr 25 2024, 03:26 PM Apr 25 2024, 03:26 PM

|

|

I will put some money into Acc3.....in-case something CB happen.

BTW, money from Acc3 can transfer to Acc 1 / 2 as contribution.

I just put 10k in Acc3.

This post has been edited by RegentCid: Apr 25 2024, 03:27 PM

|

|

|

|

|

|

ferricide

|

Apr 25 2024, 03:28 PM Apr 25 2024, 03:28 PM

|

|

By introducing AC3, the govt now secures even more money into AC1 if those choose to opt in.

Nice move.

|

|

|

|

|

|

askingquestion

|

Apr 25 2024, 03:30 PM Apr 25 2024, 03:30 PM

|

New Member

|

QUOTE(RegentCid @ Apr 25 2024, 03:26 PM) I will put some money into Acc3.....in-case something CB happen. BTW, money from Acc3 can transfer to Acc 1 / 2 as contribution. I just put 10k in Acc3.Sure or not? I thought all personal contribution is also splited up by account 1 and 2 (before account 3 is announced). Can pick which account to contribute? |

|

|

|

|

|

KarchKiraly

|

Apr 25 2024, 03:30 PM Apr 25 2024, 03:30 PM

|

Getting Started

|

Better withdraw account 3 and put into physical gold.

This post has been edited by KarchKiraly: Apr 25 2024, 03:30 PM

|

|

|

|

|

|

N9484640

|

Apr 25 2024, 03:33 PM Apr 25 2024, 03:33 PM

|

|

Withdrawal - online can do

To transfer from acct 3 to acct 1 or 2 - must goto kwsp fill form 🤦🏻♂️

This post has been edited by N9484640: Apr 25 2024, 03:33 PM

|

|

|

|

|

|

askingquestion

|

Apr 25 2024, 03:34 PM Apr 25 2024, 03:34 PM

|

New Member

|

QUOTE(N9484640 @ Apr 25 2024, 03:33 PM) Withdrawal - online can do To transfer from acct 3 to acct 1 or 2 - must goto kwsp fill form 🤦🏻♂️ There should be an auto opt in/opt out option. |

|

|

|

|

|

RegentCid

|

Apr 25 2024, 03:36 PM Apr 25 2024, 03:36 PM

|

|

QUOTE(askingquestion @ Apr 25 2024, 02:30 PM) Sure or not? I thought all personal contribution is also splited up by account 1 and 2 (before account 3 is announced). Can pick which account to contribute? It will split 1/3 from your account 2 into account 3. My Account 3 after split from account 2 amount approx. Rm17k Extra 7k will contibution back into Account 2 |

|

|

|

|

|

askingquestion

|

Apr 25 2024, 03:38 PM Apr 25 2024, 03:38 PM

|

New Member

|

QUOTE(RegentCid @ Apr 25 2024, 03:36 PM) It will split 1/3 from your account 2 into account 3. My Account 3 after split from account 2 amount approx. Rm17k Extra 7k will contibution back into Account 2 The split is not automatic one, I thought need to apply? |

|

|

|

|

|

RegentCid

|

Apr 25 2024, 03:42 PM Apr 25 2024, 03:42 PM

|

|

QUOTE(askingquestion @ Apr 25 2024, 02:38 PM) The split is not automatic one, I thought need to apply? Starting May 12 - August 31. You can choose OPT in or no OPT in. NO OPT IN, means remain same......Account 1 & 2 ...Account 3 will remain zero forever. EPF money will remain 70% account 1 , 30% account 2. If you choose OPT In....account 3 automatic take 1/3 amount of your money from Account 2. This post has been edited by RegentCid: Apr 25 2024, 03:47 PM |

|

|

|

|

|

SUSSihambodoh

|

Apr 25 2024, 03:45 PM Apr 25 2024, 03:45 PM

|

|

QUOTE(jaycee1 @ Apr 25 2024, 03:19 PM) I think if you have 300k or more in ACC2, you probably don't need the 100k in ACC3. You either already did pretty good for yourself to have additional savings and liquidity somewhere else or are already close to retirement. To me ACC3 is pretty much useless unless maybe a quick way to get funds lets say for a medical emergency. But we all know what people will spend ACC3 monies on. People with 1m will still withdraw. Let's say if you have 1010k in EPF. You can only withdrawax 10k. Unless you want to buy house or other reasons, you can't touch your 303k in account 2. Now with this account 3, I can withdraw 101k from my account 2 and put as down-payment to buy a BMW. I get to piap more girls, BMW salesmen happy, gomen happy. |

|

|

|

|

|

spacelion

|

Apr 25 2024, 03:46 PM Apr 25 2024, 03:46 PM

|

|

There should be a one button press to change distribution to 85%-15%-0%

But I guess they want us to withdraw deposit as it will increase their kpi

|

|

|

|

|

|

jmas

|

Apr 25 2024, 03:47 PM Apr 25 2024, 03:47 PM

|

|

QUOTE(Avangelice @ Apr 25 2024, 01:29 PM) Abang tax relief and life insurance long ago separate dah. For those contribution more that 4k max relief have no reason to self contribute QUOTE(fuzzy @ Apr 25 2024, 01:52 PM) If your salary is 3k, you would already max out the 4k EPF relief, no need to withdraw anymore. maxed the 4k compulsory, still got 3k voluntary right? (unless life insurance already maxed as well)  |

|

|

|

|

|

stevenryl86

|

Apr 25 2024, 03:49 PM Apr 25 2024, 03:49 PM

|

|

QUOTE(RegentCid @ Apr 25 2024, 03:42 PM) Starting May 12 - August 31. You can choose OPT in or no OPT in. NO OPT IN, means remain same......Account 1 & 2 ...Account 3 will remain zero forever. EPF money will remain 70% account 1 , 30% account 2. If you choose OPT In....account 3 automatic take 1/3 amount of your money from Account 2. Opt in for initial transfer from acct2 to acct3. If you don’t opt in, your acct3 will start with zero and upcoming contribution will split to 3 account Everyone will have account 3! This post has been edited by stevenryl86: Apr 25 2024, 03:50 PM |

|

|

|

|

Apr 25 2024, 03:14 PM

Apr 25 2024, 03:14 PM

Quote

Quote

0.0175sec

0.0175sec

0.20

0.20

5 queries

5 queries

GZIP Disabled

GZIP Disabled