QUOTE(holypredator @ Mar 14 2024, 12:45 AM)

Anwar says... withdraw apa LJ??? 51% under 55 don't even have more than RM10k liao...

Very few Malaysians can afford to reitre.. SAD!

|

|

Mar 14 2024, 04:27 PM Mar 14 2024, 04:27 PM

Show posts by this member only | IPv6 | Post

#101

|

Senior Member

4,694 posts Joined: Jan 2005 |

QUOTE(holypredator @ Mar 14 2024, 12:45 AM) Anwar says... withdraw apa LJ??? 51% under 55 don't even have more than RM10k liao... |

|

|

|

|

|

Mar 14 2024, 04:29 PM Mar 14 2024, 04:29 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

Scarified for gaza is more worthy than retire comfortably.

|

|

|

Mar 14 2024, 04:29 PM Mar 14 2024, 04:29 PM

Show posts by this member only | IPv6 | Post

#103

|

Senior Member

1,335 posts Joined: Nov 2004 |

retire and survive.. i think most msia still can la..

retire with dignity.. now that is a dream for many.. while some T1 work until they die because they dunno how else to live.. lol |

|

|

Mar 14 2024, 04:33 PM Mar 14 2024, 04:33 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

|

|

|

Mar 14 2024, 04:33 PM Mar 14 2024, 04:33 PM

Show posts by this member only | IPv6 | Post

#105

|

Junior Member

672 posts Joined: Oct 2004 |

QUOTE(bmiph @ Mar 14 2024, 04:25 PM) Oh, BTW, Roti Canai I remember used to be 30 cents. Now oledi RM1.50. realised this but what to do?So inflation is real. Government is printing money all the time. So save money only sure kena inflation loss kaw kaw. Need money market. This is where the rich gets richer and poor gets poorer. Do your maths properly. And need safety margin. Kena another few 1MDB, drop to B40 easily. borrow money from bank also got limit. aiya...tired lorr... |

|

|

Mar 14 2024, 04:48 PM Mar 14 2024, 04:48 PM

Show posts by this member only | IPv6 | Post

#106

|

Senior Member

1,335 posts Joined: Nov 2004 |

QUOTE(iGamer @ Mar 14 2024, 04:33 PM) to retire with enough cash to maintain your current lifestyle (of course some changes due to age is expected) and have some leftovers for the kids...for example, my parents late 70s now.. - no more loans - still got medical insurance coverage until age 100 (of course co-pay) with annual premium of 12k - still have their annual oversea trips and hobbies - still can splurge on meals and shopping as before without counting the pennies.. - still can change car when it is time |

|

|

|

|

|

Mar 14 2024, 04:52 PM Mar 14 2024, 04:52 PM

Show posts by this member only | IPv6 | Post

#107

|

Junior Member

252 posts Joined: Aug 2014 From: MY |

QUOTE(holypredator @ Mar 14 2024, 04:04 PM) After retire... how often do you use car??? You have to go here and there everyday??? The purpose is only to get you to nearby grocery and restaurant... Sudahlah bro i tired d reading ketard economist wannabes give lecture as if they have oracle power to see the future not to mention delusional. Everyday open tered myr down economy down semua down as if straight poor kenot live anymore. Let them be.Electricity and water bill how much?? RM200+ should be able to cover right??? Medical bill... go public hospital?? Breakdown every month ke??? don't know DIY??? I didn't say RM600k is going to be super luxury for you to retire but you can at least ensure you have decent meal with enough money for household goods and some entertainment... I shit you not... my ex-colleague with his wife mia average expenditure after retire is just RM1.5k.... before retire was a Head position in MNC financial firm.... His life was simple... breakfast just milo or nestum with biscuit..... Mixed rice for lunch RM7+ while wife makan roti or sometime noodles... varies from RM3 to RM8.... night cook simple meal... vege/egg/meat.... cost also likely less than RM20.... Daily do gardening... clean house... go meet up at the park with neighbours.... No more than RM30k per year for husband and wife... including other cost such as insurance etc... Seriously... when you are old... you aren't going to spend like you are in your 30's.... but if you still want to eat good... dress good... have the best entertainment... obviously you would say RM600k is not enough for retirement but reality is... a lot and I'm not saying this based on gut feeling but literally EPF stats..... living with much less than RM600k and they also ok jer.... |

|

|

Mar 14 2024, 04:52 PM Mar 14 2024, 04:52 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(seather @ Mar 14 2024, 04:48 PM) to retire with enough cash to maintain your current lifestyle (of course some changes due to age is expected) and have some leftovers for the kids... seems like T20 or higher kind of retirement.for example, my parents late 70s now.. - no more loans - still got medical insurance coverage until age 100 (of course co-pay) with annual premium of 12k - still have their annual oversea trips and hobbies - still can splurge on meals and shopping as before without counting the pennies.. - still can change car when it is time I guess majority will not have retirement with dignity |

|

|

Mar 14 2024, 04:54 PM Mar 14 2024, 04:54 PM

|

Senior Member

1,534 posts Joined: Jul 2006 |

who withdraw the most...u know i know lo

those yolo mindset really ...kek |

|

|

Mar 14 2024, 04:59 PM Mar 14 2024, 04:59 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(KeyMochi @ Mar 14 2024, 04:52 PM) Sudahlah bro i tired d reading ketard economist wannabes give lecture as if they have oracle power to see the future not to mention delusional. Everyday open tered myr down economy down semua down as if straight poor kenot live anymore. Let them be. ktards recommended retirement fund is RM4m |

|

|

Mar 14 2024, 05:00 PM Mar 14 2024, 05:00 PM

Show posts by this member only | IPv6 | Post

#111

|

Senior Member

2,294 posts Joined: Sep 2011 |

I wonder why t20 dun enjoy life but kehpohchee in forum 🤔

|

|

|

Mar 14 2024, 05:03 PM Mar 14 2024, 05:03 PM

Show posts by this member only | IPv6 | Post

#112

|

Junior Member

79 posts Joined: Sep 2021 |

U forgot anak itu rezeki? Anak tanggung lah. One anak give 500. 5 anak = rm2500 per month. Enough to makan rite? Your epf can generate rm2.5k or not?

|

|

|

Mar 14 2024, 05:04 PM Mar 14 2024, 05:04 PM

|

Senior Member

1,649 posts Joined: Dec 2007 |

QUOTE(iGamer @ Mar 14 2024, 04:52 PM) T20?? That is T5 lifestyle...T20 KL household starts at RM15k... per person RM7k salary GROSS.... Even with that salary while working.. I don't think you can do - still have their annual oversea trips and hobbies - still can splurge on meals and shopping as before without counting the pennies.. - still can change car when it is time Unless your oversea trips limited to Asia.... + low cost hobbies... Splurge meals only weekends and shopping once a month for high street brand not luxury brand... change car after 9 years..... all that with most likely ZERO savings cause still got housing loan... kids... and other expenditure.... Zero savings how to continue such lifestyle in the future where you only could afford like 21% of your existing salary maxx..... |

|

|

|

|

|

Mar 14 2024, 05:08 PM Mar 14 2024, 05:08 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(commonsense @ Mar 14 2024, 05:03 PM) U forgot anak itu rezeki? Anak tanggung lah. One anak give 500. 5 anak = rm2500 per month. Enough to makan rite? Your epf can generate rm2.5k or not? 600k epf @5% dividend will give u RM2.5k dividend/mthBut chances are out of the 5 rezeki, if one turn out really charsiew also can turn the parents pokai and poor at golden age. And rezeki plan no longer applicable to Chinese, most already said they don't expect their children to support them financially, hence new gen also won't be giving money to parents when they start working. |

|

|

Mar 14 2024, 05:09 PM Mar 14 2024, 05:09 PM

|

Senior Member

1,534 posts Joined: Jul 2006 |

QUOTE(ozak @ Mar 14 2024, 03:12 PM) how do you get 48k a year for 5.5% of 600k? mushigen liked this post

|

|

|

Mar 14 2024, 05:12 PM Mar 14 2024, 05:12 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(holypredator @ Mar 14 2024, 05:04 PM) T20?? That is T5 lifestyle... ayam not TXX, so ayam always humble by 20k ktards. T20 KL household starts at RM15k... per person RM7k salary GROSS.... Even with that salary while working.. I don't think you can do - still have their annual oversea trips and hobbies - still can splurge on meals and shopping as before without counting the pennies.. - still can change car when it is time Unless your oversea trips limited to Asia.... + low cost hobbies... Splurge meals only weekends and shopping once a month for high street brand not luxury brand... change car after 9 years..... all that with most likely ZERO savings cause still got housing loan... kids... and other expenditure.... Zero savings how to continue such lifestyle in the future where you only could afford like 21% of your existing salary maxx..... |

|

|

Mar 14 2024, 05:17 PM Mar 14 2024, 05:17 PM

|

Senior Member

1,534 posts Joined: Jul 2006 |

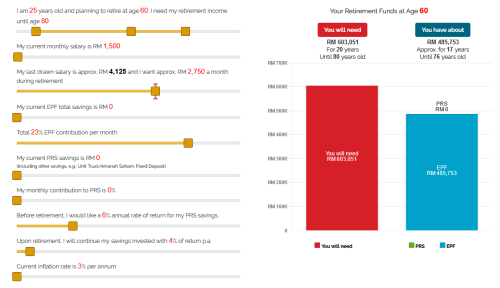

QUOTE(keybearer @ Mar 14 2024, 02:38 PM) This. All the figures are talking about the figure depositors have NOW, meaning it's 40k post-compounding interest (for the ones soon to retire anyway). Your Retirement Funds at Age 55The younger ones who joined the 40k withdrawals for stupid reasons may be dumb, but atleast they still have time to build it all back up. From the calculator: https://www.ppa.my/retirement-calculator/  Assuming 25 years old, income starting at RM1.5k, increment matching inflation at 3%. Your EPF would be atleast 480k by the time you retire. Not saying the withdrawals didn't do anything to worsen the situation, but it's just a small part of the equation. You will need Based on your choice*: RM 2,148,075 For 25 years Until 80 years old You have about RM 2,050,104 Approx. for 25 years Until 79 years old btw..it din take into consideration that the amount you have is generating passive income? then not accurate lo This post has been edited by sunami: Mar 14 2024, 05:18 PM |

|

|

Mar 14 2024, 05:22 PM Mar 14 2024, 05:22 PM

|

All Stars

17,018 posts Joined: Jan 2005 |

QUOTE(sunami @ Mar 14 2024, 05:09 PM) Minus from the principal for the balance. sunami liked this post

|

|

|

Mar 14 2024, 05:36 PM Mar 14 2024, 05:36 PM

Show posts by this member only | IPv6 | Post

#119

|

Junior Member

394 posts Joined: Dec 2017 |

What about the many millions who are on the ever flowing government pension? How many percent of population is that?

|

|

|

Mar 14 2024, 05:36 PM Mar 14 2024, 05:36 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(sunami @ Mar 14 2024, 05:17 PM) Your Retirement Funds at Age 55 that calculator use 2/3 of last salary as basis of post retirement monthly spending, ayam definitely don't need that much. Even when working only use less than 30%, no reason after retirement spend more than before retirement You will need Based on your choice*: RM 2,148,075 For 25 years Until 80 years old You have about RM 2,050,104 Approx. for 25 years Until 79 years old btw..it din take into consideration that the amount you have is generating passive income? then not accurate lo By adjusting the expected monthly money required, the calculator result show I am already able to retire now (with my frugal lifestyle). |

| Change to: |  0.0197sec 0.0197sec

0.62 0.62

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 11:04 AM |