who withdraw the most...u know i know lo

those yolo mindset really ...kek

Very few Malaysians can afford to reitre.. SAD!

Very few Malaysians can afford to reitre.. SAD!

|

|

Mar 14 2024, 04:54 PM Mar 14 2024, 04:54 PM

Return to original view | Post

#1

|

Senior Member

1,534 posts Joined: Jul 2006 |

who withdraw the most...u know i know lo

those yolo mindset really ...kek |

|

|

|

|

|

Mar 14 2024, 05:09 PM Mar 14 2024, 05:09 PM

Return to original view | Post

#2

|

Senior Member

1,534 posts Joined: Jul 2006 |

QUOTE(ozak @ Mar 14 2024, 03:12 PM) how do you get 48k a year for 5.5% of 600k? mushigen liked this post

|

|

|

Mar 14 2024, 05:17 PM Mar 14 2024, 05:17 PM

Return to original view | Post

#3

|

Senior Member

1,534 posts Joined: Jul 2006 |

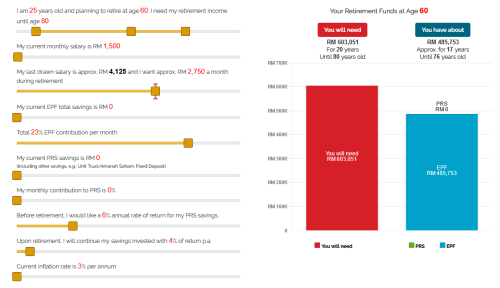

QUOTE(keybearer @ Mar 14 2024, 02:38 PM) This. All the figures are talking about the figure depositors have NOW, meaning it's 40k post-compounding interest (for the ones soon to retire anyway). Your Retirement Funds at Age 55The younger ones who joined the 40k withdrawals for stupid reasons may be dumb, but atleast they still have time to build it all back up. From the calculator: https://www.ppa.my/retirement-calculator/  Assuming 25 years old, income starting at RM1.5k, increment matching inflation at 3%. Your EPF would be atleast 480k by the time you retire. Not saying the withdrawals didn't do anything to worsen the situation, but it's just a small part of the equation. You will need Based on your choice*: RM 2,148,075 For 25 years Until 80 years old You have about RM 2,050,104 Approx. for 25 years Until 79 years old btw..it din take into consideration that the amount you have is generating passive income? then not accurate lo This post has been edited by sunami: Mar 14 2024, 05:18 PM |

|

|

Mar 14 2024, 05:49 PM Mar 14 2024, 05:49 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

1,534 posts Joined: Jul 2006 |

QUOTE(keybearer @ Mar 14 2024, 06:40 PM) The setting is for 60-80 (20 years). Got your point...The passive income generation part is up to the individual if they want to take their savings out after retirement, etc. etc. My point is even with RM1.5k salary and you just continue to work, getting to RM240k (figure specified by EPF) is not a hard target to reach. CNA's reporting of alot of members with <50k before the age of 55, meaning even if the 40k withdrawal didn't happen they're still shy of RM100k. That's what I meant by the withdrawal being only a part of the equation why people can't afford to retire. It's being politicized too much for people to see that the withdrawal is not the sole reason for it. Tbh...if those ppl know how to manage the money..it won't have those outcome rite? YOLO all the way...lol |

|

|

Mar 14 2024, 05:51 PM Mar 14 2024, 05:51 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

1,534 posts Joined: Jul 2006 |

QUOTE(iGamer @ Mar 14 2024, 06:36 PM) that calculator use 2/3 of last salary as basis of post retirement monthly spending, ayam definitely don't need that much. Even when working only use less than 30%, no reason after retirement spend more than before retirement Tat means u already achieve /k standard celery..By adjusting the expected monthly money required, the calculator result show I am already able to retire now (with my frugal lifestyle). 67% of 20k is a lot... But not b40 celery.. ,😁 |

| Change to: |  0.0199sec 0.0199sec

0.27 0.27

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 11:01 PM |