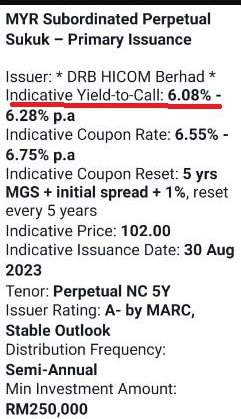

Coupon rate 6.6-6.7%!

paid 6 monthly

Subordinated Perpetual Sukuk

Min 250k rating A-

coming next month

limited stock

Price 102

Bond kaki lai, DRB HICOM bond coming

Bond kaki lai, DRB HICOM bond coming

|

|

Jul 26 2023, 12:04 AM, updated 3 months ago Jul 26 2023, 12:04 AM, updated 3 months ago

Show posts by this member only | IPv6 | Post

#1

|

Senior Member

5,922 posts Joined: Sep 2009 |

Coupon rate 6.6-6.7%!

paid 6 monthly Subordinated Perpetual Sukuk Min 250k rating A- coming next month limited stock Price 102 |

|

|

|

|

|

Jul 26 2023, 12:07 AM Jul 26 2023, 12:07 AM

Show posts by this member only | IPv6 | Post

#2

|

Senior Member

1,005 posts Joined: Mar 2019 |

When tesla masuk, drb kasih perpetual bond..

Hmm.. |

|

|

Jul 26 2023, 12:35 AM Jul 26 2023, 12:35 AM

Show posts by this member only | Post

#3

|

Senior Member

1,146 posts Joined: Dec 2015 |

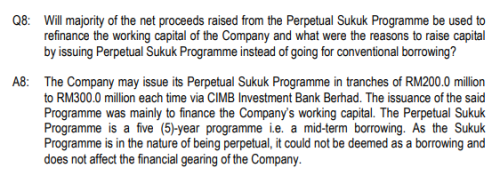

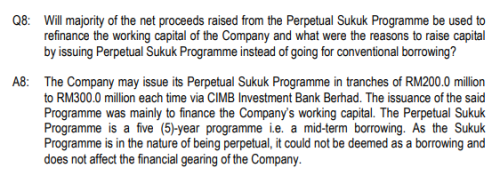

QUOTE(guy3288 @ Jul 26 2023, 12:04 AM) Coupon rate 6.6-6.7%! I am surprised you get the Rating. Which bank selling and sales charge 2%? But this one you cannot control callback and I am not sure if can sell in secondary market.paid 6 monthly Subordinated Perpetual Sukuk Min 250k rating A- coming next month limited stock Price 102 |

|

|

Jul 26 2023, 02:17 AM Jul 26 2023, 02:17 AM

Show posts by this member only | IPv6 | Post

#4

|

Senior Member

1,154 posts Joined: Oct 2021 |

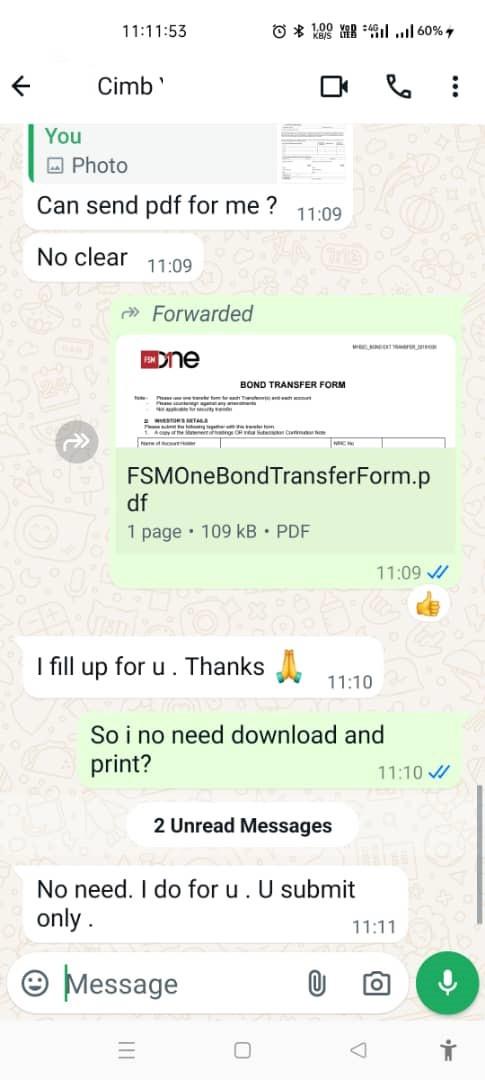

|

|

|

Jul 27 2023, 08:06 AM Jul 27 2023, 08:06 AM

Show posts by this member only | IPv6 | Post

#5

|

Senior Member

4,081 posts Joined: Aug 2005 |

I'm looking through fundsupermart but other bonds. N can't find whether it's interest is paid or default. Or issit onli available for those bought it onli?

|

|

|

Jul 27 2023, 08:14 AM Jul 27 2023, 08:14 AM

Show posts by this member only | Post

#6

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(low yat 82 @ Jul 27 2023, 08:06 AM) I'm looking through fundsupermart but other bonds. N can't find whether it's interest is paid or default. Or issit onli available for those bought it onli? It says coming next month but already not IPO price… 102, someone’s taking a profit even before it hits the market. |

|

|

|

|

|

Jul 27 2023, 05:23 PM Jul 27 2023, 05:23 PM

Show posts by this member only | IPv6 | Post

#7

|

Senior Member

4,689 posts Joined: Jan 2003 |

|

|

|

Jul 27 2023, 05:48 PM Jul 27 2023, 05:48 PM

Show posts by this member only | IPv6 | Post

#8

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(hksgmy @ Jul 27 2023, 08:14 AM) It says coming next month but already not IPO price… 102, someone’s taking a profit even before it hits the market. New launch, the bankers making 2% 150million untung 3 million just like that. last bond also same price 102, i booked pun tak dapat, must be the coupon rate too good lah. QUOTE(xander2k8 @ Jul 27 2023, 05:23 PM) bruh dont scare me, i already booked 3 lotsLast round i dint get, sold out so fast. Want to be suckers you think easy?. you sure or not losing money? consistent dividend track record , paid every year last 10 years Debt to equity ratio 0.88 have $3 billion worth landbank you ada proof kah? jangan simply tembak lah Haloperidol and max_cavalera liked this post

|

|

|

Jul 27 2023, 06:36 PM Jul 27 2023, 06:36 PM

Show posts by this member only | IPv6 | Post

#9

|

Senior Member

4,689 posts Joined: Jan 2003 |

QUOTE(guy3288 @ Jul 27 2023, 05:48 PM) New launch, the bankers making 2% 150million Go check out last bailout on Proton 🤦♀️ of course they will consistent payout because the money is from govt bailout funds 🤦♀️untung 3 million just like that. last bond also same price 102, i booked pun tak dapat, must be the coupon rate too good lah. bruh dont scare me, i already booked 3 lots Last round i dint get, sold out so fast. Want to be suckers you think easy?. you sure or not losing money? consistent dividend track record , paid every year last 10 years Debt to equity ratio 0.88 have $3 billion worth landbank you ada proof kah? jangan simply tembak lah Landbank is worth nothing when they don’t have solid consistent FCF with the shares already dropped 8% this year 🤦♀️ with low EPS of 0.1 and high revenue but low profit business This post has been edited by xander2k8: Jul 27 2023, 06:37 PM |

|

|

Jul 27 2023, 08:25 PM Jul 27 2023, 08:25 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

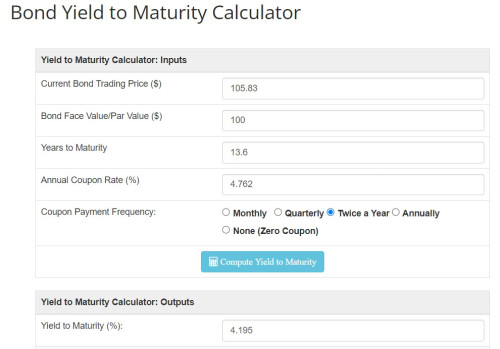

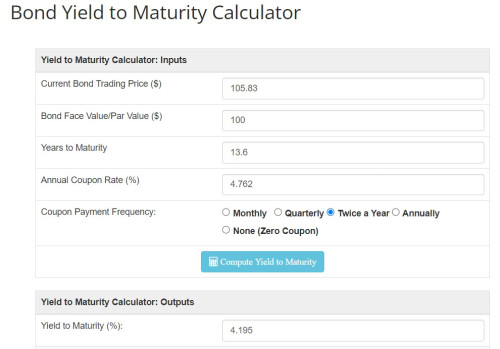

QUOTE(guy3288 @ Jul 27 2023, 05:48 PM) New launch, the bankers making 2% 150million This has to do with incentive for the RMs/banks to offer to their clients. The fee cannot be too high (obviously, cos investors will not buy anymore) but it cannot be too low: RMs won't even bother to sell or show their customer base. UT and other products are providing 1 to 2% upfront fee to the bank, and some of them even provide trailers to the banks. untung 3 million just like that. last bond also same price 102, i booked pun tak dapat, must be the coupon rate too good lah. bruh dont scare me, i already booked 3 lots Last round i dint get, sold out so fast. Want to be suckers you think easy?. ... You should look at the YTC of the sukuk to see if it is still attractive. edit: ie, in case not aware, you should also factor in the 2 dollar depreciation when called. This post has been edited by Wedchar2912: Jul 27 2023, 08:54 PM |

|

|

Jul 27 2023, 08:27 PM Jul 27 2023, 08:27 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

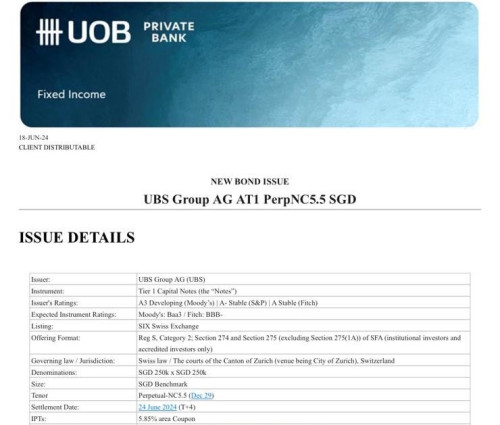

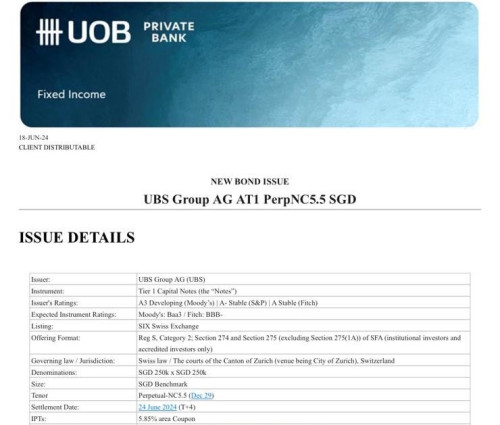

QUOTE(Wedchar2912 @ Jul 27 2023, 08:25 PM) This has to do with incentive for the RMs/banks to offer to their clients. The fee cannot be too high (obviously, cos investors will not buy anymore) but it cannot be too low: RMs won't even bother to sell or show their customer base. UT and other products are providing 1 to 2% upfront fee to the bank, and some of them even provide trailers to the banks. In Singapore, at least with the banks that I deal with, sometimes, there's a rebate that they offer - usually 0.25 or 0.5 pips or whatever they call it, so I actually buy the bond(s) at the IPO price. This is especially so if the bank involved is one of the book runners.You should look at the YTC of the sukuk to see if it is still attractive. |

|

|

Jul 27 2023, 08:50 PM Jul 27 2023, 08:50 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(hksgmy @ Jul 27 2023, 08:27 PM) In Singapore, at least with the banks that I deal with, sometimes, there's a rebate that they offer - usually 0.25 or 0.5 pips or whatever they call it, so I actually buy the bond(s) at the IPO price. This is especially so if the bank involved is one of the book runners. Different environment and different segment as well, I guess. Private banking channel usually get rebates for IPOs, up to 50 cents. So called to incentive the channel to sell to their clients. FI buyers don't get them usually. For retail segment, I heard that some banks cheat a bit and the retail side put in their orders together with the private banking side to take the 50 cents. And at the same time, retail side will add the 2 bucks extra fee... yum yum... |

|

|

Jul 27 2023, 09:00 PM Jul 27 2023, 09:00 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Wedchar2912 @ Jul 27 2023, 08:50 PM) Different environment and different segment as well, I guess. Fair enough point. As a bonus, I also got 2 Cat 1 tickets for the Liverpool vs Leicester City match this coming Sunday from the said private bank haha. Can’t complain.Private banking channel usually get rebates for IPOs, up to 50 cents. So called to incentive the channel to sell to their clients. FI buyers don't get them usually. For retail segment, I heard that some banks cheat a bit and the retail side put in their orders together with the private banking side to take the 50 cents. And at the same time, retail side will add the 2 bucks extra fee... yum yum... |

|

|

|

|

|

Jul 28 2023, 12:09 AM Jul 28 2023, 12:09 AM

Show posts by this member only | IPv6 | Post

#14

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(xander2k8 @ Jul 27 2023, 06:36 PM) Go check out last bailout on Proton 🤦♀️ of course they will consistent payout because the money is from govt bailout funds 🤦♀️ Risk is every where la bro..Landbank is worth nothing when they don’t have solid consistent FCF with the shares already dropped 8% this year 🤦♀️ with low EPS of 0.1 and high revenue but low profit business takut tak payah keluar rumah lah.. QUOTE(Wedchar2912 @ Jul 27 2023, 08:25 PM) This has to do with incentive for the RMs/banks to offer to their clients. The fee cannot be too high (obviously, cos investors will not buy anymore) but it cannot be too low: RMs won't even bother to sell or show their customer base. UT and other products are providing 1 to 2% upfront fee to the bank, and some of them even provide trailers to the banks. True if nobody wants to buy the bankers would have to keep and take the risk of that bonds (and get its dividends) ie ciak kar ki lo..You should look at the YTC of the sukuk to see if it is still attractive. edit: ie, in case not aware, you should also factor in the 2 dollar depreciation when called. YTC around 6.2% still good for me. This bond too laku la.. Stocks limited also only RM150 million RM102 i dont want, others would buy they tak heran lo.. QUOTE(hksgmy @ Jul 27 2023, 08:27 PM) In Singapore, at least with the banks that I deal with, sometimes, there's a rebate that they offer - usually 0.25 or 0.5 pips or whatever they call it, so I actually buy the bond(s) at the IPO price. This is especially so if the bank involved is one of the book runners. Wah true or not bro, good investment grade bond also so cheap ah? got discount some more! i told my RM she macam surprised and couldnt believe it, she said may be no buyers kut... ask me which bond got details , bond ID, primary or secondary market, in foreign currency, etc She said her bank doesnt simply sell any bond, only sell the good ones, price always at premium ie above 100. I also surprised actually, standard fee around 1 -1.5%, lowest i got i think was 0.6 This one is abit high lah but what to do ? too laku if cant sell then sure must sell cheaper she said. aiya she untung i untung cukup la.. anyway you guys are much luckier over there. |

|

|

Jul 28 2023, 12:21 AM Jul 28 2023, 12:21 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(guy3288 @ Jul 28 2023, 12:09 AM) Wah true or not bro, good investment grade bond also so cheap ah? Check your PMgot discount some more! i told my RM she macam surprised and couldnt believe it, she said may be no buyers kut... ask me which bond got details , bond ID, primary or secondary market, in foreign currency, etc She said her bank doesnt simply sell any bond, only sell the good ones, price always at premium ie above 100. I also surprised actually, standard fee around 1 -1.5%, lowest i got i think was 0.6 This one is abit high lah but what to do ? too laku if cant sell then sure must sell cheaper she said. aiya she untung i untung cukup la.. anyway you guys are much luckier over there. This post has been edited by hksgmy: Jul 28 2023, 12:21 AM |

|

|

Jul 28 2023, 09:04 AM Jul 28 2023, 09:04 AM

Show posts by this member only | IPv6 | Post

#16

|

Senior Member

5,922 posts Joined: Sep 2009 |

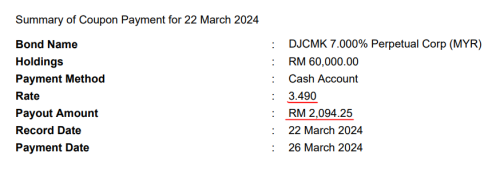

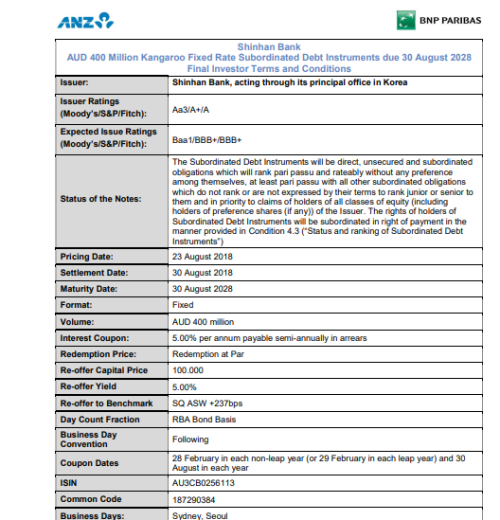

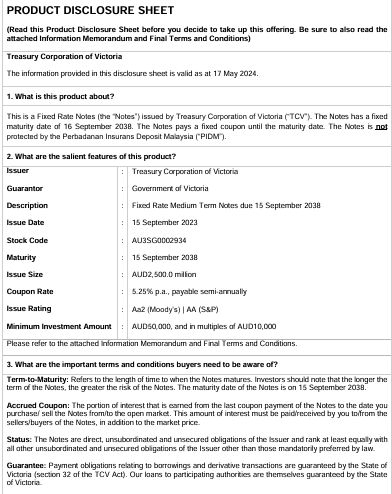

QUOTE(hksgmy @ Jul 28 2023, 12:21 AM) Wah true leh...Singapore bank bond is indeed sold at PAR 100 only, no extra cost!! You guys are so lucky... for that 800 million if in Malaysia we kena pay extra 8 to 12 million! but to be sure we need few more examples just for confirmation if you dont mind... Attached thumbnail(s)

|

|

|

Jul 28 2023, 09:33 AM Jul 28 2023, 09:33 AM

Show posts by this member only | IPv6 | Post

#17

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(guy3288 @ Jul 28 2023, 09:04 AM) Wah true leh... It's OK. I shared with you just to highlight what I bought to demonstrate what I said had substance, and you've confirmed that - I'm really not comfortable revealing my portfolio choices in its entirety. Thank you for understanding.Singapore bank bond is indeed sold at PAR 100 only, no extra cost!! You guys are so lucky... for that 800 million if in Malaysia we kena pay extra 8 to 12 million! but to be sure we need few more examples just for confirmation if you dont mind... |

|

|

Jul 28 2023, 09:55 AM Jul 28 2023, 09:55 AM

|

Senior Member

2,278 posts Joined: Jan 2019 |

QUOTE(xander2k8 @ Jul 27 2023, 05:23 PM) What do you mean losing, since sales is soaring and Elon hire advisors to suppress service cost : https://forum.lowyat.net/topic/5396431 |

|

|

Jul 28 2023, 01:16 PM Jul 28 2023, 01:16 PM

Show posts by this member only | IPv6 | Post

#19

|

Senior Member

4,689 posts Joined: Jan 2003 |

QUOTE(Pikichu @ Jul 28 2023, 09:55 AM) What do you mean losing, since sales is soaring and Elon hire advisors to suppress service cost : https://forum.lowyat.net/topic/5396431 Nothing to do with Tesla 🤦♀️ but DRB so read properly |

|

|

Jul 29 2023, 12:54 AM Jul 29 2023, 12:54 AM

Show posts by this member only | IPv6 | Post

#20

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(hksgmy @ Jul 28 2023, 09:33 AM) It's OK. I shared with you just to highlight what I bought to demonstrate what I said had substance, and you've confirmed that - I'm really not comfortable revealing my portfolio choices in its entirety. Thank you for understanding. aiyo bro tak payah takut lahwhole amount pun let people see already takkan scared people copy invest... |

|

|

Jul 29 2023, 01:09 AM Jul 29 2023, 01:09 AM

|

Senior Member

1,146 posts Joined: Dec 2015 |

QUOTE(hksgmy @ Jul 28 2023, 09:33 AM) It's OK. I shared with you just to highlight what I bought to demonstrate what I said had substance, and you've confirmed that - I'm really not comfortable revealing my portfolio choices in its entirety. Thank you for understanding. Can I check for these perpetual bonds, if you need the cash then you sell in secondary market? Is there a secondary market to sell such bonds? |

|

|

Jul 29 2023, 11:55 AM Jul 29 2023, 11:55 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

|

|

|

Jul 29 2023, 08:58 PM Jul 29 2023, 08:58 PM

|

Junior Member

302 posts Joined: Mar 2010 |

Check this Bond IPO on FSMOne 👀 DRB-Hicom Perpetual Non-callable 5Y Potential New Issuance (updated!) https://www.fsmone.com.my/bonds/ipo/factshe...reLaunchId=3405 guy3288 liked this post

|

|

|

Jul 30 2023, 01:37 AM Jul 30 2023, 01:37 AM

Show posts by this member only | IPv6 | Post

#24

|

Senior Member

5,922 posts Joined: Sep 2009 |

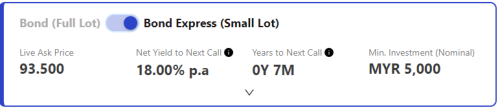

QUOTE(zebras @ Jul 29 2023, 08:58 PM) Check this Bond IPO on FSMOne 👀 price much cheaper there.DRB-Hicom Perpetual Non-callable 5Y Potential New Issuance (updated!) https://www.fsmone.com.my/bonds/ipo/factshe...reLaunchId=3405 only problem if quarterly fees, if hold long would be more expensive and sell back more difficult |

|

|

Jul 30 2023, 01:39 AM Jul 30 2023, 01:39 AM

Show posts by this member only | IPv6 | Post

#25

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(joeblow @ Jul 29 2023, 01:09 AM) Can I check for these perpetual bonds, if you need the cash then you sell in secondary market? Is there a secondary market to sell such bonds? buy from bankers no problem sell backmay even profit eg price now RM104 no exit fee hksgmy liked this post

|

|

|

Jul 30 2023, 02:08 AM Jul 30 2023, 02:08 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(guy3288 @ Jul 30 2023, 01:39 AM) Yes, you are largely correct, but even if you buy from bankers, they’ll still take a spread when it’s time to sell.My bond buying tactic involves writing off that bond from my current account balance sheet and transferring the value over to an illiquid asset sheet (as I’ve alluded to previously in a separate posting) - essentially, my bonds are for keeps, regardless of how high or how low the value goes in the market. I’m only after the coupons. |

|

|

Jul 30 2023, 02:58 PM Jul 30 2023, 02:58 PM

Show posts by this member only | IPv6 | Post

#27

|

Senior Member

5,922 posts Joined: Sep 2009 |

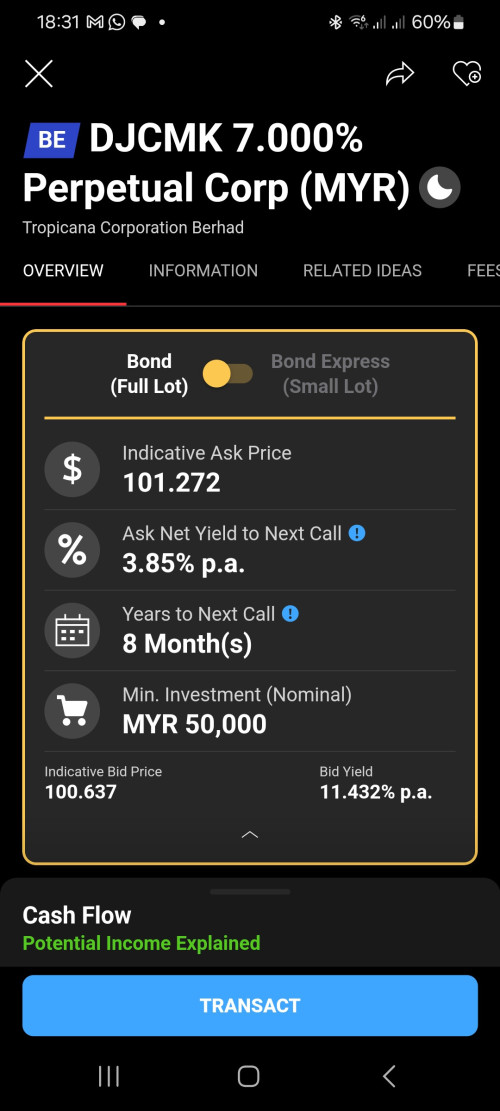

QUOTE(hksgmy @ Jul 30 2023, 02:08 AM) Yes, you are largely correct, but even if you buy from bankers, they’ll still take a spread when it’s time to sell. yeah i buy bonds for their coupons too, money dumped in i dont expect to need it again before maturity..... still cant say write off lah..My bond buying tactic involves writing off that bond from my current account balance sheet and transferring the value over to an illiquid asset sheet (as I’ve alluded to previously in a separate posting) - essentially, my bonds are for keeps, regardless of how high or how low the value goes in the market. I’m only after the coupons. as that should mean the bond has become no value aka burnt. Most of my bonds were called back at 5th yr and i always get my money back. Write off means cant back the money anymore. Just like FD matures, cant say we write off that FD right? So far i sold my bond once only, and no exit fee. Affin Hwg Single bond bought @0.93-0.97 in 2020 when HSBC HK was in trouble...sold at RM1.05 in 2021 for a tidy 9% capital gain on top of the 3 monthly 6.5% coupons..But that was a BBB bond! Currently Tropicana got some bad news , the price is RM99, my RM telling me to sell and buy another.........i hate to sell at a loss. Coupon 7% some more...take the risk keep. Ada untung can sell lah.. takda untung i dont need the money. |

|

|

Jul 30 2023, 03:21 PM Jul 30 2023, 03:21 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(guy3288 @ Jul 30 2023, 02:58 PM) yeah i buy bonds for their coupons too, money dumped in i dont expect to need it again before maturity..... still cant say write off lah.. Yes, you are correct. I meant to say I move it off the books, not write if off as a loss. Thanks for the chance to clarify.as that should mean the bond has become no value aka burnt. Most of my bonds were called back at 5th yr and i always get my money back. Write off means cant back the money anymore. Just like FD matures, cant say we write off that FD right? So far i sold my bond once only, and no exit fee. Affin Hwg Single bond bought @0.93-0.97 in 2020 when HSBC HK was in trouble...sold at RM1.05 in 2021 for a tidy 9% capital gain on top of the 3 monthly 6.5% coupons..But that was a BBB bond! Currently Tropicana got some bad news , the price is RM99, my RM telling me to sell and buy another.........i hate to sell at a loss. Coupon 7% some more...take the risk keep. Ada untung can sell lah.. takda untung i dont need the money. |

|

|

Jul 30 2023, 03:55 PM Jul 30 2023, 03:55 PM

Show posts by this member only | IPv6 | Post

#29

|

Senior Member

5,922 posts Joined: Sep 2009 |

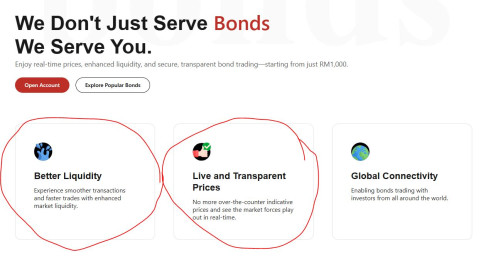

QUOTE(hksgmy @ Jul 30 2023, 03:21 PM) Yes, you are correct. I meant to say I move it off the books, not write if off as a loss. Thanks for the chance to clarify. i just reconfirm with my RM, sell back my bonds memang no spread added ie no fee You kena fees before ? how much was the spread incurred from selling price ? Attached thumbnail(s)

|

|

|

Jul 30 2023, 05:09 PM Jul 30 2023, 05:09 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Jul 30 2023, 03:55 PM) i just reconfirm with my RM, sell back my bonds memang no spread added Actually you don't know... ie no fee You kena fees before ? how much was the spread incurred from selling price ? only way to know for sure is you have another person ask the same RM whats the price if that person wants to buy. bond prices are not really transparent because they are all done OTC, ie not at a proper exchange like bursa. |

|

|

Jul 30 2023, 06:06 PM Jul 30 2023, 06:06 PM

Show posts by this member only | IPv6 | Post

#31

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(Wedchar2912 @ Jul 30 2023, 05:09 PM) Actually you don't know... I know what you meanonly way to know for sure is you have another person ask the same RM whats the price if that person wants to buy. bond prices are not really transparent because they are all done OTC, ie not at a proper exchange like bursa. You mean to say if i sell back to bank at RM99 and another buyer come buy at RM102 fees has been incurred to me. Is that what you wanted to say? |

|

|

Jul 30 2023, 06:19 PM Jul 30 2023, 06:19 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Jul 30 2023, 06:06 PM) I know what you mean yeap.... the 99-102 is the bid-ask spread. You mean to say if i sell back to bank at RM99 and another buyer come buy at RM102 fees has been incurred to me. Is that what you wanted to say? bankers never do things for free.... hksgmy liked this post

|

|

|

Jul 30 2023, 07:59 PM Jul 30 2023, 07:59 PM

Show posts by this member only | IPv6 | Post

#33

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(Wedchar2912 @ Jul 30 2023, 06:19 PM) sure lah How can we expect bank buy back from me RM99 to sell at same RM99 ? the spread could be buying fee even if no selling fee ...knowing at what price the buyer buy still not enough must work in treasury baru boleh tahu . it seems everyday there is a price list so is actually not that opaque... i doubt they can suka suka add RM2 to the price list and sell as you alleged. may be others can find out true or not buyers pay the fee sellers dont. |

|

|

Jul 30 2023, 08:07 PM Jul 30 2023, 08:07 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Jul 30 2023, 07:59 PM) sure lah actually they can. that's why it is called OTC. How can we expect bank buy back from me RM99 to sell at same RM99 ? the spread could be buying fee even if no selling fee ...knowing at what price the buyer buy still not enough must work in treasury baru boleh tahu . it seems everyday there is a price list so is actually not that opaque... i doubt they can suka suka add RM2 to the price list and sell as you alleged. may be others can find out true or not buyers pay the fee sellers dont. anything that is not traded on an established exchange, the price discovery is not efficient and many times simply decided by traders. Don't just say suka suka 2rm... even 5rm also can. btw, bid-offer spread are not fees. Fees is basically a amount or % of some value that is disclosed to you, on top of whatever transaction value you performed, and need BNM approval. (just clarifying the difference between fee and spread) This post has been edited by Wedchar2912: Jul 30 2023, 08:21 PM |

|

|

Jul 30 2023, 09:06 PM Jul 30 2023, 09:06 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Wedchar2912 @ Jul 30 2023, 06:19 PM) Spot on. Thank you for helping me to explain. Was busy watching Liverpool score 6 goals against Leicester City (2 were offside, so the final score was 4-0) in a friendly match at the Singapore National Stadium earlier. |

|

|

Jul 30 2023, 09:17 PM Jul 30 2023, 09:17 PM

Show posts by this member only | IPv6 | Post

#36

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(Wedchar2912 @ Jul 30 2023, 08:07 PM) actually they can. that's why it is called OTC. You sounded like you have knowledge in internal running of bondsanything that is not traded on an established exchange, the price discovery is not efficient and many times simply decided by traders. Don't just say suka suka 2rm... even 5rm also can. btw, bid-offer spread are not fees. Fees is basically a amount or % of some value that is disclosed to you, on top of whatever transaction value you performed, and need BNM approval. (just clarifying the difference between fee and spread) you worked in banking bonds before? but still i cannot fathom how... 1)once the bond is issued there is daily price movements that customers can view before buy or sell. And the spread is rather fixed not much different from Bursa also except it wont change every few minute lah. 2) i doubt they can suka suka pushing up selling price additional RM5 without also pushing up the equivalent amount for buying price. 3) So in an attempt to profit from buyers sell at extra RM5.00, the bank would inadvertently put itself at risk of overpaying seller also for same extra RM5.00 4) If they play dirty, imagine buyer found out later as many bonds we can buy sell from other bankers also. i doubt the banker willing to take that kind of risk of getting a bad name. The spread is not considered fee ok. How about the buying price eg new launch PAR value RM100 i have to pay RM102 for it Isnt the extra Rm2.00 the 2% buying fee as they said to me. so when i sell it is only fair that they go charge the new buyer |

|

|

Jul 30 2023, 09:58 PM Jul 30 2023, 09:58 PM

Show posts by this member only | IPv6 | Post

#37

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(Wedchar2912 @ Jul 30 2023, 08:07 PM) actually they can. that's why it is called OTC. correct me if i read you wronglyanything that is not traded on an established exchange, the price discovery is not efficient and many times simply decided by traders. Don't just say suka suka 2rm... even 5rm also can. btw, bid-offer spread are not fees. Fees is basically a amount or % of some value that is disclosed to you, on top of whatever transaction value you performed, and need BNM approval. (just clarifying the difference between fee and spread) you are saying buy and sell same investment grade bank bond on same day, the price difference from one buyer to another can be as high as RM2 to RM5? I dont believe it, never in my experience This can easily be checked with the various banks I have found out price diference is small some RM0.20 +- I dont believe it is that unregulated till can simply hantam sell at RM5.00 higher unless that banks dont bother about its reputation Remind you we are not talking about traders we are talking about buying bank bonds from banks. |

|

|

Jul 30 2023, 10:12 PM Jul 30 2023, 10:12 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Jul 30 2023, 09:17 PM) You sounded like you have knowledge in internal running of bonds Malaysia bond market is considered very illiquid, with exception of govies. you worked in banking bonds before? but still i cannot fathom how... 1)once the bond is issued there is daily price movements that customers can view before buy or sell. And the spread is rather fixed not much different from Bursa also except it wont change every few minute lah. 2) i doubt they can suka suka pushing up selling price additional RM5 without also pushing up the equivalent amount for buying price. 3) So in an attempt to profit from buyers sell at extra RM5.00, the bank would inadvertently put itself at risk of overpaying seller also for same extra RM5.00 4) If they play dirty, imagine buyer found out later as many bonds we can buy sell from other bankers also. i doubt the banker willing to take that kind of risk of getting a bad name. The spread is not considered fee ok. How about the buying price eg new launch PAR value RM100 i have to pay RM102 for it Isnt the extra Rm2.00 the 2% buying fee as they said to me. so when i sell it is only fair that they go charge the new buyer So the spread you noticed is basically made up by the bank that is servicing you. And usually, not always, the other side of transaction is the bank itself (represented by the trader). And because of this, it is possible for bank A and bank B to quote you different price. (except for buying, this different price is useless when you want to sell because your bond is being custodized with the bank you purchased at start). Bursa is a stock exchange, and by right, all publicly listed equities in Malaysia must trade via the exchange, with certain exceptions. This price is transparent for all to see. Btw, I doubt it is written anywhere by the bank that the bid-offer spread must be 2? Just like fx, which is a lot more liquid, at times of market uncertainty, the spread for FX widens like mad. 2 and 3 imply spread is fixed. It is not. and neither is real fair value of the bond needs to be within the bid-offer prices. 4 is the most interesting part. How often do clients really shop around? (even changing physical foreign currency also people don't really get the best price) Once you purchased a bond from a particular bank, you have to sell that bond back to them. Unless you transfer said bond out. Plus, its not that easy for a client to shop around unless they are premier clients of a few banks. Btw, you have also answered your own question about why the price is 102 for a IPO. The convention is that all bonds are issued at PAR (ie only the coupon is varied for each issuance), so by right you should be subscibing to the bond at 100 bucks. Occam's razor: the bank slapped extra 2 bucks on top of the real offer price, which is 100. edit: forgot to mention. If the extra 2rm is "buying fee", then in your statement it should spell out fee. Its like you purchase Maybank shares at 9.00, but got small items called this and that fee. This post has been edited by Wedchar2912: Jul 30 2023, 10:49 PM TOS liked this post

|

|

|

Jul 30 2023, 10:16 PM Jul 30 2023, 10:16 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Jul 30 2023, 09:58 PM) correct me if i read you wrongly no no... don't focus on the 2 or 5rm. It is just a number, which is also the point. you are saying buy and sell same investment grade bank bond on same day, the price difference from one buyer to another can be as high as RM2 to RM5? I dont believe it, never in my experience This can easily be checked with the various banks I have found out price diference is small some RM0.20 +- I dont believe it is that unregulated till can simply hantam sell at RM5.00 higher unless that banks dont bother about its reputation Remind you we are not talking about traders we are talking about buying bank bonds from banks. You mentioned the spread is 2rm; so I am just saying it is not a fixed number. It is all up to the bank. you just noticed 2 rm because the bonds are too short tenor.... if the bond is like a 20 year bond, then the spread can easily be wider. yeah, I know we are talking about retail banks in Malaysia. When you buy bonds from banks, whom you think is quoting you the price in actual reality? Its the traders sitting in the banks. Reputation is not that valuable, in case you didn't realize yet. |

|

|

Jul 30 2023, 11:02 PM Jul 30 2023, 11:02 PM

|

Junior Member

302 posts Joined: Mar 2010 |

lesson of the day: look at the yield you will get from your transaction price plus fees. why? because prices can be manipulated, even with zero fees, leading to potentially lower yield in the end Wedchar2912 liked this post

|

|

|

Jul 31 2023, 01:18 AM Jul 31 2023, 01:18 AM

Show posts by this member only | IPv6 | Post

#41

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(Wedchar2912 @ Jul 30 2023, 10:12 PM) Malaysia bond market is considered very illiquid, with exception of govies. above is a muddled post of irrelevant FX spreads uncertainty and bond illiquidity.So the spread you noticed is basically made up by the bank that is servicing you. And usually, not always, the other side of transaction is the bank itself (represented by the trader). And because of this, it is possible for bank A and bank B to quote you different price. (except for buying, this different price is useless when you want to sell because your bond is being custodized with the bank you purchased at start). Bursa is a stock exchange, and by right, all publicly listed equities in Malaysia must trade via the exchange, with certain exceptions. This price is transparent for all to see. Btw, I doubt it is written anywhere by the bank that the bid-offer spread must be 2? Just like fx, which is a lot more liquid, at times of market uncertainty, the spread for FX widen like mad. 2 and 3 implies spread is fixed. It is not. and neither is real fair value of the bond needs to be within the bid-offer prices. 4 is the most interesting part. How often do clients really shop around? (even changing physical foreign currency also people don't really get the best price) Once you purchased a bond from a particular bank, you have to sell that bond back to them. Unless you transfer said bond out. Plus, its not that easy for a client to shop around unless they are premier clients of a few banks. Btw, you have also answered your own question about why the price is 102 for a IPO. The convention is that all bonds are issued at PAR (ie only the coupon is varied for each issuance), so by right you should be subscibing to the bond at 100 bucks. Occam's razor: the bank slapped extra 2 bucks on top of the real offer price, which is 100. Investment grade Bond behaves like Forex, betul kah bro? Still i dont see how that can substantiate your allegation bonds are unregulated can simply charge extra RM5 for profit Very illiquid i also find it hard to believe. You got to have bonds to know the illiquidity or rather liquidity. how can you say very illiquid if i get my money at T+7? The spread of course is the fee the bank earns la. somebody has to pay the fee for sure. The question is who. My RM said it is the buyer and not me the seller! but you say i will never know unless i know at what price bank sell it out meaning what? Are you saying bank must buy and sell at same price only can say my RM is correct? If not , what is the use of finding out at what price the bank sell? That is quite a ridiculous suggestion expecting to see bank buy sell at same price. I expect the bank to sell at higher price. make some money from buyer tak boleh? the spread example there RM2.00 actually i simply put only i think is quite high already yet you are saying it is much more higher profit margin no limit? Quite unbelievable, surely there must be some limit i think. How often clients shop around? i am surprised you dont know nowadays people are no longer dumb see FD thread for example, you can see what. so easy with internet now to connect and ask You think by right i should to buy bonds at PAR RM100 only? like in Singapore as brother hksgmy proudly announced? Dream on bro, wake up to reality! this is maresia i doubt you have bought any bonds la telling me that. We just have to adjust ourselves to fit in la bro Not hoping for maresia adjust to fit us or we would miss many opportunities trying in vain to get even. |

|

|

Jul 31 2023, 01:46 AM Jul 31 2023, 01:46 AM

Show posts by this member only | IPv6 | Post

#42

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(zebras @ Jul 30 2023, 11:02 PM) lesson of the day: See how much confusion @Wedchar2912 has caused to the uninitiated.....look at the yield you will get from your transaction price plus fees. why? because prices can be manipulated, even with zero fees, leading to potentially lower yield in the end people are now thinking Bond world is a wild wild west unregulated no rules can be manipulated.... Take it from me Bank bond is regulated prices can be manipulated is an exaggeration Dont listen to people who dont even have bonds Talk from reading and hearsay only. prices is clearly stated for you to buy or sell Ask anyone who has bought bonds before No such thing must see transaction price add in fees etc then try to calculate how much return is there It is all there ready for you to see. no hanky panky lah! Attached thumbnail(s)

|

|

|

Jul 31 2023, 01:47 AM Jul 31 2023, 01:47 AM

|

Senior Member

1,146 posts Joined: Dec 2015 |

Back to the topic, so this bond worth buying? I think EV still takes several years to take shape plus the first Call is after 5 years should they execute. This company quite heavily vested in car industry and going by the Tesla selling model might impact pricing. Risk really high? I just don't like the 5 years holding period.

2% "sales charge". Anyway I got book 1 lot, so let's see if I get it. The FSM one I don't know how it works. Seems like you need to deposit the money first, but I don't know if it is a sure thing you will get. I calculated over 5 years the nett fee is less than 2%. |

|

|

Jul 31 2023, 01:54 AM Jul 31 2023, 01:54 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(guy3288 @ Jul 31 2023, 01:46 AM) See how much confusion @Wedchar2912 has caused to the uninitiated..... Yes, you are correct re the bonds being regulated, and that it’s actually supposed to be a safer class of investments compared to shares. people are now thinking Bond world is a wild wild west unregulated no rules can be manipulated.... Take it from me Bank bond is regulated prices can be manipulated is an exaggeration Dont listen to people who dont even have bonds Talk from reading and hearsay only. prices is clearly stated for you to buy or sell Ask anyone who has bought bonds before No such thing must see transaction price add in fees etc then try to calculate how much return is there It is all there ready for you to see. no hanky panky lah! Here in Singapore, bonds on the secondary market are subject to a bid offer to purchase by potential buyers. However, depending on your bank, when the bank buys the bond that you’re trying to sell, they obviously won’t tell you the bid offer by a prospective buyer, but instead, offer you their (the bank’s) own buying price, which could be a few cents lower than the buyer’s offer. The bank then sells it to the buyer at a price which is a few cents higher than the buyer’s bid price, and if the buyer is willing to buy, the bank earns both ways. This is what I meant by a spread. Sorry for any confusion. Like you, I’ve never sold any of my bonds. Not even when the capital appreciates. The way I invest in bonds is to think of them as hassle free property proxies that I don’t have to pay property tax, cukai pintu, agent fees, council tax etc on. Just buy, and collect ‘rental’ every 6 months. This post has been edited by hksgmy: Jul 31 2023, 01:55 AM |

|

|

Jul 31 2023, 02:16 AM Jul 31 2023, 02:16 AM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Jul 31 2023, 01:18 AM) above is a muddled post of irrelevant FX spreads uncertainty and bond illiquidity. Investment grade Bond behaves like Forex, betul kah bro? Still i dont see how that can substantiate your allegation bonds are unregulated can simply charge extra RM5 for profit Very illiquid i also find it hard to believe. You got to have bonds to know the illiquidity or rather liquidity. how can you say very illiquid if i get my money at T+7? The spread of course is the fee the bank earns la. somebody has to pay the fee for sure. The question is who. My RM said it is the buyer and not me the seller! but you say i will never know unless i know at what price bank sell it out meaning what? Are you saying bank must buy and sell at same price only can say my RM is correct? If not , what is the use of finding out at what price the bank sell? That is quite a ridiculous suggestion expecting to see bank buy sell at same price. I expect the bank to sell at higher price. make some money from buyer tak boleh? the spread example there RM2.00 actually i simply put only i think is quite high already yet you are saying it is much more higher profit margin no limit? Quite unbelievable, surely there must be some limit i think. How often clients shop around? i am surprised you dont know nowadays people are no longer dumb see FD thread for example, you can see what. so easy with internet now to connect and ask You think by right i should to buy bonds at PAR RM100 only? like in Singapore as brother hksgmy proudly announced? Dream on bro, wake up to reality! this is maresia i doubt you have bought any bonds la telling me that. We just have to adjust ourselves to fit in la bro Not hoping for maresia adjust to fit us or we would miss many opportunities trying in vain to get even. QUOTE(guy3288 @ Jul 31 2023, 01:46 AM) See how much confusion @Wedchar2912 has caused to the uninitiated..... lol. I thought I was doing you a favor by sharing proper knowledge. Unfortunately, not only is it not appreciated, I sense some hostility, which I do not understand. people are now thinking Bond world is a wild wild west unregulated no rules can be manipulated.... Take it from me Bank bond is regulated prices can be manipulated is an exaggeration Dont listen to people who dont even have bonds Talk from reading and hearsay only. prices is clearly stated for you to buy or sell Ask anyone who has bought bonds before No such thing must see transaction price add in fees etc then try to calculate how much return is there It is all there ready for you to see. no hanky panky lah! So, no point wasting my effort and in the same time, get your agitated for no reason. I do not simply talk nonsense when it comes to financial products, as all my old posts can clearly indicate. A little knowledge can be a dangerous thing bro. But you can ignore everything I mentioned in this tread and sure, you are very right in saying the 102 price is due to a FEE by the bank. (btw, FX is supposed to be quite simple, and yet there are so many who thinks the price on google are the tradable prices. Just an example of what normal people knows. and regulation doesn't mean prices are regulated. you are mixing things up) |

|

|

Jul 31 2023, 02:19 AM Jul 31 2023, 02:19 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Wedchar2912 @ Jul 31 2023, 02:16 AM) lol. I thought I was doing you a favor by sharing proper knowledge. Unfortunately, not only is it not appreciated, I sense some hostility, which I do not understand. Wedchar2912, thanks for your patience and your willingness to share your invaluable insights.So, no point wasting my effort and in the same time, get your agitated for no reason. I do not simply talk nonsense when it comes to financial products, as all my old posts can clearly indicate. A little knowledge can be a dangerous thing bro. But you can ignore everything I mentioned in this tread and sure, you are very right in saying the 102 price is due to a FEE by the bank. (btw, FX is supposed to be quite simple, and yet there are so many who thinks the price on google are the tradable prices. Just an example of what normal people knows. and regulation doesn't mean prices are regulated. you are mixing things up) I for one, appreciate it. Wedchar2912 liked this post

|

|

|

Jul 31 2023, 02:19 AM Jul 31 2023, 02:19 AM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(hksgmy @ Jul 31 2023, 01:54 AM) Yes, you are correct re the bonds being regulated, and that it’s actually supposed to be a safer class of investments compared to shares. Do not get confused with the meaning of regulated. Here in Singapore, bonds on the secondary market are subject to a bid offer to purchase by potential buyers. However, depending on your bank, when the bank buys the bond that you’re trying to sell, they obviously won’t tell you the bid offer by a prospective buyer, but instead, offer you their (the bank’s) own buying price, which could be a few cents lower than the buyer’s offer. The bank then sells it to the buyer at a price which is a few cents higher than the buyer’s bid price, and if the buyer is willing to buy, the bank earns both ways. This is what I meant by a spread. Sorry for any confusion. Like you, I’ve never sold any of my bonds. Not even when the capital appreciates. The way I invest in bonds is to think of them as hassle free property proxies that I don’t have to pay property tax, cukai pintu, agent fees, council tax etc on. Just buy, and collect ‘rental’ every 6 months. Just an example: Medicines are also regulated, but are the medical drug prices really regulated? Panadol must be 2rm per tablet? |

|

|

Jul 31 2023, 02:22 AM Jul 31 2023, 02:22 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Wedchar2912 @ Jul 31 2023, 02:19 AM) Do not get confused with the meaning of regulated. Thanks bro, I appreciate it. I wasn’t going to make assumptions about how the bond market behaves in Malaysia vs the way it works here in Singapore, hence my qualifier earlier stating that my experience with bonds are from a Singapore perspective. Just an example: Medicines are also regulated, but are the medical drug prices really regulated? Panadol must be 2rm per tablet? I prefer discussions and discourse over disagreements and discords Wedchar2912 liked this post

|

|

|

Jul 31 2023, 02:09 PM Jul 31 2023, 02:09 PM

|

Junior Member

112 posts Joined: Sep 2016 |

QUOTE(hksgmy @ Jul 31 2023, 01:54 AM) Yes, you are correct re the bonds being regulated, and that it’s actually supposed to be a safer class of investments compared to shares. Hmm, your comment made me think of whether cash out refinancing a fully paid house to invest in bond to be a good idea and earn the net %Here in Singapore, bonds on the secondary market are subject to a bid offer to purchase by potential buyers. However, depending on your bank, when the bank buys the bond that you’re trying to sell, they obviously won’t tell you the bid offer by a prospective buyer, but instead, offer you their (the bank’s) own buying price, which could be a few cents lower than the buyer’s offer. The bank then sells it to the buyer at a price which is a few cents higher than the buyer’s bid price, and if the buyer is willing to buy, the bank earns both ways. This is what I meant by a spread. Sorry for any confusion. Like you, I’ve never sold any of my bonds. Not even when the capital appreciates. The way I invest in bonds is to think of them as hassle free property proxies that I don’t have to pay property tax, cukai pintu, agent fees, council tax etc on. Just buy, and collect ‘rental’ every 6 months. |

|

|

Jul 31 2023, 02:16 PM Jul 31 2023, 02:16 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(mapeyeo1 @ Jul 31 2023, 02:09 PM) Hmm, your comment made me think of whether cash out refinancing a fully paid house to invest in bond to be a good idea and earn the net % Bro, one thing you must remember is that you should not buy using leverage if possible.My bond purchases are all made with spare cash. In fact my private bankers have offered me credit lines from which I could use to purchase bonds and earn the difference in the interest payable and the coupons paid. I respectfully declined. While investment-grade bonds are generally very safe, who can be 100% sure? A good example is the recent Credit Suisse debacle. Imagine if you had cashed out on your fully paid property to invest in Credit Suisse bonds. My very humble suggestion is only ever purchase what you can afford. All the best. mapeyeo1 liked this post

|

|

|

Jul 31 2023, 05:37 PM Jul 31 2023, 05:37 PM

Show posts by this member only | IPv6 | Post

#51

|

Senior Member

4,689 posts Joined: Jan 2003 |

QUOTE(Wedchar2912 @ Jul 31 2023, 02:19 AM) Do not get confused with the meaning of regulated. I think some ppl confused with the regulated 🤦♀️ the structure is regulated but not for bond trading prices as they can be manipulated as CS AT1 bonds proves that already Just an example: Medicines are also regulated, but are the medical drug prices really regulated? Panadol must be 2rm per tablet? What are you are saying is right because with OTC price can be rigged upon trading price for buying and selling as that is what is taken for reference in order for the issuers to indicate future coupon prices |

|

|

Jul 31 2023, 11:50 PM Jul 31 2023, 11:50 PM

Show posts by this member only | IPv6 | Post

#52

|

Senior Member

4,500 posts Joined: Mar 2014 |

Safer than investment grade are government bonds of a solid country. Tho safer means lower yield. |

|

|

Aug 1 2023, 06:43 PM Aug 1 2023, 06:43 PM

Show posts by this member only | IPv6 | Post

#53

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(joeblow @ Jul 31 2023, 01:47 AM) Back to the topic, so this bond worth buying? I think EV still takes several years to take shape plus the first Call is after 5 years should they execute. This company quite heavily vested in car industry and going by the Tesla selling model might impact pricing. Risk really high? I just don't like the 5 years holding period. Worth la.2% "sales charge". Anyway I got book 1 lot, so let's see if I get it. The FSM one I don't know how it works. Seems like you need to deposit the money first, but I don't know if it is a sure thing you will get. I calculated over 5 years the nett fee is less than 2%. gomen will bail it out if got trouble, facepalm guy said ... apa mahu takut? QUOTE(hksgmy @ Jul 31 2023, 01:54 AM) Yes, you are correct re the bonds being regulated, and that it’s actually supposed to be a safer class of investments compared to shares. Wah many thanks for saying that, tired trying to counter Wedchar2912´s totally negative post...Here in Singapore, bonds on the secondary market are subject to a bid offer to purchase by potential buyers. However, depending on your bank, when the bank buys the bond that you’re trying to sell, they obviously won’t tell you the bid offer by a prospective buyer, but instead, offer you their (the bank’s) own buying price, which could be a few cents lower than the buyer’s offer. The bank then sells it to the buyer at a price which is a few cents higher than the buyer’s bid price, and if the buyer is willing to buy, the bank earns both ways. This is what I meant by a spread. Sorry for any confusion. Like you, I’ve never sold any of my bonds. Not even when the capital appreciates. The way I invest in bonds is to think of them as hassle free property proxies that I don’t have to pay property tax, cukai pintu, agent fees, council tax etc on. Just buy, and collect ‘rental’ every 6 months. i sold that one was BBB, your UOB AT1 also downgraded to BBB since CS issue but lucky US sorted it out fast enough and it has moved up back QUOTE(Wedchar2912 @ Jul 31 2023, 02:16 AM) lol. I thought I was doing you a favor by sharing proper knowledge. Unfortunately, not only is it not appreciated, I sense some hostility, which I do not understand. you might be trying to help but kind of giving raw data and not in context So, no point wasting my effort and in the same time, get your agitated for no reason. I do not simply talk nonsense when it comes to financial products, as all my old posts can clearly indicate. A little knowledge can be a dangerous thing bro. But you can ignore everything I mentioned in this tread and sure, you are very right in saying the 102 price is due to a FEE by the bank. (btw, FX is supposed to be quite simple, and yet there are so many who thinks the price on google are the tradable prices. Just an example of what normal people knows. and regulation doesn't mean prices are regulated. you are mixing things up) aka talking from the behind your desk me practical guy going more by real life experience, what´s behind the scene is secondary unless i can change it. buy banker bonds i still will l..despite you have painted them ALL negatively. QUOTE(Wedchar2912 @ Jul 31 2023, 02:19 AM) Do not get confused with the meaning of regulated. You have a misconception thereJust an example: Medicines are also regulated, but are the medical drug prices really regulated? Panadol must be 2rm per tablet? Medicine is regulated for another purpose not so much for regulating prices of Panadol etc. no difference from bond prices - leave it to demand and supply especially WHEN u can choose where to get it. QUOTE(Cubalagi @ Jul 31 2023, 11:50 PM) ya true very safe also no use if coupons so low. |

|

|

Aug 1 2023, 07:44 PM Aug 1 2023, 07:44 PM

Show posts by this member only | IPv6 | Post

#54

|

Senior Member

5,614 posts Joined: Jun 2006 From: Cyberjaya, Shah Alam, Ipoh |

QUOTE(guy3288 @ Jul 27 2023, 06:48 PM) New launch, the bankers making 2% 150million Isnt drb the one pasang most of mesia ckd import car?untung 3 million just like that. last bond also same price 102, i booked pun tak dapat, must be the coupon rate too good lah. bruh dont scare me, i already booked 3 lots Last round i dint get, sold out so fast. Want to be suckers you think easy?. you sure or not losing money? consistent dividend track record , paid every year last 10 years Debt to equity ratio 0.88 have $3 billion worth landbank you ada proof kah? jangan simply tembak lah |

|

|

Aug 1 2023, 07:50 PM Aug 1 2023, 07:50 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Aug 1 2023, 06:43 PM) Worth la. Oh well... Just ignore everything I wrote since you feel so bad about it. gomen will bail it out if got trouble, facepalm guy said ... apa mahu takut? Wah many thanks for saying that, tired trying to counter Wedchar2912´s totally negative post... i sold that one was BBB, your UOB AT1 also downgraded to BBB since CS issue but lucky US sorted it out fast enough and it has moved up back you might be trying to help but kind of giving raw data and not in context aka talking from the behind your desk me practical guy going more by real life experience, what´s behind the scene is secondary unless i can change it. buy banker bonds i still will l..despite you have painted them ALL negatively. You have a misconception there Medicine is regulated for another purpose not so much for regulating prices of Panadol etc. no difference from bond prices - leave it to demand and supply especially WHEN u can choose where to get it. ya true very safe also no use if coupons so low. I kinda regretted sharing too much industry secrets. edit: remember your post 36? didn't you wanted to know whats going on? This post has been edited by Wedchar2912: Aug 1 2023, 08:11 PM |

|

|

Aug 2 2023, 05:35 AM Aug 2 2023, 05:35 AM

Show posts by this member only | IPv6 | Post

#56

|

Senior Member

4,689 posts Joined: Jan 2003 |

QUOTE(max_cavalera @ Aug 1 2023, 07:44 PM) Yes as they own most assembly for import cars for Merc and BMW previously that was exported to China until recently QUOTE(Wedchar2912 @ Aug 1 2023, 07:50 PM) Oh well... Just ignore everything I wrote since you feel so bad about it. Don’t bother with him 🤦♀️ he cannot accept criticisms and must win type A as silly enough to think that every banker bonds is profitable to him 🤦♀️ when you know better that not all bonds are solid and credibleI kinda regretted sharing too much industry secrets. edit: remember your post 36? didn't you wanted to know whats going on? |

|

|

Aug 2 2023, 11:07 AM Aug 2 2023, 11:07 AM

Show posts by this member only | IPv6 | Post

#57

|

Senior Member

4,500 posts Joined: Mar 2014 |

QUOTE(guy3288 @ Aug 1 2023, 06:43 PM) I also invest in treasuries to get potential capital gains, on top of the coupon. Basically take a directional view of where interest rate is going.Add: for cap gains: I prefer Bond ETFsz rather than individual bonds. This post has been edited by Cubalagi: Aug 2 2023, 11:42 AM Gwynbleidd liked this post

|

|

|

Aug 4 2023, 08:54 PM Aug 4 2023, 08:54 PM

|

Senior Member

1,146 posts Joined: Dec 2015 |

|

|

|

Aug 4 2023, 08:57 PM Aug 4 2023, 08:57 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

|

|

|

Aug 5 2023, 12:09 AM Aug 5 2023, 12:09 AM

Show posts by this member only | IPv6 | Post

#60

|

Senior Member

5,922 posts Joined: Sep 2009 |

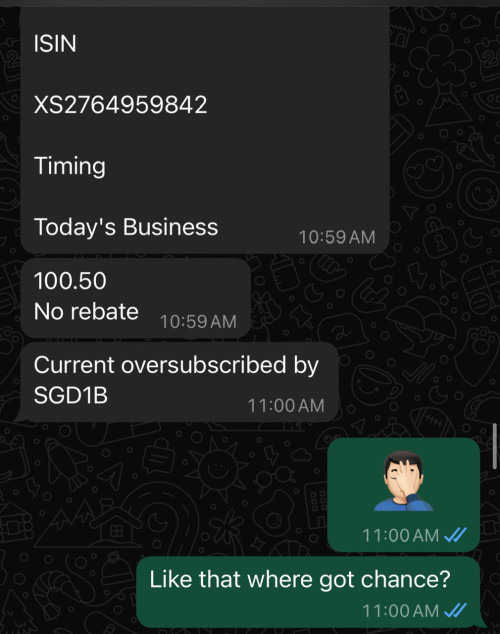

QUOTE(joeblow @ Aug 4 2023, 08:54 PM) morning she already called happily told me i got all 3 lots..i asked since got others didnt getcan i let go 1 or 2 lots in case i wanted to..it seems she may lose out..it goes into the pool , she cant keep it sigh.. she booked 11milion got 4.75M. i actually booked another 2 at FSM RM 100.50.....tak dapat then no headache lah.. |

|

|

Aug 5 2023, 02:09 PM Aug 5 2023, 02:09 PM

|

Senior Member

1,146 posts Joined: Dec 2015 |

QUOTE(guy3288 @ Aug 5 2023, 12:09 AM) morning she already called happily told me i got all 3 lots..i asked since got others didnt get Congrats, it seems my RM is useless. Anyway Monday I will just park my money in FD. FSM one you got too? You really going all in... haha.can i let go 1 or 2 lots in case i wanted to..it seems she may lose out..it goes into the pool , she cant keep it sigh.. she booked 11milion got 4.75M. i actually booked another 2 at FSM RM 100.50.....tak dapat then no headache lah.. |

|

|

Aug 5 2023, 06:01 PM Aug 5 2023, 06:01 PM

Show posts by this member only | IPv6 | Post

#62

|

Senior Member

1,496 posts Joined: May 2019 |

A newbie wanna explore SG market...

a Malaysian can buy SG Bond ? |

|

|

Aug 5 2023, 06:21 PM Aug 5 2023, 06:21 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Haloperidol @ Aug 5 2023, 06:01 PM) Yes, you have a few options - I can elaborate on the options of buying through a banker (as that's what I do), I don't have any bonds through DIY options like FSM so I can't comment on those, nor do I have any participation in bond funds.You'll need to open a bank account in Singapore and demonstrate that you are an ACCREDITED INVESTOR. The criteria (for DBS anyway, but it's quite uniform amongst the banks in Singapore) to be an accredited investor are as below: Minimum income of S$300,000 in the last 12 months (or its equivalent in a foreign currency); or Net personal assets exceeding S$2 million, of which the net value of your primary place of residence can only contribute up to S$1 million; or Net financial assets exceeding S$1 million (or its equivalent in a foreign currency); or Hold a joint account with an Accredited Investor, in respect of dealings through that joint account. Once you've successfully opened a bank account, you'll need to be assigned a relationship manager. For DBS, unless you're with private banking, you'll be assigned a RM that takes care of a group of investors. In my case, I have a personal private banker so the bond options I get are usually not available to those that are taken care of by the common pool RM. These are usually IPO bonds of good companies. For UOB, you're assigned a personal RM even if you're just a UOB Privilege (AUM $250,000 or $300,000) or Privilege Reserve (AUM $1,500,000) account holder, but I followed my Privilege Reserve RM over when he got promoted to private banking (AUM $3,000,000 and above) - and it's the same case: if you're UOB Privilege, you won't get access to certain bonds, and certainly not the IPO bonds of good companies. For that, you'll need to be at least Privilege Reserve or Private Banking. Finally, Maybank (these are the 3 banks that I bank privately, so I can comment a bit). I was assigned an RM when I was merely Maybank Privilege, and initially, just like with UOB or DBS, I was only ever offered bonds on the secondary market. However, as my portfolio grew and my AUM expanded with Maybank, my status was upgraded to Private Banking and the IPO offerings came fast and furious. I believe it should be quite the same with all the other banks in Singapore: they'll reserve the juicy ones for their "best" clients. Moving on, to the bonds themselves: private banks offer the option of buying bonds at IPO price, and usually offer a rebate of between 0.25 to 0.5 basis points as an incentive, so I've bought a few IPO bonds at par prices. However, they will charge an account keeping fee (can be quite hefty if not waived - and waiver depends on AUM value), and take a commission out of every coupon payable (not a lot). There are also ancillary charges pertaining to keeping the bonds in trust for you and lodging them with the CDP. Finally, the cost of entry of a bond in Singapore is like that of Malaysia's: you'll need SGD250,000 minimum to buy a bond. I believe Malaysia requires at least RM250,000 as well. Some Australian bonds (bought through the Singapore banks) allowed entry as low as AUD200,000 in the past, but because the AUD has trended downward, it's now also AUD250,000 per bond per purchase. Hope that helps. Hoshiyuu, Haloperidol, and 1 other liked this post

|

|

|

Aug 6 2023, 07:56 PM Aug 6 2023, 07:56 PM

Show posts by this member only | IPv6 | Post

#64

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(hksgmy @ Aug 5 2023, 06:21 PM) Yes, you have a few options - I can elaborate on the options of buying through a banker (as that's what I do), I don't have any bonds through DIY options like FSM so I can't comment on those, nor do I have any participation in bond funds. I fail the first criteria 😁You'll need to open a bank account in Singapore and demonstrate that you are an ACCREDITED INVESTOR. The criteria (for DBS anyway, but it's quite uniform amongst the banks in Singapore) to be an accredited investor are as below: Minimum income of S$300,000 in the last 12 months (or its equivalent in a foreign currency); or Net personal assets exceeding S$2 million, of which the net value of your primary place of residence can only contribute up to S$1 million; or Net financial assets exceeding S$1 million (or its equivalent in a foreign currency); or Hold a joint account with an Accredited Investor, in respect of dealings through that joint account. Once you've successfully opened a bank account, you'll need to be assigned a relationship manager. For DBS, unless you're with private banking, you'll be assigned a RM that takes care of a group of investors. In my case, I have a personal private banker so the bond options I get are usually not available to those that are taken care of by the common pool RM. These are usually IPO bonds of good companies. For UOB, you're assigned a personal RM even if you're just a UOB Privilege (AUM $250,000 or $300,000) or Privilege Reserve (AUM $1,500,000) account holder, but I followed my Privilege Reserve RM over when he got promoted to private banking (AUM $3,000,000 and above) - and it's the same case: if you're UOB Privilege, you won't get access to certain bonds, and certainly not the IPO bonds of good companies. For that, you'll need to be at least Privilege Reserve or Private Banking. Finally, Maybank (these are the 3 banks that I bank privately, so I can comment a bit). I was assigned an RM when I was merely Maybank Privilege, and initially, just like with UOB or DBS, I was only ever offered bonds on the secondary market. However, as my portfolio grew and my AUM expanded with Maybank, my status was upgraded to Private Banking and the IPO offerings came fast and furious. I believe it should be quite the same with all the other banks in Singapore: they'll reserve the juicy ones for their "best" clients. Moving on, to the bonds themselves: private banks offer the option of buying bonds at IPO price, and usually offer a rebate of between 0.25 to 0.5 basis points as an incentive, so I've bought a few IPO bonds at par prices. However, they will charge an account keeping fee (can be quite hefty if not waived - and waiver depends on AUM value), and take a commission out of every coupon payable (not a lot). There are also ancillary charges pertaining to keeping the bonds in trust for you and lodging them with the CDP. Finally, the cost of entry of a bond in Singapore is like that of Malaysia's: you'll need SGD250,000 minimum to buy a bond. I believe Malaysia requires at least RM250,000 as well. Some Australian bonds (bought through the Singapore banks) allowed entry as low as AUD200,000 in the past, but because the AUD has trended downward, it's now also AUD250,000 per bond per purchase. Hope that helps. Moving on. What's the typical returns for these types of bonds? |

|

|

Aug 6 2023, 09:19 PM Aug 6 2023, 09:19 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(gashout @ Aug 6 2023, 07:56 PM) Hi Gashout, my bonds average between 4 to 6% coupons, but that’s somewhat a little on the conservative side as I pick only investment grade and mainly Singapore based bonds. |

|

|

Aug 6 2023, 10:44 PM Aug 6 2023, 10:44 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

|

|

|

Aug 6 2023, 11:21 PM Aug 6 2023, 11:21 PM

|

Senior Member

4,500 posts Joined: Mar 2014 |

QUOTE(hksgmy @ Aug 5 2023, 06:21 PM) Yes, you have a few options - I can elaborate on the options of buying through a banker (as that's what I do), I don't have any bonds through DIY options like FSM so I can't comment on those, nor do I have any participation in bond funds. Not necessary to have Singapore bank account. If you have a Malaysia private bank/wealth management account, they could also offer SGD bonds.You'll need to open a bank account in Singapore and demonstrate that you are an ACCREDITED INVESTOR. The criteria (for DBS anyway, but it's quite uniform amongst the banks in Singapore) to be an accredited investor are as below: Minimum income of S$300,000 in the last 12 months (or its equivalent in a foreign currency); or Net personal assets exceeding S$2 million, of which the net value of your primary place of residence can only contribute up to S$1 million; or Net financial assets exceeding S$1 million (or its equivalent in a foreign currency); or Hold a joint account with an Accredited Investor, in respect of dealings through that joint account. Once you've successfully opened a bank account, you'll need to be assigned a relationship manager. For DBS, unless you're with private banking, you'll be assigned a RM that takes care of a group of investors. In my case, I have a personal private banker so the bond options I get are usually not available to those that are taken care of by the common pool RM. These are usually IPO bonds of good companies. For UOB, you're assigned a personal RM even if you're just a UOB Privilege (AUM $250,000 or $300,000) or Privilege Reserve (AUM $1,500,000) account holder, but I followed my Privilege Reserve RM over when he got promoted to private banking (AUM $3,000,000 and above) - and it's the same case: if you're UOB Privilege, you won't get access to certain bonds, and certainly not the IPO bonds of good companies. For that, you'll need to be at least Privilege Reserve or Private Banking. Finally, Maybank (these are the 3 banks that I bank privately, so I can comment a bit). I was assigned an RM when I was merely Maybank Privilege, and initially, just like with UOB or DBS, I was only ever offered bonds on the secondary market. However, as my portfolio grew and my AUM expanded with Maybank, my status was upgraded to Private Banking and the IPO offerings came fast and furious. I believe it should be quite the same with all the other banks in Singapore: they'll reserve the juicy ones for their "best" clients. Moving on, to the bonds themselves: private banks offer the option of buying bonds at IPO price, and usually offer a rebate of between 0.25 to 0.5 basis points as an incentive, so I've bought a few IPO bonds at par prices. However, they will charge an account keeping fee (can be quite hefty if not waived - and waiver depends on AUM value), and take a commission out of every coupon payable (not a lot). There are also ancillary charges pertaining to keeping the bonds in trust for you and lodging them with the CDP. Finally, the cost of entry of a bond in Singapore is like that of Malaysia's: you'll need SGD250,000 minimum to buy a bond. I believe Malaysia requires at least RM250,000 as well. Some Australian bonds (bought through the Singapore banks) allowed entry as low as AUD200,000 in the past, but because the AUD has trended downward, it's now also AUD250,000 per bond per purchase. Hope that helps. You also need to be accredited in Malaysia, but Malaysian accredited is lower threshold as its in MYR eg RM3 million. But for small fry like me minimum ticket size (SGD250k) is a problem. Thats a huge chunk to be exposed to one name. This post has been edited by Cubalagi: Aug 6 2023, 11:23 PM |

|

|

Aug 6 2023, 11:25 PM Aug 6 2023, 11:25 PM

|

Senior Member

4,500 posts Joined: Mar 2014 |

|

|

|

Aug 7 2023, 02:15 AM Aug 7 2023, 02:15 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Cubalagi @ Aug 6 2023, 11:21 PM) Not necessary to have Singapore bank account. If you have a Malaysia private bank/wealth management account, they could also offer SGD bonds. Oh ya, I totally forgot that private banking in Malaysia would also allow you the same access. My bad. Thank you for clarifying that for the readers! You also need to be accredited in Malaysia, but Malaysian accredited is lower threshold as its in MYR eg RM3 million. But for small fry like me minimum ticket size (SGD250k) is a problem. Thats a huge chunk to be exposed to one name. |

|

|

Aug 7 2023, 03:17 AM Aug 7 2023, 03:17 AM

Show posts by this member only | IPv6 | Post

#70

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(hksgmy @ Aug 6 2023, 09:19 PM) Hi Gashout, my bonds average between 4 to 6% coupons, but that’s somewhat a little on the conservative side as I pick only investment grade and mainly Singapore based bonds. The right choice. Once you reach q certain level, preservation of fund even at slow growth is good. QUOTE(Wedchar2912 @ Aug 6 2023, 10:44 PM) The conditions are of "or" logic/statements... you just need to satisfy one of them. So the easiest is maybe is the condition 3 (1 sgd million). So it's either or. Got it. Thanks. QUOTE(Cubalagi @ Aug 6 2023, 11:25 PM) Yes. I forgot about the rating part. Thanks for reminding. |

|

|

Aug 7 2023, 06:12 AM Aug 7 2023, 06:12 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(gashout @ Aug 7 2023, 03:17 AM) The right choice. Once you reach q certain level, preservation of fund even at slow growth is good. The better the rating, the lower the yield. It’s a fact of finance life haha.So it's either or. Got it. Thanks. Yes. I forgot about the rating part. Thanks for reminding. gashout liked this post

|

|

|

Aug 7 2023, 08:14 AM Aug 7 2023, 08:14 AM

|

Senior Member

4,500 posts Joined: Mar 2014 |

|

|

|

Aug 7 2023, 08:32 AM Aug 7 2023, 08:32 AM

Show posts by this member only | IPv6 | Post

#73

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Cubalagi @ Aug 7 2023, 08:14 AM) Earlier this year, some of the lower rated USD AT1 bonds of European banks were being offered at more than 10% yield. Yeah, if I were a betting man, I would have gone in ... most of the AT1 suffered a sell down after the Credit Suisse debacle, but almost all of the bigger names recovered. Could have taken the profit from the capital recovery, but because of my bond buying approach is to buy & hold till maturity, I didn't bite. |

|

|

Aug 7 2023, 09:31 AM Aug 7 2023, 09:31 AM

Show posts by this member only | IPv6 | Post

#74

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(Cubalagi @ Aug 7 2023, 08:14 AM) Earlier this year, some of the lower rated USD AT1 bonds of European banks were being offered at more than 10% yield. Sounds very tempting. But bonds is always safer with high rating. I have never touched bonds cause I have zero clue about it. If I got my first bond, I will update here hksgmy liked this post

|

|

|

Aug 7 2023, 01:16 PM Aug 7 2023, 01:16 PM

Show posts by this member only | IPv6 | Post

#75

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(gashout @ Aug 7 2023, 09:31 AM) Sounds very tempting. But bonds is always safer with high rating. Do take note, coupons from bonds paid in Australia &/or NZ are also not tax-exempt. So, if something pays 5%, after taxes, it'll be closer to 3.5% compared to an equivalent 6% bond in Singapore.I have never touched bonds cause I have zero clue about it. If I got my first bond, I will update here |

|

|

Aug 7 2023, 01:25 PM Aug 7 2023, 01:25 PM

|

Senior Member

5,741 posts Joined: Apr 2019 |

QUOTE(hksgmy @ Aug 7 2023, 01:16 PM) Do take note, coupons from bonds paid in Australia &/or NZ are also not tax-exempt. So, if something pays 5%, after taxes, it'll be closer to 3.5% compared to an equivalent 6% bond in Singapore. Yup, which makes Sg bonds much more attractive. Needless to say the currency factor as well. Good choice. |

|

|

Aug 7 2023, 09:20 PM Aug 7 2023, 09:20 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(gashout @ Aug 7 2023, 01:25 PM) Yup, which makes Sg bonds much more attractive. Needless to say the currency factor as well. As a financial centre, Singapore has a much wider repertoire of products and a much more agreeable tax environment for the utilisation of such products than a country like Australia or New Zealand. Good choice. Stability of currency aside, it’s also helped by a certain political predictability that investors find attractive, not to mention a high ranking in terms of good governance and lack of corruption (although low corruption is not the same as no corruption - but the system is in place to weed out the perpetrators aggressively). Hong Kong was its biggest rival but since COVID and the uprising, as well as the prevailing anti-China sentiment and narrative, Hong Kong has sadly lost a lot of its former lustre. Ah well, Hong King’s loss is Singapore’s gain and who am I to complain. gashout liked this post

|

|

|

Aug 8 2023, 05:14 PM Aug 8 2023, 05:14 PM

Show posts by this member only | IPv6 | Post

#78

|

Junior Member

893 posts Joined: Aug 2007 |

Since we have good sharing on bond, what your thought and opinion on this.

MY GOVT BOND Issued 2017 and matured 2037. It’s being resold by the bank from original owner. Coupon is 4.7% but yield to maturity is 4.01% Indicative ask price is MYR107.83 Payout semi annual Sukok code MX170003 Min 100k. The bank now have left only 400k Stable under RAM Outlook rating This post has been edited by gamenoob: Aug 8 2023, 05:16 PM |

|

|

Aug 8 2023, 05:30 PM Aug 8 2023, 05:30 PM

Show posts by this member only | IPv6 | Post

#79

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(gamenoob @ Aug 8 2023, 05:14 PM) Since we have good sharing on bond, what your thought and opinion on this. This reads like it's a sovereign bond. Honestly, these are bonds that you can hold on to, unless you have absolutely no faith in Malaysia - the only thing you worry about is if the country defaults. The yield won't be the most attractive, but it's as safe as it gets. MY GOVT BOND Issued 2017 and matured 2037. It’s being resold by the bank from original owner. Coupon is 4.7% but yield to maturity is 4.01% Indicative ask price is MYR107.83 Payout semi annual Sukok code MX170003 Min 100k. The bank now have left only 400k Stable under RAM Outlook rating Please feel free to correct if I'm mistaken. |

|

|

Aug 8 2023, 06:00 PM Aug 8 2023, 06:00 PM

Show posts by this member only | IPv6 | Post

#80

|

Senior Member

4,689 posts Joined: Jan 2003 |

QUOTE(hksgmy @ Aug 8 2023, 05:30 PM) This reads like it's a sovereign bond. Honestly, these are bonds that you can hold on to, unless you have absolutely no faith in Malaysia - the only thing you worry about is if the country defaults. The yield won't be the most attractive, but it's as safe as it gets. It is basically MGS-I or Islamic bond from Malaysia Govt as it should yields around 4% with A+ rating from RAM itself Please feel free to correct if I'm mistaken. The worry is not the default 🤦♀️ but the RM depreciation upon maturity and lower coupons payment even though as RM will depreciated more and inflation will eat in through the coupons money making it less value upon maturity USDMYR uptrend since 1998 will tells you a better picture |

|

|

Aug 8 2023, 06:10 PM Aug 8 2023, 06:10 PM

Show posts by this member only | IPv6 | Post

#81

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(xander2k8 @ Aug 8 2023, 06:00 PM) It is basically MGS-I or Islamic bond from Malaysia Govt as it should yields around 4% with A+ rating from RAM itself Yes, that's true. Unfortunately for holders of ringgit, there's always the fear of currency depreciation that will eat away at any and all profits.The worry is not the default 🤦♀️ but the RM depreciation upon maturity and lower coupons payment even though as RM will depreciated more and inflation will eat in through the coupons money making it less value upon maturity USDMYR uptrend since 1998 will tells you a better picture |

|

|

Aug 8 2023, 10:25 PM Aug 8 2023, 10:25 PM

|

Senior Member

4,500 posts Joined: Mar 2014 |

QUOTE(hksgmy @ Aug 8 2023, 05:30 PM) This reads like it's a sovereign bond. Honestly, these are bonds that you can hold on to, unless you have absolutely no faith in Malaysia - the only thing you worry about is if the country defaults. The yield won't be the most attractive, but it's as safe as it gets. CorrectPlease feel free to correct if I'm mistaken. N its very very very unlikely a govt will default with its own currency bond. This post has been edited by Cubalagi: Aug 8 2023, 10:25 PM |

|

|

Aug 8 2023, 11:28 PM Aug 8 2023, 11:28 PM

Show posts by this member only | IPv6 | Post

#83

|

Senior Member

5,922 posts Joined: Sep 2009 |