QUOTE(gamenoob @ Aug 8 2023, 05:14 PM)

MY GOVT BOND

Issued 2017 and matured 2037.

It’s being resold by the bank from original owner. Coupon is 4.7% but yield to maturity is 4.01%

Indicative ask price is MYR107.83

Payout semi annual

Sukok code MX170003

Min 100k.

Issued 2017 and matured 2037.

It’s being resold by the bank from original owner. Coupon is 4.7% but yield to maturity is 4.01%

Indicative ask price is MYR107.83

Payout semi annual

Sukok code MX170003

Min 100k.

QUOTE(gamenoob @ Aug 9 2023, 05:22 PM)

FD at 6% 12m, one time offering of 1:1 if bought together with bondCurrent 12m FD promo is around >= 4%

Indicative ask price of bond is MYR107.83

Taking into consideration of the promo FD extra of around 2%, this will lower the ask price of the bond.

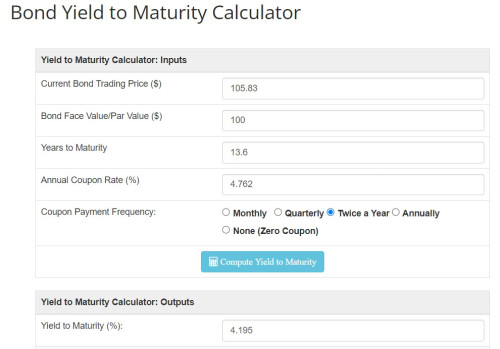

Not sure my understanding is correct here, can I take that the adjusted current price of bond is around MYR105.83 (107.83 -2)?

Is so, this give YTM % of around 4.195% using the bond YTM calculator below.

Hopefully someone can confirm whether my understanding is correct. Newbie here learning. Thanks

https://dqydj.com/bond-yield-to-maturity-calculator/

Aug 10 2023, 11:51 AM

Aug 10 2023, 11:51 AM

Quote

Quote 0.0262sec

0.0262sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled