QUOTE(ChuanHong @ Oct 2 2023, 03:56 PM)

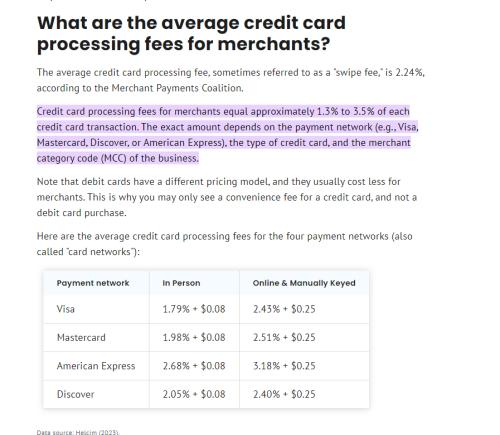

revenue record is there.. cant bypass taxes.. the only benefits for seller is no need to pay extra merchant fee on machine.. that's the reason some franchise retail shop ask for additional amount of money if buyer going for installment.. add RM80/100/120 depending.. else they will use retail price of product to sell u instead of discounted price..

although bank say cannot charge the fee to customer (true< if seller sell at retail price.. e.g. TV RRP 3999).. but if seller sell at 3499 (discoutned price).. they ady offset the fee & margin.. so they have to charge one time fee on top of 3499..

Well, I did ask some of the hawkers out there. They specifically told me that they try to bypass tax as much as possible. For example, even for touch and go transactions, they try to use touch and go QR code that is not link to them.

Also there is another korean restaurant near my house. If I pay by cc, I need to pay 10% extra. I am pretty sure this 10% is not just covering cc charges but taxes as well.

And also they do not accept tng payments as well. I mean it's obvious why they dun do that.

I would say they are smart. First of all, they still declare taxes to the government as there are going to be many people who pays using CC. But at the same time, they can bypass taxes for most of their other non cc transactions as well.

One of the reason why governments around the world wants to go cashless is because once everything goes cashless, there is no way to bypass taxes anymore. As long as cash is being used, you can easily bypass taxes.

This post has been edited by BrookLes: Oct 2 2023, 04:19 PM

Oct 2 2023, 03:26 PM

Oct 2 2023, 03:26 PM

Quote

Quote

0.0234sec

0.0234sec

0.29

0.29

5 queries

5 queries

GZIP Disabled

GZIP Disabled