QUOTE(blackamikaze @ Oct 2 2023, 10:25 AM)

it is not, dont spit nonsense if you dont know how 0% installment work. Dont compare with shopee spay later installment top kek. That one is not 0% installment lah dumbass, of course there will be charges by shopee.

This is an example on how 0% installment work

Iphone 14 from machines, RM3799.00 Retail price.

When u pay with 0% installment for 36 months, U will pay

rm106 x 35 months = 3710

rm 89 x 1 month = 89

---------------------------

total rm3799 for 36 months.

I bet u dint have credit card, that is why u spit shit like this.

Actually shoppee also have 0% installment with certain credit card, but i doubt u too dumb to find it.

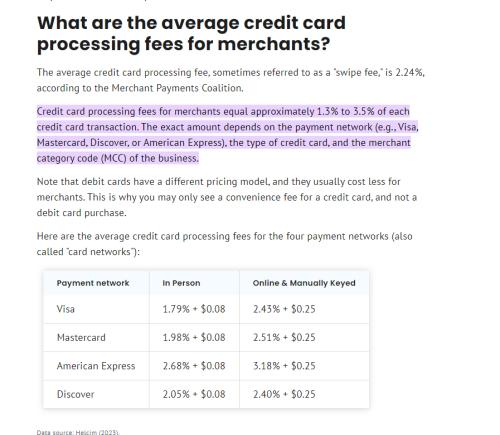

What he means is that the 3799 is already priced in the interest cost.

For example, I dunno what the term, but say the retail willing to pocket RM3600 for the sales, so just mark up the price till 3799 that 199 goes to bank, 3600 goes to retail

The price is masked that yes, for consumer like us, the end price is what matters. But he is explaining the possible reason of Zero Installment plan items tend to be more expensive than the items without this offered

So if you cash buy an item with zero installment plan option, you may be letting the retail pocket the 199 for no reason, hence it is wise to at least sought for discount

This post has been edited by viktorherald: Oct 2 2023, 01:57 PM

May 26 2023, 11:02 AM

May 26 2023, 11:02 AM

Quote

Quote

0.0258sec

0.0258sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled