QUOTE(Davidtcf @ Mar 1 2022, 10:22 AM)

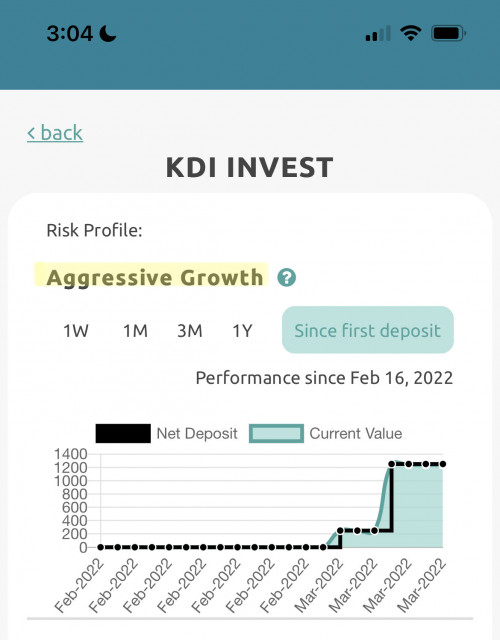

wah all their selections good leh.. much better than Stashaway.

SPY, QQQ, VT, VWOB, VNQ all are good ETFs. Many diversified bond ETFs also.

only ASHR is pure China ETF but don't see any allocation to it, maybe in future when it improves.

so far looks good.. prefer this over Stashaway's portfolio any time

Beware as there’s RSX inside and be prepared KDI might even start buying 9nce the war is over SPY, QQQ, VT, VWOB, VNQ all are good ETFs. Many diversified bond ETFs also.

only ASHR is pure China ETF but don't see any allocation to it, maybe in future when it improves.

so far looks good.. prefer this over Stashaway's portfolio any time

QUOTE(bcombat @ Mar 1 2022, 03:35 PM)

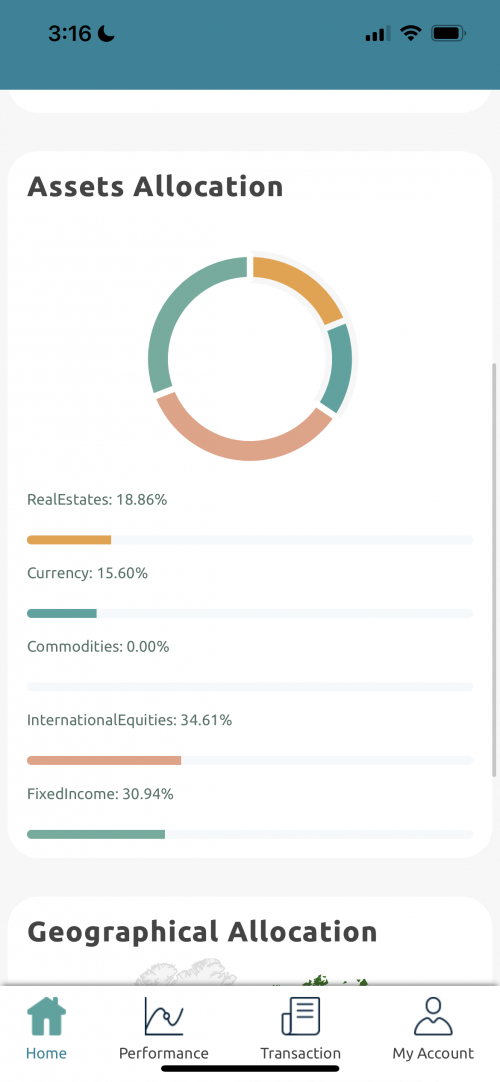

SHV is ishares short term us treasury bondBWX is bloomberg us treasury bond most likely short to medium term

In fact the bond are solids so far

Mar 1 2022, 03:53 PM

Mar 1 2022, 03:53 PM

Quote

Quote

0.1204sec

0.1204sec

0.32

0.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled