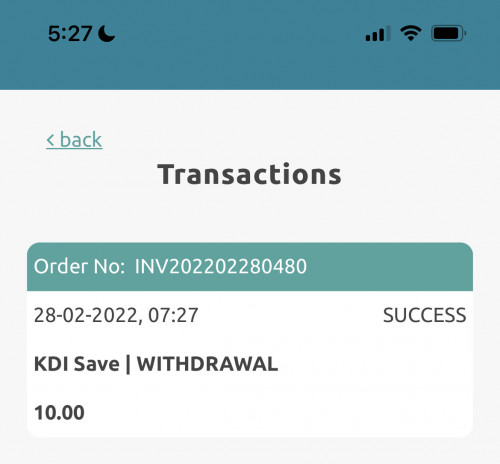

Did a test withdrawal of 10 bucks. Transaction section says success, but at my Maybank account couldn’t see it. Will wait tomorrow see if the amount reflected or not. Double checked my account number and saw it is correct.

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Mar 1 2022, 05:30 PM Mar 1 2022, 05:30 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 1 2022, 06:14 PM Mar 1 2022, 06:14 PM

Return to original view | Post

#22

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Mar 1 2022, 11:00 PM Mar 1 2022, 11:00 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

3,520 posts Joined: Jan 2003 |

First RM3k managed for free by KDI invest. I will utilize this as part of my portfolio.. Investing in "conservative" risk since my IBKR DIY portfolio is already aggressive. Being 30+ good to have some reserves in bonds and KDI Invest one of the ways for me to do it.

Too many type of bond ETFs till I'm confused when looking at them. So gonna let a robo do it for me. KDI save is gooding if don't wanna leave too much cash in savings yet still need it for emergency use. Quick withdrawal useful in this case. 3% till end of year is great.. hope next year's rate is at least as good as Versa's. This post has been edited by Davidtcf: Mar 1 2022, 11:03 PM |

|

|

Mar 2 2022, 12:16 AM Mar 2 2022, 12:16 AM

Return to original view | IPv6 | Post

#24

|

Senior Member

3,520 posts Joined: Jan 2003 |

Go to their website on a pc and use chat function if u want a faster reply. I just tried it today.

|

|

|

Mar 2 2022, 10:01 AM Mar 2 2022, 10:01 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Mar 2 2022, 10:14 AM Mar 2 2022, 10:14 AM

Return to original view | IPv6 | Post

#26

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Medufsaid @ Mar 2 2022, 10:09 AM) i think it's there for the "AI" to choose. so if you are unlucky to have it chosen for you, make noise to kenaga to remove. There's still a fund manager that set the AI on what to invest in. Similar to Stashaway having Freddy Lim to manage and set which ETFs to buy for every risk portfolio chosen (which explains why always see KWEB in their general investing portfolio). Majority of the process then they are managed by AI - such as buy/sell orders.If this part (choosing which ETFs to buy) leave it to AI to decide then is dangerous liao.. current AI still not smart/safe enough to make such decisions. This post has been edited by Davidtcf: Mar 2 2022, 10:15 AM |

|

|

|

|

|

Mar 2 2022, 10:27 AM Mar 2 2022, 10:27 AM

Return to original view | IPv6 | Post

#27

|

Senior Member

3,520 posts Joined: Jan 2003 |

Ok maybe I'm wrong.. they claim it is 100% AI driven:

https://ringgitplus.com/en/blog/investment/...bo-advisor.html QUOTE The artificial intelligence engine behind KDI Invest – dubbed the Factor Analytics Machine Learning Engine (F.A.M.E.) – will monitor global market conditions and rebalances customers’ portfolios automatically, thereby offering convenience and removing the influence of human emotions. Its back-tested portfolio performance yielded average annual return rates between 7.3% to 16.7% from 2004 to February 2021. As of now seems like they focusing on US market: QUOTE KDI Invest invests in a fixed pool of ETFs, carefully screened and curated to offer a range of top-performing developed and emerging equities, fixed income, commodities, and currencies. According to its FAQ, KDI stated that KDI Invest is focused on the US stock exchange market because the US market “offers the most liquid, deepest, and widest range of ETFs covering asset classes across the world, compared to ETFs listed in other countries.” This post has been edited by Davidtcf: Mar 2 2022, 10:28 AM |

|

|

Mar 2 2022, 10:31 AM Mar 2 2022, 10:31 AM

Return to original view | IPv6 | Post

#28

|

Senior Member

3,520 posts Joined: Jan 2003 |

Ok la.. since they already stress tested it before launch of product:

QUOTE Its back-tested portfolio performance yielded average annual return rates between 7.3% to 16.7% from 2004 to February 2021. better than Freddy Lim simply dumping people's money into KWEB |

|

|

Mar 2 2022, 10:33 AM Mar 2 2022, 10:33 AM

Return to original view | IPv6 | Post

#29

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(xander83 @ Mar 2 2022, 10:31 AM) Not focusing on US market share but focusing on US exchange offering ETFs covering asset classes across the world If the AI is claimed to be that smart they will avoid these 2 for now.. maybe one day when they shooting to moon then only invest in them (unlikely). Which is why EWZ and RSX are in the list or pool will monitor the statements closely. |

|

|

Mar 2 2022, 01:29 PM Mar 2 2022, 01:29 PM

Return to original view | IPv6 | Post

#30

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Medufsaid @ Mar 2 2022, 10:41 AM) so KDI uses FAME to determine what ETFs to pick. while DAAS is used to give you the ETF ratio based on your risk appetite QUOTE sorry but this is a potential alarm for me. luckily u quoted it again as i missed it the first time around. will test it out to see for myself. so far only 1k in Invest to see how the conservative portfolio will perform.backtesting will have the danger of curve fitting, and kenaga definitely won't tell us how well they eliminate it. tell us how robust it is, don't tell us how profitable it is if trading as though it was 2005 This post has been edited by Davidtcf: Mar 2 2022, 01:30 PM |

|

|

Mar 3 2022, 10:49 AM Mar 3 2022, 10:49 AM

Return to original view | IPv6 | Post

#31

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(mystvearn @ Mar 3 2022, 10:48 AM) For those of you already invested in KDI Invest, does it give you any breakdown on what ETFs portfolios is your money invested in? I made an account, but after answering robo questions, only give options to choose risk. No option to see where money is invested to. after get statement only will know the allocation. on 1st every month. |

|

|

Mar 3 2022, 04:02 PM Mar 3 2022, 04:02 PM

Return to original view | IPv6 | Post

#32

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(x3Kai @ Mar 3 2022, 03:49 PM) any referrals? pm thanks [got it, thanks!] I'm trying it myself to see the outcome. So far happy with their ETF choices (those allocated - and not the blank ones).looking to enjoy that 3% since even my trusty SC PSA doesn't give that much interest anymore lol. so far what are the thoughts on their offerings? i saw many here complained about transparency, but i'm still thinking of taking advantage of the first RM3k managed for free if the portfolios offered looks reasonable and such. |

|

|

Mar 3 2022, 05:51 PM Mar 3 2022, 05:51 PM

Return to original view | IPv6 | Post

#33

|

Senior Member

3,520 posts Joined: Jan 2003 |

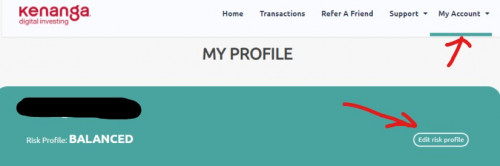

QUOTE(shawnme @ Mar 3 2022, 04:55 PM) I did it via website. yea should be this method.. the AI will help you rebalance it. Go to : My Accounts > My Profile > Edit Risk Profile Accidentally stumbled onto it. I did it without selling anything, and despite after the deposit succeeded as I was just playing around without matter the consequences. If i remember correctly, it took a few days before it actually changed.  *Disclaimer : I searched high and low, but couldn't find any correspondence to prove my claim. I just remember the steps, but what happens during/after change or cost incurred, I am not sure. I didn't notice any losses though. Just that when changing profile risk cannot put in new funds until it is complete. Usually take a few days. |

|

|

|

|

|

Mar 3 2022, 08:42 PM Mar 3 2022, 08:42 PM

Return to original view | IPv6 | Post

#34

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Mar 4 2022, 10:41 AM Mar 4 2022, 10:41 AM

Return to original view | IPv6 | Post

#35

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(c64 @ Mar 4 2022, 09:42 AM) Yeah, Over 1 year +, SA sucks. I'd put some money to test there. Was planning to test for 3 years. Now i am not sure want to put that long. likely due to KWEB.. especially for the higher risk in the General Investing Portfolio, since allocation for KWEB there will be even more.KWEB been going down since Feb 2021, from 102 down to today 30+ USD a share:  This is the main reason why I stay away from Stashaway. Their portfolio manager keep very gungho on this ETF. This post has been edited by Davidtcf: Mar 4 2022, 10:42 AM c64 liked this post

|

|

|

Mar 4 2022, 11:23 AM Mar 4 2022, 11:23 AM

Return to original view | IPv6 | Post

#36

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Mar 5 2022, 12:51 AM Mar 5 2022, 12:51 AM

Return to original view | Post

#37

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(lovelyuser @ Mar 4 2022, 08:38 PM) Assume you put in 100k in KDI Save Agree. Most important is the main deposit that goes into KDI Save. Farhana already confirm it's compounded also. Make sense else where the money gonna sit in? For KDI invest Faq also they got mention all dividends are auto invested into the Invest portfolio for our convenience.If it's compounded daily, interest earn 1st day will be RM 8.2191, 2nd day will be RM 8.2198..... If it's not compounded daily, interest earn daily will be RM 8.2191 Guys! That's RM 0.0007 of difference daily provided you put in 100k, do we need to waste so much time discuss on this? Can we move on? This post has been edited by Davidtcf: Mar 5 2022, 12:52 AM |

|

|

Mar 5 2022, 09:16 AM Mar 5 2022, 09:16 AM

Return to original view | IPv6 | Post

#38

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(lovelyuser @ Mar 5 2022, 08:48 AM) I think we have to look at this in a bigger perspective. Compare both KDI Invest vs Stashaway list of ETFs. That is how I come to conclusion KDI is better. Stashaway made a mistake of choosing kweb. Many people lost money coz of it. Few days ago broke new low reaching 30 usd. Earlier was 32 usd. Imagine KDI launch last year, and SA just launch this month, I believe KDI will be condemn at this moment. Why? Very simple, the market last year is on high side. All investment associate with risk, understand it before you jump in. Be ready to average down, KDI or SA are investing in ETF, which is a basket of good underlying. Whatever go down will recover, whatever go up will have retracement, but crash to crash, market always recover and trending higher Not sure how much KWEB or China paid them to invest in it. Earlier they were doing well before introduction of KWEB etf. |

|

|

Mar 5 2022, 02:00 PM Mar 5 2022, 02:00 PM

Return to original view | Post

#39

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(lovelyuser @ Mar 5 2022, 11:03 AM) Your conclusion is base on such short span of period comparison as KDI just launch not more than a month, do you think it's fair? You can search the history of those ETFs KDI chose. Although past history does not guarantee future returns.. Their performance is better than Stashaway's KWEB. QQQ, SPX are confirmed good selections. Anyhow don't wanna debate on this any longer. We'll see the results here in a few years time. |

|

|

Mar 5 2022, 10:39 PM Mar 5 2022, 10:39 PM

Return to original view | Post

#40

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(xander83 @ Mar 5 2022, 07:31 PM) SA started with XLK before moving to KWEB during Covid to take advantage of China economy boom of that year Agree. XLK is a much better option. KWEB not sure when can go up is like keep sea of red no matter how well general stock market is performing. - [XLK] Global Technology: Exited May 2020 exercise. No holdings since then. They claimed that the whole sector is massively overpriced at that point in time in their webinars. It was less than 100 in May 2020, and its above 150 now. That’s a whopping 60% of potential gains totally missed out. - [KWEB] China Technology: Entered May 2020 exercise, no change for this round of re-optimization. Yes, Stashaway chose KWEB over XLK. No surprise why new Stashaway consumers are sitting on losses, especially those that started since the start of this year who tanked through the 40% losses or this. Looking at the new wave of crackdown launched by China recently with no end in sight, I’m extremely alarmed this is still part of the portfolio. Really dumb for Stashaway to switch from XLK to KWEB. If they experiment see not working should quickly switch back to XLK or some better ETF la. Keep die die say China tech etf is good. All over the news we can see what’s happening. This post has been edited by Davidtcf: Mar 5 2022, 10:40 PM |

| Change to: |  0.0880sec 0.0880sec

0.91 0.91

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 06:31 PM |