QUOTE(Medufsaid @ May 31 2024, 08:23 AM)

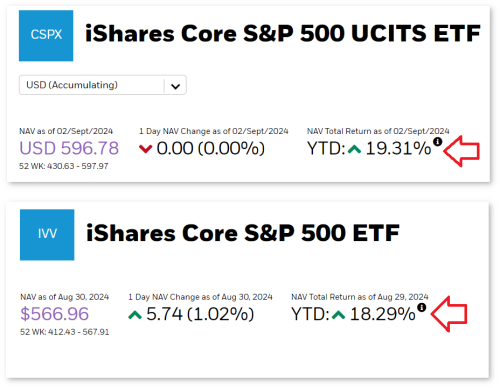

my strategy is to buy USA etfs using recurring investment, then once a year, liquidate that ETF and buy CSPX

buying purely LSE will cost you $20.40 yearly. the difference is only $11.90 or RM55.93.

| Month | Action | Fees |

| Jan | buy USA etf | $0.35 |

| Feb | buy USA etf | $0.35 |

| Mar | buy USA etf | $0.35 + $0.34 (34 cents because your money in USA etf so additional 15% deduction) |

| Apr | buy USA etf | $0.35 |

| May | buy USA etf | $0.35 |

| Jun | buy USA etf | $0.35 + $0.68 (you have twice as much money now) |

| Jul | buy USA etf | $0.35 |

| Aug | buy USA etf | $0.35 |

| Sep | buy USA etf | $0.35 + $1.02 |

| Oct | buy USA etf | $0.35 |

| Nov | buy USA etf | $0.35 |

| Dec |

|

|

| Total fees | $8.50 |

buying purely LSE will cost you $20.40 yearly. the difference is only $11.90 or RM55.93.

Aug 31 2024, 02:09 PM

Aug 31 2024, 02:09 PM

Quote

Quote

0.0326sec

0.0326sec

1.27

1.27

6 queries

6 queries

GZIP Disabled

GZIP Disabled