A special rebalance of the Nasdaq-100 Index has happened only once before. Next week it’s going to happen again. Exciting, right? No, probably not.

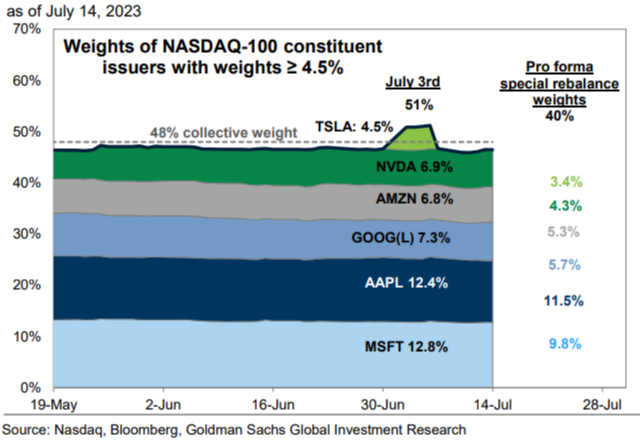

After the outperformance of a handful of very big tech and tech-ish companies this year, nearly all US stock indices are lacking diversity. Concentration is most visible in the Nasdaq-100, also known as NDX, which tracks the bourse’s biggest non-financial companies. Earlier this month, briefly, just six issuers were making up more than half of its total by weight.

Luckily, NDX is a modified market cap weighted index. What “modified” means in effect is that the Nasdaq committee tries to cap individual constituent weights so the index can continue to be used as a benchmark without breaching US Regulated Investment Company asset diversification requirements.

Members can’t individually carry an index weight greater than 24 per cent. Nor can issuers with weights greater than 4.5 per cent collectively account for more than 48 per cent. It was the latter threshold that tripped briefly earlier this month, after Tesla hit a 10-month high, and prompted the intervention between

quarterly reviews. Chart via Goldman Sachs:

As a result, the collective weights of the big-seven issuers will be cut from 56 per cent to 44 per cent. Nvidia and Microsoft are most affected, both being docked about 3 percentage points, with their weight redistributed to smaller caps. The changes take effect before the open

next Monday, July 24.

According to EPFR data, $251bn in passive mutual fund and ETF assets under management are benchmarked to the NDX, plus a puny $10bn in active funds. There’s also about $20bn of short money in the relevant ETFs, which offer a popular way to hedge long positions in growth stocks.

Rebalancing by passive funds can create a bit of churn, though since all the effects were known or guessable since Nasdaq’s announcement on July 10 it’s hard to say by how much. The top-seven NDX stocks by weight

outperformed last week, rising 5 per cent versus a 3.5 per cent for the index, so anticipatory trading might not be as big a damper as logic might suggest.

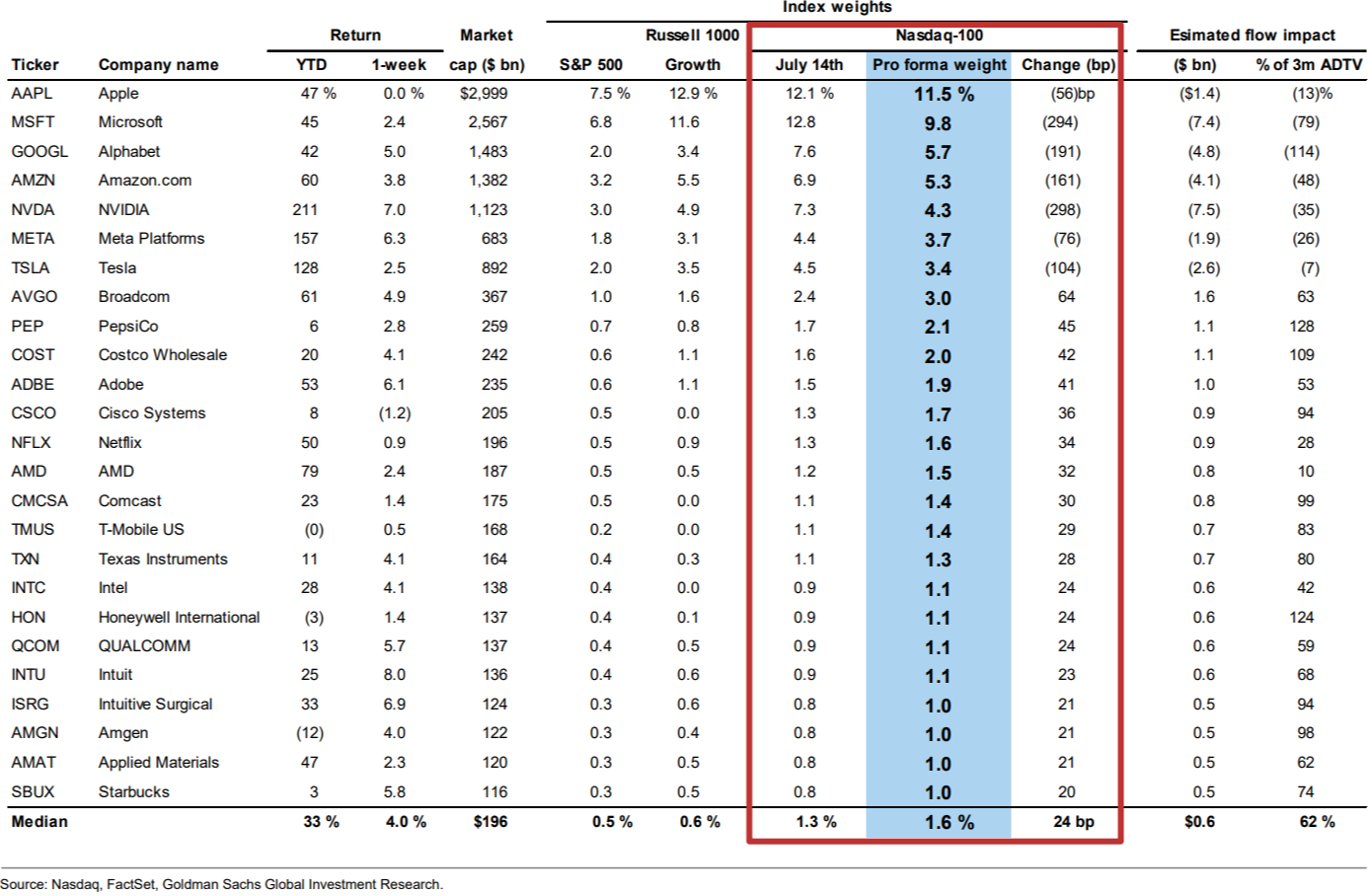

Goldman’s estimates that for the top 25 constituents only

Google Alphabet has an overhang of passive sales equivalent to more than a day’s average volume. For passive buys the ones to watch are probably PepsiCo, Costco and Honeywell:

But precedent suggests it’ll be uneventful. The NDX’s one previous

special rebalance, in 2011, was after Apple had grown to an uncomfortable 20 per cent of the total. The rejig is easy to forget because, even though a big slice of Apple was reallocated to Microsoft, there was no effect whatsoever on share prices.

That tends to be the way of these things. Whatever volatility there is around index reshuffles tends to be temporary, and is more often a result of trader error than orderly passive flows — Dimension Data’s

entry to the FTSE 100 in 2000 being a famous example.

Plus, as Goldman argues, the Nasdaq-100’s just not that useful or important as anything other than a narrow gauge of tech hype:

QUOTE

Consensus bottom-up 2023 EPS estimates for NDX have fallen by just 1% YTD, compared with a 5% decline for S&P 500 EPS. In addition to an improving near-term economic outlook, investor optimism regarding AI and the end of Fed tightening have lifted the NDX forward P/E multiple by 32% (21x to 28x) leading to a YTD return of 42% for the index and 65% for its largest seven stocks.

[ . . . ]

The NDX special rebalance is unlikely to solve the challenge that elevated current market concentration poses for many benchmarked investors. According to the Investment Company Act of 1940, a “diversified” fund cannot hold more than 25% of its portfolio in positions that each account for greater than 5% of its portfolio. The outperformance of the largest stocks and their increased weights in benchmark indices have driven persistent mutual fund underweights in those stocks, which in turn have created large headwinds to funds’ relative returns.

YTD only 31% of large-cap funds are outperforming their benchmarks. However, only $10 billion of active mutual fund AUM is benchmarked to the NDX, compared with $805 billion for the Russell 1000 Growth and $2 trillion for the S&P 500. Even after the rebalance, the NDX will remain too concentrated to be considered an actively managed “diversified” fund according to the SEC (stocks greater than 5% weight will total 32% of the index).

Apr 11 2023, 01:49 PM

Apr 11 2023, 01:49 PM

Quote

Quote

0.0426sec

0.0426sec

0.65

0.65

6 queries

6 queries

GZIP Disabled

GZIP Disabled