Any tax from dividend from stock in oversea market if you used local broker ?

All the dividend will be tax once remit to Malaysia broker ?

double taxation ?

tax for oversea trading /dividend, its become more complicated

tax for oversea trading /dividend, its become more complicated

|

|

Oct 30 2021, 10:11 PM, updated 5y ago Oct 30 2021, 10:11 PM, updated 5y ago

Show posts by this member only | Post

#1

|

Junior Member

105 posts Joined: Nov 2014 |

Any tax from dividend from stock in oversea market if you used local broker ?

All the dividend will be tax once remit to Malaysia broker ? double taxation ? |

|

|

|

|

|

Oct 30 2021, 10:39 PM Oct 30 2021, 10:39 PM

Show posts by this member only | Post

#2

|

Junior Member

275 posts Joined: Oct 2021 |

|

|

|

Oct 30 2021, 10:49 PM Oct 30 2021, 10:49 PM

Show posts by this member only | IPv6 | Post

#3

|

Junior Member

223 posts Joined: Dec 2006 |

if you dont intend to bring them back... not need to declare...unless you wanna convert back to malaysia.. and spend.. then declare.. thats my stupid logic.. please any pro here.. educate us apology..didnt read properly... the TS say .. USE LOCAL BANK>>> so ignore my message This post has been edited by rootbeer: Oct 30 2021, 10:50 PM Msxxyy liked this post

|

|

|

Oct 31 2021, 01:04 AM Oct 31 2021, 01:04 AM

Show posts by this member only | IPv6 | Post

#4

|

Senior Member

2,210 posts Joined: Jan 2018 |

You will not be taxed on foreign income.

|

|

|

Oct 31 2021, 03:58 AM Oct 31 2021, 03:58 AM

Show posts by this member only | Post

#5

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Oct 31 2021, 07:07 AM Oct 31 2021, 07:07 AM

Show posts by this member only | IPv6 | Post

#6

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(homosapien8888 @ Oct 30 2021, 10:11 PM) Any tax from dividend from stock in oversea market if you used local broker ? All the dividend will be tax once remit to Malaysia broker ? double taxation ? QUOTE(Yggdrasil @ Oct 31 2021, 01:04 AM) What until 2022 for clarity.QUOTE(xander83 @ Oct 31 2021, 03:58 AM) It's considered overseas income. And we all know overseas income will be tax. Whether the one taxable is job or investment, we won't know until 2022. Remember now govt desperate. No money already. Need to tax everything. |

|

|

|

|

|

Oct 31 2021, 07:17 AM Oct 31 2021, 07:17 AM

Show posts by this member only | Post

#7

|

Junior Member

275 posts Joined: Oct 2021 |

QUOTE(homosapien8888 @ Oct 30 2021, 10:11 PM) Any tax from dividend from stock in oversea market if you used local broker ? Tax apply when your submit your filing. All foreign income be taxed from 1st Jan 2022, for all Tax-Resident in Malaysia.All the dividend will be tax once remit to Malaysia broker ? double taxation ? No issue of double taxation, tax shall apply in the country you make the money thats once, and tax shall apply when you bring home - once. This post has been edited by baby_4ever: Oct 31 2021, 07:18 AM |

|

|

Oct 31 2021, 06:21 PM Oct 31 2021, 06:21 PM

Show posts by this member only | Post

#8

|

Junior Member

105 posts Joined: Nov 2014 |

3 % tax on foreign earning

if use local broker , dividend will deposit to your local brokerage . so the broker will deduct 3% from that once you receive the dividend Or , u need to declared that part when u declared tax 2022? |

|

|

Oct 31 2021, 06:24 PM Oct 31 2021, 06:24 PM

Show posts by this member only | Post

#9

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Wait for the finance bill tabling next week.

|

|

|

Oct 31 2021, 07:53 PM Oct 31 2021, 07:53 PM

Show posts by this member only | IPv6 | Post

#10

|

All Stars

24,433 posts Joined: Feb 2011 |

|

|

|

Oct 31 2021, 07:59 PM Oct 31 2021, 07:59 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Ramjade @ Oct 31 2021, 07:53 PM) https://www.parlimen.gov.my/bills-dewan-rak...uweb=dr&lang=enAccording to last year's schedule, finance bill first reading will be on the Monday one week after the second reading of the supply bill (i.e. budget). Second reading will be one month after that. Sorry I should mean one month after next week. Second reading is when the details will be known. First reading will just be title mentioned. |

|

|

Oct 31 2021, 10:29 PM Oct 31 2021, 10:29 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.sinchew.com.my/20211030/%e7%99%...b5%b7%e5%a4%96/

So, tax experts say no need to worry about double taxation as those who are already taxed overseas can enjoy tax relief, and as long as the money does not flow into Malaysia then you don't need to declare tax. Just keep it in your offshore bank accounts. That means I can look for money changer in SG to convert money into cash and bring to MY to spend when retire, as long as don't deposit large amount in bank, then LHDN won't know and no need to pay tax. This post has been edited by TOS: Oct 31 2021, 10:30 PM |

|

|

Oct 31 2021, 11:52 PM Oct 31 2021, 11:52 PM

Show posts by this member only | IPv6 | Post

#13

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(TOS @ Oct 31 2021, 10:29 PM) https://www.sinchew.com.my/20211030/%e7%99%...b5%b7%e5%a4%96/ Bro, don't use SG money changer. Use the one in Midvalley. I believed they have the best rate in Malaysia. I compared with the ones in JB, JB rates are lousy vs midvalley.So, tax experts say no need to worry about double taxation as those who are already taxed overseas can enjoy tax relief, and as long as the money does not flow into Malaysia then you don't need to declare tax. Just keep it in your offshore bank accounts. That means I can look for money changer in SG to convert money into cash and bring to MY to spend when retire, as long as don't deposit large amount in bank, then LHDN won't know and no need to pay tax. |

|

|

|

|

|

Nov 1 2021, 02:20 AM Nov 1 2021, 02:20 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(TOS @ Oct 31 2021, 10:29 PM) https://www.sinchew.com.my/20211030/%e7%99%...b5%b7%e5%a4%96/ No point as there’s is restriction of 10k either way anything more still need to declare so don’t think you can get away unless you crossing into Malaysia daily So, tax experts say no need to worry about double taxation as those who are already taxed overseas can enjoy tax relief, and as long as the money does not flow into Malaysia then you don't need to declare tax. Just keep it in your offshore bank accounts. That means I can look for money changer in SG to convert money into cash and bring to MY to spend when retire, as long as don't deposit large amount in bank, then LHDN won't know and no need to pay tax. |

|

|

Nov 1 2021, 07:50 AM Nov 1 2021, 07:50 AM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 31 2021, 10:29 PM) https://www.sinchew.com.my/20211030/%e7%99%...b5%b7%e5%a4%96/ just use your sg debit card lor... mastercard spot rate zero mark up... kaotim... dont need money changerSo, tax experts say no need to worry about double taxation as those who are already taxed overseas can enjoy tax relief, and as long as the money does not flow into Malaysia then you don't need to declare tax. Just keep it in your offshore bank accounts. That means I can look for money changer in SG to convert money into cash and bring to MY to spend when retire, as long as don't deposit large amount in bank, then LHDN won't know and no need to pay tax. wise debit already in Japan... soon will be in sg... sg got a few local multicurrency fintech with card too... that time you already not Malaysian tax residence... why worry This post has been edited by dwRK: Nov 1 2021, 07:52 AM |

|

|

Nov 1 2021, 08:18 AM Nov 1 2021, 08:18 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

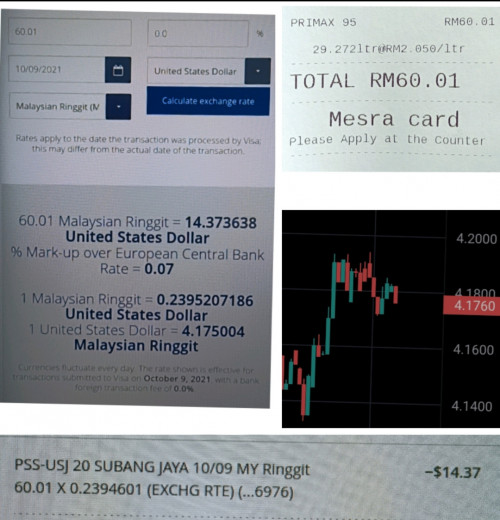

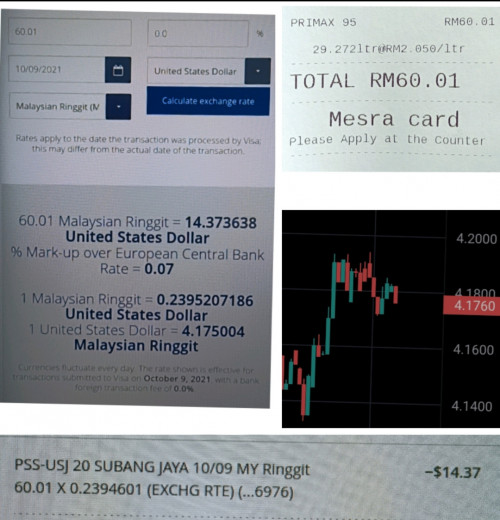

QUOTE(dwRK @ Nov 1 2021, 07:50 AM) just use your sg debit card lor... mastercard spot rate zero mark up... kaotim... dont need money changer Mastercard fees very expensive, they earn like 8% when I pay for my HK SIM top-up using Malaysia debit card. I didn't know SG works differently?that time you already not Malaysian tax residence... why worry When I retire in M'sia I am a tax resident since I will stay here more than 6 months (182 days). |

|

|

Nov 1 2021, 08:25 AM Nov 1 2021, 08:25 AM

Show posts by this member only | IPv6 | Post

#17

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(TOS @ Nov 1 2021, 08:18 AM) Mastercard fees very expensive, they earn like 8% when I pay for my HK SIM top-up using Malaysia debit card. I didn't know SG works differently? It's already in Singapore. Only stupid Malaydia does not have wise card.When I retire in M'sia I am a tax resident since I will stay here more than 6 months (182 days). |

|

|

Nov 1 2021, 10:55 AM Nov 1 2021, 10:55 AM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 1 2021, 08:18 AM) Mastercard fees very expensive, they earn like 8% when I pay for my HK SIM top-up using Malaysia debit card. I didn't know SG works differently? it's your bank lah I think... not mastercardWhen I retire in M'sia I am a tax resident since I will stay here more than 6 months (182 days). Mastercard has that forex conversion website... the rates about same as spot forex rates... then you add in any bank markup to calc your final bill. .. Mastercard earn from the merchant... I forgot liau how much like 1-2%... is the bank then slaughter you with markups... TOS liked this post

|

|

|

Nov 1 2021, 11:18 AM Nov 1 2021, 11:18 AM

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Nov 1 2021, 11:31 AM Nov 1 2021, 11:31 AM

Show posts by this member only | IPv6 | Post

#20

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(dwRK @ Nov 1 2021, 11:18 AM) https://wise.com/sg/travel-money/singapore-dollar-cardGot revolut also. maxguy liked this post

|

|

|

Nov 1 2021, 11:38 AM Nov 1 2021, 11:38 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(dwRK @ Nov 1 2021, 10:55 AM) it's your bank lah I think... not mastercard Mastercard has that forex conversion website... the rates about same as spot forex rates... then you add in any bank markup to calc your final bill. .. Mastercard earn from the merchant... I forgot liau how much like 1-2%... is the bank then slaughter you with markups... QUOTE(dwRK @ Nov 1 2021, 11:18 AM) QUOTE(Ramjade @ Nov 1 2021, 11:31 AM) So you guys are saying no need to move money back, but directly use the "SGD debit card" from Wise or Revolut in any POS terminal in Malaysia? So when money is deducted in buying goods, it is deducted in MYR but internally is converted to MYR from SGD via Wise/revolut from SGD money deposited in Wise/revolut earlier? (which means wise/revolut functions like a bank account?) |

|

|

Nov 1 2021, 12:24 PM Nov 1 2021, 12:24 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 1 2021, 11:38 AM) So you guys are saying no need to move money back, but directly use the "SGD debit card" from Wise or Revolut in any POS terminal in Malaysia? So when money is deducted in buying goods, it is deducted in MYR but internally is converted to MYR from SGD via Wise/revolut from SGD money deposited in Wise/revolut earlier? (which means wise/revolut functions like a bank account?) correct.. . just spend like a tourist here lah... by that time myrsgd maybe 6:1 cheap cheap... hahahaincome tax ask "did you transfer/remit money back"... "no"... hahaha anyways when you retire should be premier or private banking status liao... bankcard should be zero markup fee... so just use those directly lah... don't waste time with wise, revolute, etc... not only pos, can withdraw from atm also at zero fee... hahaha TOS liked this post

|

|

|

Nov 1 2021, 01:12 PM Nov 1 2021, 01:12 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Nov 1 2021, 02:14 PM Nov 1 2021, 02:14 PM

Show posts by this member only | IPv6 | Post

#24

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(TOS @ Nov 1 2021, 11:38 AM) So you guys are saying no need to move money back, but directly use the "SGD debit card" from Wise or Revolut in any POS terminal in Malaysia? So when money is deducted in buying goods, it is deducted in MYR but internally is converted to MYR from SGD via Wise/revolut from SGD money deposited in Wise/revolut earlier? (which means wise/revolut functions like a bank account?) My money have never been brought back to Malaysia. It's a one way trip. Been always like that since I started.The question is even if I don't intend to bring back the money will it be tax? If yes how much? We only know once the bill is clear. Unless you want to chase air miles then use bank card. If you use bank cards Vs fintech, you instantly lose like 3% but you gain like 20% provided you know how to play the miles game. This post has been edited by Ramjade: Nov 1 2021, 02:15 PM |

|

|

Nov 1 2021, 04:14 PM Nov 1 2021, 04:14 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 1 2021, 04:25 PM Nov 1 2021, 04:25 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Ramjade @ Nov 1 2021, 02:14 PM) My money have never been brought back to Malaysia. It's a one way trip. Been always like that since I started. I have a question for you. You invest now in various overseas market to prepare for retirement right? Or at least some life goals in the future, I hope? The question is even if I don't intend to bring back the money will it be tax? If yes how much? We only know once the bill is clear. Unless you want to chase air miles then use bank card. If you use bank cards Vs fintech, you instantly lose like 3% but you gain like 20% provided you know how to play the miles game. So that means at some point later in life, say for example when you retire, you need to spend those money that you invested, obviously they have to be brought back to Malaysia for you to spend on retirement, no? Or you plan to retire elsewhere? Or say that money is for your wedding, (you are still single? So by hook or by crock, a portion of your money will have to come back to Malaysia anyhow in the future, you can't escape unless you go through the "illegal" route. Of course in the cases above, I assume the tax laws remain the same, which might not be. |

|

|

Nov 1 2021, 05:57 PM Nov 1 2021, 05:57 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 1 2021, 04:25 PM) I have a question for you. You invest now in various overseas market to prepare for retirement right? Or at least some life goals in the future, I hope? he using fuzzy logic with selective memory So that means at some point later in life, say for example when you retire, you need to spend those money that you invested, obviously they have to be brought back to Malaysia for you to spend on retirement, no? Or you plan to retire elsewhere? Or say that money is for your wedding, (you are still single? So by hook or by crock, a portion of your money will have to come back to Malaysia anyhow in the future, you can't escape unless you go through the "illegal" route. Of course in the cases above, I assume the tax laws remain the same, which might not be. TOS liked this post

|

|

|

Nov 1 2021, 05:59 PM Nov 1 2021, 05:59 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 1 2021, 06:25 PM Nov 1 2021, 06:25 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(dwRK @ Nov 1 2021, 10:55 AM) it's your bank lah I think... not mastercard MasterCard has hidden FPX conversion rate and it won’t be spot rate but overnight rate which sometimes can goes to up 0.5% higher together with bank charges be prepared to at least 1.5% markup for every transaction Mastercard has that forex conversion website... the rates about same as spot forex rates... then you add in any bank markup to calc your final bill. .. Mastercard earn from the merchant... I forgot liau how much like 1-2%... is the bank then slaughter you with markups... QUOTE(dwRK @ Nov 1 2021, 05:57 PM) Wonder got U turn selection |

|

|

Nov 1 2021, 08:48 PM Nov 1 2021, 08:48 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Nov 1 2021, 09:09 PM Nov 1 2021, 09:09 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 1 2021, 09:15 PM Nov 1 2021, 09:15 PM

Show posts by this member only | IPv6 | Post

#32

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(TOS @ Nov 1 2021, 04:25 PM) I have a question for you. You invest now in various overseas market to prepare for retirement right? Or at least some life goals in the future, I hope? Bro, I have never withdraw my money for I think 7-8 years already. All my salary all dump overseas.So that means at some point later in life, say for example when you retire, you need to spend those money that you invested, obviously they have to be brought back to Malaysia for you to spend on retirement, no? Or you plan to retire elsewhere? Or say that money is for your wedding, (you are still single? So by hook or by crock, a portion of your money will have to come back to Malaysia anyhow in the future, you can't escape unless you go through the "illegal" route. Of course in the cases above, I assume the tax laws remain the same, which might not be. How to retire? Simple. Use epf and savings. I planned to move to new Zealand,, Canada or Portugal or Finland or Netherlands. My savings rate already 75%. If I need something just save up for it. Remember my overseas investment are now self reliant already thanks to options. I don't need to transfer money overseas anymore and still can continue to invest and grow my wealth and still get cash flow to fund my investment account. Another perks of not being a dividend Investor. If I cont to be dividend Investor, I need to wait 12 years for it to happen or don't know how many donkey years. But I do see having to pay tax on that. Hence I am going to register myself and vote after all this while. Retirement is a long journey. Say another 10 years time, 10 years time govt tax may change (highly doubt it) or govt change can happen. No one expect BN to lose right? I expect they are going to piss off lots of online seller with that tax. So anything can happen. This post has been edited by Ramjade: Nov 1 2021, 09:20 PM |

|

|

Nov 1 2021, 09:57 PM Nov 1 2021, 09:57 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Ramjade @ Nov 1 2021, 09:15 PM) Bro, I have never withdraw my money for I think 7-8 years already. All my salary all dump overseas. All the best with your plan. How to retire? Simple. Use epf and savings. I planned to move to new Zealand,, Canada or Portugal or Finland or Netherlands. My savings rate already 75%. If I need something just save up for it. Remember my overseas investment are now self reliant already thanks to options. I don't need to transfer money overseas anymore and still can continue to invest and grow my wealth and still get cash flow to fund my investment account. Another perks of not being a dividend Investor. If I cont to be dividend Investor, I need to wait 12 years for it to happen or don't know how many donkey years. But I do see having to pay tax on that. Hence I am going to register myself and vote after all this while. Retirement is a long journey. Say another 10 years time, 10 years time govt tax may change (highly doubt it) or govt change can happen. No one expect BN to lose right? I expect they are going to piss off lots of online seller with that tax. So anything can happen. |

|

|

Nov 2 2021, 02:41 AM Nov 2 2021, 02:41 AM

Show posts by this member only | IPv6 | Post

#34

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(TOS @ Nov 1 2021, 09:57 PM) All the best with your plan. It's just dream. Unlikely will happen. Might try Portugal though. Cause if US people can retire to Portugal, why not.Anyway I am ready to pay tax even though I am bitter about it. |

|

|

Nov 2 2021, 03:39 AM Nov 2 2021, 03:39 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Nov 2 2021, 07:05 AM Nov 2 2021, 07:05 AM

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Nov 2 2021, 07:10 AM Nov 2 2021, 07:10 AM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(Ramjade @ Nov 2 2021, 02:41 AM) It's just dream. Unlikely will happen. Might try Portugal though. Cause if US people can retire to Portugal, why not. a lot of old folks like to retire to cheaper n warmer climatesAnyway I am ready to pay tax even though I am bitter about it. you get a lot of old folks in Florida for example my Dutch friend bought a boat, retired to Spain... imho... no need to migrate if skill set is good... just become an expat enjoy big pay n benefits |

|

|

Nov 2 2021, 07:50 PM Nov 2 2021, 07:50 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Nov 2 2021, 10:12 PM Nov 2 2021, 10:12 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(xander83 @ Nov 2 2021, 07:50 PM) you can bs noobs lah... not veterans... lolusing visa and mastercard at pos/pss... where got connect to fpx?... totally different unconnected payment system... lol oe_kintaro, red streak, and 1 other liked this post

|

|

|

Nov 2 2021, 11:10 PM Nov 2 2021, 11:10 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 2 2021, 11:50 PM Nov 2 2021, 11:50 PM

|

All Stars

10,125 posts Joined: Aug 2007 |

QUOTE(dwRK @ Nov 2 2021, 07:10 AM) a lot of old folks like to retire to cheaper n warmer climates As for being expat, I hope the Msia govt won't implement the new MM2H policy. It's kinda sucks. you get a lot of old folks in Florida for example my Dutch friend bought a boat, retired to Spain... imho... no need to migrate if skill set is good... just become an expat enjoy big pay n benefits That requirement better retire in 1st world country - why need to retire in Malaysia? If you're a retiree and only have passive income, usually it isn't taxed (or not much) at the source but if they keep having those requirements, it's like going back to work. And on top of that.. that's could be an income they (the govt) want to tax as per the new budget proposals 'coz the retirees have to bring it in as requirement for staying on that visa. |

|

|

Nov 3 2021, 08:18 AM Nov 3 2021, 08:18 AM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(danmooncake @ Nov 2 2021, 11:50 PM) As for being expat, I hope the Msia govt won't implement the new MM2H policy. It's kinda sucks. i went and read up the mm2h... it is indeed nuts...That requirement better retire in 1st world country - why need to retire in Malaysia? If you're a retiree and only have passive income, usually it isn't taxed (or not much) at the source but if they keep having those requirements, it's like going back to work. And on top of that.. that's could be an income they (the govt) want to tax as per the new budget proposals 'coz the retirees have to bring it in as requirement for staying on that visa. looks like it is changing from "for retirees" to "for holiday homes"... some of the requirements just too much |

|

|

Nov 3 2021, 10:36 AM Nov 3 2021, 10:36 AM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 2 2021, 11:10 PM) some of the stuff he post is ok ah... not all bs... just that almost every post makes it like he expert... and other people dumb dumb... hahahaanyways... this time I call his bs... I show my hand... hahaha  and my bank charge me spot rate...1/0.2394601 = 4.17606 live fx rate... but I choose Saturday since no trading to lock down this variable This post has been edited by dwRK: Nov 3 2021, 10:46 AM |

|

|

Nov 3 2021, 12:09 PM Nov 3 2021, 12:09 PM

|

Junior Member

451 posts Joined: Feb 2008 |

QUOTE(dwRK @ Nov 3 2021, 10:36 AM) some of the stuff he post is ok ah... not all bs... just that almost every post makes it like he expert... and other people dumb dumb... hahaha Thanks for sharing , which card are you using btw ?anyways... this time I call his bs... I show my hand... hahaha  and my bank charge me spot rate...1/0.2394601 = 4.17606 live fx rate... but I choose Saturday since no trading to lock down this variable |

|

|

Nov 3 2021, 01:58 PM Nov 3 2021, 01:58 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Nov 3 2021, 02:02 PM Nov 3 2021, 02:02 PM

|

Junior Member

451 posts Joined: Feb 2008 |

QUOTE(dwRK @ Nov 3 2021, 01:58 PM) visa debit which SG bank are you with ? & was it applied online / without been in SG ?as for the mark up... it depends on your bank and types of account... they will have a pdf that discloses all the fees I currently only have a CIMB SG account (open remotely via CIMB MY). Thanks. |

|

|

Nov 3 2021, 02:19 PM Nov 3 2021, 02:19 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Nov 3 2021, 02:30 PM Nov 3 2021, 02:30 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(mytrader @ Nov 3 2021, 02:02 PM) which SG bank are you with ? & was it applied online / without been in SG ? saw this for cimb sg atm card... I currently only have a CIMB SG account (open remotely via CIMB MY). Thanks. Local & Overseas Cash Withdrawal Enjoy zero service charge for overseas withdrawals with your CIMB ATM card at over 6,000 CIMB ATMs regionally and any PLUS ATM globally. Additional service fee, which may vary from bank to bank, may be imposed by the ATM bank that you use for the withdrawal. |

|

|

Nov 5 2021, 10:26 AM Nov 5 2021, 10:26 AM

|

Senior Member

1,604 posts Joined: Aug 2014 |

QUOTE(dwRK @ Nov 3 2021, 02:19 PM) Did you open a savings account, in Singapore branch of a US bank?Sigh, that will be out of reach for many of us here. Another method is to apply for BigPay Prepaid Card from BigPay Singapore. However, many of us cannot use this method, since we do not have residency status in Singapore. |

|

|

Nov 5 2021, 01:39 PM Nov 5 2021, 01:39 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(kart @ Nov 5 2021, 10:26 AM) Did you open a savings account, in Singapore branch of a US bank? no. des why I don't talk about it because useless info for most ppl hereSigh, that will be out of reach for many of us here. Another method is to apply for BigPay Prepaid Card from BigPay Singapore. However, many of us cannot use this method, since we do not have residency status in Singapore. I've looked high n low...and no way to open a foreign bank account anywhere because we don't meet conditions... there are crypto/fiat wallets and cards but fees are no good the only virtual bank ppl have had some success opening is N26 Bank... |

|

|

Nov 5 2021, 02:37 PM Nov 5 2021, 02:37 PM

Show posts by this member only | IPv6 | Post

#51

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(dwRK @ Nov 5 2021, 01:39 PM) I've looked high n low...and no way to open a foreign bank account anywhere because we don't meet conditions... there are crypto/fiat wallets and cards but fees are no good Agreed, I have look at plenty of virtual banks, basically no way to open account. Only way is fly to that country and open account. That also not confirm can get.the only virtual bank ppl have had some success opening is N26 Bank... This post has been edited by Ramjade: Nov 5 2021, 02:38 PM |

|

|

Nov 8 2021, 01:18 PM Nov 8 2021, 01:18 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Hansel liked this post

|

|

|

Nov 8 2021, 09:07 PM Nov 8 2021, 09:07 PM

|

Senior Member

9,363 posts Joined: Aug 2010 |

QUOTE(TOS @ Nov 8 2021, 01:18 PM) The terms in Mandarin is not so accurate, but what they said is right : Msia practises the Territorial-based Taxation System and should not be taxing at source. At most, things shld be with reference to 'Remittance Base (RB)'. This RB method is not new, there are already models out there. Msia just needs to replicate that for this ctry.If Msia starts to 'select' who gets what,... then becomes IRS ? Which ctry wants to implement Msia-styled W8-BEN ? Call it W8-MAT ??? |

|

|

Nov 8 2021, 09:23 PM Nov 8 2021, 09:23 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hansel @ Nov 8 2021, 09:07 PM) The terms in Mandarin is not so accurate, but what they said is right : Msia practises the Territorial-based Taxation System and should not be taxing at source. At most, things shld be with reference to 'Remittance Base (RB)'. This RB method is not new, there are already models out there. Msia just needs to replicate that for this ctry. https://www.thesundaily.my/business/how-is-...taxed-AB8535064If Msia starts to 'select' who gets what,... then becomes IRS ? Which ctry wants to implement Msia-styled W8-BEN ? Call it W8-MAT ??? So fast some tax consultants already can provide info... I think they are based on the older day laws. |

|

|

Nov 8 2021, 09:30 PM Nov 8 2021, 09:30 PM

|

Senior Member

1,152 posts Joined: Jun 2007 From: Kuala Lumpur |

The stupid thing with the LHDN income declaration form is that even if you have non-taxable source of funds (capital gains or profit distribution), putting it into any column of income will incur taxes.

|

|

|

Nov 8 2021, 09:39 PM Nov 8 2021, 09:39 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(TOS @ Nov 8 2021, 09:23 PM) https://www.thesundaily.my/business/how-is-...taxed-AB8535064 The problem and biggest hurdle need to reform the taxation laws as it is really outdated with those info by tax consultants So fast some tax consultants already can provide info... I think they are based on the older day laws. |

|

|

Nov 8 2021, 09:48 PM Nov 8 2021, 09:48 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 8 2021, 10:11 PM Nov 8 2021, 10:11 PM

|

Senior Member

1,152 posts Joined: Jun 2007 From: Kuala Lumpur |

QUOTE(TOS @ Nov 8 2021, 09:48 PM) Because there’s no column for non taxable income. TOS liked this post

|

|

|

Nov 8 2021, 10:35 PM Nov 8 2021, 10:35 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(kelvinlym @ Nov 8 2021, 10:11 PM) only need to declare taxable lah... non taxable why need to put? TOS liked this post

|

|

|

Nov 8 2021, 10:54 PM Nov 8 2021, 10:54 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 8 2021, 09:23 PM) https://www.thesundaily.my/business/how-is-...taxed-AB8535064 dun waste time n energy reading all these vis-a-vis the new law... they still writing it... everyone is just speculating... hahahaSo fast some tax consultants already can provide info... I think they are based on the older day laws. my simplistic view is... got foreign sourced kangtao... good lah... tax exempted until ye2021... enjoy while it last... TOS liked this post

|

|

|

Nov 8 2021, 11:35 PM Nov 8 2021, 11:35 PM

|

Senior Member

1,152 posts Joined: Jun 2007 From: Kuala Lumpur |

QUOTE(dwRK @ Nov 8 2021, 10:35 PM) I asked LHDN before on the phone and via email. They told me to declare. I already emphasised that I have funds coming from overseas but they are capital gains. I get some boiler plate answer. I called and same thing. Sumber kewangan yang tidak dikenakan cukai perlu dilaporkan. Ask where to put, they say put at lain-lain pendapatan. But put there will increase tax payable. Then I gave up. Anyone can give a clearer answer will be appreciated.That is why this is stupid. TOS liked this post

|

|

|

Nov 8 2021, 11:38 PM Nov 8 2021, 11:38 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

- (Wrong reading)

This post has been edited by TOS: Nov 8 2021, 11:45 PM |

|

|

Nov 9 2021, 12:13 AM Nov 9 2021, 12:13 AM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(kelvinlym @ Nov 8 2021, 11:35 PM) I asked LHDN before on the phone and via email. They told me to declare. I already emphasised that I have funds coming from overseas but they are capital gains. I get some boiler plate answer. I called and same thing. Sumber kewangan yang tidak dikenakan cukai perlu dilaporkan. Ask where to put, they say put at lain-lain pendapatan. But put there will increase tax payable. Then I gave up. Anyone can give a clearer answer will be appreciated. i c...stupid answer lahThat is why this is stupid. IRB told my mrs in a face to face meeting if non taxable no need to declare in ea form and submission... |

|

|

Nov 9 2021, 01:17 AM Nov 9 2021, 01:17 AM

|

Senior Member

1,152 posts Joined: Jun 2007 From: Kuala Lumpur |

QUOTE(dwRK @ Nov 9 2021, 12:13 AM) i c...stupid answer lah Yeah that’s why I keep all my investment statements properly so that it can be proven that those are capital gains and not from active income.IRB told my mrs in a face to face meeting if non taxable no need to declare in ea form and submission... |

|

|

Nov 9 2021, 01:16 PM Nov 9 2021, 01:16 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 10 2021, 11:43 AM Nov 10 2021, 11:43 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 10 2021, 07:23 PM Nov 10 2021, 07:23 PM

Show posts by this member only | IPv6 | Post

#67

|

Senior Member

2,106 posts Joined: Jul 2018 |

Mastercard set to launch Asia’s first crypto-linked cards that you can use anywhere

lets see if this works for us, no need remit back, put into this, spend in Malaysia? sounds too good to be true |

|

|

Nov 10 2021, 08:07 PM Nov 10 2021, 08:07 PM

Show posts by this member only | IPv6 | Post

#68

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(tadashi987 @ Nov 10 2021, 07:23 PM) Mastercard set to launch Asia’s first crypto-linked cards that you can use anywhere You do use crypto for paying. That's just silly.lets see if this works for us, no need remit back, put into this, spend in Malaysia? sounds too good to be true https://www.marketwatch.com/story/bitcoin-p...pto-11621714395 |

|

|

Nov 10 2021, 08:50 PM Nov 10 2021, 08:50 PM

Show posts by this member only | IPv6 | Post

#69

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(Ramjade @ Nov 10 2021, 08:07 PM) You do use crypto for paying. That's just silly. haha just sharing, ramjade got buy crypto?https://www.marketwatch.com/story/bitcoin-p...pto-11621714395 |

|

|

Nov 10 2021, 09:15 PM Nov 10 2021, 09:15 PM

Show posts by this member only | IPv6 | Post

#70

|

All Stars

24,433 posts Joined: Feb 2011 |

|

|

|

Nov 11 2021, 11:24 AM Nov 11 2021, 11:24 AM

Show posts by this member only | IPv6 | Post

#71

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Nov 11 2021, 01:53 PM Nov 11 2021, 01:53 PM

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

Nov 11 2021, 01:54 PM Nov 11 2021, 01:54 PM

Show posts by this member only | IPv6 | Post

#73

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Nov 11 2021, 04:15 PM Nov 11 2021, 04:15 PM

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

Nov 11 2021, 04:28 PM Nov 11 2021, 04:28 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 11 2021, 05:39 PM Nov 11 2021, 05:39 PM

Show posts by this member only | IPv6 | Post

#76

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Nov 12 2021, 08:52 AM Nov 12 2021, 08:52 AM

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Nov 12 2021, 03:52 PM Nov 12 2021, 03:52 PM

Show posts by this member only | IPv6 | Post

#78

|

All Stars

24,433 posts Joined: Feb 2011 |

|

|

|

Nov 13 2021, 02:54 AM Nov 13 2021, 02:54 AM

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

Nov 13 2021, 10:50 AM Nov 13 2021, 10:50 AM

Show posts by this member only | IPv6 | Post

#80

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(abcn1n @ Nov 13 2021, 02:54 AM) Borderless is the one where we can transfer foreign currency to RM right? If so, I also have and no invite for me too No. It's account where you can received and send foreign currency like a local in that country. You will even have a virtual bank account with your own account number. |

|

|

Nov 13 2021, 03:03 PM Nov 13 2021, 03:03 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Nov 13 2021, 03:50 PM Nov 13 2021, 03:50 PM

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(Ramjade @ Nov 13 2021, 10:50 AM) No. It's account where you can received and send foreign currency like a local in that country. You will even have a virtual bank account with your own account number. Ramjade Hmmm... I have some USD in my Wise account. And my USD has an account # (checking account). So I guess I have borderless? |

|

|

Nov 13 2021, 06:22 PM Nov 13 2021, 06:22 PM

Show posts by this member only | IPv6 | Post

#83

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(abcn1n @ Nov 13 2021, 03:50 PM) Ramjade Hmmm... I have some USD in my Wise account. And my USD has an account # (checking account). So I guess I have borderless? Most likely. But if you want to confirm, check and see if you have banks cciunt inside wise or not. If you can view your bank account, it is confirm you have borderless account. |

|

|

Nov 13 2021, 06:30 PM Nov 13 2021, 06:30 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

maxguy liked this post

|

|

|

Nov 13 2021, 08:56 PM Nov 13 2021, 08:56 PM

Show posts by this member only | IPv6 | Post

#85

|

Senior Member

9,363 posts Joined: Aug 2010 |

QUOTE(TOS @ Nov 13 2021, 06:30 PM) Initiative partially defeated ?? |

|

|

Nov 13 2021, 10:33 PM Nov 13 2021, 10:33 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Nov 14 2021, 12:09 PM Nov 14 2021, 12:09 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Nov 16 2021, 01:43 PM Nov 16 2021, 01:43 PM

|

Senior Member

2,222 posts Joined: Jan 2003 From: Penang |

Right now I have funds tied to a foreign equities (US) brokerage. I happen to have a SG bank multicurrency account. Would it make sense to just leave it all outside the country? I was thinking of just directing my profits to Singapore after I sell my US stocks instead of bringing it back

|

|

|

Nov 16 2021, 04:54 PM Nov 16 2021, 04:54 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(oe_kintaro @ Nov 16 2021, 01:43 PM) Right now I have funds tied to a foreign equities (US) brokerage. I happen to have a SG bank multicurrency account. Would it make sense to just leave it all outside the country? I was thinking of just directing my profits to Singapore after I sell my US stocks instead of bringing it back depends how much and what you need it for... unless you migrate, eventually excess you probably want it back...decision is move some now... or wait n hope the law changes in future in your favor |

|

|

Nov 16 2021, 07:03 PM Nov 16 2021, 07:03 PM

Show posts by this member only | IPv6 | Post

#90

|

Senior Member

2,222 posts Joined: Jan 2003 From: Penang |

QUOTE(dwRK @ Nov 16 2021, 04:54 PM) depends how much and what you need it for... unless you migrate, eventually excess you probably want it back... Don't really need in a hurry. Maybe I'll just leave it there for the time beingdecision is move some now... or wait n hope the law changes in future in your favor |

|

|

Nov 16 2021, 07:20 PM Nov 16 2021, 07:20 PM

Show posts by this member only | IPv6 | Post

#91

|

All Stars

17,025 posts Joined: Jan 2005 |

I have a foreign debit Visa card and if I take cash from ATM here, do I need to declare? or buy something here.

|

|

|

Nov 16 2021, 08:15 PM Nov 16 2021, 08:15 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

It's confirmed.

https://www.sinchew.com.my/20211116/%e7%a8%...8d%8a%e5%b9%b4/ https://phl.hasil.gov.my/pdf/pdfam/KM_LHDNM...LUAR_NEGARA.pdf 1st half of 2022 rate is 3%, no auditing done during that period. Another "article" https://www.theedgemarkets.com/article/look...nsourced-income This post has been edited by TOS: Nov 16 2021, 08:19 PM |

|

|

Nov 16 2021, 08:55 PM Nov 16 2021, 08:55 PM

Show posts by this member only | IPv6 | Post

#93

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(TOS @ Nov 16 2021, 08:15 PM) It's confirmed. Thanks. I am not remitting my money back. All the more reasons for me not to bring my money back to Malaysia.https://www.sinchew.com.my/20211116/%e7%a8%...8d%8a%e5%b9%b4/ https://phl.hasil.gov.my/pdf/pdfam/KM_LHDNM...LUAR_NEGARA.pdf 1st half of 2022 rate is 3%, no auditing done during that period. Another "article" https://www.theedgemarkets.com/article/look...nsourced-income elea88 now you can plan ahead. Hansel well bro, now it's confirm. For incoming remittance. This post has been edited by Ramjade: Nov 16 2021, 08:56 PM TOS liked this post

|

|

|

Nov 16 2021, 08:57 PM Nov 16 2021, 08:57 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 16 2021, 09:01 PM Nov 16 2021, 09:01 PM

Show posts by this member only | IPv6 | Post

#95

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(TOS @ Nov 16 2021, 08:57 PM) I found out that I don't need to depend on EPF or asnb anymore. I can generate basically min double what they give me every year without fail. Even more so know with my options.Actually asnb is good as in local income. But yoy declining is a "bad dividend counter". Lol. |

|

|

Nov 16 2021, 09:33 PM Nov 16 2021, 09:33 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

I'm happy to pay tax for new money that hasn't been taxed...

but force me to pay tax twice is too much lah... |

|

|

Nov 16 2021, 10:31 PM Nov 16 2021, 10:31 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(ozak @ Nov 16 2021, 07:20 PM) I have a foreign debit Visa card and if I take cash from ATM here, do I need to declare? or buy something here. atm cash is remittance lah in a waylocal purchases... imho can argue not remittance or money received locally... but who knows idiots at MOF what they thinking |

|

|

Nov 19 2021, 09:46 AM Nov 19 2021, 09:46 AM

|

Junior Member

177 posts Joined: Jun 2012 |

QUOTE(ozak @ Nov 16 2021, 07:20 PM) I have a foreign debit Visa card and if I take cash from ATM here, do I need to declare? or buy something here. QUOTE(dwRK @ Nov 16 2021, 10:31 PM) atm cash is remittance lah in a way I think shouldn't be an issue. I don't think they are able to enforce anything on foreign banks. I don't think we are able to trace the from the numerous foreign bank card ATM withdrawals here in Malaysia.local purchases... imho can argue not remittance or money received locally... but who knows idiots at MOF what they thinking |

|

|

Nov 19 2021, 10:01 AM Nov 19 2021, 10:01 AM

|

All Stars

17,025 posts Joined: Jan 2005 |

|

|

|

Nov 19 2021, 10:10 AM Nov 19 2021, 10:10 AM

|

Junior Member

177 posts Joined: Jun 2012 |

|

|

|

Nov 19 2021, 11:01 AM Nov 19 2021, 11:01 AM

|

All Stars

17,025 posts Joined: Jan 2005 |

QUOTE(wotvr @ Nov 19 2021, 10:10 AM) Not very sure for large amts like that. You may consider to check with a tax consultant. The foreign bank like those in SG might report your behavior to authorities in SG and MY. Over hundred k withdrawal is pretty small amount in US banks. Not worry at all. Of course, I can't get hundred K in ATM at 1 shot. It is over a yrs withdrawal. |

|

|

Nov 19 2021, 12:09 PM Nov 19 2021, 12:09 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(wotvr @ Nov 19 2021, 09:46 AM) I think shouldn't be an issue. I don't think they are able to enforce anything on foreign banks. I don't think we are able to trace the from the numerous foreign bank card ATM withdrawals here in Malaysia. it's up to you to report... IRB don't do any tracing... as long as you don't give them a reason to audit, don't kena random audit, if audit you lucky they don't ask for foreign bank statements, then can continue push your luck evading lor... just make sure nobody knows or nobody whistle blow you to IRB... hahaha |

|

|

Nov 19 2021, 12:35 PM Nov 19 2021, 12:35 PM

|

Junior Member

177 posts Joined: Jun 2012 |

QUOTE(dwRK @ Nov 19 2021, 12:09 PM) it's up to you to report... IRB don't do any tracing... Actually I just come across this article. as long as you don't give them a reason to audit, don't kena random audit, if audit you lucky they don't ask for foreign bank statements, then can continue push your luck evading lor... just make sure nobody knows or nobody whistle blow you to IRB... hahaha "IRB explained that after the expiration of the special programme, it would review and scrutinise the income information of Malaysian residents kept abroad received through tax information exchange agreements with other countries. “If based on the review, it is found that income kept abroad originating from Malaysia has not been declared, additional assessment can be raised along with penalties under the Income Tax Act 1967,” read the statement." https://www.theedgemarkets.com/article/irb-...ysian-residents |

|

|

Nov 19 2021, 01:57 PM Nov 19 2021, 01:57 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(dwRK @ Nov 19 2021, 12:09 PM) it's up to you to report... IRB don't do any tracing... as long as you don't give them a reason to audit, don't kena random audit, if audit you lucky they don't ask for foreign bank statements, then can continue push your luck evading lor... just make sure nobody knows or nobody whistle blow you to IRB... hahaha QUOTE(wotvr @ Nov 19 2021, 12:35 PM) Actually I just come across this article. said i don't want to play the luck game but to declare it on my own so as to be able to sleep tight, still, i don't get the HOW to declare LOL"IRB explained that after the expiration of the special programme, it would review and scrutinise the income information of Malaysian residents kept abroad received through tax information exchange agreements with other countries. “If based on the review, it is found that income kept abroad originating from Malaysia has not been declared, additional assessment can be raised along with penalties under the Income Tax Act 1967,” read the statement." https://www.theedgemarkets.com/article/irb-...ysian-residents we hold multiple counters overseas, US ones, SG ones, or even more, these counters declare special dividends/interim dividends et al., US ones are taxed with US withholdings tax, so mean no need to declare to Malaysia? SG ones e.g. SG REITs are not taxed, means need declare in Malaysia? The article sounds ridiculous on "it is found that income kept abroad originating from Malaysia has not been declared", are we all expected to be like professional tax consultants knowing up and down on how to declare? it sounds even more ridiculous the HOW has not been finalized, they already can't wait to have this special programme so to get everyone to remit back ASAP, looks really awkwardly desperate to me. This post has been edited by tadashi987: Nov 19 2021, 02:02 PM |

|

|

Nov 19 2021, 02:01 PM Nov 19 2021, 02:01 PM

Show posts by this member only | IPv6 | Post

#105

|

All Stars

12,287 posts Joined: Oct 2010 |

QUOTE(tadashi987 @ Nov 19 2021, 01:57 PM) said i don't want to play the luck game but to declare it on my own so as to be able to sleep tight, still, i don't get the HOW to declare LOL They ARE desperate. That is why they are flinging the wide tax net and firing all cylinders without clarity. That is the Bolih way. Tembak dulu.we hold multiple counters overseas, US ones, SG ones, or even more, these counters declare special dividends/interim dividends et al., US ones are taxed with WTH, so mean no need to declare to Malaysia? SG ones e.g. SG REITs are not taxed, means need declare in Malaysia? The article sounds ridiculous on "it is found that income kept abroad originating from Malaysia has not been declared", are we all expected to be like professional tax consultants knowing up and down on how to declare? it sounds even more ridiculous the HOW has not been finalized, they already can't wait to have this special programme so to get everyone to remit back ASAP, looks really awkwaredly desperate to me. |

|

|

Nov 19 2021, 03:55 PM Nov 19 2021, 03:55 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(tadashi987 @ Nov 19 2021, 01:57 PM) said i don't want to play the luck game but to declare it on my own so as to be able to sleep tight, still, i don't get the HOW to declare LOL our tax form got a box to fill up any other income... just put it there lor... it will follow your tax rate... des why 3% is incentive for ppl but for this 3% need to wait for sop... we hold multiple counters overseas, US ones, SG ones, or even more, these counters declare special dividends/interim dividends et al., US ones are taxed with US withholdings tax, so mean no need to declare to Malaysia? SG ones e.g. SG REITs are not taxed, means need declare in Malaysia? The article sounds ridiculous on "it is found that income kept abroad originating from Malaysia has not been declared", are we all expected to be like professional tax consultants knowing up and down on how to declare? it sounds even more ridiculous the HOW has not been finalized, they already can't wait to have this special programme so to get everyone to remit back ASAP, looks really awkwardly desperate to me. pay tax only when remit back... so you remit 10k... but 9k is capital/profit... 1k is dividend n interest... declare 1k as taxable, and keep the div statements as proof... obviously also keep the capital monies statements as proof as to div from US & SG... we got no tax treaty with US, so by right buta buta double tax...so need to wait n see how... |

|

|

Nov 19 2021, 04:16 PM Nov 19 2021, 04:16 PM

Show posts by this member only | IPv6 | Post

#107

|

Junior Member

465 posts Joined: Oct 2011 From: KL |

Oh no.... I just got myself an SG bank account, invested in SG reits, and planning to invest more in SG reits.

And now they gonna tax me, sigh, haiyaaaaaa Really hope they not gonna tax me when I am not remitting money back to Malaysia. |

|

|

Nov 19 2021, 05:11 PM Nov 19 2021, 05:11 PM

Show posts by this member only | IPv6 | Post

#108

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(dwRK @ Nov 19 2021, 03:55 PM) our tax form got a box to fill up any other income... just put it there lor... it will follow your tax rate... des why 3% is incentive for ppl but for this 3% need to wait for sop... Wait. If we never bring money back, need to fill up the section under other income?pay tax only when remit back... so you remit 10k... but 9k is capital/profit... 1k is dividend n interest... declare 1k as taxable, and keep the div statements as proof... obviously also keep the capital monies statements as proof as to div from US & SG... we got no tax treaty with US, so by right buta buta double tax...so need to wait n see how... Cause I understand it will only be taxed if we bring back. This post has been edited by Ramjade: Nov 19 2021, 05:11 PM |

|

|

Nov 19 2021, 05:56 PM Nov 19 2021, 05:56 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(Ramjade @ Nov 19 2021, 05:11 PM) Wait. If we never bring money back, need to fill up the section under other income? nope. don't fill if not bringing back foreign source income...Cause I understand it will only be taxed if we bring back. if bring back during the 3% grace period... IRB will likely issue another form to fill and to pay that tax |

|

|

Nov 19 2021, 10:42 PM Nov 19 2021, 10:42 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.sinchew.com.my/20211119/2022%e8...b7%9d%e7%a6%bb/

So if you remit back dividends there is a chance that you will be taxed. But he thinks capital gains not likely. He reminds everyone: Keep your documents! This post has been edited by TOS: Nov 19 2021, 10:43 PM |

|

|

Nov 20 2021, 08:44 AM Nov 20 2021, 08:44 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

donhay liked this post

|

|

|

Nov 20 2021, 09:42 AM Nov 20 2021, 09:42 AM

Show posts by this member only | IPv6 | Post

#112

|

Junior Member

650 posts Joined: Jun 2020 |

QUOTE(TOS @ Nov 20 2021, 08:44 AM) Glad to bring up this issue for the public’s awareness! |

|

|

Nov 22 2021, 01:02 PM Nov 22 2021, 01:02 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.sinchew.com.my/?p=3435256

Nothing new, just a Mandarin version of the LHDN press statement earlier. |

|

|

Nov 24 2021, 03:22 PM Nov 24 2021, 03:22 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.thesundaily.my/home/malaysia-sh...trend-AL8591301 QUOTE On the matter of taxation of foreign-sourced income introduced in the latest budget, he said that more detailed guidelines will be published prior to the implementation in 2022. “There may be some exemptions considered in the future, but the main principle behind it is not to subject any income to double taxation, if you have been taxed in another jurisdiction and you can bring it here,” he said. “As long as we don’t subject any income to additional taxation, the system is fair.” Ziet Inv liked this post

|

|

|

Nov 27 2021, 09:34 PM Nov 27 2021, 09:34 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 30 2021, 09:33 AM Nov 30 2021, 09:33 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

2021/2022 Malaysia Tax Booklet by PwC

https://www.pwc.com/my/en/publications/mtb.html This post has been edited by TOS: Nov 30 2021, 09:33 AM |

|

|

Dec 9 2021, 11:29 AM Dec 9 2021, 11:29 AM

Show posts by this member only | IPv6 | Post

#117

|

All Stars

24,433 posts Joined: Feb 2011 |

https://drive.google.com/file/d/1c0rWG2PHbr...Ep4cnKNT9zuAa2g TOS, Hansel, prophetjul, tadashi987, elea88 Govt goint to get access to bank account without notifying us before hand from my understanding. This post has been edited by Ramjade: Dec 9 2021, 11:32 AM TOS liked this post

|

|

|

Dec 9 2021, 12:49 PM Dec 9 2021, 12:49 PM

Show posts by this member only | IPv6 | Post

#118

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(Ramjade @ Dec 9 2021, 11:29 AM) https://drive.google.com/file/d/1c0rWG2PHbr...Ep4cnKNT9zuAa2g such BS from gomen TOS, Hansel, prophetjul, tadashi987, elea88 Govt goint to get access to bank account without notifying us before hand from my understanding. |

|

|

Dec 9 2021, 01:33 PM Dec 9 2021, 01:33 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(Ramjade @ Dec 9 2021, 11:29 AM) https://drive.google.com/file/d/1c0rWG2PHbr...Ep4cnKNT9zuAa2g IRB already doing it...TOS, Hansel, prophetjul, tadashi987, elea88 Govt goint to get access to bank account without notifying us before hand from my understanding. TOS liked this post

|

|

|

Dec 9 2021, 04:09 PM Dec 9 2021, 04:09 PM

|

Senior Member

4,174 posts Joined: Dec 2008 |

QUOTE(Ramjade @ Dec 9 2021, 11:29 AM) https://drive.google.com/file/d/1c0rWG2PHbr...Ep4cnKNT9zuAa2g yes they already accessed mine in year 2017. took me one year to submit all documents.TOS, Hansel, prophetjul, tadashi987, elea88 Govt goint to get access to bank account without notifying us before hand from my understanding. |

|

|

Dec 10 2021, 05:24 PM Dec 10 2021, 05:24 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Dec 10 2021, 09:57 PM Dec 10 2021, 09:57 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Ramjade @ Dec 9 2021, 11:29 AM) https://drive.google.com/file/d/1c0rWG2PHbr...Ep4cnKNT9zuAa2g It is reported in Sinchew today: https://www.sinchew.com.my/20211210/%e6%97%...9d%a1%e6%96%87/TOS, Hansel, prophetjul, tadashi987, elea88 Govt goint to get access to bank account without notifying us before hand from my understanding. |

|

|

Dec 10 2021, 10:09 PM Dec 10 2021, 10:09 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(TOS @ Dec 10 2021, 05:24 PM) nothing new... but I don't like the example 1 line of thinking... also no counter arguments... imho... foreign sourced income and foreign savings before 2022 should be tax free when repatriated... the taxable clock should only start on January 1 forward basis on new income... anyways... |

|

|

Dec 10 2021, 11:09 PM Dec 10 2021, 11:09 PM

Show posts by this member only | IPv6 | Post

#124

|

Senior Member

9,363 posts Joined: Aug 2010 |

So long as Msia does not adopt the Residential Taxation System, it is fine, meaning, we shld not be taxed if we don't remit back anything.

Them Knowing what we have overseas is no big deal if we are clean in our holdings and what we have have been earned in the right way. |

|

|

Dec 13 2021, 09:34 PM Dec 13 2021, 09:34 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.thestar.com.my/news/nation/2021...in-dewan-rakyat

Supply bill passed, still waiting for finance bill https://www.parlimen.gov.my/bills-dewan-rak...uweb=dr&lang=en |

|

|

Dec 14 2021, 12:24 PM Dec 14 2021, 12:24 PM

|

Senior Member

4,174 posts Joined: Dec 2008 |

QUOTE(Hansel @ Dec 10 2021, 11:09 PM) So long as Msia does not adopt the Residential Taxation System, it is fine, meaning, we shld not be taxed if we don't remit back anything. even if clean in holdings .. its a lot a lot alot....of paper work to justify xxxxxx amount for a certain year.Them Knowing what we have overseas is no big deal if we are clean in our holdings and what we have have been earned in the right way. unless like my friend portfolio year 2000 start invest with 3 banks.. reach 2021 also the 3 banks then easy to justify. but i like open one long street ac. take me almost 1 year to get clearance... so i also dunno moving forward how.. |

|

|

Dec 15 2021, 02:01 PM Dec 15 2021, 02:01 PM

|

Senior Member

9,363 posts Joined: Aug 2010 |

QUOTE(elea88 @ Dec 14 2021, 12:24 PM) even if clean in holdings .. its a lot a lot alot....of paper work to justify xxxxxx amount for a certain year. Sis,... if you don;t bring back or remit back,... no headache, right ? It becomes a headache IF YOU NEED TO BE ASSESSED on that foreign oncome even though you leave it all out there. Like the ATO,... international taxation,... then the problem starts.unless like my friend portfolio year 2000 start invest with 3 banks.. reach 2021 also the 3 banks then easy to justify. but i like open one long street ac. take me almost 1 year to get clearance... so i also dunno moving forward how.. But still there was a fella here once that displayed all his wealth in many threads,... and then suddenly disappeared when he was warned by another forummer. That big-mouth claimed that the Aussie ATO would still not tax him on his international income. So,... there is always a way, sis,.... call it tax-planning,.... |

|

|

Dec 15 2021, 02:45 PM Dec 15 2021, 02:45 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.sinchew.com.my/20211215/2021%e8...bc%b4%e7%a8%8e/

Finance bill 2021 passed. Deputy finance minister confirms that those who work in overseas like Singapore, if repatriate their income back to Malaysia, will need to pay tax in Malaysia. This post has been edited by TOS: Dec 15 2021, 02:48 PM |

|

|

Dec 15 2021, 03:33 PM Dec 15 2021, 03:33 PM

Show posts by this member only | IPv6 | Post

#129

|

All Stars

12,287 posts Joined: Oct 2010 |

QUOTE(TOS @ Dec 15 2021, 02:45 PM) https://www.sinchew.com.my/20211215/2021%e8...bc%b4%e7%a8%8e/ So similarly for those who work in UK, Aus, etc?Finance bill 2021 passed. Deputy finance minister confirms that those who work in overseas like Singapore, if repatriate their income back to Malaysia, will need to pay tax in Malaysia. |

|

|

Dec 15 2021, 03:39 PM Dec 15 2021, 03:39 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(prophetjul @ Dec 15 2021, 03:33 PM) No details given. I tried looking for news report on Google for the "past hour" and found nothing. But should be the case for "employment income". No details on tax on dividends/interests etc. Foreign pension fund savings like CPF repatriation still under consideration by MoF. |

|

|

Dec 15 2021, 03:51 PM Dec 15 2021, 03:51 PM

Show posts by this member only | IPv6 | Post

#131

|

All Stars

12,287 posts Joined: Oct 2010 |

QUOTE(TOS @ Dec 15 2021, 03:39 PM) No details given. I tried looking for news report on Google for the "past hour" and found nothing. Rather messy. But this is Malaysia.But should be the case for "employment income". No details on tax on dividends/interests etc. Foreign pension fund savings like CPF repatriation still under consideration by MoF. |

|

|

Dec 15 2021, 04:21 PM Dec 15 2021, 04:21 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(TOS @ Dec 15 2021, 02:45 PM) https://www.sinchew.com.my/20211215/2021%e8...bc%b4%e7%a8%8e/ wow it is a clusterf*ck considering the amounts of MY expats working in SGFinance bill 2021 passed. Deputy finance minister confirms that those who work in overseas like Singapore, if repatriate their income back to Malaysia, will need to pay tax in Malaysia. TOS liked this post

|

|

|

Dec 15 2021, 04:28 PM Dec 15 2021, 04:28 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

Foreign Sourced Income tax confirm passed liao? Means year 2022 any incoming funds to Malaysia that has profit will be taxed? follow our individual income tax bracket?

|

|

|

Dec 15 2021, 07:59 PM Dec 15 2021, 07:59 PM

|

Senior Member

9,363 posts Joined: Aug 2010 |

If you are classified as a Msian Tax Resident, then yes, the above repatriation will be assessed and then taxed. Whether from SG, or UK, etc,... all will be taxed. TOS liked this post

|

|

|

Dec 15 2021, 08:32 PM Dec 15 2021, 08:32 PM

Show posts by this member only | IPv6 | Post

#135

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Hansel @ Dec 15 2021, 07:59 PM) If you are classified as a Msian Tax Resident, then yes, the above repatriation will be assessed and then taxed. Whether from SG, or UK, etc,... all will be taxed. They will even check our bank accounts? Isn't that against bank privacy rules? Wah no privacy laws like that gov/LHDN can korek our bank accounts as they like. |

|

|

Dec 15 2021, 09:09 PM Dec 15 2021, 09:09 PM

Show posts by this member only | IPv6 | Post

#136

|

Senior Member

3,520 posts Joined: Jan 2003 |

^What he said.. Finance minister don't care just simply come out with this plan without seeking advise or providing clarity. |

|

|

Dec 15 2021, 10:25 PM Dec 15 2021, 10:25 PM

|

Senior Member

9,363 posts Joined: Aug 2010 |

QUOTE(Davidtcf @ Dec 15 2021, 08:32 PM) They will even check our bank accounts? Isn't that against bank privacy rules? Wah no privacy laws like that gov/LHDN can korek our bank accounts as they like. Yes,... they can start doing the 'korek' from next year without getting approval from us and the banks must cooperate with them.But frankly,... I believe they have always been doing this,... in a subtle way behind our back. |

|

|

Dec 15 2021, 10:40 PM Dec 15 2021, 10:40 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Davidtcf @ Dec 15 2021, 08:32 PM) They will even check our bank accounts? Isn't that against bank privacy rules? Wah no privacy laws like that gov/LHDN can korek our bank accounts as they like. Even if put money in overseas, AEOI will ensure exchange of bank accounts information. So if they can know your foreign assets, there is no reason they can't know your own onshore assets. Anyway, I will put less money in Malaysia, privacy reasons plus lack of investible assets. Hansel Can I hide my money in shares/brokerage accounts? I know they can check your money in foreign banks, but what if I hide them in my shares/bonds? Does the AEOI apply to brokers? |

|

|

Dec 16 2021, 12:06 AM Dec 16 2021, 12:06 AM

Show posts by this member only | IPv6 | Post

#139

|

Senior Member

2,406 posts Joined: Jul 2010 From: bandar Sunway |

QUOTE(TOS @ Dec 15 2021, 10:40 PM) Even if put money in overseas, AEOI will ensure exchange of bank accounts information. So if they can know your foreign assets, there is no reason they can't know your own onshore assets. You cannot hide AEOI applies to all financial institutions including broker firms.I need to fill in the AEOI form from my Australian and SGX brokerAnyway, I will put less money in Malaysia, privacy reasons plus lack of investible assets. Hansel Can I hide my money in shares/brokerage accounts? I know they can check your money in foreign banks, but what if I hide them in my shares/bonds? Does the AEOI apply to brokers? TOS liked this post

|

|

|

Dec 16 2021, 12:15 AM Dec 16 2021, 12:15 AM

|

Senior Member

4,174 posts Joined: Dec 2008 |

QUOTE(TOS @ Dec 15 2021, 10:40 PM) Even if put money in overseas, AEOI will ensure exchange of bank accounts information. So if they can know your foreign assets, there is no reason they can't know your own onshore assets. this one i can loudly answer a big YES!Anyway, I will put less money in Malaysia, privacy reasons plus lack of investible assets. Hansel Can I hide my money in shares/brokerage accounts? I know they can check your money in foreign banks, but what if I hide them in my shares/bonds? Does the AEOI apply to brokers? TOS liked this post

|

|

|

Dec 16 2021, 12:18 AM Dec 16 2021, 12:18 AM

|

Senior Member

4,174 posts Joined: Dec 2008 |

|

|

|

Dec 16 2021, 12:33 AM Dec 16 2021, 12:33 AM

Show posts by this member only | IPv6 | Post

#142

|

Senior Member

2,106 posts Joined: Jul 2018 |

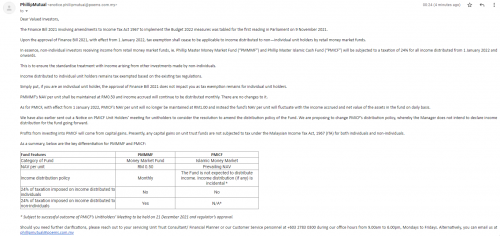

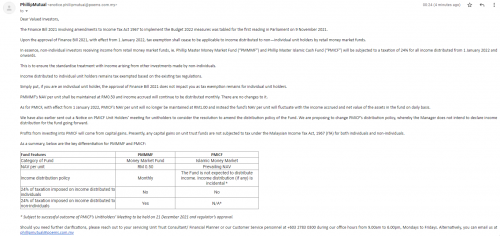

Received this mail from phillipmutual, for our gauge on the impact of proposed Finance Bill 2021 to Investors investing in their Money Market Fund (MMF)

DESCLAIMER: I do not know if the rule explained in the mail applied to other/all MMF or any other fund type beside MMF » Click to show Spoiler - click again to hide... «  |

|

|

Dec 16 2021, 01:42 AM Dec 16 2021, 01:42 AM

Show posts by this member only | IPv6 | Post

#143

|

All Stars

24,433 posts Joined: Feb 2011 |

QUOTE(TOS @ Dec 15 2021, 10:40 PM) Even if put money in overseas, AEOI will ensure exchange of bank accounts information. So if they can know your foreign assets, there is no reason they can't know your own onshore assets. You cannot hide if you are normal person. Why? All brokerage will ask for TIN. By asking for TIN that's your automatic tax exchange.Anyway, I will put less money in Malaysia, privacy reasons plus lack of investible assets. Hansel Can I hide my money in shares/brokerage accounts? I know they can check your money in foreign banks, but what if I hide them in my shares/bonds? Does the AEOI apply to brokers? Well unless you have private banking, able to do stuff like Jho Low then yes you can hide your money TOS liked this post

|

|

|

Dec 16 2021, 07:49 AM Dec 16 2021, 07:49 AM

Show posts by this member only | IPv6 | Post

#144

|

Senior Member

2,406 posts Joined: Jul 2010 From: bandar Sunway |

QUOTE(elea88 @ Dec 16 2021, 12:18 AM) Sorry it should be FATCA self certification of tax residency status https://www.dbs.com.sg/personal/deposits/ba...orting-standard |

|

|

Dec 16 2021, 08:55 AM Dec 16 2021, 08:55 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Thanks everyone. Got your points.

|

|

|

Dec 16 2021, 09:12 AM Dec 16 2021, 09:12 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE 15. Is income derived from outside Malaysia taxable? In general, income from employment should be taxable in the country where the services are performed regardless of the place where the contract is signed or where the remuneration is paid. However, from the Year of Assessment 2004, income received in Malaysia from outside Malaysia is tax exempt. Therefore, any income received by resident or non-resident taxpayers in Malaysia are taxable (Paragraph 28 (1), Schedule 6 of the Income Tax Act 1967). If you have worked abroad and the work carried out is related to the employment carried out in Malaysia, thus the employment income received will be taxable in Malaysia. Kindly log on to IRBM Official Portal, https://www.hasil.gov.my >> Legislation >> Public Ruling >> No.1/2011 – Taxation of Malaysian Employees Seconded Overseas for further information. https://www.hasil.gov.my/bt_goindex.php?bt_...=5000&bt_sequ=1 This page is updated on Dec. 13. Can't remember if this is a new addition. This is the public ruling paper: https://phl.hasil.gov.my/pdf/pdfam/PR1_2011.pdf |

|

|

Dec 16 2021, 09:41 AM Dec 16 2021, 09:41 AM

Show posts by this member only | IPv6 | Post

#147

|

Senior Member

3,520 posts Joined: Jan 2003 |

Confirm liao LHDN can check our bank accounts. And we won’t be informed about it:

https://www.thestar.com.my/news/nation/2021...=smartech#close Starting year 2022. |

|

|

Dec 16 2021, 09:46 AM Dec 16 2021, 09:46 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(tadashi987 @ Dec 16 2021, 12:33 AM) Received this mail from phillipmutual, for our gauge on the impact of proposed Finance Bill 2021 to Investors investing in their Money Market Fund (MMF) They didn't say anything on foreign dividends/interests for mutual funds/UTs that hold foreign shares/bonds?DESCLAIMER: I do not know if the rule explained in the mail applied to other/all MMF or any other fund type beside MMF » Click to show Spoiler - click again to hide... «  |

|

|

Dec 16 2021, 10:00 AM Dec 16 2021, 10:00 AM

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(TOS @ Dec 16 2021, 09:46 AM) They didn't say anything on foreign dividends/interests for mutual funds/UTs that hold foreign shares/bonds? nope they didn't, guess the details are still in speculations TOS liked this post

|

|

|

Dec 16 2021, 11:14 AM Dec 16 2021, 11:14 AM

|

Junior Member

489 posts Joined: Jun 2009 |

dont 4gt Finance Minister has power to give exemption

cant wait for black & white doc, what a very super last min works.... sigh |

|

|

Dec 16 2021, 02:49 PM Dec 16 2021, 02:49 PM

|

Senior Member

9,363 posts Joined: Aug 2010 |

Bros,... only individuals deemed to be able to pay higher taxes but NOT DOING SO will be pursued, there is no time to go after everybody ! So,... how do they decide who these individuals are ? You'll have to think like this. TOS liked this post

|

|

|

Dec 16 2021, 04:56 PM Dec 16 2021, 04:56 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Hansel @ Dec 16 2021, 02:49 PM) Bros,... only individuals deemed to be able to pay higher taxes but NOT DOING SO will be pursued, there is no time to go after everybody ! So,... how do they decide who these individuals are ? You'll have to think like this. if they really impose this.. i bet u many won't declare.. wait LHDN come after us haha if scare detection people might withdraw bit by bit. LHDN got time then come hunt us la. bring back money to spend in malaysia pay your SST and whatever tax still not enough? wanna make us poorer. If only your local bursa performing well 99% of us will invest locally instead! go make sure our local politicians not abusing money, rasuah all.. big fishes don't catch wanna make rakyat life miserable! This post has been edited by Davidtcf: Dec 16 2021, 04:58 PM Hansel liked this post

|

|

|

Dec 16 2021, 09:27 PM Dec 16 2021, 09:27 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Davidtcf @ Dec 16 2021, 09:41 AM) Confirm liao LHDN can check our bank accounts. And we won’t be informed about it: https://www.theedgemarkets.com/article/dont...%80%94-deloittehttps://www.thestar.com.my/news/nation/2021...=smartech#close Starting year 2022. They need "court order". If you can be informed of the "court order", I wonder why they need to amend the legislation, since asking the bank for details and asking court to approve via garnishee will still result in informing the person (owner of bank account). |

|

|

Dec 16 2021, 09:48 PM Dec 16 2021, 09:48 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(TOS @ Dec 16 2021, 09:27 PM) https://www.theedgemarkets.com/article/dont...%80%94-deloitte a garnishee order.... and ability to freely look and analyze your banking data are 2 different thingsThey need "court order". If you can be informed of the "court order", I wonder why they need to amend the legislation, since asking the bank for details and asking court to approve via garnishee will still result in informing the person (owner of bank account). actually I prefer that they can get access to it themselves... so I don't have to request and pay the banks to print prior years' statements... lol This post has been edited by dwRK: Dec 16 2021, 09:48 PM TOS liked this post

|

|

|

Dec 16 2021, 10:30 PM Dec 16 2021, 10:30 PM

|

Junior Member

501 posts Joined: Apr 2020 |

|

|

|

Dec 16 2021, 11:50 PM Dec 16 2021, 11:50 PM

Show posts by this member only | IPv6 | Post

#156

|

All Stars

24,433 posts Joined: Feb 2011 |

|

|

|

Dec 20 2021, 03:44 PM Dec 20 2021, 03:44 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Dec 21 2021, 09:29 AM Dec 21 2021, 09:29 AM

|

Senior Member

2,106 posts Joined: Jul 2018 |