Do take into consideration that there are high chances of premium increase every few years.... For the medical plans.

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Jun 29 2021, 10:39 AM Jun 29 2021, 10:39 AM

Show posts by this member only | IPv6 | Post

#781

|

Senior Member

8,188 posts Joined: Apr 2013 |

Do take into consideration that there are high chances of premium increase every few years.... For the medical plans.

|

|

|

|

|

|

Jul 1 2021, 01:37 PM Jul 1 2021, 01:37 PM

|

Junior Member

57 posts Joined: Jul 2012 |

Hi sifus,

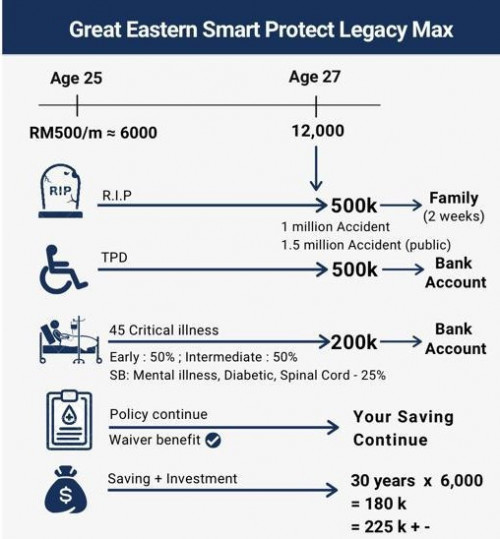

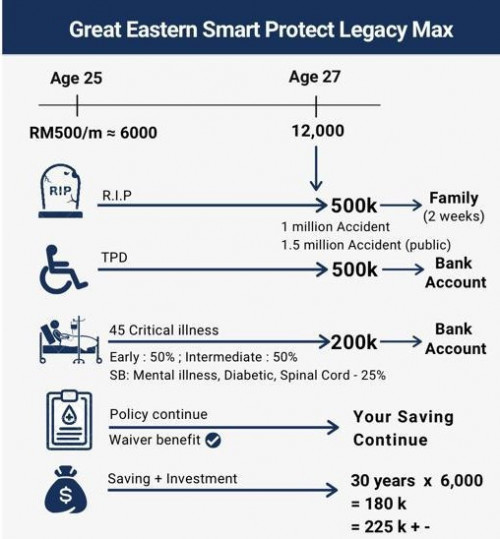

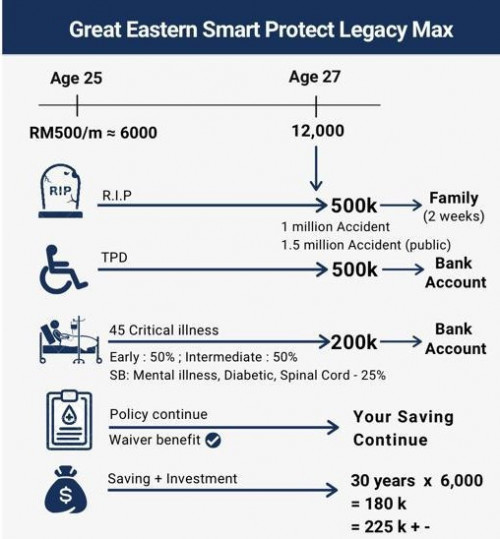

I was approached by an old friend (lol) who's a GE agent. Was introduced to the SmartProtect Legacy Max. My friend sent me a quote as per the photo below: - Assuming I'll be paying RM 500/month - Pay for 30 years  I'm 25 this year, non-smoker. I already have my own medical card (RM 300/month coverage 1.5 million with AIA) - was just wondering if this plan is ok or should I just politely decline my friend. I would really appreciate any expert opinions as I'm not so well versed with ILPs. Thank you |

|

|

Jul 1 2021, 01:45 PM Jul 1 2021, 01:45 PM

Show posts by this member only | IPv6 | Post

#783

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(magicnox @ Jul 1 2021, 01:37 PM) ................. I'm 25 this year, non-smoker. I already have my own medical card (RM 300/month coverage 1.5 million with AIA) - was just wondering if this plan is ok or should I just politely decline my friend. I would really appreciate any expert opinions as I'm not so well versed with ILPs. Thank you This post has been edited by MUM: Jul 1 2021, 01:47 PM |

|

|

Jul 1 2021, 01:47 PM Jul 1 2021, 01:47 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(magicnox @ Jul 1 2021, 01:37 PM) Hi sifus, Ask yourself this questionI was approached by an old friend (lol) who's a GE agent. Was introduced to the SmartProtect Legacy Max. My friend sent me a quote as per the photo below: - Assuming I'll be paying RM 500/month - Pay for 30 years  I'm 25 this year, non-smoker. I already have my own medical card (RM 300/month coverage 1.5 million with AIA) - was just wondering if this plan is ok or should I just politely decline my friend. I would really appreciate any expert opinions as I'm not so well versed with ILPs. Thank you 1. Why do you need such coverage in the first place? 2. Is this necessary? 3. What was discussed that bring upon 500k as the sum assured ? 4. What are you not sure about ILP ? 5. I can't comment whether this is for you or not if I don't even know you & your personal finances. [It's akin to asking me to prescribe you a medicine without even doing a diagnosis/consultation] This post has been edited by lifebalance: Jul 1 2021, 01:48 PM |

|

|

Jul 1 2021, 02:03 PM Jul 1 2021, 02:03 PM

|

Junior Member

57 posts Joined: Jul 2012 |

QUOTE(MUM @ Jul 1 2021, 01:45 PM) I don't think I need this coverage since I already have my medical card... This post has been edited by magicnox: Jul 1 2021, 02:04 PM |

|

|

Jul 1 2021, 02:07 PM Jul 1 2021, 02:07 PM

Show posts by this member only | IPv6 | Post

#786

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(magicnox @ Jul 1 2021, 02:03 PM) My current commitment is pretty ok in general - only paying for medical card and PTPTN loan at the moment. No car loans or rent as I'm staying with my parents. I'm able to save about 50% of my salary? I don't think I need this coverage since I already have my medical card... then just learn to say "NO" and contentment of "enough is enough" there are better uses of that 50% of your monthly saving than getting something with super long commitment on something that you had already had enough magicnox liked this post

|

|

|

|

|

|

Jul 1 2021, 02:18 PM Jul 1 2021, 02:18 PM

|

Junior Member

57 posts Joined: Jul 2012 |

QUOTE(lifebalance @ Jul 1 2021, 01:47 PM) Ask yourself this question Ask yourself this question1. Why do you need such coverage in the first place? 2. Is this necessary? 3. What was discussed that bring upon 500k as the sum assured ? 4. What are you not sure about ILP ? 5. I can't comment whether this is for you or not if I don't even know you & your personal finances. [It's akin to asking me to prescribe you a medicine without even doing a diagnosis/consultation] 1. Why do you need such coverage in the first place? What attracted me was the fact that at least my family can get a certain amount in case anything happens (touch wood) 2. Is this necessary? At the moment...no. In a few years, maybe - especially when I settle down and have a family. 3. What was discussed that bring upon 500k as the sum assured ? According to the agent 500k is the sum insured, he did not really explain why but he mentioned that for accidental death it's x2 (1million) if accidental death via public conveyance x3 (1.5 million) 4. What are you not sure about ILP? Probably part of me doubts if it's really worth it in the long run....returns and all. Also thinking about my future lol 5. I can't comment whether this is for you or not if I don't even know you & your personal finances. [It's akin to asking me to prescribe you a medicine without even doing a diagnosis/consultation] This is true...my personal finances are generally ok at the moment. Currently living with my parents, only paying for ptptn loan & medical card. I help with my parents' utility bills as well. No car or house loan at the moment (I'd like to keep it that way for now lol) overall I am still able to save about 50% of my current salary This post has been edited by magicnox: Jul 1 2021, 02:19 PM |

|

|

Jul 1 2021, 02:18 PM Jul 1 2021, 02:18 PM

Show posts by this member only | IPv6 | Post

#788

|

Junior Member

685 posts Joined: Jul 2012 From: Kuala Lumpur |

QUOTE(magicnox @ Jul 1 2021, 01:37 PM) Hi sifus, Basically this is a Life and CI plan. Life is for death and CI payout as income replacement. I was approached by an old friend (lol) who's a GE agent. Was introduced to the SmartProtect Legacy Max. My friend sent me a quote as per the photo below: - Assuming I'll be paying RM 500/month - Pay for 30 years  I'm 25 this year, non-smoker. I already have my own medical card (RM 300/month coverage 1.5 million with AIA) - was just wondering if this plan is ok or should I just politely decline my friend. I would really appreciate any expert opinions as I'm not so well versed with ILPs. Thank you High life coverage is needed in the event of acquired new house loan? new addition of member (baby) or some money for old age parents if the Death happen. Critical illness is an income replacement in the event any 45 types of CI happen and unable to back to work for the next 3-5 years. No right or wrong to pick this policy just have a look into the you own needs. ultimately insurance is a risk transfer tool. Just wondering ur AIA 300/m with 1.5mil coverage is for life coverage or annual medical limit? If medical limit then is for hospitalization claim only. |

|

|

Jul 1 2021, 02:23 PM Jul 1 2021, 02:23 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(magicnox @ Jul 1 2021, 02:18 PM) Ask yourself this question If you're looking to enhance it, probably the area you'd like to look into is Critical Illness/Disabilities since you don't have much debt beside the PTPTN but you might want to have some income replacement in the event you're disabled or critically ill.1. Why do you need such coverage in the first place? What attracted me was the fact that at least my family can get a certain amount in case anything happens (touch wood) 2. Is this necessary? At the moment...no. In a few years, maybe - especially when I settle down and have a family. 3. What was discussed that bring upon 500k as the sum assured ? According to the agent 500k is the sum insured, he did not really explain why but he mentioned that for accidental death it's x2 (1million) if accidental death via public conveyance x3 (1.5 million) 4. What are you not sure about ILP? Probably part of me doubts if it's really worth it in the long run....returns and all. Also thinking about my future lol 5. I can't comment whether this is for you or not if I don't even know you & your personal finances. [It's akin to asking me to prescribe you a medicine without even doing a diagnosis/consultation] This is true...my personal finances are generally ok at the moment. Currently living with my parents, only paying for ptptn loan & medical card. I help with my parents' utility bills as well. No car or house loan at the moment (I'd like to keep it that way for now lol) overall I am still able to save about 50% of my current salary Since you do have monthly surplus, it's advisable to invest the money. I'd recommend you to perform Financial Health Check for you to understand what you can better with your finances. This post has been edited by lifebalance: Jul 1 2021, 02:26 PM magicnox liked this post

|

|

|

Jul 1 2021, 02:26 PM Jul 1 2021, 02:26 PM

|

Junior Member

57 posts Joined: Jul 2012 |

QUOTE(Ewa Wa @ Jul 1 2021, 02:18 PM) Basically this is a Life and CI plan. Life is for death and CI payout as income replacement. Thanks for the explanation High life coverage is needed in the event of acquired new house loan? new addition of member (baby) or some money for old age parents if the Death happen. Critical illness is an income replacement in the event any 45 types of CI happen and unable to back to work for the next 3-5 years. No right or wrong to pick this policy just have a look into the you own needs. ultimately insurance is a risk transfer tool. Just wondering ur AIA 300/m with 1.5mil coverage is for life coverage or annual medical limit? If medical limit then is for hospitalization claim only. 1.5mil for annual medical limit, and my AIA plan also includes CI (100k), Personal Accident, Disability benefit (100k) This post has been edited by magicnox: Jul 1 2021, 02:27 PM |

|

|

Jul 1 2021, 03:55 PM Jul 1 2021, 03:55 PM

Show posts by this member only | IPv6 | Post

#791

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(magicnox @ Jul 1 2021, 01:37 PM) » Click to show Spoiler - click again to hide... « |

|

|

Jul 1 2021, 04:03 PM Jul 1 2021, 04:03 PM

|

Probation

15 posts Joined: Dec 2019 |

QUOTE(ckdenion @ Jun 25 2021, 05:55 PM) for this case. lets say you have: Dear ckdenion, sorry I still confuse about the admission process of option A, could you pls help me clarify? company medical insurance 70k annual limit with no deductible own medical insurance with 20k deductible Note: Assuming 80k is the claimable portion you can either: Option A: use company insurance to claim the 70k, then the balance 10k claim from your own medical insurance (20k deductible already borne by company medical insurance) Option B: you pay the hospital bill of 80k, then claim from own medical insurance 60k, the balance 20k claim from company insurance. in this case, Option A is a better option to go for. Scenario 2: Hospital Bill: 30k (claimable) company medical insurance 70k annual limit with no deductible own medical insurance with 20k deductible you can claim this 30k bill fully from your company medical insurance. then on that policy year of your own medical insurance, the deductible of 20k is already exceeded (have to submit the 30k claim details to your own medical insurer), so whatever subsequent bill you can claim from your own medical insurance (for that policy year only). on the next policy year then the deductible will reset again. Is it I use the company medical card to issue GL first, then when reach 70k, I request the hospital to separate bill, then I call my own insurance to issue GL, then claim the subsequent 10k on own medical card? |

|

|

Jul 1 2021, 04:35 PM Jul 1 2021, 04:35 PM

|

Junior Member

474 posts Joined: Mar 2011 From: Kuala Lumpur |

QUOTE(magicnox @ Jul 1 2021, 02:03 PM) My current commitment is pretty ok in general - only paying for medical card and PTPTN loan at the moment. No car loans or rent as I'm staying with my parents, I help pay for the utility bills at home too but I'm able to save about 50% of my salary? If you are looking for anything, it should be to enhance or close any gaps of your current and future insurance needs. A review with your Life Planner would be a good point to start. I don't think I need this coverage since I already have my medical card... You can consider to add to your existing policy for any shortfalls, as you are already commiting a significant amount as premium. Given both are investment linked products, you may also want to checkout the projected Cash Value at selected age, say 60,70 or 80 or maturity. |

|

|

|

|

|

Jul 1 2021, 05:11 PM Jul 1 2021, 05:11 PM

Show posts by this member only | IPv6 | Post

#794

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(grace_ong @ Jul 1 2021, 04:03 PM) Dear ckdenion, sorry I still confuse about the admission process of option A, could you pls help me clarify? hi grace, i just use the scenario stated here.Is it I use the company medical card to issue GL first, then when reach 70k, I request the hospital to separate bill, then I call my own insurance to issue GL, then claim the subsequent 10k on own medical card? when you use company medical card to do admission with GL, meaning to say that medical card settle 70k of your bill (annual limit 70k). upon discharge, hospital will ask you to pay the balance here which is the RM10k. so you left the hospital with the Final GL (issued by your company medical insurance) and together with the total receipt of RM80k. you then file this to your personal medical insurance. your personal medical insurance will then reimburse you back the RM10k. so how this works is the final GL issued by your company medical insurance will state how much is covered by them and how much balance is actually paid by you. so when you submit the receipt issued by the hospital together with the final GL, your personal medical insurance will tally the receipt together with the final GL. grace_ong liked this post

|

|

|

Jul 1 2021, 05:18 PM Jul 1 2021, 05:18 PM

Show posts by this member only | IPv6 | Post

#795

|

Junior Member

685 posts Joined: Jul 2012 From: Kuala Lumpur |

QUOTE(grace_ong @ Jul 1 2021, 04:03 PM) Dear ckdenion, sorry I still confuse about the admission process of option A, could you pls help me clarify? Do check with those insurance company that offer high deductible amount can issue GL? Some unable to issue GL and based on reimbursement. If unable to issue GL then u might fork out the balance 1st. Is it I use the company medical card to issue GL first, then when reach 70k, I request the hospital to separate bill, then I call my own insurance to issue GL, then claim the subsequent 10k on own medical card? In my experience, my customer issued 2 times GL (company and personal) but his personal card without any deductible amount. grace_ong liked this post

|

|

|

Jul 1 2021, 05:18 PM Jul 1 2021, 05:18 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(grace_ong @ Jul 1 2021, 04:03 PM) Dear ckdenion, sorry I still confuse about the admission process of option A, could you pls help me clarify? No, you don't request a separate bill with the Hospital.Is it I use the company medical card to issue GL first, then when reach 70k, I request the hospital to separate bill, then I call my own insurance to issue GL, then claim the subsequent 10k on own medical card? To simplify it. Total bill 80k Your company MC annual limit is 70k Your personal MC annual limit is 100k (Example) The first 70k is claimed under your Company MC The balance 10k will be paid by you (since the Company MC can only cover up to 70k) You file back a reimbursement claim with your personal MC for the 10k that you've paid. grace_ong liked this post

|

|

|

Jul 1 2021, 05:22 PM Jul 1 2021, 05:22 PM

Show posts by this member only | IPv6 | Post

#797

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(Ewa Wa @ Jul 1 2021, 05:18 PM) Do check with those insurance company that offer high deductible amount can issue GL? Some unable to issue GL and based on reimbursement. If unable to issue GL then u might fork out the balance 1st. yes Ewa, you are right. it depends on situation. if it is still under deductible, GL cant be issue. if still within that same rider year and already passed the deductible amount, then yes GL can be issued. this is for medical card with deductible amount. really need to use example to elaborate because this deductible thing is kinda confusing.In my experience, my customer issued 2 times GL (company and personal) but his personal card without any deductible amount. grace_ong liked this post

|

|

|

Jul 1 2021, 06:26 PM Jul 1 2021, 06:26 PM

|

Probation

15 posts Joined: Dec 2019 |

QUOTE(lifebalance @ Jul 1 2021, 05:18 PM) No, you don't request a separate bill with the Hospital. Let say if my personal card deductible is RM20k pruValue Med (currently considering, can this issue GL?)To simplify it. Total bill 80k Your company MC annual limit is 70k Your personal MC annual limit is 100k (Example) The first 70k is claimed under your Company MC The balance 10k will be paid by you (since the Company MC can only cover up to 70k) You file back a reimbursement claim with your personal MC for the 10k that you've paid. Can I use personal card to issue GL first, then I pay the 20k first, and then claim the 20k from company insurance with the bill, receipt and final GL? So must one card pay and reimburse? Cannot totally cashless admission if want to use company insurance to support a deductible card izit? |

|

|

Jul 1 2021, 07:05 PM Jul 1 2021, 07:05 PM

Show posts by this member only | IPv6 | Post

#799

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(grace_ong @ Jul 1 2021, 06:26 PM) Let say if my personal card deductible is RM20k pruValue Med (currently considering, can this issue GL?) ok grace i give you 2 scenarios:Can I use personal card to issue GL first, then I pay the 20k first, and then claim the 20k from company insurance with the bill, receipt and final GL? So must one card pay and reimburse? Cannot totally cashless admission if want to use company insurance to support a deductible card izit? Scenario 1: this is the first claim using your card (meaning it still have 20k deductible) in this case, when you admit to hospital, GL wont be issue. you have to pay everything then do reimbursement claim. say if the claimable bill is 50k, you have to pay the 50k first. submit this 50k bill to insurance company, then company will reimburse you back 30k (20k deductible is paid by you or could be other insurer) Scenario 2: say you have already claim the 20k deductible during that rider year OR say this is a 2nd claim followed by Scenario 1 since the 20k deductible during that rider year is already claimed due to previous admission, the next admission you can use this medical card already and GL will be issued. so whatever bill incurred will be paid by the insurance company to the hospital subjected to your plan's annual limit. grace_ong liked this post

|

|

|

Jul 1 2021, 07:12 PM Jul 1 2021, 07:12 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(grace_ong @ Jul 1 2021, 06:26 PM) Let say if my personal card deductible is RM20k pruValue Med (currently considering, can this issue GL?) I don't think your issue of understanding is on the deductible. Rather your main issue is "you want to have a claims under one roof" which means you don't want to deal with paperworks for reimbursement. Can I use personal card to issue GL first, then I pay the 20k first, and then claim the 20k from company insurance with the bill, receipt and final GL? So must one card pay and reimburse? Cannot totally cashless admission if want to use company insurance to support a deductible card izit? In this case, you should opt for non deductible plans. grace_ong liked this post

|

| Change to: |  0.0293sec 0.0293sec

0.51 0.51

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 05:15 AM |