Just me thinking out loud.

Info given: insuree is 20 years old, healthy, ILP premium is RM3K yearly, and the surrender/investment value is above RM50K.

Since it’s an old ILP from 2005, I suspect the medical coverage is relatively low — probably around RM100K per year for hospitalization.

Can share if this is the case? if yes, then insuree seriously should add more coverage given his/her age of just 20.

Here’s a few potential paths forward:

Option A:

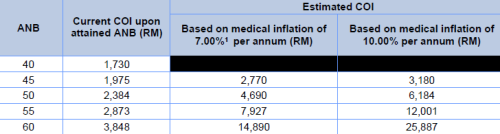

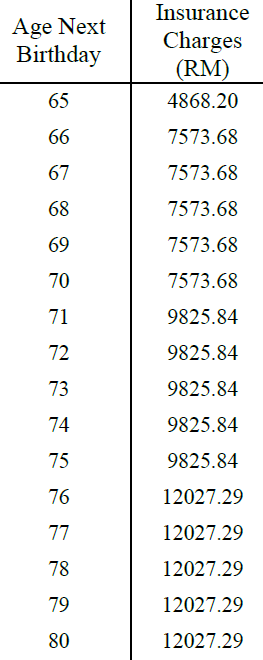

Keep the ILP, but stop paying premiums. Let the policy auto-deduct the medical portion from the existing investment units. Rough estimate — RM50K ÷ RM1.8K per year = ~25 years of potential coverage (assuming charges don’t spike).

Meanwhile, get a new medical card from another insurer (important — don’t overlap within the same company). Go for one with a higher deductible to reduce cost, but aim for at least RM1.5–2 million annual limit. Premiums can be quite reasonable — likely below RM250/month.

Option B:

Ask the current insurer whether the existing policy can be upgraded to higher annual coverage (1.5–2 million).

Option C:

If upgrading isn’t possible, take a new policy elsewhere. Once that’s active and past the waiting period (to be safe, wait 1 year), then consider terminating the old ILP and get the 50K rm.

QUOTE(numbertwo @ Oct 22 2025, 05:51 PM)

Hi all

Back in the old days i was pretty active in joining all sort of Medical card related discussion in LYN. For whatever reasons which I could no longer recall, I bought an ILP for my dd 20 years ago, now i'm at the junction to decide whether to continue or to part with the ILP and get my dd to purchase a standalone medical card.

FYI.

I pay 3K/pa for this ILP - Assuming 20 years straight of paying 3K, i have paid the insurance co. 60K by now.

Total fund value now is over 50K.

Not too bad as a whole if I can still get back 50K assuming not much chargers if I were to surrender the ILP now.

As i have left the topic for so many years, many medical product may have surfaced since then, hence I would like to hear some comments, recommendations, etc.

Tks all.

a throwback of one of my chit-chat in this topic back in 2009......

Oct 22 2025, 06:15 PM

Oct 22 2025, 06:15 PM

Quote

Quote

0.0166sec

0.0166sec

0.71

0.71

6 queries

6 queries

GZIP Disabled

GZIP Disabled