QUOTE(Katrinah @ Jan 16 2024, 07:56 PM)

I've also been relooking on my insurance based on all the good sharing here.

For pure life insurance, you can consider FWD Takaful which is level term (https://www.fwd.com.my/direct/protect-direct/), so far found this to be cheapest.

Another level term life is Tokio Marine Term Defender. This is quoted in Fi.Life too, if you clicked on the "prefer Level term".

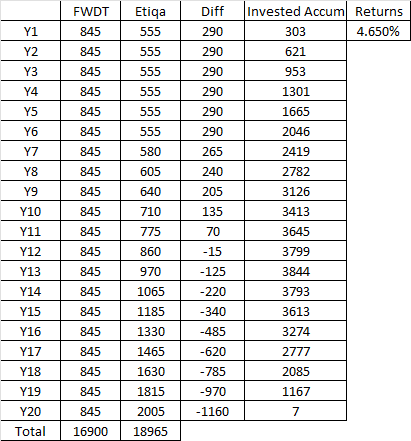

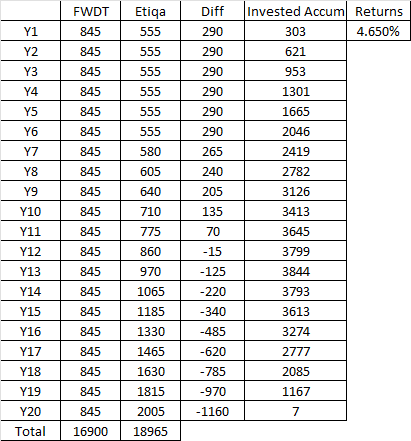

I just did some projection for a 20Y policy comparison between FWD Takaful level premium term insurance vs Etiqa increasing premium life insurance.

To match the level premium using time value of money approach, the premiums saved in the initial years from the increasing premium has to be invested at 4.65%. Meaning to say, if you are certain you can get returns above 4.65% on the saved premiums, then the level premium term insurance might not be the best idea.

Overall, now that I've run the numbers, I actually think it's a good deal with obvious drawbacks of level term insurance being as follows:

1. Early termination of such a policy is at your loss as you overpay in the earlier years.

2. You have to be very sure about the policy term at the point of purchase, as a 30Y term life will cost significantly more than a 20Y term life and you have to commit to it for the entire duration.

3. You will not have much flexibility and lock yourself into a multi-decade contract.

Projection for 30M with coverage at RM500k:

Edit: I don't understand how FDW Takaful has got such competitive rates! Great Eastern's increasing premium direct life insurance (purchased from their website) already starts in 4 figures and keep rising!

This post has been edited by contestchris: Jan 16 2024, 08:38 PM

This post has been edited by contestchris: Jan 16 2024, 08:38 PM

Jan 16 2024, 06:01 PM

Jan 16 2024, 06:01 PM

Quote

Quote

0.0260sec

0.0260sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled