QUOTE(perseides @ Jul 17 2024, 11:27 PM)

Yeap, I was inaccurate. The current plan is SPE3 + SMM-200-D + SMMES + IL PWE.

Now the suggested plan is SPY + PWE + SMS 250- D + SMSE + SMSDAL - 250.

My alarm went off when he said the new plan is cheaper, ie higher coverage with same premium.

Okay, so the new plan being proposed is

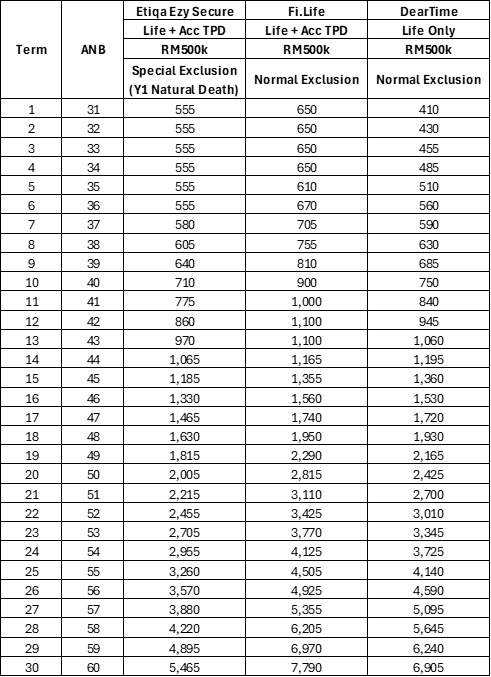

superior to the old plan, assuming nothing changes. Bear in mind, SMM is also a newer medical card, there is no loss spiral issue there, yet. Plus your old R&B limit is RM200, new is RM250. SMM and SMS are largely otherwise similar.

Given that, it is absolutely

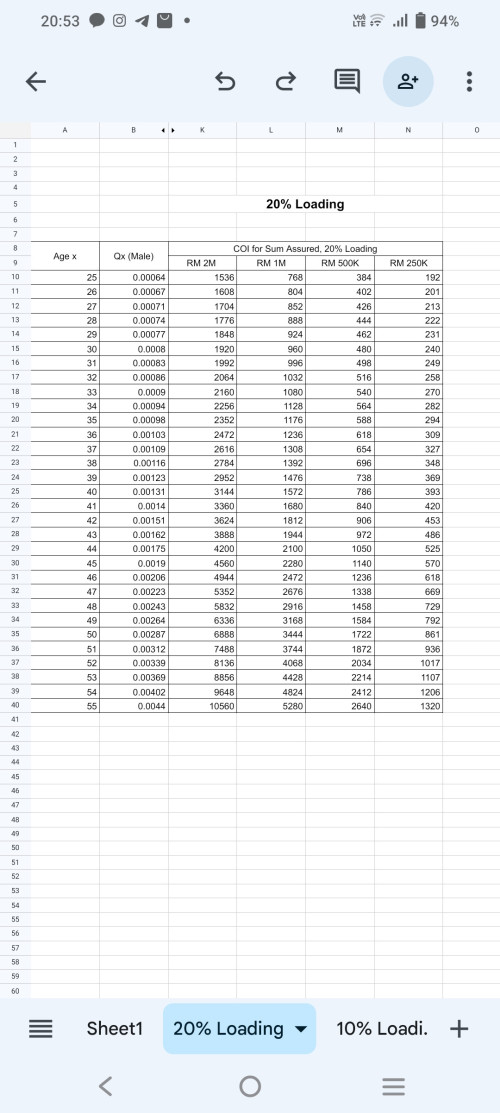

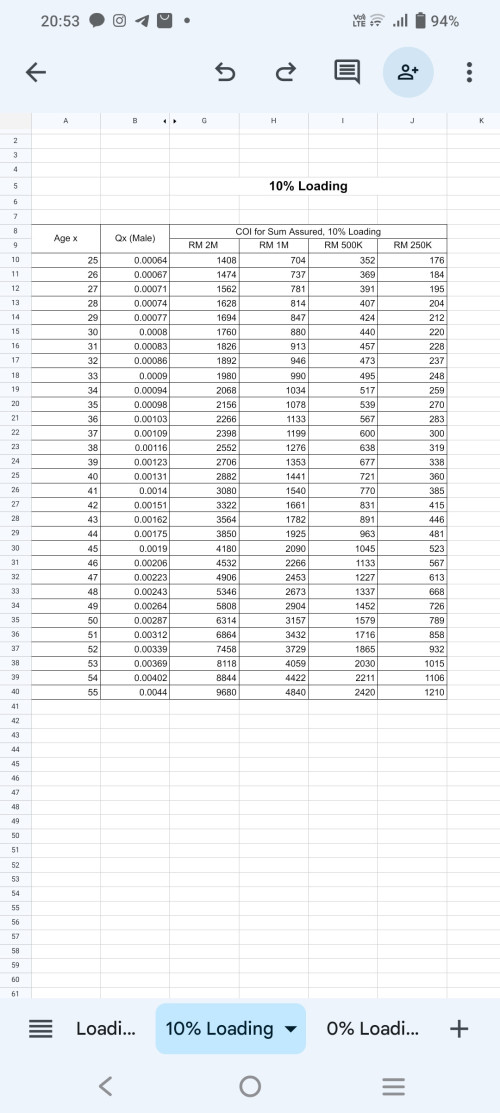

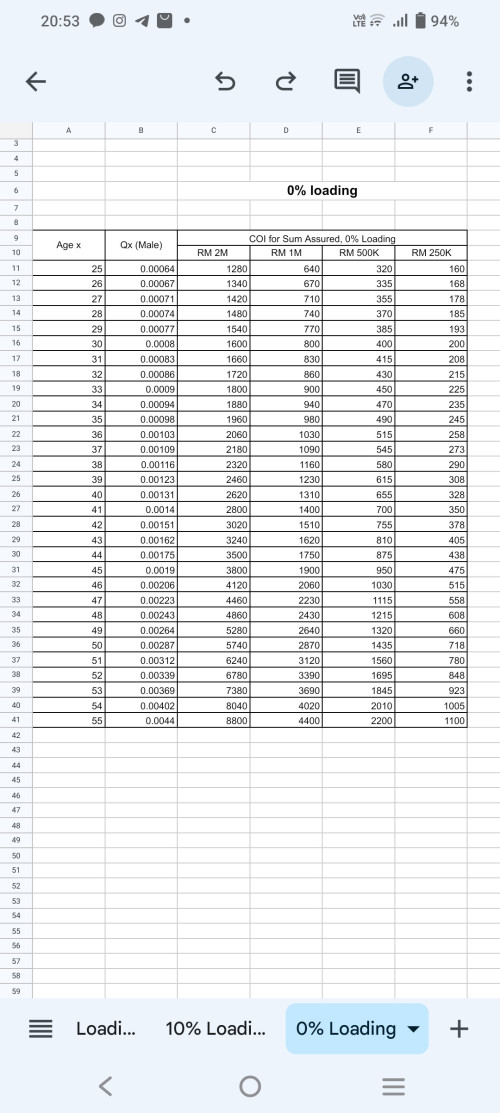

not possible for the new plan to be cheaper than the older plan, given that the new medical rider's insurance charges is higher (e.g. at age 31-35 Male, SMS-250-D costs RM976 while SMM-200-D costs RM864), and also your older entry age. Plus you will need to pay the high distribution + management expenses in your initial years, where your allocation rate will be low.

1. How much is your current plan's monthly premium and what is the new plan's monthly premium?

2. What is the basic plan's Death/TPD coverage for both old and new plans?

3. What is the coverage term for the basic plan and also the medical rider?

4. What is the target sustainability period for the new plan vs the old plan?

Might I just suggest to upgrade SMM-200-D and SMME to SMS-250-D and SMSE? You will not need to lose out on paying the high expenses in the initial years.

Something is missing somewhere, the bugger is cheating you and you better find out how/where, then proceed to lodge a formal complaint against him with Great Eastern.

This post has been edited by contestchris: Jul 17 2024, 11:52 PM

Jun 20 2024, 08:09 PM

Jun 20 2024, 08:09 PM

Quote

Quote

0.0320sec

0.0320sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled