QUOTE(Wedchar2912 @ Sep 18 2025, 02:43 PM)

wah... so cheap ar... a pure life insurance without surrender value is only Rm 100 pm?

then the 900rm per mth (10.8K pm) can be thrown into EPF and get 6% pa....

if 6% pa return, portfolio after

10 years: 165K

20 years: 440K

30 years: 0.93 million

40 years: 1.80 million

Isn't this better? or insurance take too much?

even if the return is only 2.5% pa, portfolio after

10 years: 135K

20 years: 295K

30 years: 0.5 million

40 years: 0.75 million

????? insurance firm taking too much?

It's not about insurance firm taking too much. After all the savings and maturity element is priced in. You also pay for the guatanteed returns. (Note: Although, yes, of course, insurers get higher profit margins from savings plan compared to pure protection products. )then the 900rm per mth (10.8K pm) can be thrown into EPF and get 6% pa....

if 6% pa return, portfolio after

10 years: 165K

20 years: 440K

30 years: 0.93 million

40 years: 1.80 million

Isn't this better? or insurance take too much?

even if the return is only 2.5% pa, portfolio after

10 years: 135K

20 years: 295K

30 years: 0.5 million

40 years: 0.75 million

????? insurance firm taking too much?

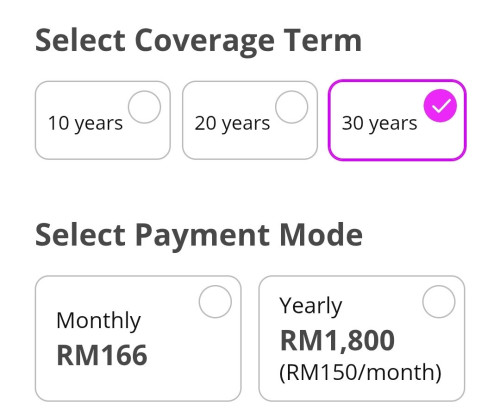

Anyways, this is a Kaotim quote for 36y/o female with RM1mil covering death TPD. No surrender value at all and level premium throughout. 30y level premiums

This post has been edited by contestchris: Sep 18 2025, 02:59 PM

Sep 18 2025, 02:58 PM

Sep 18 2025, 02:58 PM

Quote

Quote

0.0226sec

0.0226sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled